As one particular of the ecosystems that FTX and Alameda concentrate on, Solana is surely dealing with a whole lot of issues soon after the latest incidents. And Solend, the lending venture on this platform is also recording a whole lot of notable metrics.

Solemn liquidation of whales

Last evening, a whale was liquidated on a loan on the Solend platform. The venture announcement tweet read through:

The whale bill has been wholly liquidated, stabilizing the problem on Solend.

There are ~ $ six.five million of terrible debt in the primary pool and ~ $ 22 million of USDC in the treasury. A DAO vote will adhere to shortly.

– 🙏🚫 Solend (we’re employing!) (@Solendprotocol) November 10, 2022

“A whale bill has been cleared, assisting to stabilize the problem on Solend. Currently, there are $ six.five million of terrible debt nonetheless excellent in the primary pool and USDC 22 million in the reserve fund. A DAO vote will consider location in the close to long term. “

Previously, a deviation in the Oracle index also induced Solend to publish terrible credit score ranges in the HUSD stablecoin pools.

>> See additional: Solend posted terrible debts due to the assault on Oracle’s cost index

Liquidity fluctuations

After numerous liquidity shocks more than the previous week, soBTC (a token representing BTC on Solana) has also witnessed cost fluctuations. As a outcome, Solend was forced to end lending with this asset.

The soBTC LTVs have been decreased to %.

– 🙏🚫 Solend (we’re employing!) (@Solendprotocol) November 10, 2022

“SoBTC’s Loan-to-Value (LTV) ratio has been reduced to 0%.”

The curiosity price on SOL deposits on this platform has occasionally reached a whopping two,500% / yr. The staggering figure over partly displays the dangers as effectively as the scarce liquidity of the ecosystem soon after the collapse of FTX – Alameda.

At the time of creating, it can be mentioned that income movement has escaped from the Solana ecosystem in standard and the Solend lending platform in unique.

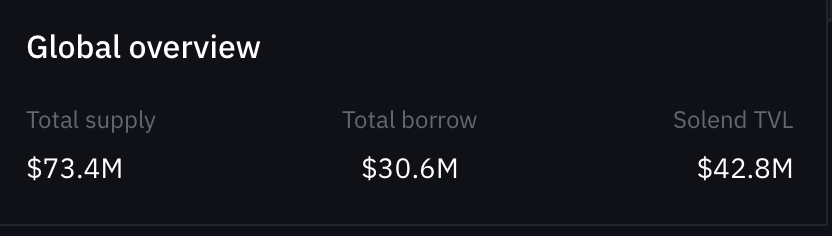

The complete worth of frozen assets (TVL) dropped to $ 42.eight million. In unique, it is really worth noting that the USDC stablecoin loan industry presently only has a deposit of USD 22 million.

Also on November 9, Multicoin Capital (one particular of the investment money supporting the Solana ecosystem) also mentioned it had issues withdrawing income from FTX.

Synthetic currency 68

Maybe you are interested: