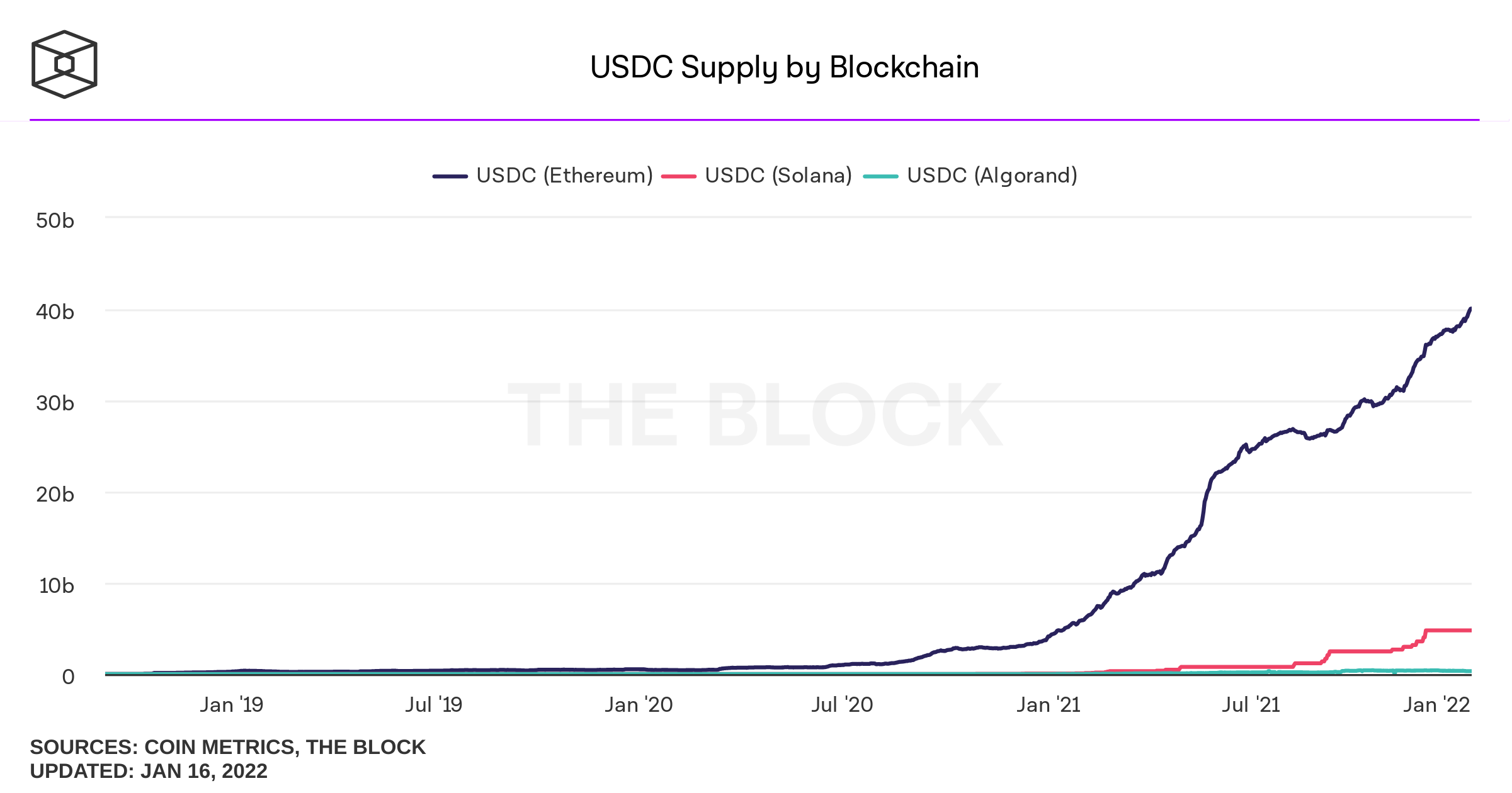

The complete provide of stablecoin USD Coin (USDC) on the Ethereum blockchain outperformed the offer you of rival Tether (USDT) for the initially time.

According to information from The Block, the latest complete provide of USDC on Ethereum is $ 39.92, when that of USDT on the blockchain is $ 39.82 billion.

USDC’s bid milestone beating USDT is vital as ETH’s blockchain stays a key contributor to the development and competitors of each of these stablecoins. Both USDC and USDT are now also offered on a lot of other common blockchains which include Solana (SOL) and Algorand (ALGO).

One of the motives that has aided drive USDC’s latest breakthrough momentum is the rising demand for USDC in the DeFi industry. USDC is favored for DEX trading and for a variety of functions in a lot of key DeFi tasks. Equally vital are the dynamics all over the industry in common.

In 2021, because Circle, the business behind USDC, finished a $ 440 million funding round and announced the USDC escrow mechanism, the place of the 2nd stablecoin on the industry has altered substantially. The evidence is that USDC may perhaps quickly broaden to function on ten diverse blockchains. The not too long ago additional blockchains are Tron (TRX), Hedera Hashgraph (HBAR) and Avalanche (AVAX). Not only that, the Solana blockchain has more than two.five billion USDC in circulation.

– See a lot more: The “surprising” statistics on the USDC

Additionally, Circle also ideas to develop into an American crypto financial institution, following arranging to publicly offer you the business at a $ four.five billion valuation, focusing all awareness on the USDC. Followed by a partnership with Mastercard to launch a crypto-fiat payment campaign or the launch of an investment fund to help crypto begin-up tasks, Circle is performing a wonderful career at this stage in setting up believe in in key fiscal institutions.

It is not all-natural for Messari to confidently say that USDC will develop into the “dominant” stablecoin on Ethereum, regardless of the relatively tense regulatory condition when the SEC started investigating Circle because October of this 12 months.

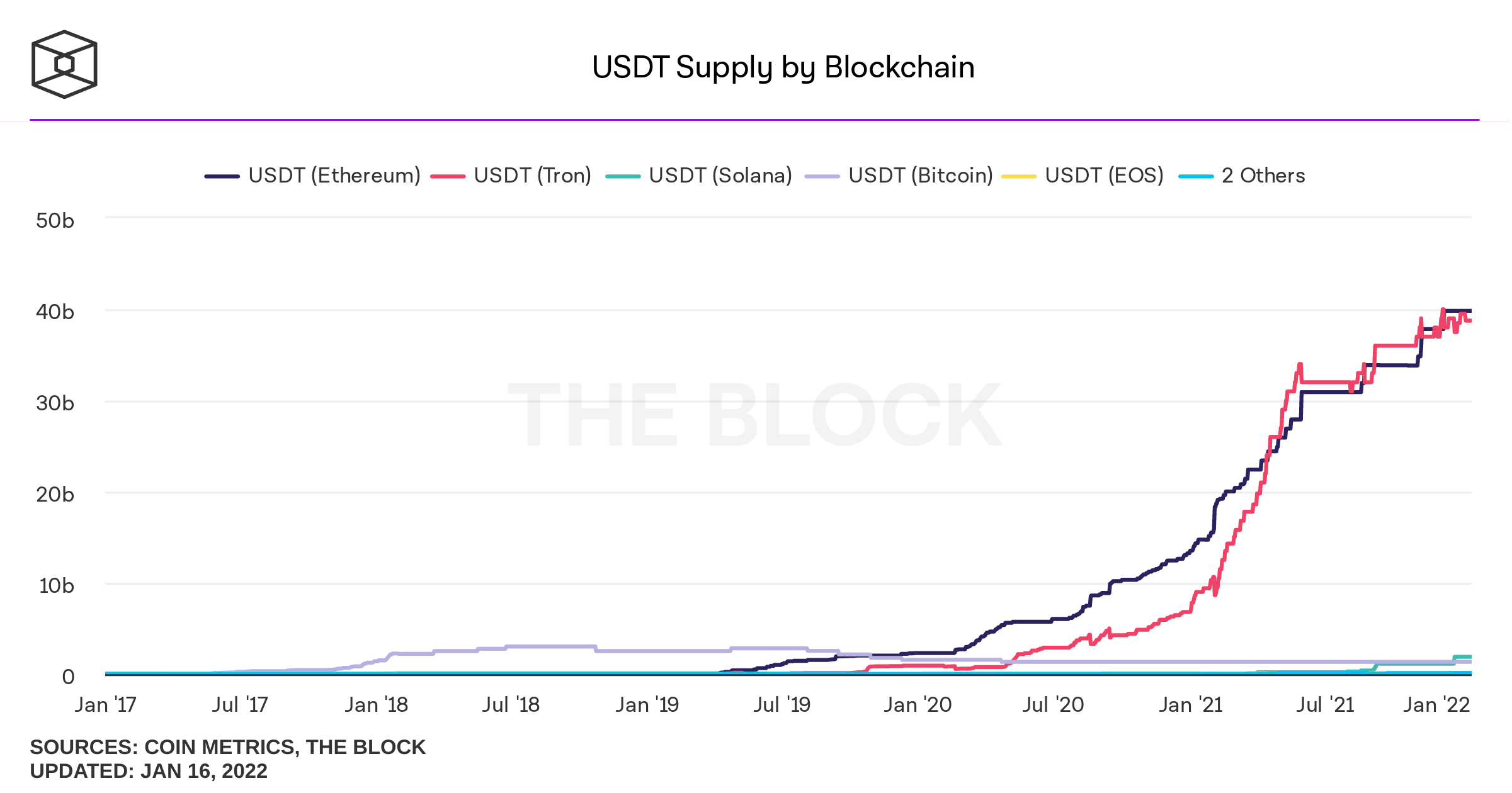

However, the story of Tether (USDT) is an opposite situation. In May, Tether announced for the initially time the kinds of assets it held, to reassure the public about the securitization standing of the platform, but the effects have been not specifically constructive. In purchase to ease tensions, the platform continued to publish a new audit report in August, but even a lot more “worrying” indicators emerged.

Things acquired worse when Bloomberg abruptly launched a “shocking” report on Tether (USDT). Not stopping there, Tether and Bitfinex continued to be fined $ 42.five million in the USDT escrow situation, which was brought in right by the US Futures Trading Commission (CFTC). Hence, the skepticism surrounding Tether’s degree of self-confidence that there are ample reserves to help the USDT stays an unanswered query.

To clarify USDT’s inferiority to USDC on Ethereum, Tether CTO Paolo Ardoino mentioned USDT is diverse from rivals who depend largely on DeFi platforms to boost their providing. With the latest bear industry sentiment, the demand for USDT from institutions has declined, whilst the attraction from retail traders is rising from Turkey and some Latin American nations.

Looking at the greater image, the complete provide of USDT on all other blockchains continues to stay larger than that of USDC, even as the provide of USDC has elevated constantly more than the previous couple of months, when USDT nevertheless has a stagnant share.

Synthetic currency 68

Maybe you are interested: