Bankruptcy lending platform Voyager Digital will return income to clients inside of the up coming week.

Cryptocurrency Lending Platform Digital traveler notification will restore entry to income deposits on August eleven, though cryptocurrencies and stablecoins will proceed to await a Chapter eleven court ruling.

Yesterday the court accepted our proposal to restore entry to income (US bucks) held at the Metropolitan Commercial Bank for the advantage of Voyager clients.

We prepare to resume entry to in-app income withdrawals starting up Thursday 11th August. Details: https://t.co/yqsKdJhiXQ (one/seven)

– Voyager (@investvoyager) August 5, 2022

Voyager’s account had previously been blocked in bankruptcy proceedings, right up until yesterday a judge accepted the company’s proposal to restore entry. In certain, Voyager will be in a position to return $ 270 million in income from clientele held at the Metropolitan Commercial Bank (MCB). Those with income in their account will be in a position to withdraw up to USD a hundred,000 each and every 24 hrs and the dollars will be returned inside of five-ten days of the request.

Voyager stated in the statement:

“Requests will be processed as quickly as possible, but will have to go through a series of manual reviews, including fraud assessment and account reconciliation, which will depend in part on individual banks.”

At the exact same time, Voyager also uncovered that it acquired 88 buyback presents at larger rates and far better terms than FTX had ever presented.

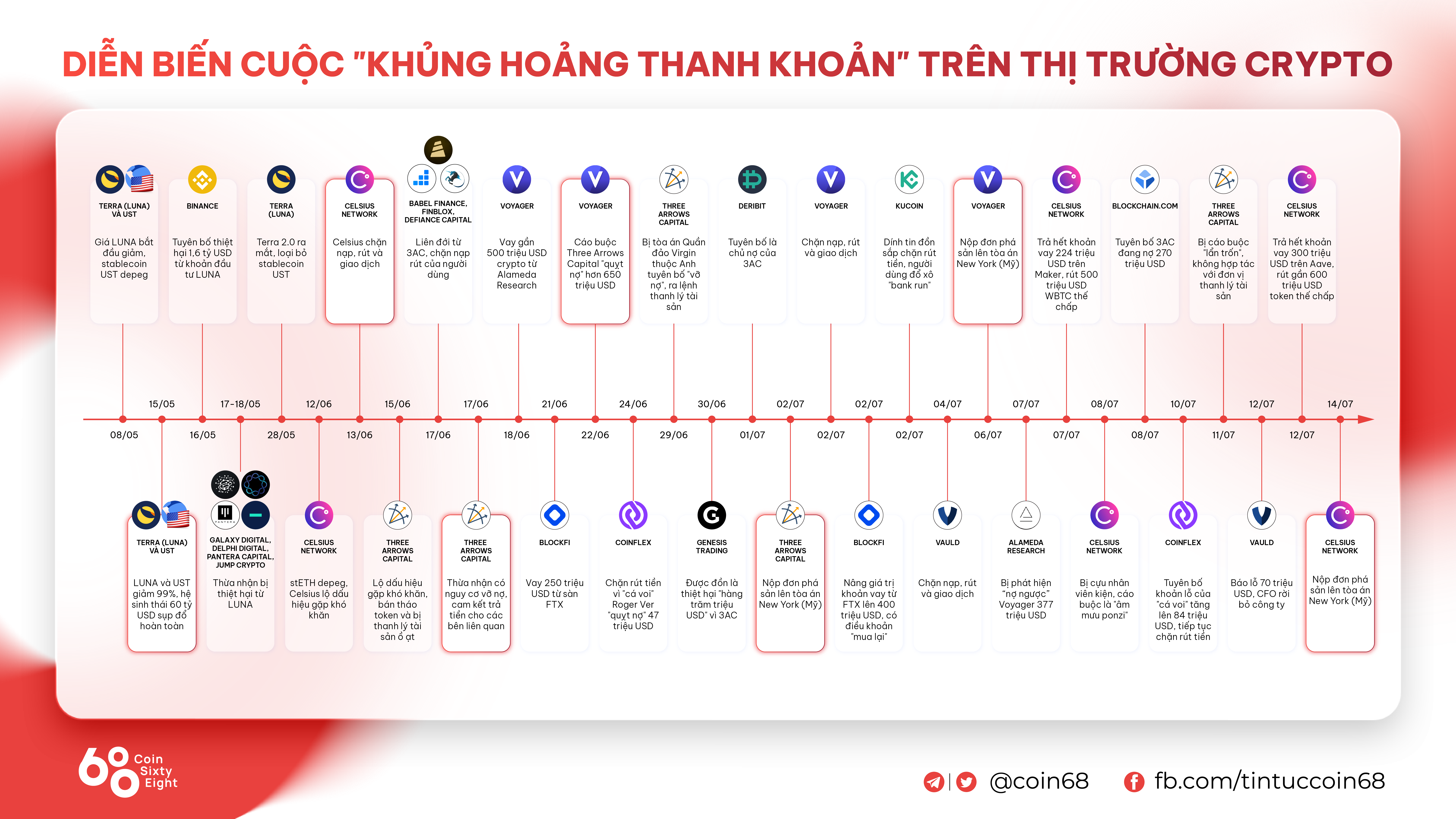

As reported by Coinlive, Voyager, which is run by CEO Steve Ehrlich, filed for bankruptcy safety on July five immediately after staying implicated by the enterprise. hedge fund Three capital arrows and the liquidity crisis has spread to the marketplace. Clients have lent the organization billions of bucks in cryptocurrency and it is not still clear exactly where the token’s fate will go. However, Voyage uncovered that it is pursuing an independent restructuring course of action in an work to maximize the worth of the cryptocurrencies on the platform.

Synthetic currency 68

Maybe you are interested: