Vires Finance undertaking overview

What is the Vires Finance undertaking?

The Vires Finance undertaking is a peer-to-contract undertaking that produces a dollars industry for end users of the Waves blockchain. Where end users, wallets and dapps can participate as depositors or borrowers. Depositors offer liquidity to the industry to earn passive earnings, whilst borrowers can borrow extreme collateral.

The Vires Finance undertaking is a Pool-primarily based undertaking that aids end users not to have to negotiate on curiosity charges simply because the protocol determines itself primarily based on algorithms and the stability in between provide and demand.

The particularity of the Vires Finance undertaking

Vires.finanza makes use of a typical pool-primarily based mechanism in which all deposited money engage in assets of the exact same curiosity. The higher the demand for a true estate loan, the higher the revenue for a loan provider with an APY.

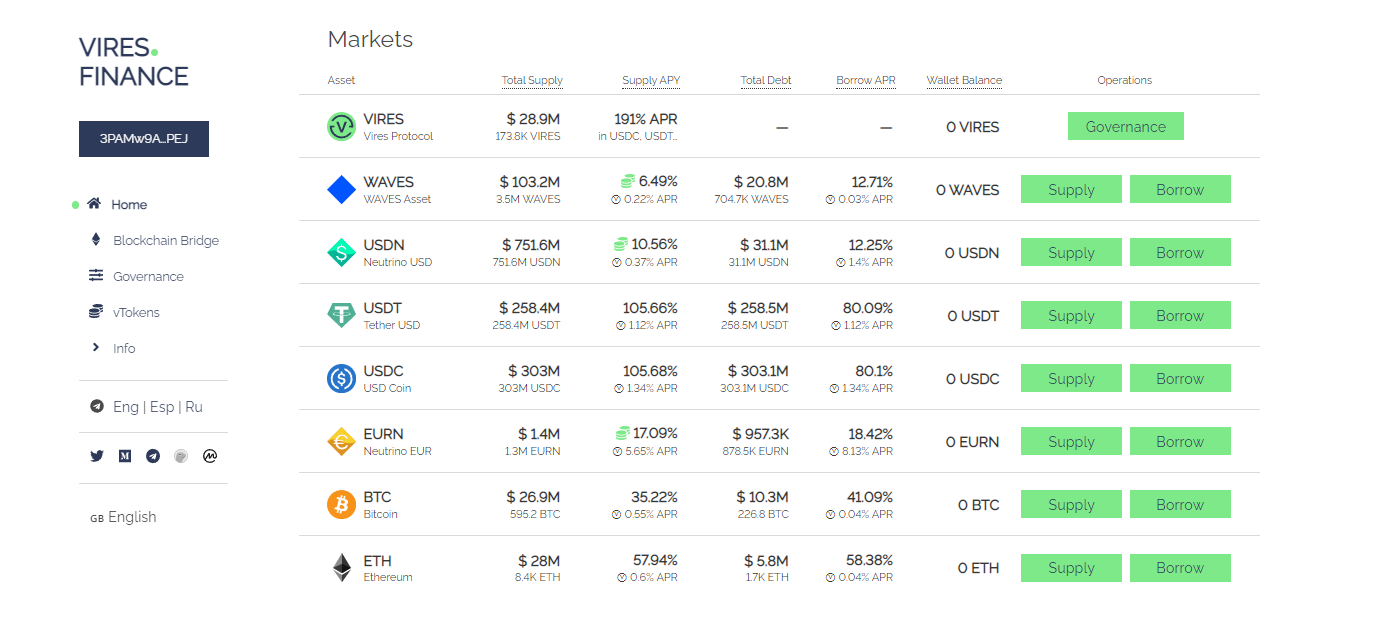

Users can lend and borrow the following tokens: WAVES, USDN, USDT, ETH and BTC.

To borrow a home, the man or woman should initial offer the home as collateral for a loan. The debt can be repaid at any time, like the sum borrowed and the curiosity incurred.

How the Vires Finance undertaking operates

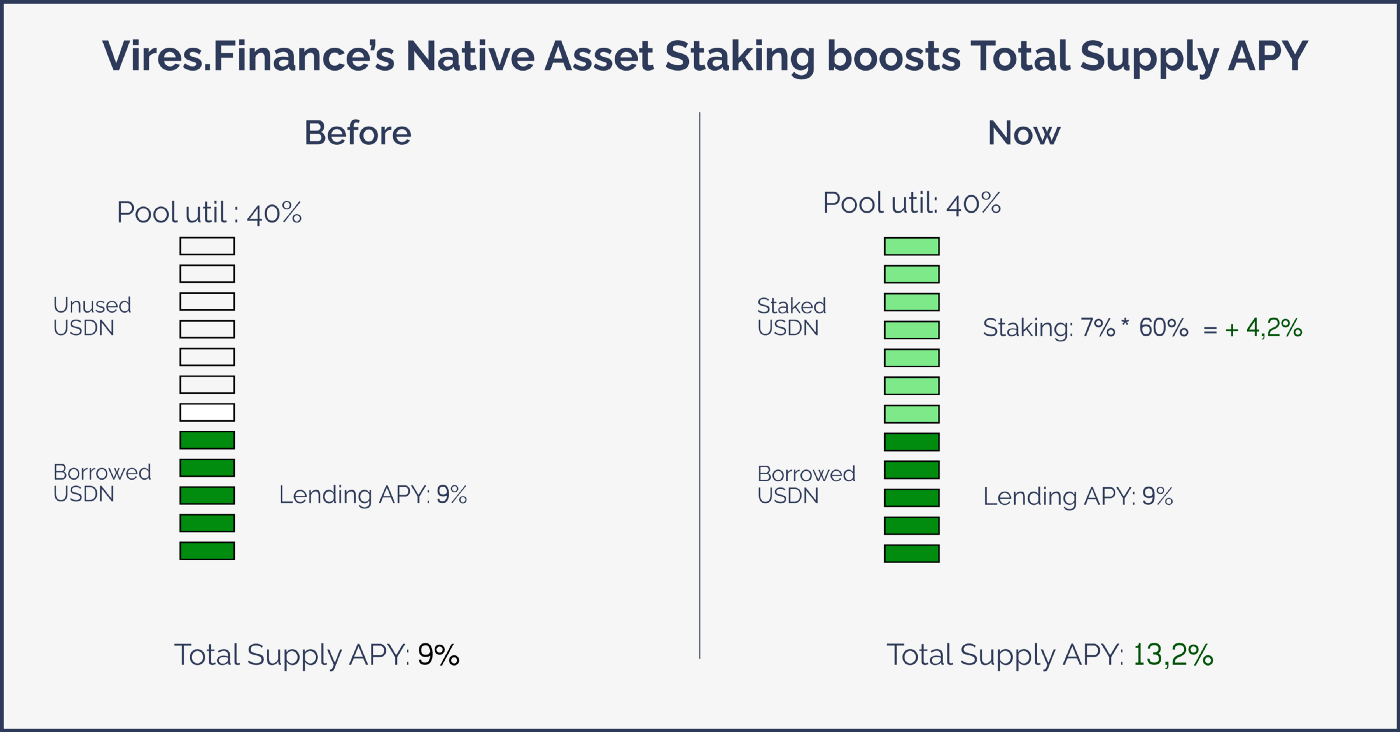

When end users offer liquidity to Vires.Finance, element of it is loaned to other end users. Borrowers pay out off APR loans, which are distributed between liquidity companies in the type of APY loans. The increased the utilization, the increased the APY and APR. With the new update, the unused (non-lending) USDN will immediately be assigned to Neutrino to create far more USDN income for liquidity companies.

The exact same goes for WAVES: Unused (not loaned) WAVES are normally immediately leased to a node to create far more WAVES income for the LP.

Overall, this can make Vires.Finance the very best spot to bet on WAVES and USDN – not only do liquidity companies appreciate the highest returns across mixed income streams, they also participate in the First campaign to earn additional $ VIRES!

Basic information and facts about the VIRES token

Key metrics of the VIRES token

- Token title: Personal finance.

- Ticker: VIRES.

- Blockchain: WAVES.

- Standard Token: WAVES.

- To contract: Updating…

- Token variety: Government.

- Total provide: ten,000,000 VIRE

- Circulating provide: 309.870 VIRES

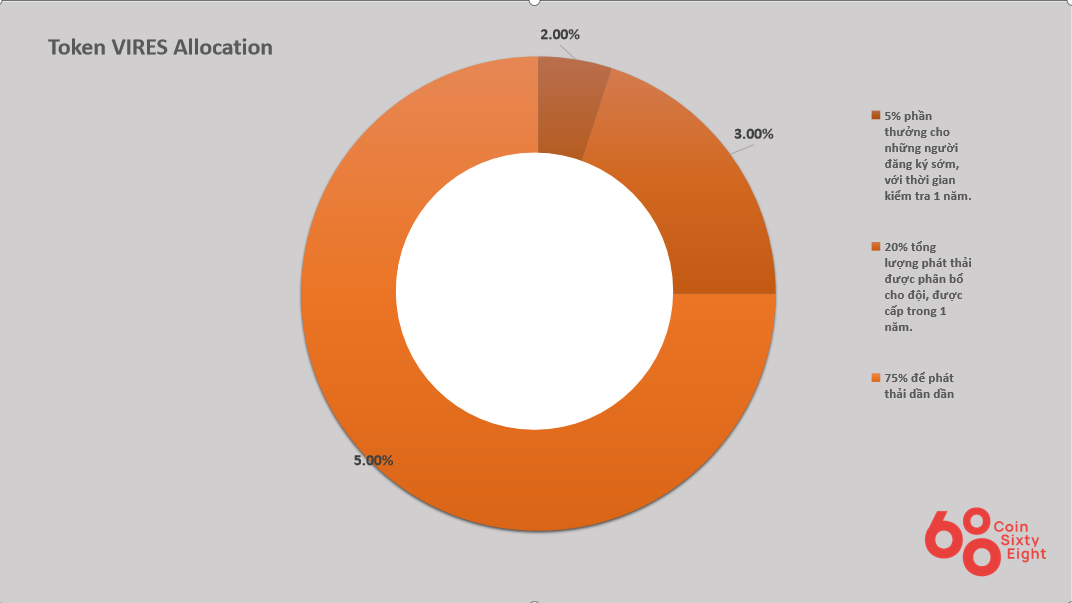

Token VIRES Allocation

- five% of the complete troubles are awarded in early enrollment rewards, with a trial time period of one 12 months.

- twenty% of the complete emissions are assigned to the group, granted for one 12 months.

- The residual sum (75%) is meant for phased troubles to protocol participants and other desires underneath complete governance manage.

Use situation of the VIRES token

- Protocol administration.

- Provide liquidity.

- VIRES stakeout.

How to invest in, promote and hold VIRES tokens

You can order and hold VIRES tokens on the Waves Keeper wallet or on the Waves Exchange.

VIRES Finance roadmap

Updating…

The refined advancement group of the Vires Finance undertaking

Updating…

Investors and advancement partners

Updating…

Vires Finance undertaking overview, really should invest in VIRES tokens or not?

The Vires Finance undertaking is a loan and lending undertaking and also has unique assistance for the USDN stablecoin, an algorithmic stablecoin. Currently, the Vires Finance undertaking delivers one hundred% increased APY charge for stablecoins this kind of as USDT, USDC when participating in the undertaking. However, this undertaking by now has some FUD information and facts from operation and securityyou have to be cautious and make a selection when you skin in the game with this undertaking.

This write-up is not investment suggestions, you really should thoroughly take into account prior to building choices when working with your dollars. Coinlive is not accountable for any of your investment choices. I want you good results and earn a good deal from this prospective industry.