Stellar (XLM) price has dropped 10% in the past seven days as it struggles to maintain its $10 billion market capitalization, currently at $10.87 billion. Momentum indicators such as RSI show a sharp decline, signaling increased selling pressure and the trend potentially moving closer to oversold conditions.

The Ichimoku Cloud chart further reinforces the negative outlook, as XLM trades below the cloud and shows no immediate signs of a reversal. Traders are keeping a close eye on the $0.351 support level, as failure to hold this level could lead to further decline, while a successful recovery could pave the way for a recovery towards 0.40 USD and more.

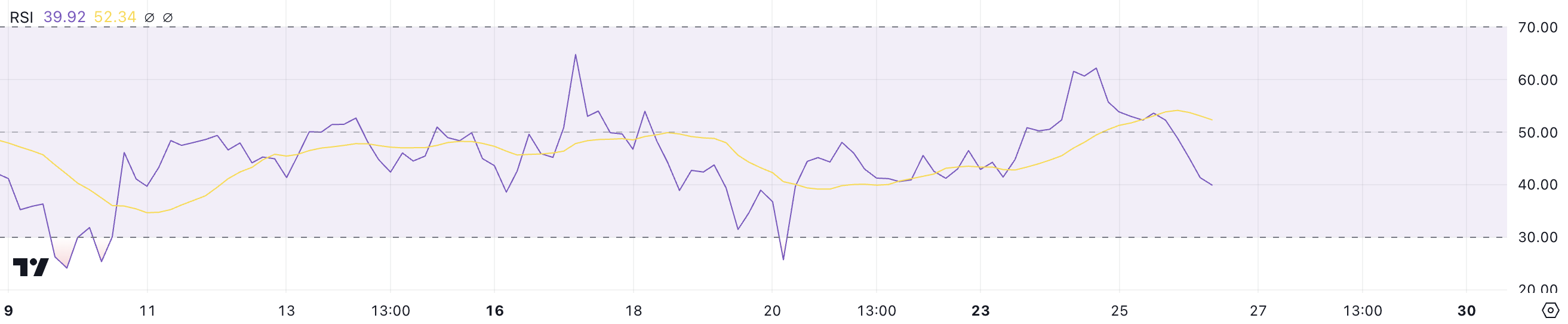

Stellar’s RSI is neutral, but falling

The Stellar Relative Strength Index (RSI) is currently at 39.9, down sharply from a level of over 60 just two days earlier, on December 24. This significant drop indicates a rapid loss of buying momentum quickly, with the market shifting towards negative sentiment.

The move from the previously strong neutral zone to the lower RSI zone indicates increased selling pressure, bringing XLM closer to oversold conditions, although not yet fully entering that zone.

RSI, a momentum oscillator, measures the speed and amplitude of price changes on a scale of 0 to 100. Values above 70 indicate overbought conditions, often heralding a price correction, while Values below 30 indicate oversold conditions, potentially signaling a recovery.

With XLM’s RSI at 39.9 and falling rapidly, the coin is hovering near the edge of negative momentum, signaling the possibility of further near-term declines. If selling pressure continues, XLM’s price could test lower levels, but if buyers return and stabilize the market, a potential recovery could prevent further losses.

XLM’s Ichimoku Cloud forecast shows a strong negative setup

XLM’s Ichimoku Cloud chart points to a negative outlook, as the price currently trades below the cloud (red and blue shaded areas), signaling bearish momentum.

The blue conversion line (Tenkan-sen) is below the red baseline (Kijun-sen), further reinforcing the negative sentiment and suggesting that sellers currently dominate the market. Additionally, the price has failed to break above the cloud in recent attempts, reinforcing the strength of the negative trend.

The lag (blue line) lies below both price and the cloud, further emphasizing the continued negative pressure.

The futures cloud (red) shows that lead A (blue edge) remains below lead B (red edge), forecasting continued negative sentiment in the short term. These indicators suggest that XLM price is likely to continue under pressure, with limited signs of an imminent reversal unless there is a significant shift in momentum.

XLM Price Forecast: Can the $0.351 support hold?

Stellar price is currently trading near the critical support level at $0.351.

If this support fails to hold, XLM price could face further negative pressure, with a possible drop to $0.31.

On the other hand, if XLM holds the $0.351 support and rebounds, it could regain upward momentum and test resistance at $0.40.

Breaking through this resistance could pave the way for further gains for XLM, with the possibility of testing the next key level at $0.47.