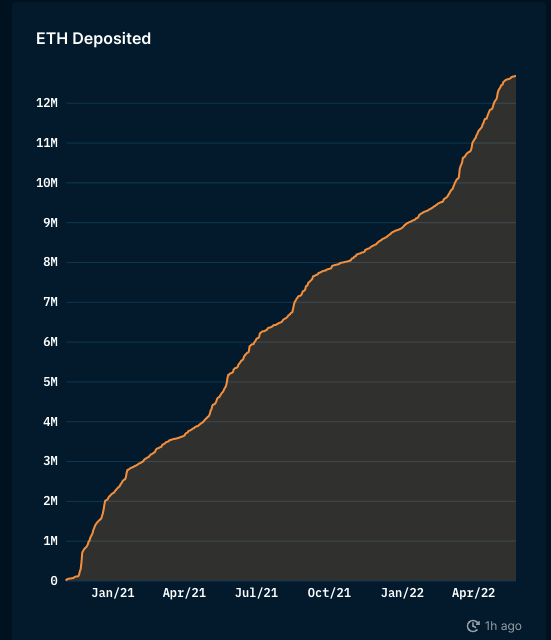

The information that ETH two. will put into action the merger phase in August 2022 is one particular of the occasions that several traders are interested in a short while ago. There are several opinions that switching to The Merge will negatively have an impact on ETH price tag mainly because there are a great deal of ETH staking unlocked, primarily a lot more than twelve million ETH.

In this write-up, I’ll give some factors to examine with you guys!

one. What is The Merge?

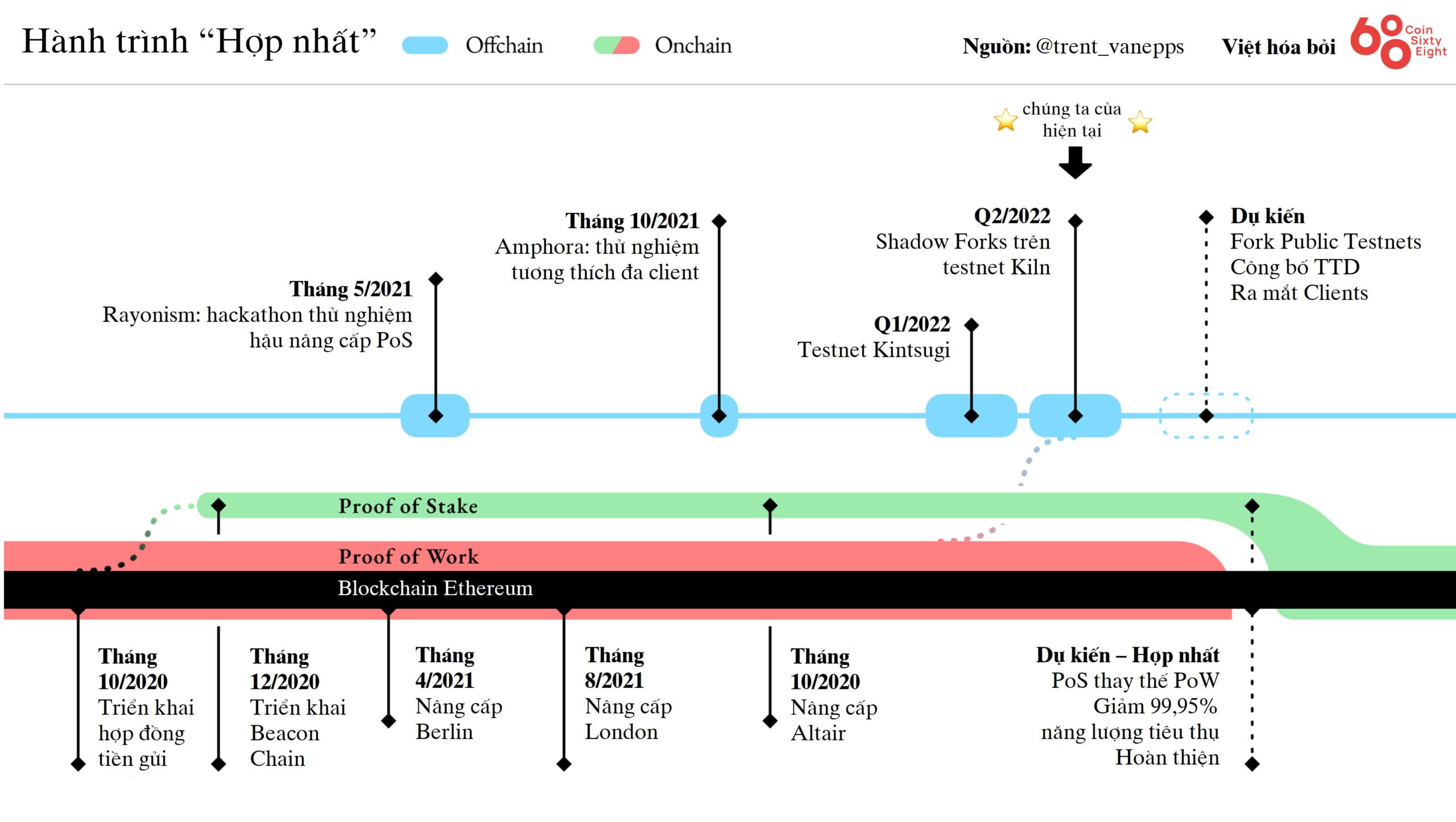

The ETH two. update method will take a enormous quantity of function, so it can be divided into three little phases: Beacon Chain, The Merge and Shard Chain.

Headlight chain (launched December 2020) is the initial phase for Ethereum’s transition from the Proof-of-Work (PoW) consensus mechanism to the Proof-of-Stake (PoS) mechanism. During this time, the Ethereum network will have two parallel chains, ETH1 (employing PoW) and Beacon Chain (employing PoS). During this phase, to participate in staking, consumers will have to use a minimal of 32 ETH and can’t withdraw right up until the subsequent phases are finished.

The merger is the phase of merging Beacon and ETH one. into a single chain, employing PoS. Ethereum one. will carry the skill to execute clever contracts in the PoS process, as very well as the comprehensive historical past and latest standing of Ethereum, to make sure that the transition goes smoothly for all consumers and owners of ETH.

Chain of fragments is the application phase of the Sharding option on the Ethereum network. Sharding is the method of dividing information into little pieces and processing it at the exact same time to assist the Ethereum network realize increased functionality, strengthen scalability and capability.

two. Correct comprehending of ETH unblocking soon after The Merge

two.one. The Merge is not synonymous with ETH unblocking

First, you require to recognize that the merger phase does not imply that there will be a substantial quantity of ETH withdrawn and launched on the market place. Merging does not unlock ETH withdrawals from the network at all. Unlocking will get spot soon after this time period for a time period of six – twelve months. Then the quantity of ETH staking and the rewards will stay locked for a lengthy time.

two.two. ETH will be unlocked gradually in accordance to the routine

This usually means that even if a withdrawal is produced, the ETH will not be unlocked massively but produced one particular soon after the other.

According to the mechanism, to cancel the staking of ETH, validators will have to initial exit the pool of energetic validators. However, in each and every cycle (epoch), there will be a restrict to the variety of validators to exit, this to make sure that there are constantly validators energetic, trying to keep the network.

According to statistics, at present on ETH two., there are 395,000 validators (like energetic or pending validators), each and every epoch can enable you to exit four validators, each and every epoch cycle is six.four seconds lengthy, so it will take a lot more than 420 days to be finished. of this validator entirely. This is incredibly unlikely to transpire in practice.

two.three. Participants are betting on ETH

Most traders, money or groups will participate in ETH staking in two types:

- Direct participation (retail traders)

- Stake by way of Liquid Staking remedies this kind of as Lido Finance

- Stake by way of staking pool or centralized exchanges (CEX)

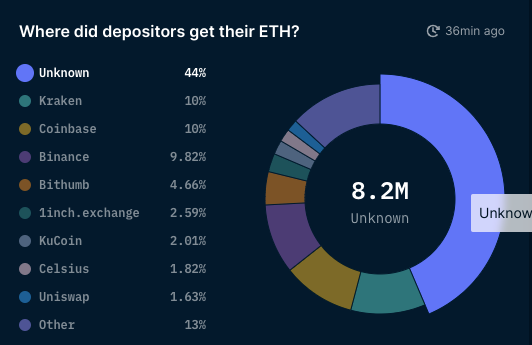

In the situation of staking by way of Lido, traders can a lot more effortlessly withdraw ETH. So if a bearish situation happens, the early marketing will largely come from liquid staking remedies like Lido. According to Nansen statistics, there are at present three Liquid Staking remedies representing the biggest proportion, respectively, Lido Finance (32.six%), Rocket Pool (one.four%) and Ankr (.four%). The complete quantity of ETH blocked by way of liquid staking remedies ranges from 34% to 35%. It is definitely unlikely that all traders who participate in staking by way of this option will withdraw and dump the market place.

According to the ETH deposit supply chart, you can see that 44% of the ETH staked is largely from unlabeled portfolios (i.e. retail traders). If these traders are prepared to block a substantial quantity of ETH (the minimal is 32 ETH) for a lengthy time, they are surely maxi ETH and are ready to hold ETH for a lengthy time. So the product sales strain from this supply is rather little.

three. Impact of the merger on ETH

If effective, The Merge will assist the total Ethereum network operate with the PoS mechanism. This is estimated to assist cut down ETH inflation from four% / 12 months to just one% / 12 months. This will be one particular of the huge upside instances for ETH.

Furthermore, the results of The Merge will make the fomo local community a lot more concerned in the potential of Ethereum, consequently making a demand to obtain, which mixed with the require for staking will generate a better drive for the improve in the price tag of ETH.

Furthermore, one particular of the key beneficiaries of The Merge’s results will be the tasks on Ethereum. When transaction prices are inexpensive, transactions are a lot quicker, consumers will return to DeFi, GameFi and NFT on Ethereum, consequently making new cash in the ecosystem, main each tasks and Ethereum itself to develop.

From the over evaluation, I personally feel that the effective implementation of The Merge will have a a lot more constructive effect on Ethereum than a damaging one particular. What is your viewpoint? Leave a comment or examine in the Coinlive local community!

Poseidon

See other articles or blog posts by the writer of Poseidon: