Silvergate Bank is dealing with a US investigation into its ties to the collapse of Sam Bankman-Fried’s FTX/Alameda crypto empire.

According to Bloomberg A group of US Senators reportedly sent a letter to Silvergate on Jan. thirty clarifying the “major link” concerning this financial institution and FTX/Alameda, just after becoming dissatisfied with the bank’s “avoidant” response on this matter earlier.

US prosecutors from Justice Department’s Fraud Unit are wanting into Silvergate’s dealings with FTX and Alameda Research https://t.co/JAoA36GdGU

— Bloomberg Crypto (@crypto) February 2, 2023

The investigation centered on “crypto-friendly” financial institution accounts linked to Sam Bankman-Fried’s organization. However, Silvergate was not charged with any wrongdoing in the early phases of the investigation.

Silvergate stated bankruptcy fund Alameda opened an account with the financial institution in 2018 ahead of establishing FTX. The financial institution says it has a detailed danger management and compliance plan in area and has continually monitored FTX and Alameda. The financial institution is also topic to yearly audits by regulators this kind of as the Federal Reserve, as very well as independent audits.

However, the crypto financial institution has not been immune to the fallout from FTX, getting to be the hardest hit by the exchange’s sudden collapse in November, Silvergate notes. net reduction of $one billion final quarter and had to lay off forty% of its workers, as very well as reveal that it borrowed billions of bucks to protect against “liquidity crisis“spread just after FTX went bust. In the fourth quarter of 2022, Silvergate shoppers withdrew up to $eight billion of assets from the financial institution.

Shares of Silvergate fell much more than twenty% in February two trading ahead of jumping 29% at the shut, but information of the financial institution becoming investigated by the US came out just after hrs for the US stock market place. In January, utilized to get up to 50% off due to a series of FUDs involve. Recently, The “crypto bank” is even now in the midst of a class action lawsuit for alleged violation of securities laws.

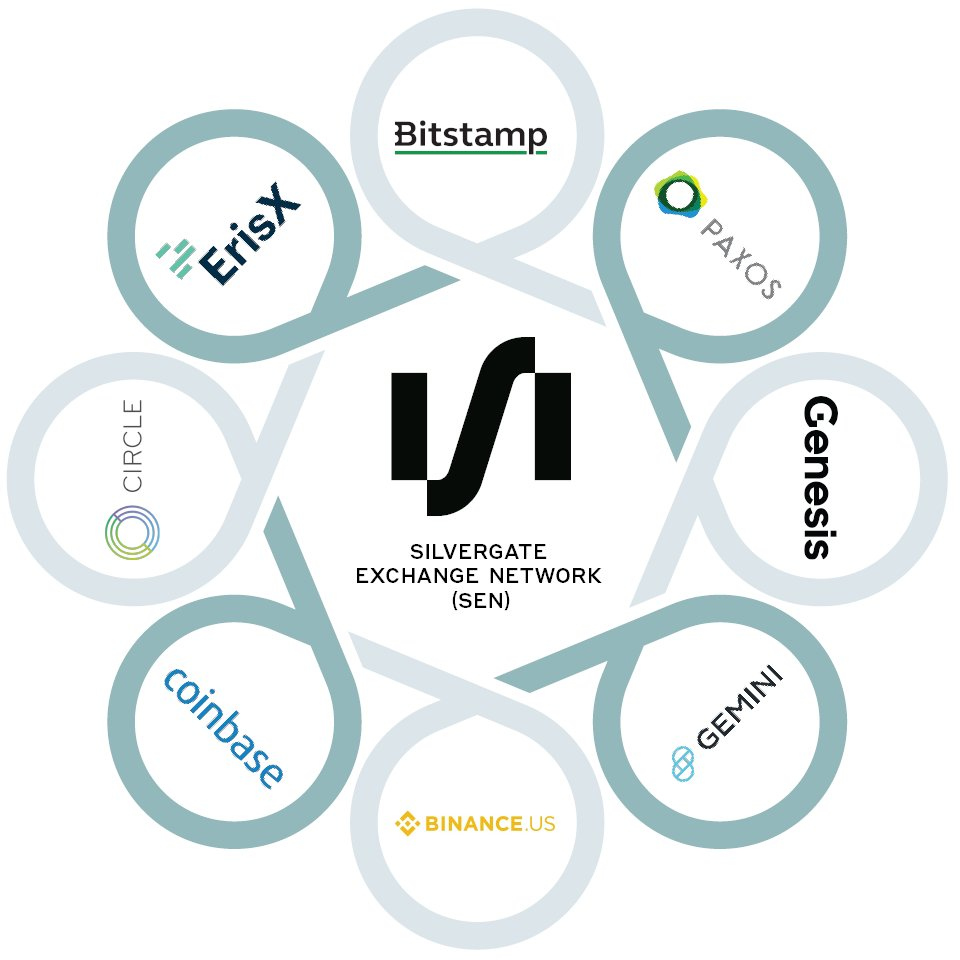

Silvergate “models itself” as a financial institution for cryptographic providers and an early cryptographic services supplier. The financial institution has set up techniques to allow true-time fiat and cryptocurrency transactions.

However, this bank’s function with the FTX/Alameda cluster is by far the most significant headache in Washington. The senators described the bank’s position in managing FTX-relevant money as a “major failure.”

Synthetic currency68

Maybe you are interested: