Uniswap (UNI) price has been struggling lately, down nearly 5% over the past 24 hours and down 5.24% in the last week, despite Bitcoin’s surge. The recent decline highlights the weakness in UNI’s momentum, with technical indicators suggesting a cautious outlook.

While the EMAs still show a bullish structure, price slipping below the short-term EMAs indicates fading buying pressure. A reversal is still possible, but caution should be exercised because the current trend is still susceptible to further negative influences.

UNI’s RSI is in the neutral zone

On November 7, UNI’s RSI hit 85, driven by a 50% spike in price in just 24 hours. Since reaching that peak, RSI has gradually decreased and currently stands at 43.32. RSI is an index used to gauge momentum by measuring the speed and variability of price movements, helping to determine whether an asset is overbought or oversold.

Typically, an RSI above 70 signals that the asset may be overbought, while an RSI below 30 indicates conditions may be oversold.

With UNI’s RSI currently at 43.32, the index implies that recent momentum has cooled significantly. This level is in the average range, reflecting a condition that is neither overbought nor oversold but rather a balanced market sentiment.

It implies UNI price may stabilize after the spike, with the possibility of consolidation or a new move depending on the change in buying or selling pressure.

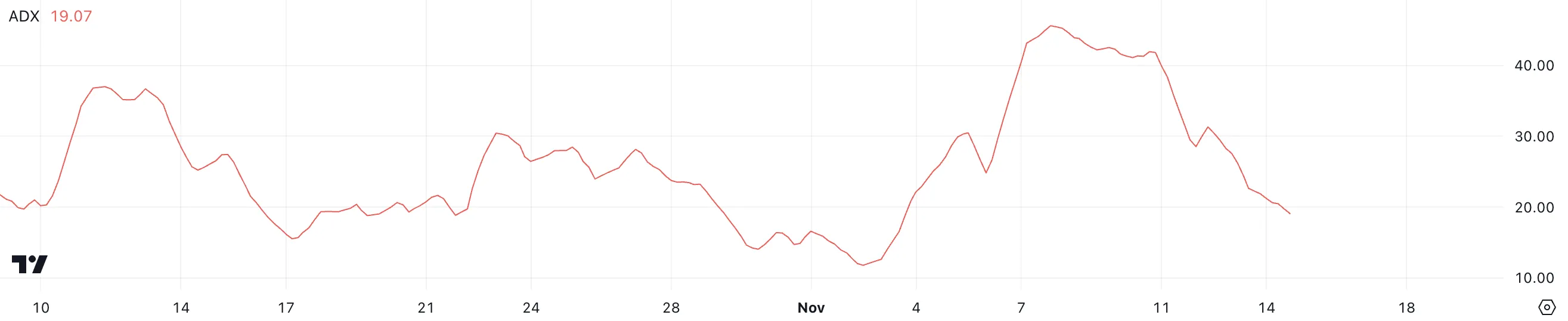

Uniswap ADX Index shows that the current trend is not strong

UNI’s ADX is now 19, down significantly from over 40 just a week ago. The Average Directional Index (ADX) measures the strength of a trend without indicating its direction.

Typically, an ADX index above 25 indicates a strong trend, while values below 20 indicate a lack of trend or weak momentum. The sharp drop from over 40 to 19 signals that the power behind UNI’s recent trend has diminished significantly.

With Uniswap price currently in a downtrend, an ADX at 19 suggests that the downward momentum is weak. This implies that although prices are falling, the downward pressure is not strong, possibly suggesting a period of consolidation rather than an aggressive sell-off.

It could also mean that the current trend could soon reverse or that market participants are still waiting for a clearer direction before taking action.

UNI Price Prediction: Will UNI Drop Below 7 USD Next?

UNI’s EMAs are currently showing a bullish configuration, with the short-term lines above the long-term ones. This points to previous strong upward momentum. However, the price has now dropped below the short-term EMAs, signaling a weakening in buying pressure.

Furthermore, the short-term lines are trending down, and if they break below the long-term EMAs, this could form a bearish crossover. This type of crossover often indicates the beginning of a new, possibly strong, correction.

If a bearish crossover occurs, UNI price could test the support levels around $7.50 and $7.10 and possibly drop to $6.60. However, as indicated by the current ADX index, the downtrend is not particularly strong. This leaves the possibility of a possible reversal.

If the trend turns upward, UNI price could challenge the first resistance level at $8.70. If this level is broken, the next target would be $9.60, representing a possible upside of up to 14%.