Valkyrie stated it will get started acquiring Ethereum futures contracts in planning for including to the current Bitcoin futures ETF.

Valkyrie Prepares to Launch a Hybrid Bitcoin and Ethereum Futures ETF

Valkyrie Prepares to Launch a Hybrid Bitcoin and Ethereum Futures ETF

Second FOX Business, well-liked Wall Street asset manager Valkyrie stated it has obtained SEC approval to convert the Bitcoin futures ETF into a hybrid investment product or service consisting of Bitcoin and Ethereum futures contracts. Valkyrie initial filed with the SEC in mid-August, as reported by Coinlive.

Valkyrie claims to be the initial to present this kind of a product or service in the US industry.

🚨SCOOP: Tomorrow @ValkyrieFunds will begin providing visibility to #ETH futures by means of its a short while ago mixed Bitcoin and Ether Strategy ETF, producing it the initial U.S. corporation to permit traders to bet on the long term cost of the 2nd-greatest digital asset.

We will have Valkyrie CIO…

— Eleanor Terrett (@EleanorTerrett) September 28, 2023

The fund will get started trading BTC and ETH futures solutions on October three, below the code identify BTF. This is the Bitcoin futures ETF product or service launched by Valkyrie in October 2021.

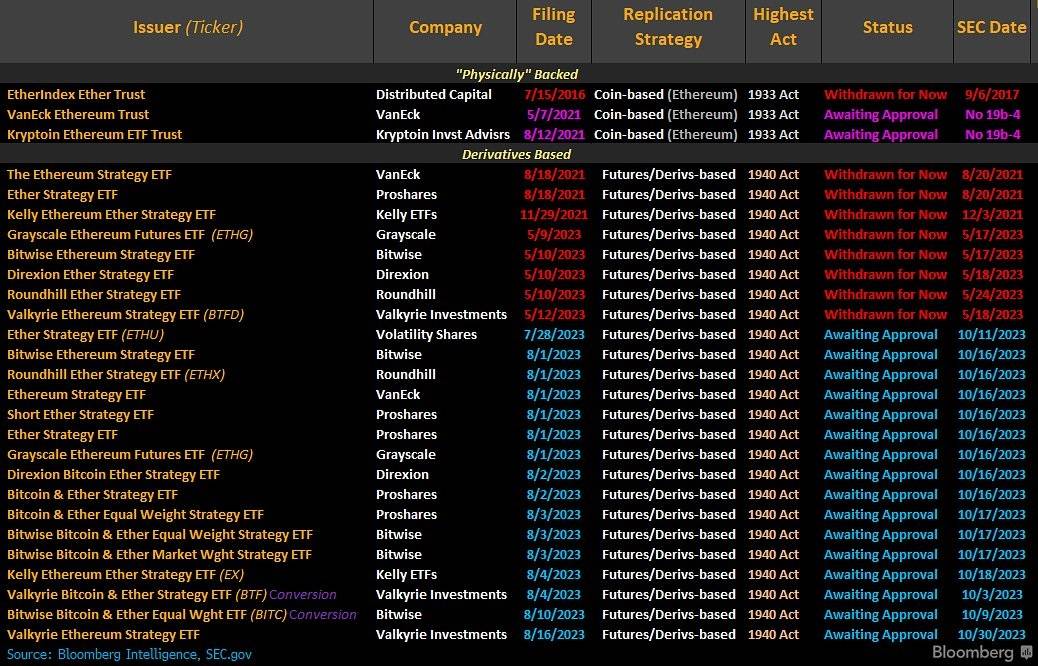

As reported by Coinlive, there has a short while ago been a wave of Wall Street giants opening proposals to set up an Ethereum futures ETF with the SEC, which include Volatility Shares, VanEck, Roundhill, Bitwise, Direxion, ProfessionalShares, Hashdex and Grayscale.

Ethereum futures ETF proposals are awaiting SEC approval. Photo: Bloomberg

Ethereum futures ETF proposals are awaiting SEC approval. Photo: Bloomberg

Earlier on the evening of September 28, a further unit, VanEck, stated it was about to open trading for its Ethereum futures ETF product or service, code-named EFUT.

Financial observers stated that the Ethereum futures ETF has a large probability of remaining authorized, for the reason that the Bitcoin futures ETF has existed in the industry considering that October 2021.

However, the SEC is nevertheless saying no to Bitcoin and Ethereum spot ETF proposals, as demonstrated by a series of reprieves this week.

Coinlive compiled

Join the discussion on the hottest difficulties in the DeFi industry in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!