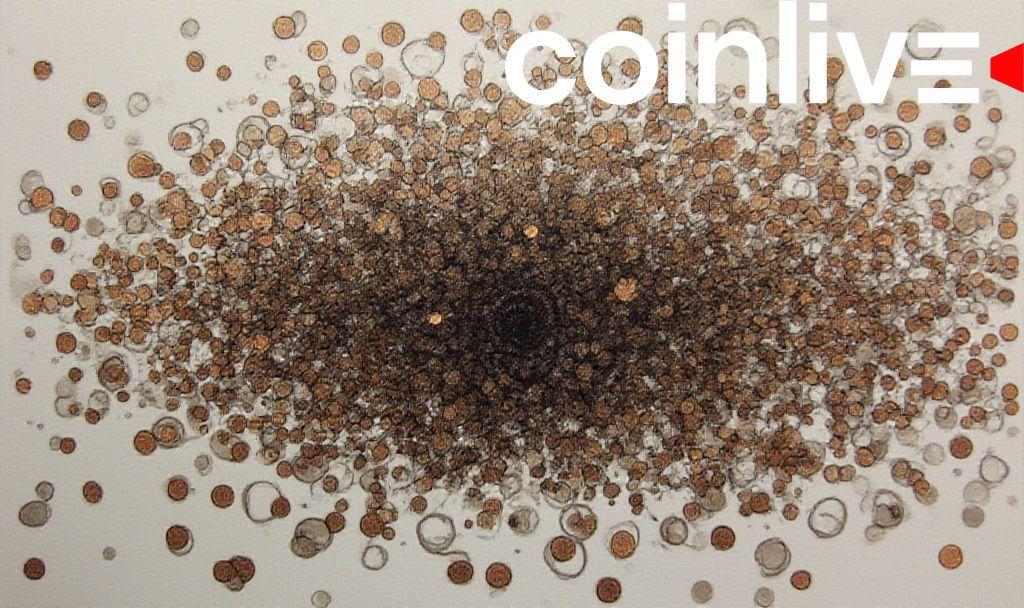

- The U.S. government ceases penny production, saving $56 million yearly.

- Treasury Department and President Trump lead this initiative.

- The public must adapt to the rounding of cash transactions.

The discontinuation of penny production aims to enhance government efficiency and reduce costs. It is expected to save approximately $56 million annually, aligning with broader efforts to cut governmental waste.

Strategic Leadership in Policy Savings

The U.S. Treasury Department, under President Trump’s direction, announced the cessation of penny production by early 2026. Trump criticized the penny for costing more than its face value. As he stated:

“For far too long the United States has minted pennies which literally cost us more than 2 cents. This is so wasteful! Let’s rip the waste out of our great nation’s budget, even if it’s a penny at a time.” — President Donald Trump, Truth Social

The Treasury Department spokesperson noted the anticipated taxpayer savings and highlighted efforts for government efficiency.

Economic Implications

Ceasing penny production affects financial allocations, cutting $85.3 million in losses experienced by the Mint in 2024. According to the 2024 Annual Report of the United States Mint, production cost savings reinforce shifts toward electronic transactions but minimally impact core crypto assets.

Historically, countries like Canada discontinued coins with no adverse macroeconomic effects. These actions indirectly nudge towards digital payments and alternative tools like stablecoins, without immediate market disruptions, reinforcing discussions about cashless transactions.

Market and social impacts focus on transaction changes, requiring cash adjustments to the nearest five cents. The decision reflects a move towards digital-friendly policies, affecting market sentiments slightly, without impacting major crypto markets directly.

While previous strategies in coin discontinuation show limited fiscal disruption, the move favors digital currency acceptance. Historical trends suggest limited immediate impact on digital asset flows but enable further discussion on digital currency implementations.