The price of Uniswap (UNI) has seen incredible growth, surpassing a $10 billion market cap and growing 80.44% in the past 30 days. With the price currently hitting 67 on the Relative Strength Index (RSI), UNI is approaching overbought territory but still has space to grow before signaling an immediate correction.

Despite a slight decline in the Average Directional Index (ADX) from 46 to 39, UNI still maintains a strong uptrend with trend strength above 25. If the uptrend continues, UNI could test resistance at 17.39 USD, the possibility of reaching 20 USD, the highest price since 2021.

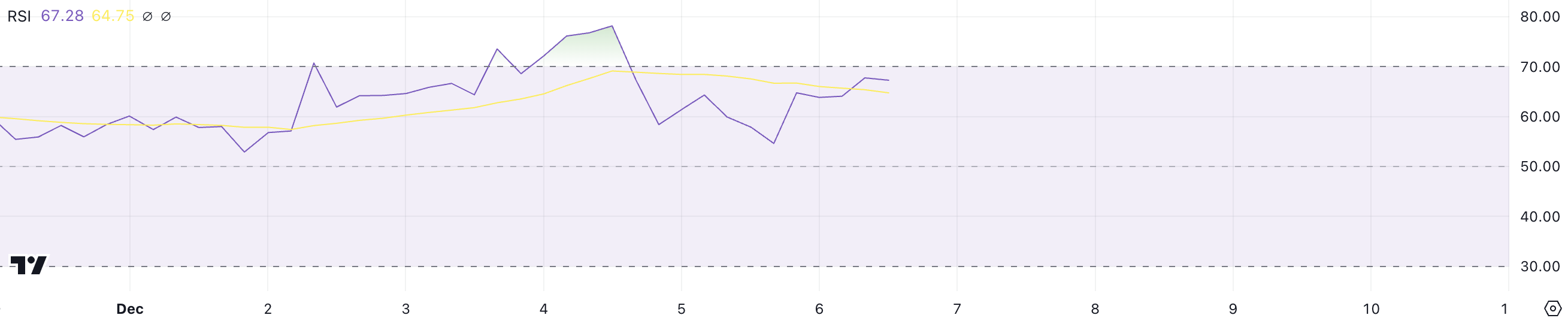

UNI’s RSI Still Below Overbought Zone

Uniswap’s RSI is currently at 67, which means it is close to the overbought zone but has not yet reached the 70 level.

An RSI above 70 usually indicates an asset is overbought, but at 67, UNI still has room to rise without signaling an immediate correction.

RSI measures price momentum on a scale of 0 to 100, with values above 70 indicating overbought conditions and below 30 indicating oversold conditions.

As UNI’s RSI has remained above 70 during recent bullish points, the current level of 67 suggests there is still room for growth before a possible correction occurs.

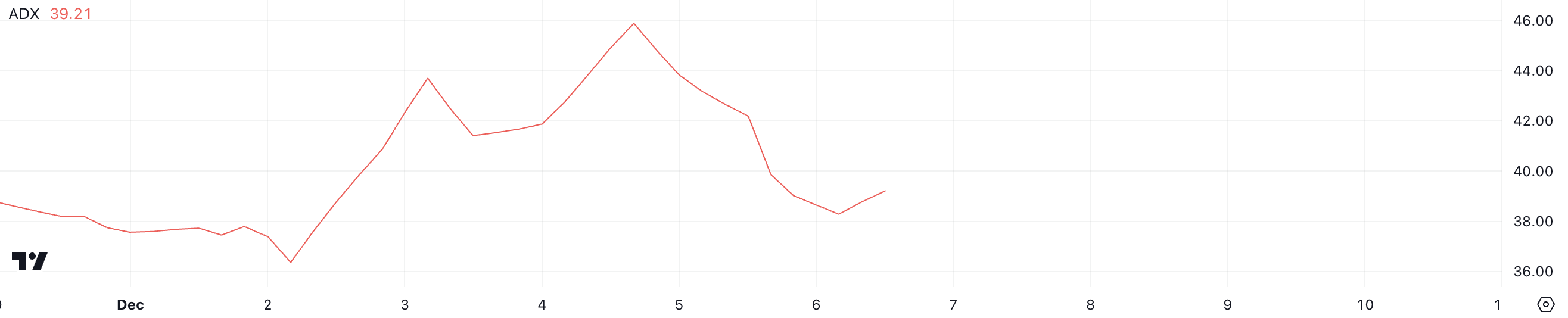

Uniswap’s ADX Shows that the current Uptrend is Strong

UNI’s ADX is currently 39, down from 46 just two days ago, indicating a slight decrease in trend strength.

Although this decline indicates a decline in momentum, ADX remains above 25, which suggests that UNI price is in a strong trend, despite the recent pullback.

The Average Directional Index (ADX) measures the strength of a trend, with values above 25 indicating a strong trend and below 20 indicating a weak or no trend.

As UNI’s ADX is at 39, it shows that the asset is still in a strong uptrend, although the recent decline could indicate a possible deceleration in momentum. ADX at 39 indicates that UNI’s uptrend remains solid, but there could be a short correction before fresh gains.

UNI Price Prediction: Can It Rise Again to 20 USD After 3 Years?

If the uptrend continues, UNI price could test resistance at $17.39 and potentially rally up to $20, which would mark its highest price since 2021.

This would signal a strong continuation of the bullish move, with Uniswap price aiming for significant gains.

However, if the current trend reverses, Uniswap price could test the first level of support around $13.50. If this support fails to hold, the price could fall further, potentially as low as $12.40, indicating a move to the downside if the trend fails to regain strength.