The world’s biggest DEX exchange Uniswap (UNI) has just proven that the platform can give far more liquidity than the main centralized exchanges (CEX) Coinbase and Binance, thanks to the incentives the undertaking delivers liquidity suppliers to give superior rates for negotiations.

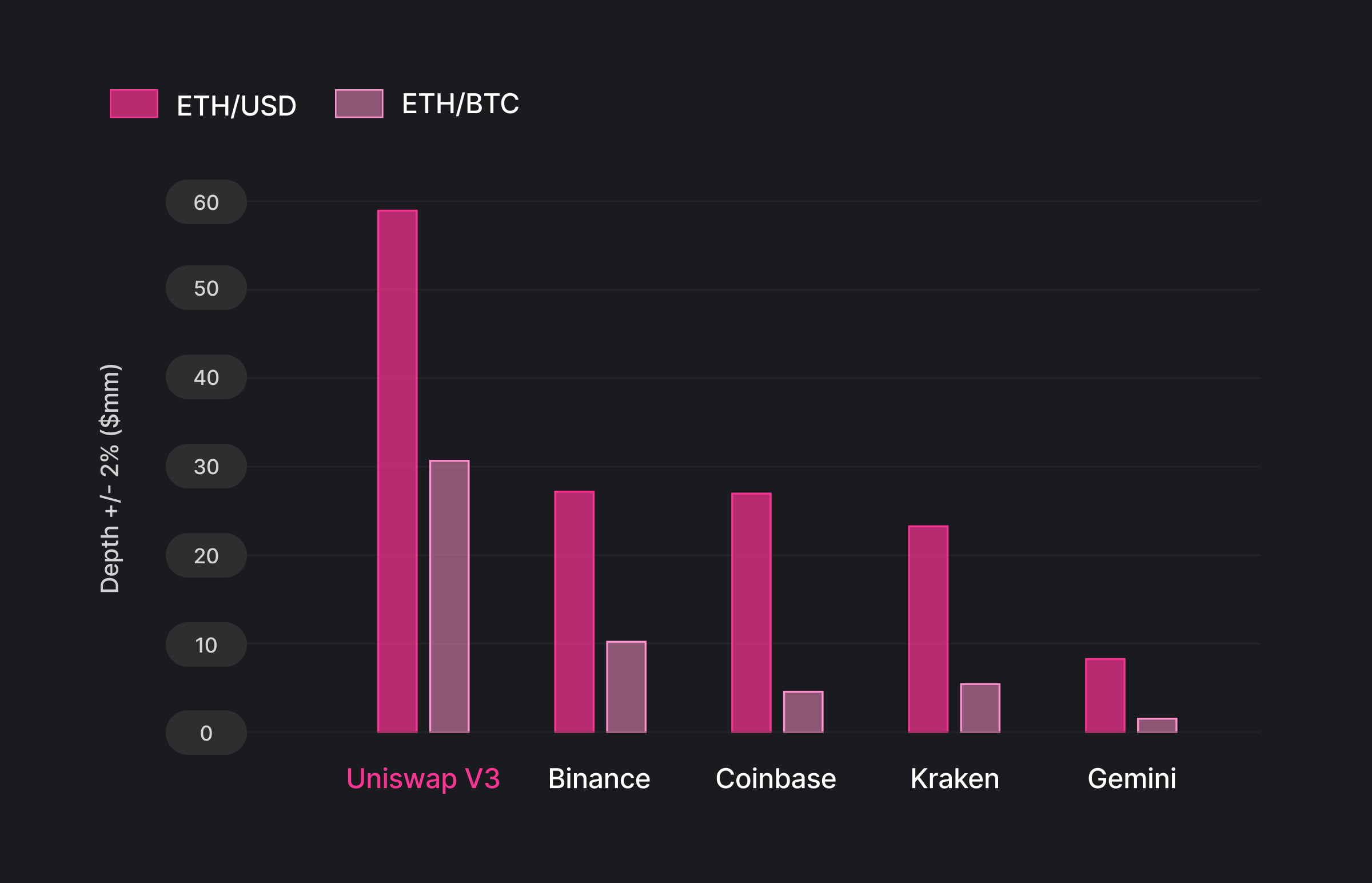

In a new research launched above the weekend by the advancement staff, the newest model of the exchange, Uniswap v3 has higher liquidity in trading ETH / USD, ETH / BTC and other ETH pairs than a lot of other main CEX brokers.

four / Check out our site publish, total analysis report and open supply methodology, code and information right herehttps://t.co/ZHPHgaveh7

– Uniswap Labs (@Uniswap) May 5, 2022

For far more details on how to use and check out Uniswap v3, please refer to the video beneath:

– See far more: I use DeFi: Try Uniswap V3 on optimism: the ace in the hole of the Uniswap exchange

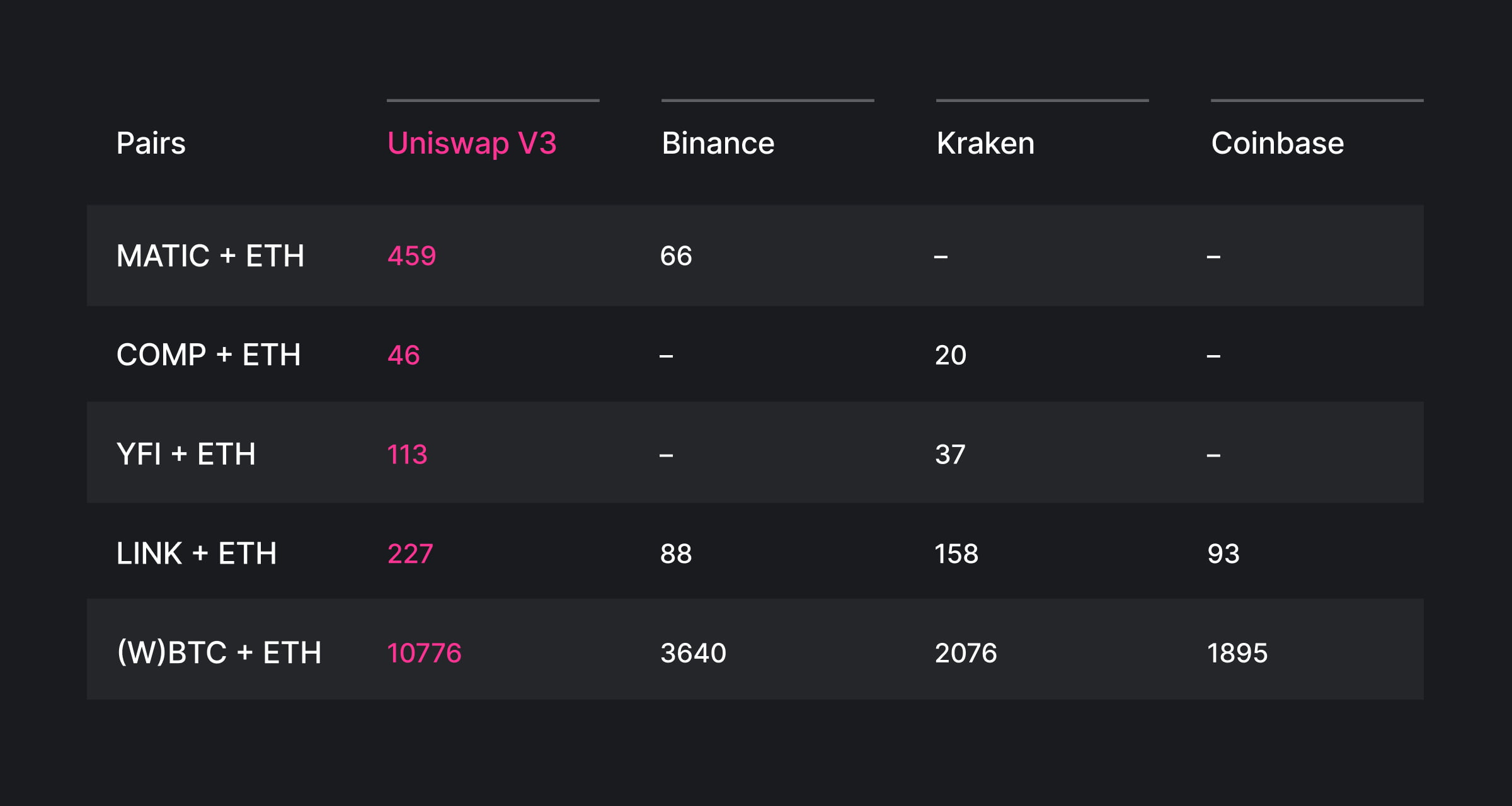

Uniswap claims that the present AMM marketplace framework can surpass that of CEX exchanges and transform the classic fiscal marketplace method into far more liquid, steady and safe, with the following statistics:

- For the ETH / USD pair, Uniswap is far more than double the liquidity of Binance and Coinbase.

- For ETH / BTC, Uniswap is three occasions far more liquid than Binance and four.five occasions far more liquid than Coinbase.

- For mid-cap ETH / token pairs, Uniswap is on regular three occasions far more liquid than main CEX exchanges.

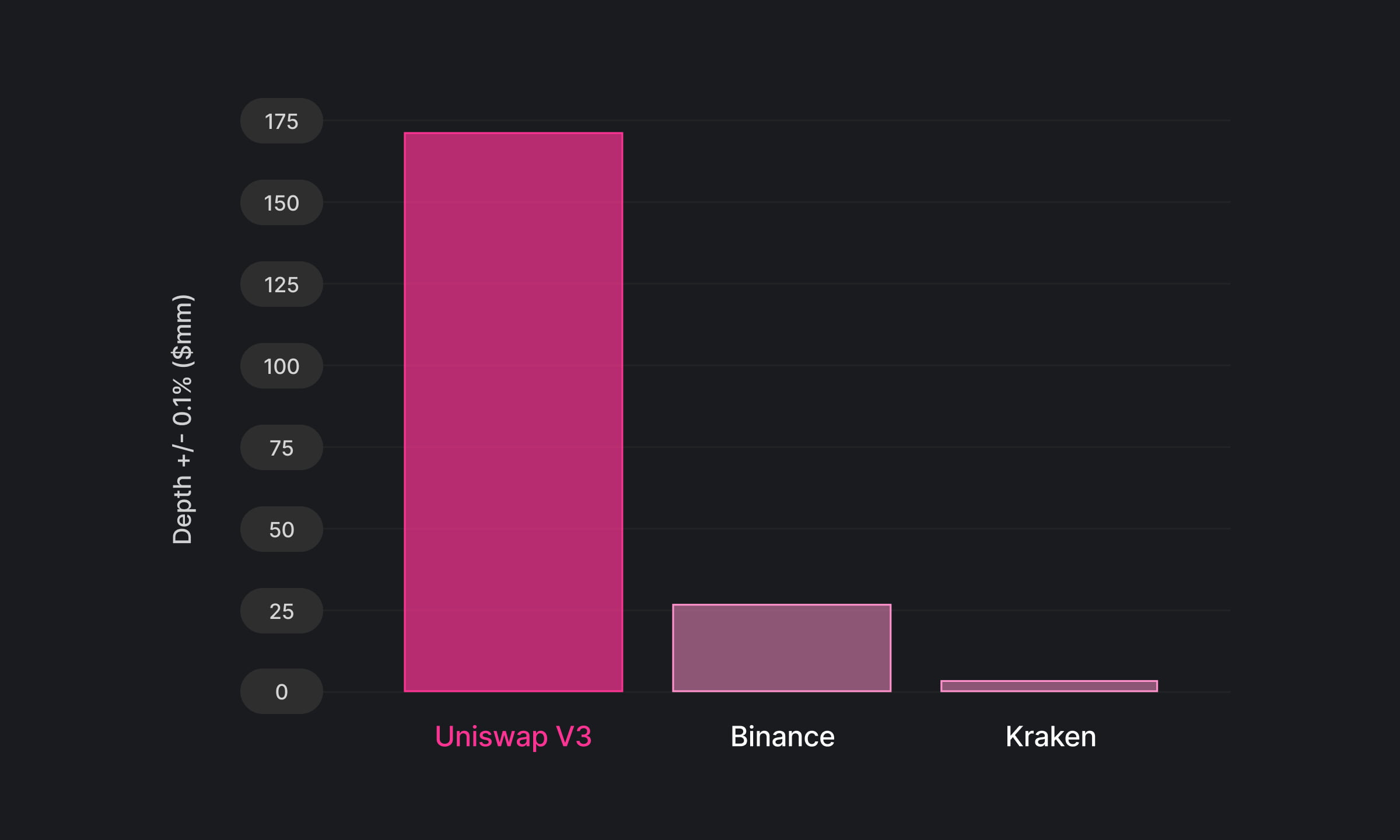

Research also demonstrates that a lot of stablecoin pairs are considerably far more liquid on Uniswap v3 than centralized exchanges. For USDC / USDT, Uniswap v3 is about five.five occasions far more liquid than Binance.

Traditional marketplace structures are dominated by a little amount of marketplace makers. But the quick creation of liquidity has tremendously lowered the barrier to enable end users enter and participate in the marketplace. This opens up new and current varieties of worth for communities as nicely as men and women.

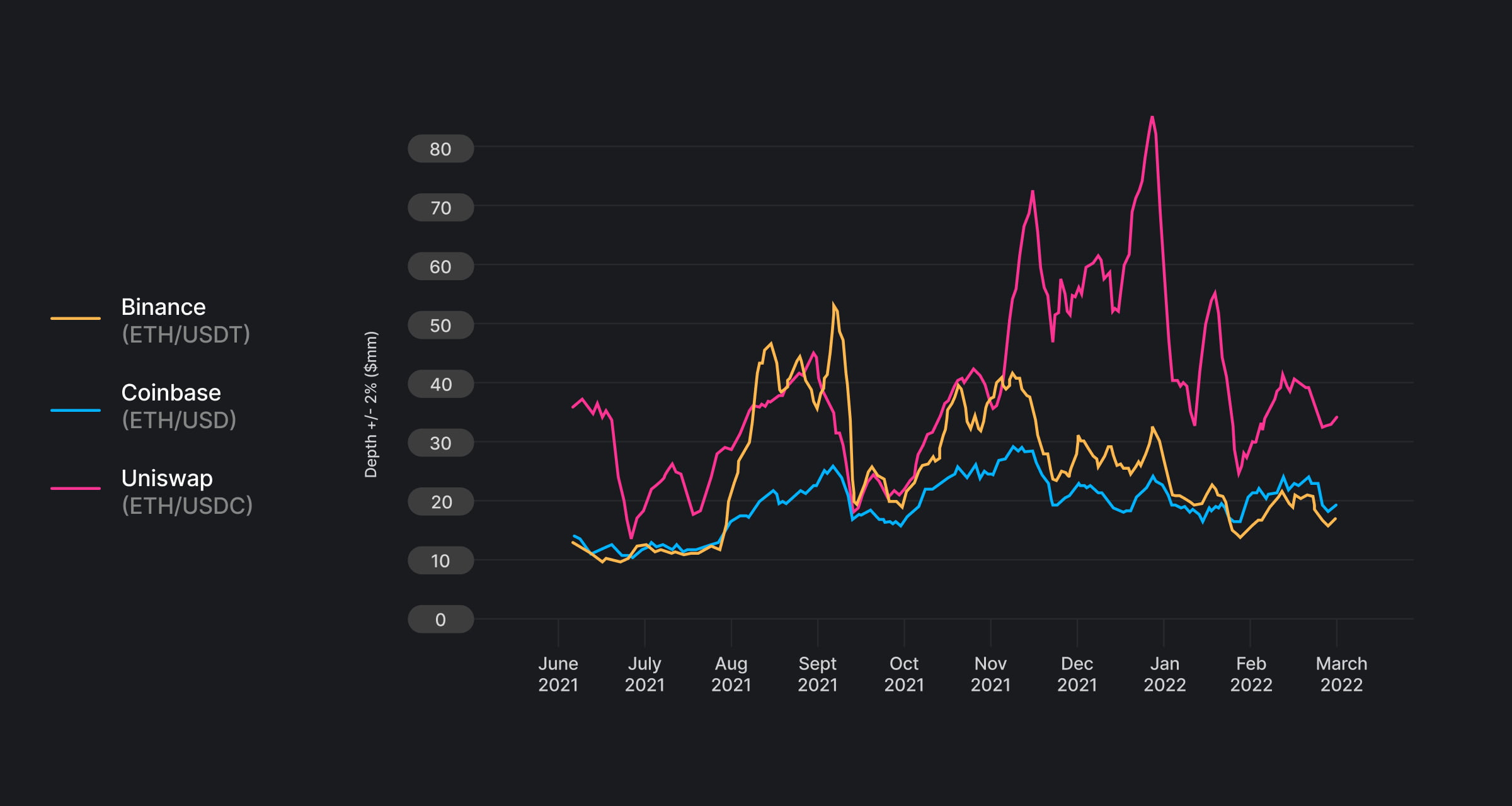

Overall, Uniswap v3 has had drastically higher marketplace depth in latest months than CEX exchanges. This enhanced liquidity is noticed on the two huge cap pairs this kind of as ETH / USDC (in contrast to equivalents on centralized exchanges) and on little and medium cap pairs.

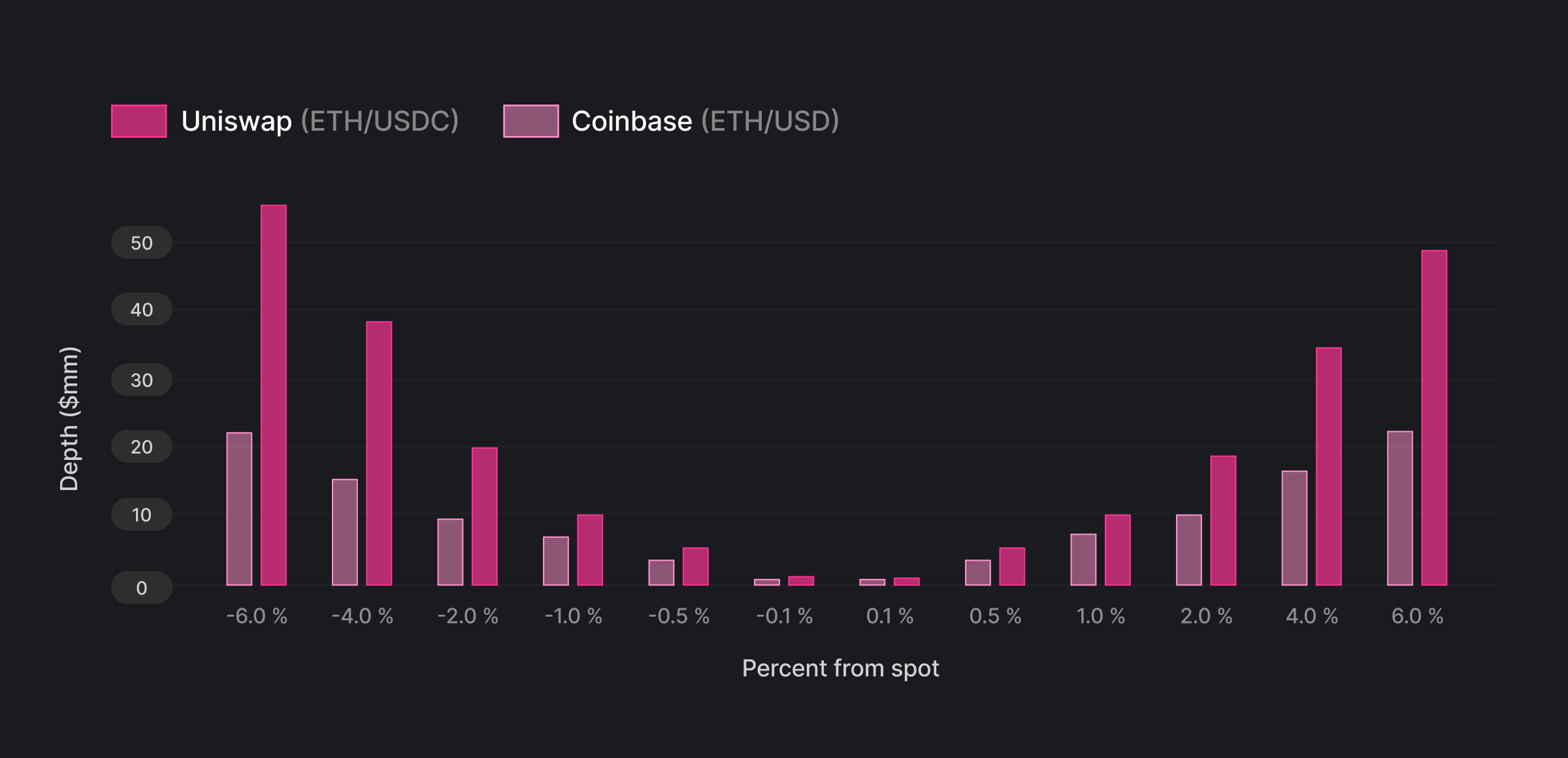

Uniswap v3 also has higher marketplace depth across all rate ranges, which indicates it is even far more worthwhile for end users to do huge trades on Uniswap v3 than on CEX. For instance, for a $ five million ETH / USD transaction, the cost savings would be somewhere around $ 24,000 at the anticipated rate influence spread, averaging somewhere around .five% on Uniswap v3 and one. % on Coinbase.

The over examination does not consider into account transaction expenses, together with gasoline expenses on Ethereum and charges on centralized or decentralized exchanges, or sudden slippage in advance of the transaction. These are prospective subjects for long term analysis. In essence, these extra trading charges are fairly little in contrast to the expenses connected with marketplace depth for huge trade sizes.

Synthetic currency 68

Maybe you are interested: