The big difference in the consumption charge of Binance’s WBETH and BETH ETH staking tokens is raising several queries.

Was Binance caught minting new ETH staking tokens but not burning previous ones?

Was Binance caught minting new ETH staking tokens but not burning previous ones?

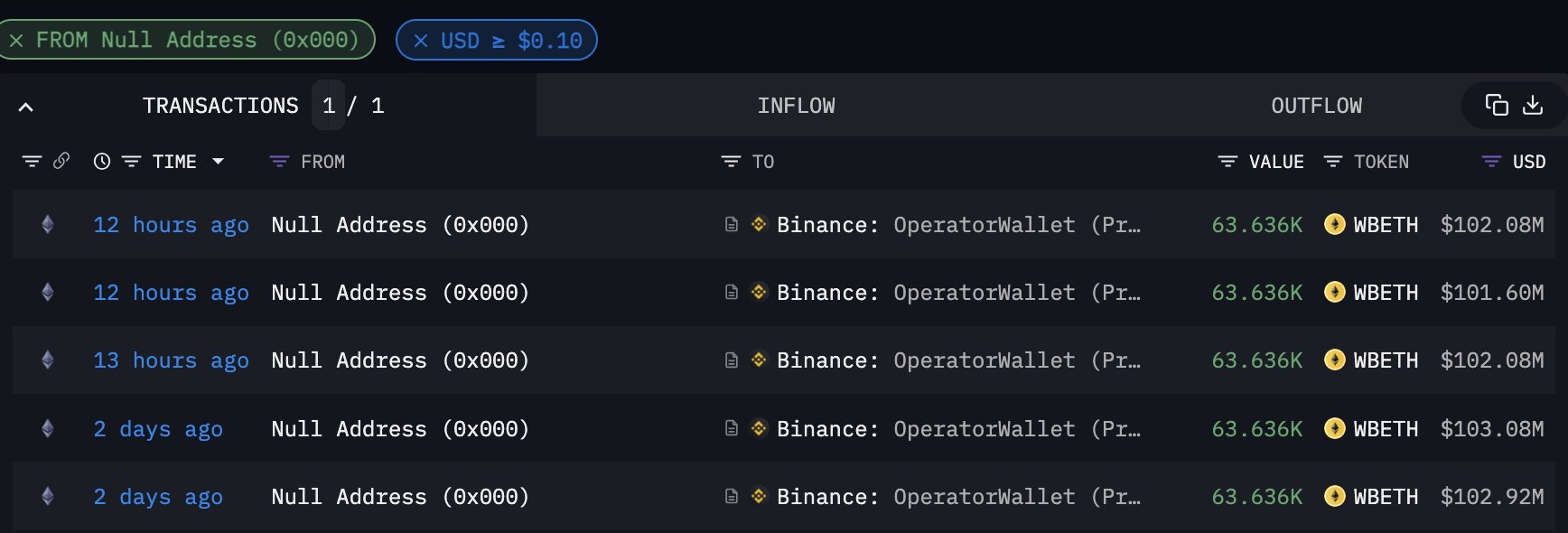

On-chain information exhibits that in excess of the previous two weekends, Binance has minted a complete of 318,180 WBETH, divided into five tons, well worth in excess of $500 million. These tokens are then transferred to a wallet handle termed “Binance 6,” a cold wallet the place the exchange holds the user’s assets.

Data on Binance’s new WBETH difficulties

Data on Binance’s new WBETH difficulties

WBETH (Wrapped Beacon ETH) is a far more up to date edition of BETH, a wrapped token employed to exchange ETH when consumers stake ETH by way of Binance. WBETH was launched by Binacne in April 2023, following which the exchange announced a series of measures to strengthen new tokens and restrict previous ones, such as the “gradual” burning of BETH in the Binance wallet.

This usually means that when Binance Mint releases a specific quantity of new WBETH, it has to burn up the equivalent quantity of BETH in the wallet. However, this hottest Binance minting sparked controversy mainly because it did not burn up BETH quickly following the minting action, but until eventually it was reported by Conor Grogan, Director of Product and Sales at Coinbase:

Binance burned $524 million well worth of BETH following my tweet https://t.co/Bt2eZ7VRDD https://t.co/vsUfpJty9n pic.twitter.com/59Fdvb5FS2

— Conor (@jconorgrogan) September 26, 2023

On Monday (September 25), the exchange eventually burned 330,000 BETH.

Binance explained in a submit that these transactions are aspect of the exchange’s previously announced move to progressively convert BETH to WBETH, as pointed out.

In truth, this is not the 1st time that Binance has been ambiguous about the token mint burn up ratio. After the over discovery, the on the net neighborhood returned at the finish of 2022, the exchange burned only 98.five% of the complete a hundred million BETH issued.

It will get a good deal far more enjoyable, Binance minted a hundred million $BETH (85% of $ETH provide) in 2020, when BSC was launched

And they only observed it final yr, in 2022, when they burned 98.five%. https://t.co/AvPQt0eCjW pic.twitter.com/uQhcluhf3E

— Wazz (@WazzCrypto) September 26, 2023

This new minting and burning of Binance induced the organization’s TVL to raise as it noticed $500 million inflow, bringing the short-term TVL complete to $one.two billion.

Binance is staked at one.two million ETH and is one particular of the biggest units in the Ethereum staking network, behind only Lido Finance and Coinbase, in accordance to 21Shares. Currently, in accordance to information, the quantity of WBETH representing ETH is close to USD 765,000 DefilLama.

Coinlive compiled

Join the discussion on the hottest difficulties in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!