Bitcoin seems to be dealing with a “moment of life or death” when most whales commence reporting BTC’s release on exchanges.

According to information reported on May seven by CryptoQuantThe quantity of Bitcoin whales is quickly declining to amounts not witnessed because the starting of the 12 months. The unhappy information is that the major whales on the industry have sent in between ten and ten,000 Bitcoins to the exchanges. This demonstrates that they distribute BTC a lot more than retail traders.

#Bitcoin Do whales promote or invest at retail? 🧐

“Biggest player and whales who sent ten to 10k $ BTC to the Exchanges. They distribute a lot more than retail traders. “

from @IT_Tech_PLRead more👇https://t.co/wt19VglLJo pic.twitter.com/hXwJKHZAfZ

– CryptoQuant.com (@cryptoquant_com) May 7, 2022

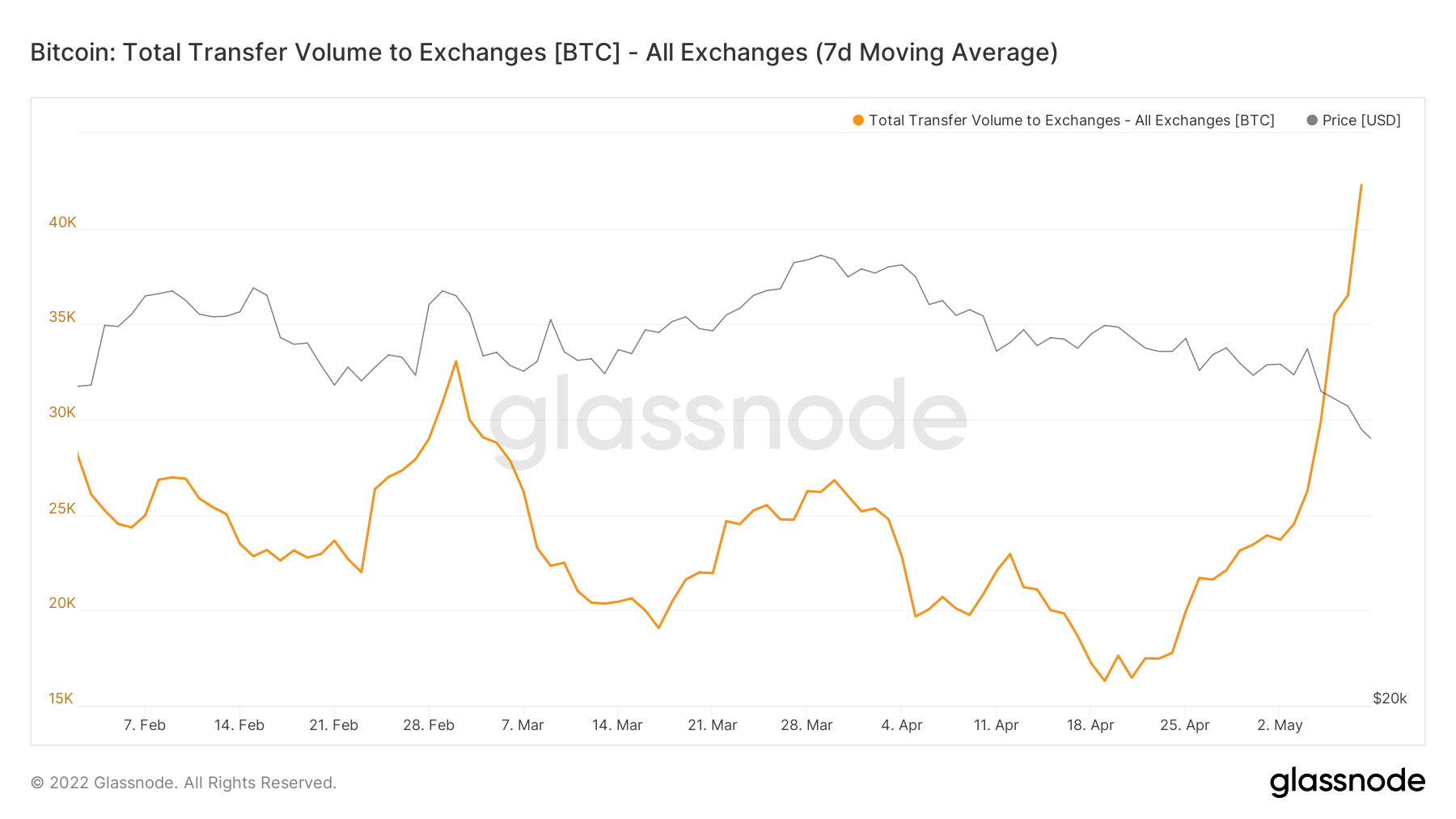

Daily bitcoin inflows into CEX exchanges have been just recorded on May eight with more than one.75k BTC, surpassing the three-month higher of one.72k BTC. The higher quantity of Bitcoins deposited on exchanges signifies that whales are a lot more probable to depart the industry by promoting most of their BTC holdings, maybe as a way to put together for a prolonged-phrase downtrend.

#Bitcoin $ BTC Trade Inflow Volume (7d MA) just hit a three month higher of one,755,021 BTC

The preceding three-month higher of one,729,605 BTC was observed on May eight, 2022

View metrics:https://t.co/1S6EbDkdOO pic.twitter.com/8kSJPOLJXW

– glassnode alerts (@glassnodealerts) May 9, 2022

Even the Luna Foundation Guard (LFG), which is believed to have a extremely near bond and loyalty to Bitcoin by means of quite a few “huge” purchases, had to “lend” $ 750 million in Bitcoin right after acquiring yet another $ one.five billion in Bitcoin alone. five days in the past .

This move is meant to safeguard UST’s value from the occasion that UST just misplaced USD one due to the influence of BTC’s USD 33,000 dump. However, frankly, it is LFG that sells Bitcoin and goes towards its mission of constructing a hedge fund for the FSO.

Furthermore, the provide of reduction-producing Bitcoin is even now reaching “alarming” amounts. If the quantity recorded on April 28 is all-around seven.six million BTC, it has so far reached seven.seven million BTC, marking the highest degree not observed because April 15, 2020. More dangerously, this is when Bitcoin is plummeted from more than $ ten,000 to underneath $ five,000 in an quick when the COVID-19 pandemic started to erupt.

The reduction-producing give has reached its highest degree because the collapse of COVID.

from @GrizzlyBTCloverVerify👇https://t.co/3g7rOanHsw

– CryptoQuant.com (@cryptoquant_com) April 28, 2022

seven.seven million #Bitcoin I am presently at a reduction. This is the highest sum because April 15, 2020.

This is pretty much 41% of the complete circulating provide. pic.twitter.com/uXPR9PiJHT

– On-Chain College (@OnChainCollege) May 7, 2022

However, even though traders do not have to be concerned as well a lot about the epidemic suitable now, what we’re dealing with is just as critical, namely the Fed curiosity charge hikes, the subject inherently relevant to Bitcoin because late final 12 months and has dragged the whole cryptocurrency industry in a economic downturn.

In a press conference right after announcing the selection to increase curiosity costs by .five% just lately, Fed Chairman Jerome Powell created quite a few statements to carry on contemplating .five% for the upcoming June charge hikes. and July and does not intend to use the curiosity charge of .75%. However, this was adequate for the collapse of the standard economic industry, not just cryptocurrencies.

To get a standard knowing of why Fed charge hikes triggered this kind of a enormous storm in the cryptocurrency landscape, study the video under:

– Detail: Why is the cryptocurrency industry holding its breath waiting for details from the Fed – How does growing curiosity costs impact cryptocurrencies?

The prospect of an unfavorable industry also pushed the Fear and Greed Index of Investors to a quick drop to eleven, corresponding to “Extreme Fear”. Therefore, the danger of imminent huge-scale revenue stress can be rather higher.

Bitcoin Fear and Greed Index is eleven – Extreme Fear

Current value: $ 34,041 pic.twitter.com/PQK3x6YMok– Bitcoin Fear and Greed Index (@BitcoinFear) May 9, 2022

In terms of institutional investment, regulatory adoption and miner, Bitcoin showed a good side in contrast to the value response when it was officially accepted by the Central African Republic as a legal currency and payment system in Panama.

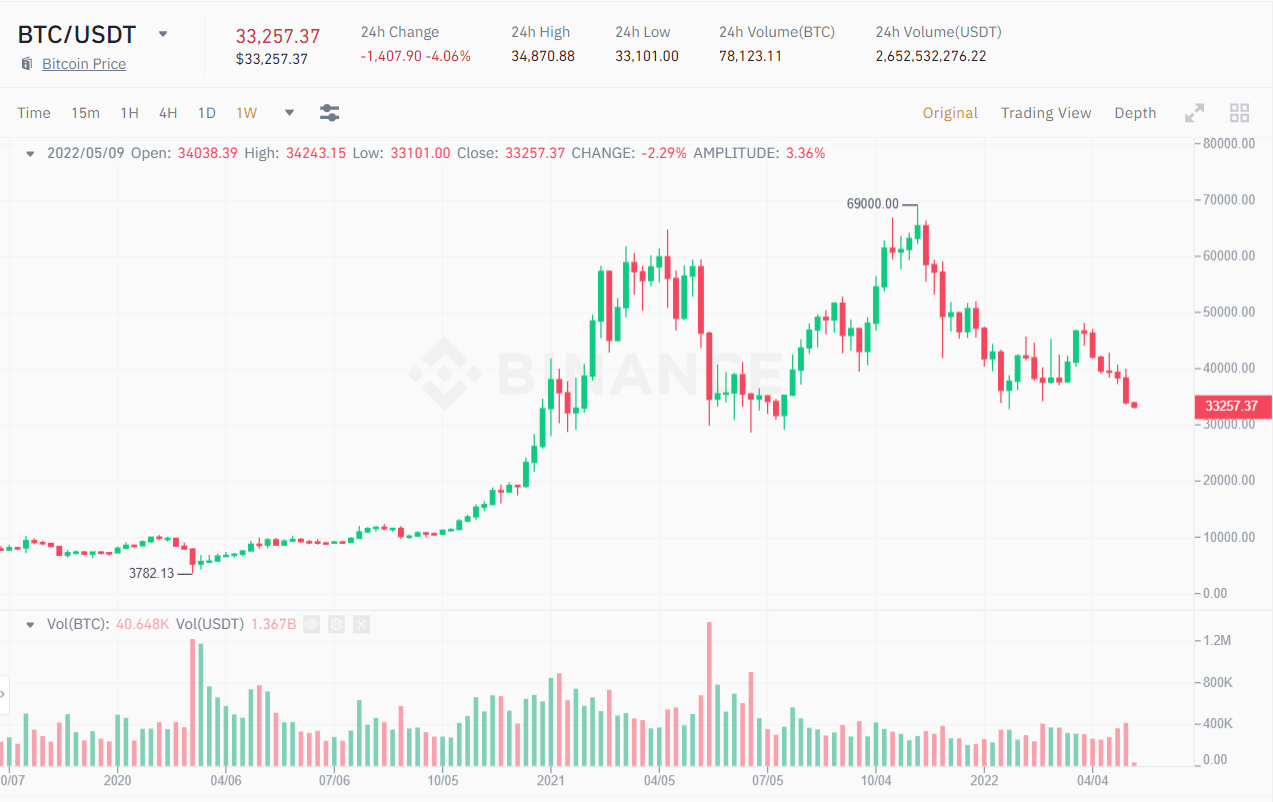

Through their Q1 2022 earnings report, the two most renowned whales in the industry, MicroStrategy and Tesla, the two announced that they have not offered any Bitcoin. Bitcoin mining problems and hashrate carry on to attain new highs, BTC’s every day transactions do not seem to be negatively impacted, and the cumulative action of miners is returning. However, that even now isn’t going to look adequate to create a safer momentum for Bitcoin’s recovery, ending at least the streak of seven consecutive red weeks because the starting of April.

However, it need to even now be mentioned that, if BTC continues to preserve its downward momentum, specially by surpassing the $ thirty,000 mark, MicroStrategy subsidiary MacroStrategy’s BTC home loan loans ($ 205 million) with organization Silverbank and Coinbase (undisclosed) with Goldman Sachs they are the two at possibility of liquidation. And the story of no matter whether these two giants will promote their BTC or preserve escalating the sum of collateral will be a major query mark.

This indicates that with the present condition, the Bitcoin whales themselves are “shipwrecked”. At press time, BTC is trading all-around $ 33,257.

Synthetic currency 68

Maybe you are interested: