Institutional crypto money have knowledgeable their biggest retracement because the starting of the yr as most traders worry the existing industry problem.

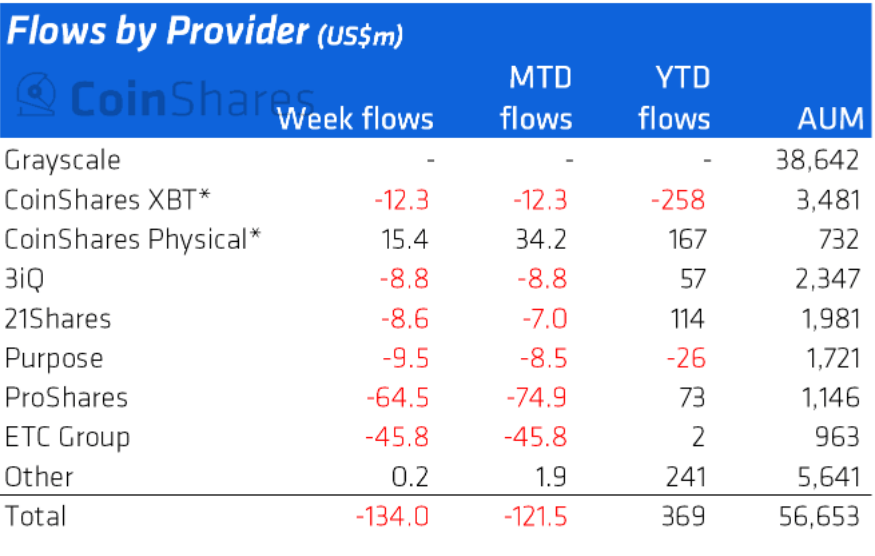

With $ 134 million in income outflows from cryptocurrency investment merchandise, the industry continues to return to its trajectory of stagnation that has lasted because December 2021, marking the 2nd worst week of 2022 for managed money and has proven adverse transform right after only two consecutive weeks of recording capital inflows.

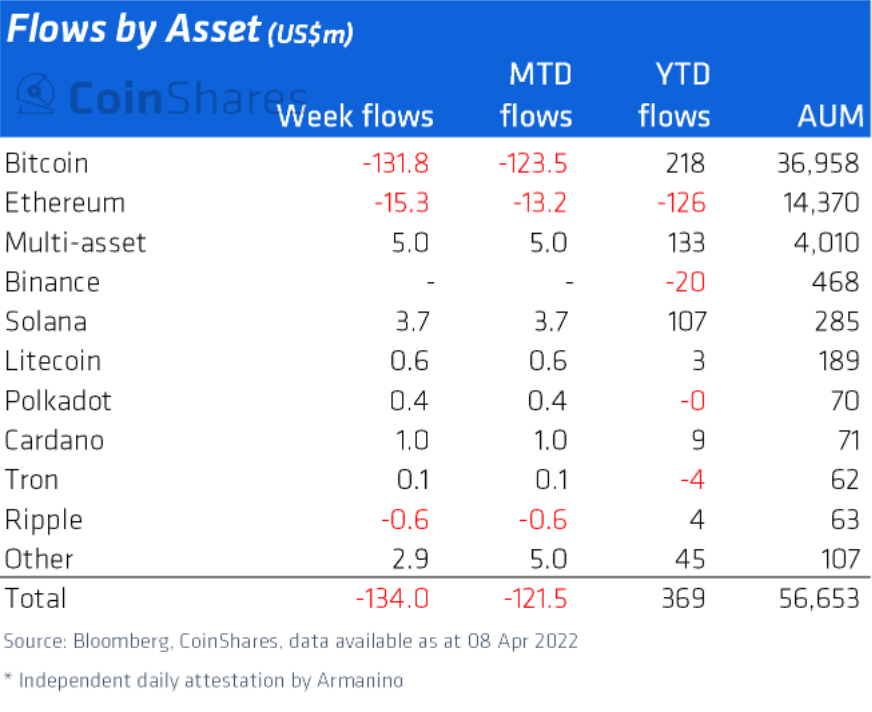

Notably, Bitcoin’s industry share accounted for just about 90% of the industry final week, up to $ 131.eight million out of the pockets of institutional traders. Next up is Ethereum (ETH), which noticed $ 15.three million dry up, bringing its estimated yearly net really worth to a adverse $ 126 million.

Meanwhile, altcoins and other multi-asset money even now have remarkable resilience and have viewed inflows of $ six million and $ five million respectively. Solana (SOL) in unique prospects with $ three.seven million right after seeing a $ eight.two million drop final week alongside Cardano (ADA) $ one million.

The momentum for SOL, ADA and altcoin in standard is understandable for the reason that in the encounter of the volatile volatility of Bitcoin, which corrected to a one-month very low at $ 39,200, the world’s major derivatives exchange CME abruptly regarded as the implementation of a merchandise for this coin.

CME has also extra benchmark charges for eleven distinct altcoins, opening a big tipping stage in terms of probable ETFs and futures merchandise for the altcoin industry, by no means in advance of viewed in background. Consequently, the sentiment of institutional traders is relatively deflected when all their efforts seem to be to “surrender” wholly to the stress of the BTC miners.

The purpose is that in the previous CME has alone assisted Bitcoin and Ethereum to attain unimaginable objectives. In December 2017, as quickly as CME officially launched the world’s to start with Bitcoin futures contract, BTC instantly peaked at $ twenty,000, marking a “successful” yr. Next up is ETH, the merchandise launched in February 2021, and ETH also set an ATH in May at $ four,a hundred.

Summary of Coinlive

Maybe you are interested: