[ad_1]

Uniswap (UNI) price has increased nearly 20% in the past 24 hours, reaching its highest level in three years. This is a quick jump, pushing UNI price closer to breaking through key resistance levels, which could lead to even bigger gains.

Indicators such as RSI and BBTrend suggest momentum is improving, with further upside likely if bullish sentiment holds. However, maintaining strong support at $14.5 will be key to continuing this uptrend and avoiding a deeper decline.

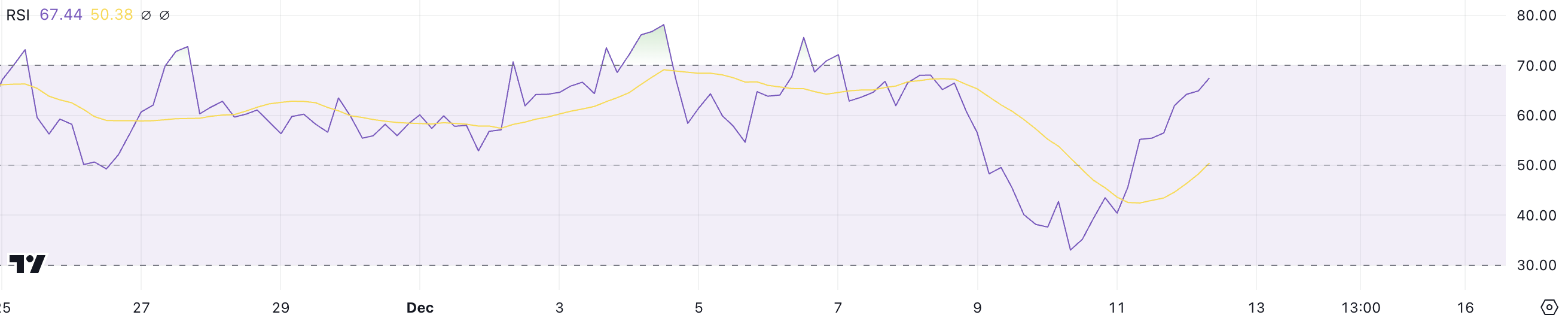

UNI’s RSI Still Below Overbought Level

Uniswap’s RSI has jumped from 33 to 67 over the past two days, reflecting a sharp increase in positive momentum. This rapid escalation suggests the asset has moved from oversold conditions to neutral to more optimistic territory, in line with the recent price recovery.

Current RSI levels suggest strong buying activity, but it is approaching the overbought threshold, where the uptrend could encounter resistance if buying momentum slows.

RSI, or Relative Strength Index, measures the speed and magnitude of price changes to assess overbought or oversold conditions. Values below 30 indicate oversold levels, signaling possible buying opportunities, while values above 70 suggest overbought conditions that could lead to a price correction.

If UNI’s RSI can break above 70 and stay above it without an immediate correction, Uniswap price could continue to rise. Historical trends show that when UNI’s RSI remains above 70 for extended periods, it is often preceded by significant price increases before a pullback, further suggesting short-term growth potential.

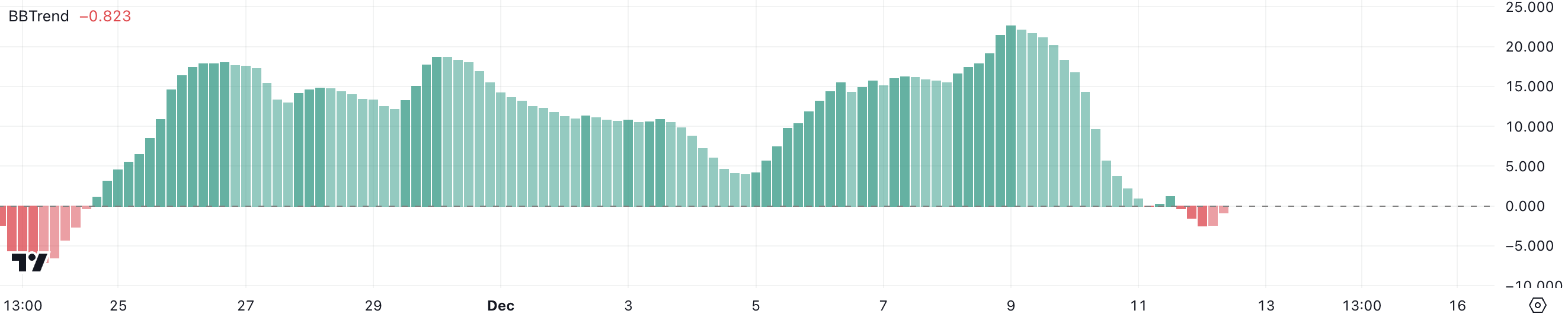

Uniswap’s BBTrend Currently Negative

UNI’s BBTrend index recovered to -0.82, from -2.47 a few hours earlier, signaling an improvement in price dynamics. This shift indicates that the downward pressure seen earlier is fading, suggesting the possibility of a stabilization or even a reversal towards optimistic conditions.

Although BBTrend remains in negative territory, the upward movement reflects growing support and a possible return of buying interest.

BBTrend, or Bollinger Bands Trend, measures the strength and direction of price movements based on Bollinger Bands. Positive values indicate bullish momentum, while negative values signal bearish conditions. Uniswap’s BBTrend has been positive since November 24, peaking at 22.6 on December 9, before turning negative between December 11 and 12.

The recent recovery from -2.47 to -0.82 has shown that selling momentum is weakening. If BBTrend turns positive again, UNI price could continue to increase further.

UNI Price Prediction: Could It Be Back To $25 After 3 Years?

UNI price is currently holding strong support around $14.50, which could serve as a key area to stabilize the price in case of a downtrend. If this support fails, the price could fall further, potentially testing $13.50 as the next key level.

These support zones are key to preventing a deeper correction and maintaining market confidence during periods of selling pressure.

Conversely, if the current uptrend continues, UNI price could soon test resistance at $19.47, with a possible climb up to $20. Breaking these levels would mark Uniswap’s highest price in three years, signaling strong bullish momentum.

A sustained rally towards $25 would represent the highest level since November 11, 2021, marking a possible return to long-term growth territory if the trend continues to strengthen.

General Bitcoin News

[ad_2]