The father of blockchain provide chain monitoring VeChain Foundation just launched its economic report for the very first quarter of 2022, bragging about accumulating $ one.two billion in money but investing only $ four.one million in the final quarter .

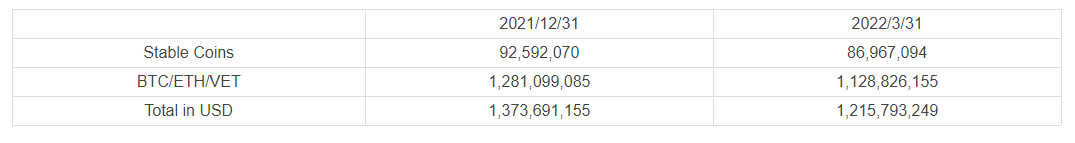

In the stability sheet there is a diagram of the fund’s stability sheet as of March 31st, which exhibits the funds movement of the task in the quarter. Although the coffers have been total of $ one.37 billion in assets which include stablecoin, Bitcoin (BTC), Ether (ETH) and VET, this figure had dropped somewhat to $ one.two billion by the finish of the time period. The report states that most of the losses are evident “due to the volatility of the cryptocurrency market and other expenses of the VeChain Foundation.”

The rate of BTC has dropped 34%, ETH has fallen by 36%, and VET has fallen by 54% because December 31, 2021.

In the curiosity of constant transparency pertaining to the investments and expenditures of the #VeChain Foundation, we are delighted to share the Financial Report Q1 2022:https://t.co/eJzc3NmBAx#SmartContract #Blockchain #Finance #Cryptocurrency #VeChainThor $ VET $ VTHOR

– VeChain Foundation (@vechainofficial) May 10, 2022

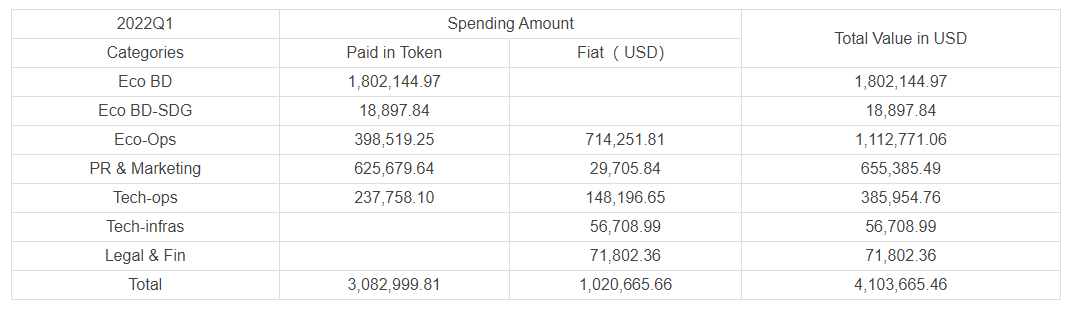

Of the $ four.one million in funding in the very first quarter, the Foundation invested $ one.eight million on producing the ecosystems business enterprise, which was the heaviest cost in the final quarter.

This was followed by $ one.one million for operational routines this kind of as payments to the task group, workplace area, utilities, consulting costs, and outdoors solutions.

Although the report claims that the treasury is only made use of to “secure the long-term development of the VeChainThor blockchain”, it is unclear no matter whether the platform will “open the tap” of the treasury for other investments.

The Fund does not mention the quantity of cash the Fund earned in Q1 VeChainThor costs costs for transactions involving the validator and other stakeholders in the ecosystem. However, the complete quantity of these accumulated commissions is also not disclosed in the stability sheet.

The report also mentions VeChain’s carbon information management method and VeCarbon’s partnerships with cement manufacturing firms.

In the very first quarter, VeChain launched its VeUSD stablecoin. The task also partnered with Amazon Web Service (AWS) to generate VeCarbon emissions management application as a support method (SaaS) for China.

Currently, VET has a marketplace capitalization of $ two.six billion, down about .six% in the previous 24 hrs and is trading at $ .039 in accordance to information obtained by Cointelegraph. Coinecko.

Synthetic currency 68

Maybe you are interested: