The U.S. Treasury Department and Biden administration are reportedly trying to find assist from the world’s greatest cryptocurrency exchanges to thwart any attempts to circumvent harsh restrictions imposed by the U.S. Treasury. The West is punishing Russia. for his invasion of Ukraine final week.

The US government is established to get robust action

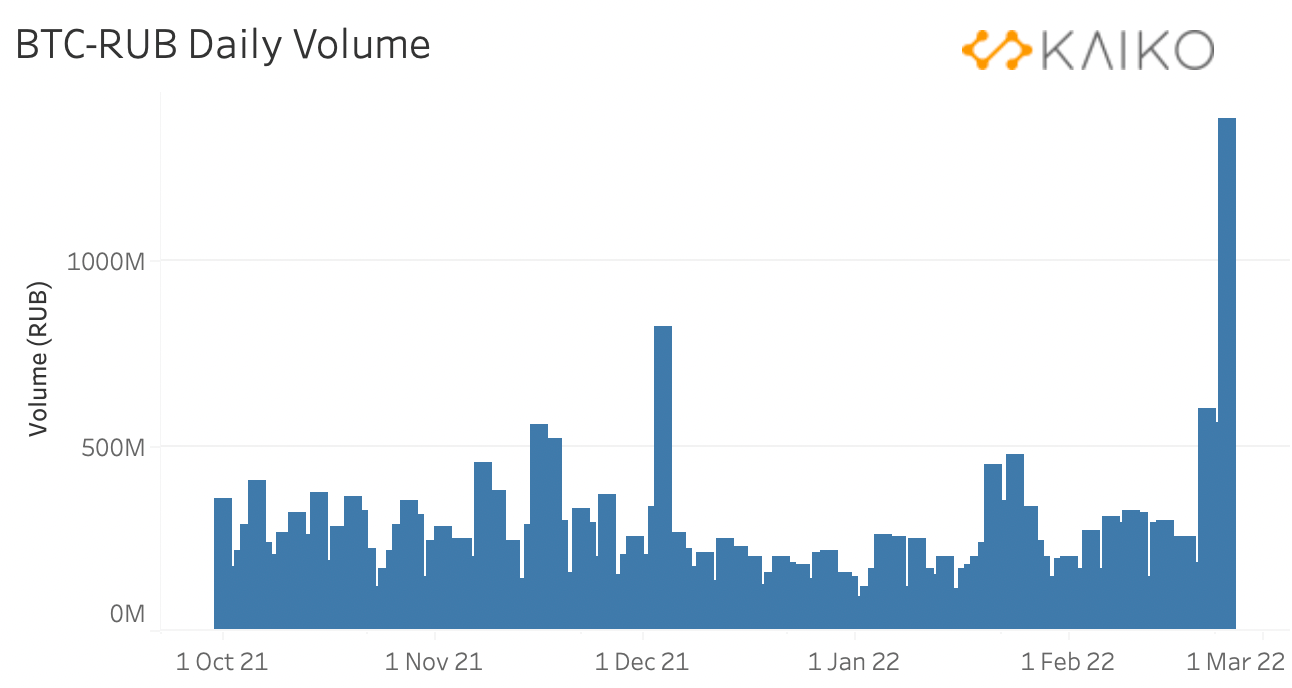

It looks that the story that Russia is working with cryptocurrencies to evade US and European Union (EU) sanctions is turning into clearer than ever. The evidence is that given that he was banned from SWIFT as nicely as becoming below expanding strain from quite a few distinct nations, the amount of wallet addresses of more than one,000 Bitcoins has all of a sudden enhanced in a single day, coinciding with when the trading volume of Bitcoin in Russia peaked in 9 months. It is pretty probably that each the government and the Russian elite have picked their very own “escape” answer.

p lang = “it” dir = “ltr”> Wow! About 150 new #bitcoin addresses with> one,000 BTC on them. This indicates both a rebalancing of trade or custodial solutions (not occasion) or a group of persons with deep pockets all of a sudden have robust interests to get into. #bitcoin (major occasion!) What will it be? pic.twitter.com/JGBN7OQgxT

– Dr. Julian Hosp (@julianhosp) March 1, 2022

The undesirable devaluation of the Russian ruble is also one particular of the principal good reasons persons in the nation transfer their assets to common Bitcoin and stablecoins like USDT or USDC. The Central Bank of Russia has also determined to increase curiosity charges from 9.five% to twenty%.

Russian central financial institution raises benchmark price to twenty% https://t.co/XbQXopvXeq

– Bloomberg (@business enterprise) February 28, 2022

Faced with this problem, US officials instantly urged quite a few of the most common cryptocurrency exchanges globally to block any action from Russia. The move only came one day when Ukraine’s Deputy Prime Minister and Digital Transformation Minister Mykhailo Fedorov officially requested seven global exchanges like Coinbase, Binance, Huobi, KuCoin, Bybit, Gate.io, Whitebit and the exchange Ukrainian domestic Kuna block Russian consumers from their platforms.

Second BloombergAs of March one, three exchanges, FTX, Binance and Coinbase are at the moment collaborating with the US regulator at the request of the Biden administration.

American officials have targeted significant cryptocurrency exchanges to get an method only on individuals that have been sanctioned.

FTX, Binance, and Coinbase are all doing work with the administration https://t.co/n1kHAfQFkh

– Bloomberg Crypto (@crypto) February 28, 2022

In addition, President Biden’s ultimate edition of the 2021 Cryptocurrency Executive Order, announced on March one by the Ministry of Finance and coming into result on the identical day, expressly prohibits transactions aimed at circumventing any U.S. embargo by way of the use of cryptocurrencies. . As a consequence, the government forbids Americans from dealing with the Russian central financial institution and the bank’s assets will be entirely frozen in the United States.

However, the present chaos has attracted a great deal of focus from individuals with significant influence in US politics, commonly former presidential candidate Hillary Clinton. She criticized the Biden administration and European governments for not becoming also harsh in forcing cryptocurrency exchanges to finish trade with Russian consumers in a radical way.

Indeed, in spite of the effect of the United States and Ukraine, Coinbase, the greatest cryptocurrency exchange in the United States, has responded by saying that it has no strategies to impose a complete ban on clients. Russia, but it will block business actions involving people. or sanctioned entities. Meanwhile, Binance has also manufactured the identical argument and action as Coinbase. Commenting on the matter, Ms. Clinton stated:

“I am pretty disappointed to see that some renowned exchanges refuse to enter into transactions with Russia for specified good reasons. I do not comprehend what they are pondering. We really should apply as significantly legal strain as achievable to isolate Russia’s financial action proper now. “

On Clinton’s side is Democratic Senator Elizabeth Warren. The politician who has normally been hostile to cryptocurrencies also took the possibility on March one to say that US money regulators really should seem into the scope of cryptocurrencies mainly because they pose a possibility to the public, permitting President Putin and Russian officials to ease the “economic pain”.

Will Russia not use cryptocurrencies to circumvent sanctions?

However, not anyone has this kind of ideas. Many crypto policy industry experts say the issues of international authorities about Russia’s potential to evade financial sanctions working with cryptocurrencies are entirely unfounded. Therefore, they should not get worried.

As the cryptocurrency industry is not that massive, mature and deep sufficient to assistance the volume that Russia requires, allow alone the country’s cryptocurrency infrastructure, it is pretty little. On March two, the head of the Blockchain Association in the United States, Jake Chervinsky, posted a thorough thread on his personalized webpage to clarify the challenge.

two / To commence, I want to express my robust and unequivocal assistance for the Ukrainian persons fighting a totalitarian invader to defend their households and their basic rights to freedom and self-sovereignty. Glory to Ukraine

The free of charge planet will have to help Ukraine and battle towards Putin.

– Jake Chervinsky (@jchervinsky) March 1, 2022

“To commence with, I would like to express my robust and unequivocal assistance for the Ukrainian persons who are fighting the authoritarian aggressor to defend their nation and its basic rights. The free of charge planet will have to assistance Ukraine and oppose Putin. “

Chervinsky cited 3 principal good reasons, initial, that sanctions are not restricted to the US dollar, it is now unlawful for any US business enterprise or citizen to do business enterprise with Russia as described over. And it does not matter if they use bucks, gold or Bitcoin.

sixteen / Can cryptocurrencies mitigate penalties by giving an substitute to SWIFT? Not specifically.

If Russia desires an substitute, it is significantly additional probably to use China’s CIPS than a public network it can’t handle.

In any situation, there is no one particular in the free of charge planet performing business enterprise with them anyway!

– Jake Chervinsky (@jchervinsky) March 1, 2022

“If Russia wants an alternative, it is more likely to use China’s CIPS rather than a public network (blockchain), which it cannot control.”

The 2nd purpose is that the money requires of a nation like Russia far exceed the present capability of the cryptocurrency industry, which looks also little, high-priced and also transparent to be valuable to the Russian economic climate. In other phrases, even if Russia had accessibility to enough liquidity, it would nonetheless be unable to hide its transactions in this kind of a industry.

18 / Russia also can’t hide its tracks with cryptocurrencies.

Putting aside legitimate privacy issues, the transparency of public ledgers + the analytical expertise of US law companies = cryptocurrencies are ineffective for sanction evasion.

The Treasury Department stated it very best:https://t.co/ouzbV6OA8c

– Jake Chervinsky (@jchervinsky) March 1, 2022

“The cryptocurrency industry is nonetheless in its infancy and trading in rubles pairs is uncommon. So Russia can’t have sufficient liquidity.

On the other hand, Russia can’t hide its tracks with cryptocurrency. You know, blockchain is normally transparent mixed with the analytical prowess of quite a few US and European intelligence units, Russia will not “hit a dead end” alone.

Finally, Russia has not been interested in cryptocurrencies for many years making an attempt to demonstrate to itself that sanctions do not have an effect on the nation. Not even Russia has been in a position to formulate and refine any important regulation on cryptocurrencies. Basically, cryptocurrencies do not look to be in President Putin’s strategies.

twenty / Putin could have developed a cryptographic infrastructure if he had desired to. He did not. There is no purpose to feel he will (or could) now.

there @New York Times, which fueled fears about cryptocurrency evasion and sanctions final week, about Putin’s correct system. Zero mentions of cryptocurrencies:https://t.co/niWQ9VlUIY

– Jake Chervinsky (@jchervinsky) March 1, 2022

“Russia has normally managed to survive thanks to Western sanctions and cryptocurrencies are not in its strategies. Putin’s system is to diversify Russian reserves into yuan and gold (non-crypto) and shift trade to Asia (non-blockchain).

Putin could have developed his very own crypto infrastructure if he had desired to. But he did not. Therefore, there is no purpose for Putin to do it now. “

However, the controversy surrounding Russia’s shares with cryptocurrencies is occurring exceptionally significantly and significantly on all fronts, from authorities to major industry experts. While the present findings are nonetheless inconclusive, it really should be mentioned that in the previous as quite a few as 3 nations – North Korea, Venezuela and Iran – have utilised cryptocurrencies to evade sanctions and hide quite a few secret ambitions.

Synthetic currency 68

Maybe you are interested: