Cryptocurrency loan provider Voyager Digital says it has acquired various repurchase features at greater charges and improved terms than FTX has performed in the previous.

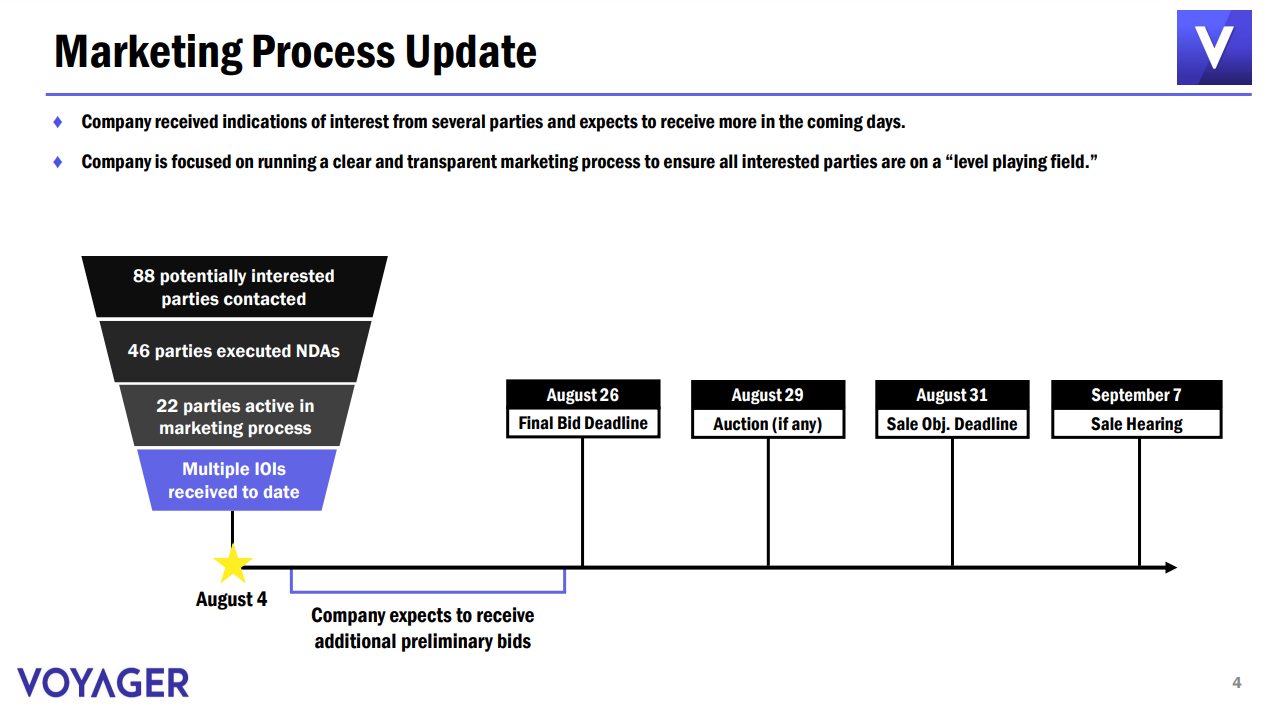

In its Aug. four presentation, Voyager stated it had acquired information from 88 stakeholders making an attempt to conserve the corporation from its fiscal woes, as effectively as good discussions with additional than twenty prospective stakeholders.

This seems to have opened a “new gate” for Voyager, which is locked in a rather difficult romantic relationship with the FTX exchange and the Alameda Research fund.

In July 2022, FTX proposed to buy all of Voyager’s assets and exceptional debt except Three Arrows Capital’s default loan of up to $ one billion when the fund was deemed to be “defaulting on debt.” “in excess of $ 662 million, soon after which FTX will liquidate assets and distribute money in USD through the FTX.US exchange.

However, Voyager turned down this present on the grounds that FTX did not maximize worth for the company’s shoppers. In addition, Voyager announced that it has also individually sent Alameda and FTX a letter of termination and desistance pertaining to inaccurate public statements, confirming that organizations led by CEO Sam Bankman-Fried are at this time not out there “opportunities” to participate in a acquisition than a lot of other traders.

However, the information comes at the identical time as US Bankruptcy Court Judge Michael Wiles permitted Voyager to return $ 270 million in consumer money held at the Metropolitan Commercial Bank (MCB).

– db (@ tier10k) August 4, 2022

Voyager had funds held in a financial institution account when the corporation filed for bankruptcy on July five. Those money have been frozen when bankruptcy proceedings started. Voyager’s debt quantities to practically $ ten billion from somewhere around one hundred,000 creditors.

Synthetic currency 68

Maybe you are interested: