The price of Uniswap (UNI) has increased about 15% in the past 24 hours, driven by strong bullish momentum. The RSI has climbed to 67, showing that UNI is approaching overbought territory but there is still room for further gains before a correction can occur.

If the uptrend continues, UNI could test resistance at $13.3 and $14.8, with a push to $17 possible, but a reversal could see it retest these levels. Support at $12 or drop to $8.59.

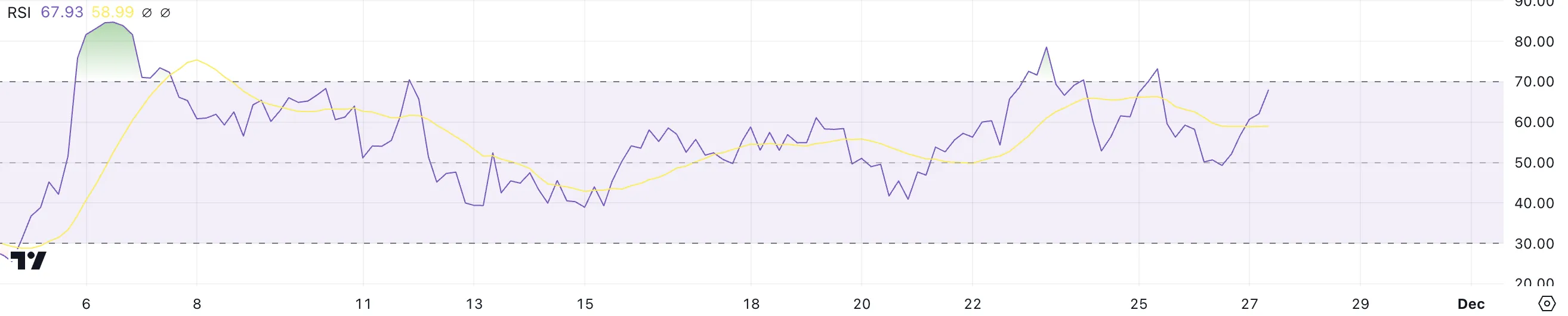

UNI’s RSI Not yet in Overbought Zone

Uniswap’s RSI increased from 50 to 67 in just one day, reflecting a sharp increase in bullish momentum. RSI, or Relative Strength Index, measures the speed and scale of price movements on a scale of 0 to 100.

Values above 70 indicate overbought conditions and a possible correction, while values below 30 suggest oversold conditions and a possible recovery. Current RSI of 67 shows that UNI is approaching the overbought zone but there is still space for further increases.

Following recent developments, UNI price may continue to climb until RSI exceeds 70, signaling strong bullish sentiment in the short term.

History shows that currencies often undergo corrections when entering overbought zones. However, with the RSI currently not in that zone, the rise may still have space to grow, as it did in early October.

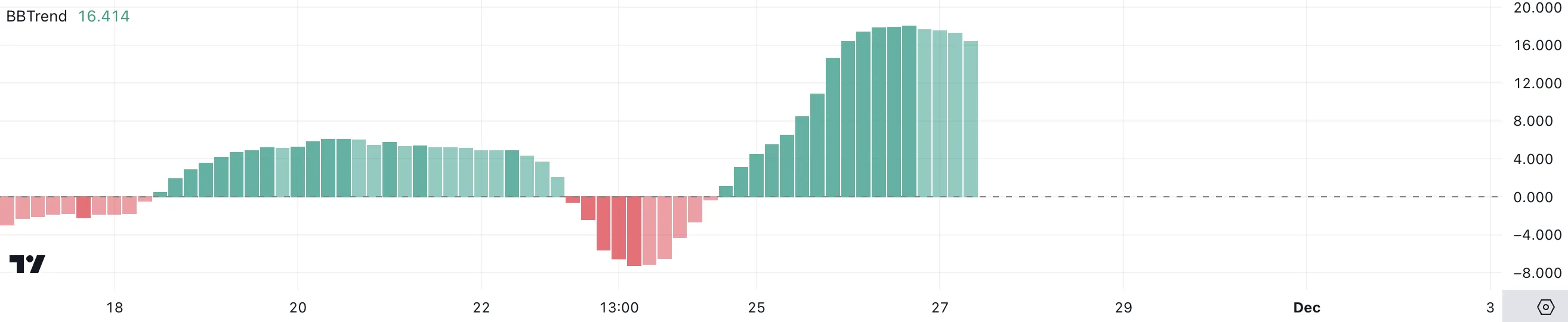

Uniswap’s BBTrend Very Positive

UNI’s BBTrend index is currently at 16.5, continuing to remain positive since November 24 after temporarily turning negative between November 23 and 24. The BBTrend Index, or Bollinger Band Trend, measures the strength and direction of price movements relative to the Bollinger Bands.

Positive values indicate upward momentum, while negative values reflect downward pressure. BBTrend positively signals that Uniswap is in a bullish phase.

Although still high at 16.5, UNI’s BBTrend index has decreased slightly from yesterday’s level of 18, showing a slight decline in price momentum.

This indicates that although the uptrend remains, the strength of the current bounce may not be as strong as before. If the BBTrend index continues to decline, it could signal a period of consolidation or correction in UNI price.

UNI Price Prediction: Could Reach $17 In October?

If the strong uptrend in Uniswap price continues, the price is likely to test the resistance levels at $13.3 and $14.8 in the short term. A breach of these levels could push UNI prices as high as $17, which would mark the highest price since March and represent a potential upside of 36%.

However, if the uptrend reverses, UNI price could face a retest of key support levels at $12 and $10.4. If these levels fail to hold, the price could fall further to $8.59, marking a sharp 31% correction.