What is Waterfall Defi (WTF)?

DeFi waterfall is a platform for correct danger diversification via revenue-producing tranches of DeFi assets.

How does Waterfall Defi get the job done?

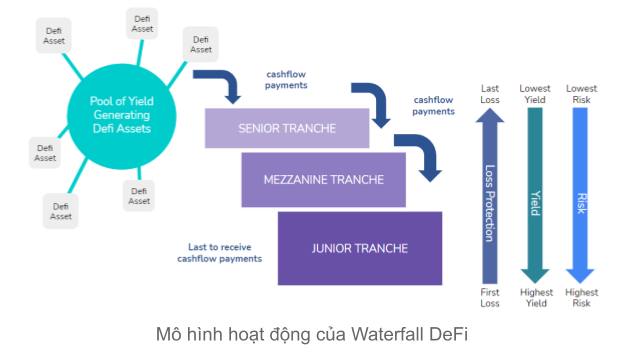

The tranche is portion of the DeFi asset pool. The Waterfall DeFi tranches are investment solutions. Each tranche is graded and has its personal anticipated return, danger and maturity. There are three kinds of tranches: Senior Tranche, Mezzanine Tranche, Junior Tranche.

Cash movement produced by the underlying DeFi assets is paid sequentially wherever Senior Tranche customers are paid in advance of Junior Tranche customers. This kind of cascade payment is applicable in the two situations wherever the underlying asset helps make a revenue or suffers a reduction. In the 2nd situation, Senior Tranche customers are to start with paid their principal + fixed earnings and then Junior Tranche customers are paid the rest of their principal when they endure a big reduction. Senior Tranche customers only acquire their fixed APY, even though all supplemental income are paid to Junior Tranche customers.

Highlights of the Waterfall DeFi tranche

Diversification: DeFi customers can invest in a portfolio of DeFi assets as a substitute of just a single, as a result benefiting from the diversification of danger and return.

Leverage the yield: Lower trading divisions let danger-taking DeFi customers to earn leveraged returns on their current investment approaches, this kind of as delivering liquidity to DEXs.

Products with increased fixed APYBy pooling the riskiest DeFi assets, the platform features a safe fixed fee of return products that allows customers to reach increased returns than conventional DeFi solutions. The senior tranches will be especially eye-catching to danger averse customers.

Waterfall DeFi solutions

Project tranches let customers to make their personal danger management choices effectively and economically. The to start with tranche Waterfall DeFi products is the BUSD stablecoin, which is a portfolio of 3 picked BUSD loan deposits on BSC: Alpaca Finance, Cream Finance and Venus.

Basic info about the WTF token

- Token title: Waterfall

- Ticker: WTF

- Blockchain: Binane Smart Chain

- Token normal: BEP-twenty

- To contract: Updating

- Token style: Utility

- Total give: one hundred,000,000 WTF

- Circulating provide: Updating

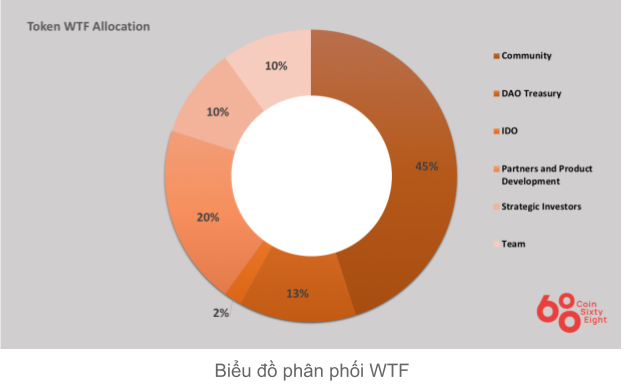

Token allocation

- Community: 45%

- Darling DAO: 13%

- I DO: two%

- Product developers and partners: twenty%

- Strategic Investors: 10%

- Squad: 10%

What is the WTF token utilised for?

- Administration

- Sharing of platform income

- Encourage customers to deposit funds in unique tranches to stability the deposit fee

WTF Token Storage Wallet

Updating

How to earn and personal WTF tokens

Updating

Where to purchase and promote WTF tokens?

Updating

Roadmap

V1. Waterfall Defi – Predetermined sets of assets and tranches of portfolios

The platform will to start with launch various fixed sets of DeFi portfolio assets, wherever every single asset portfolio will be split into a minimal of two tranches: Senior and Junior. The income will be fixed and established on the Senior tranche even though the income on the Junior tranche will be variable (based on any losses suffered on the capital). The phrase will also be fixed (quick phrase – up to one week, two weeks, four weeks). The governance mechanism will also let customers to propose a record of DeFi assets to be incorporated in the pool’s eligibility, this kind of as COVER-WETH Sushi-swap LP tokens. Other governance challenges will involve the percentage of WTF tokens distributed to unique tranches, as very well as the quantity of costs redistributed to WTF token holders.

V2. Waterfall Defi – Tranche with variable / perpetual maturity

As the Waterfall DeFi platform turns into additional strong and effective, the task improvement workforce will launch variants of the tranche, enabling for additional versatile duration and yield selections.

V3. Waterfall Defi – Origin of DIY tranches

The Waterfall platform ideas to democratize the conventional origin and management of tranche solutions so that any seasoned DeFi consumer can make their personal portfolio of tranche solutions, which will earn initialization and transaction costs in return, as a result encouraging higher use and ease. for the products and platform.

Strategic partners and traders

What is the potential of the Waterfall Defi task, really should I invest in WTF tokens or not?

DeFi waterfall is a task that makes it possible for customers to classify dangers by dividing DeFi asset pools into numerous unique tranches, with unique revenue margins and danger pools providing customers additional possibilities when it comes to making crops. Through this write-up, you need to have by some means grasped the essential info about the task to make your investment choices. Coinlive is not accountable for any of your investment choices. I want you accomplishment and earn a good deal from this prospective marketplace.