Major Polygon investors have accumulated an additional $65 million in tokens over the past seven days, coinciding with a 12% increase in the price of the POL Token over the past 30 days. This growth has reignited hopes that the altcoin, formerly known as MATIC, can recover some of its recent losses.

However, some investors remain cautious, speculating that the current buying pressure may not be enough to maintain momentum. Below is an in-depth analysis of the situation.

Polygon Holders Add 113 Million Tokens To Their Balance

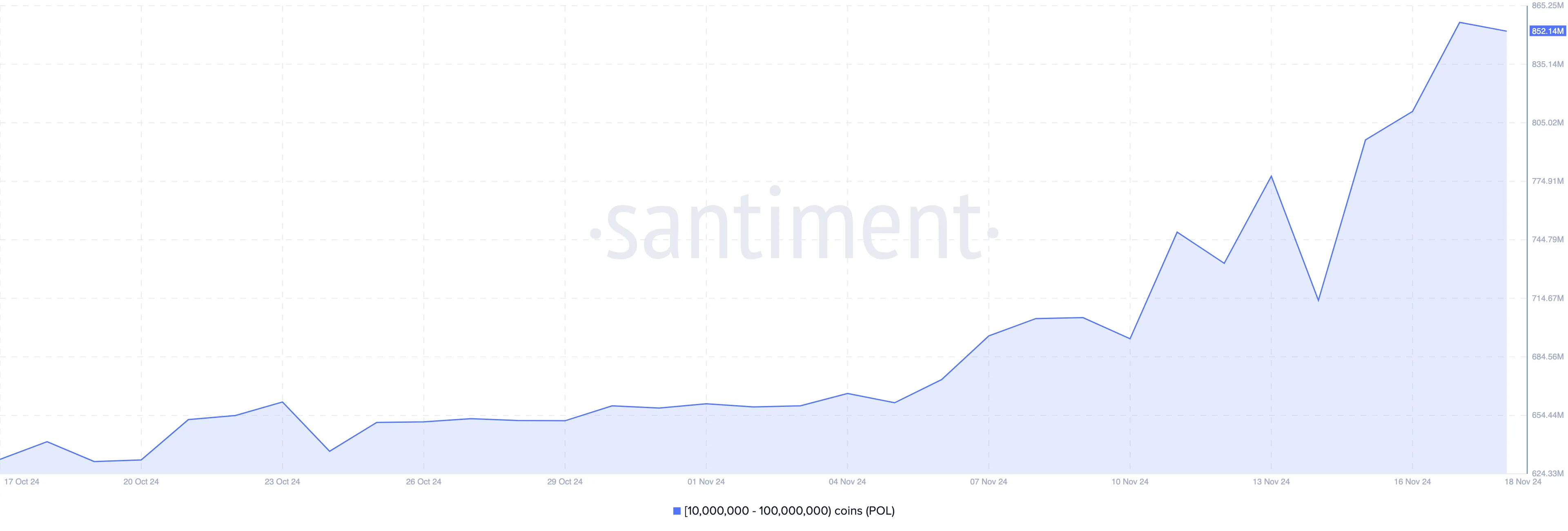

On November 11, addresses holding between 10 million and 100 million POL Tokens in their wallets owned a total of 695.38 million Tokens. Today, that number has skyrocketed to 852.14 million, proving that Polygon’s major investor has accumulated more than 113 million Tokens in the past seven days.

At the current price of the altcoin, this accumulation is valued at around 65 million USD. Typically, when large investors buy in, it’s a sign the value of a cryptocurrency may increase. This also encourages retail investors to accumulate, creating more pressure on price increases.

Conversely, when large investors sell, it often indicates negative sentiment, indicating that the Token’s value may have difficulty maintaining upward momentum. However, for POL, the recent accumulation by large investors is a positive indicator. If this trend continues, the Token’s price could surpass $0.42 in the short term.

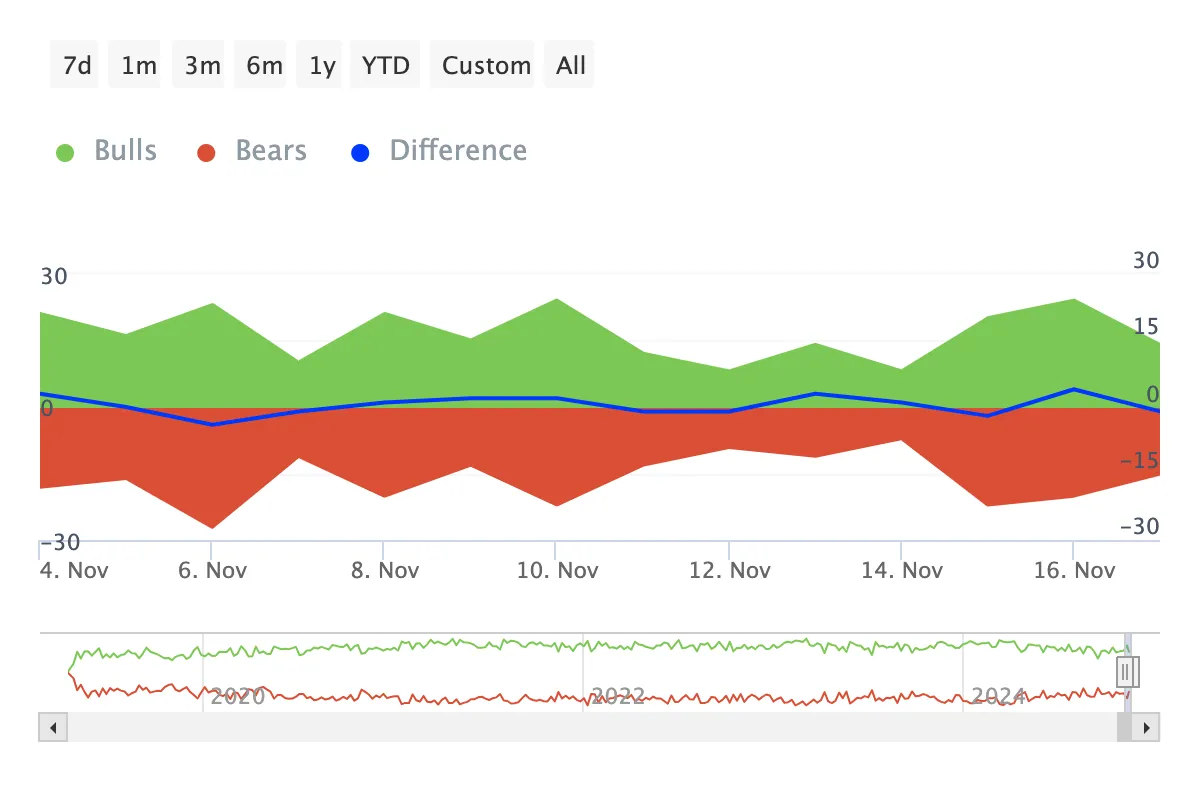

Furthermore, the increase in large investor accumulation has been accompanied by growing bullish dominance, as highlighted by IntoTheBlock’s Bull and Bear index. This metric tracks the performance of investors who buy (bulls) at least 1% of total trading volume compared to those who sell (bears) the same amount.

When bears outnumber bulls, this often signals a possible price drop. However, for Polygon ecosystem tokens, bulls are currently outperforming their bears, suggesting a higher likelihood of short-term price increases for the altcoin.

POL Price Forecast: Trend Becomes Bullish

Looking at the 4-hour chart shows that the POL/USD chart has formed an inverse head and shoulders pattern. The inverse head and shoulders pattern is a technical pattern that indicates a possible reversal from a downtrend to an uptrend.

The first bottom marks the beginning of the downtrend. The deepest bottom is below both the left and right shoulder, while the third and final bottom mirrors the left shoulder in depth but is higher than the head.

According to current assessments, POL’s price may increase to 0.45 USD in the short term. If Polygon’s large investors continue to buy in large quantities, the price of this altcoin could climb to the $0.60 mark.

However, if these large investors decide to sell part of their assets, this forecast could be invalidated. In that case, the price of Polygon Token could drop to 0.38 USD.