On December 4, the price of Bitcoin (BTC) surpassed the $100,000 mark for the first time, up 128% in 2024. Despite the impressive performance, BTC’s ADX index of 15.8 indicates a current uptrend lacks significant strength, suggesting the momentum behind recent price movements is limited.

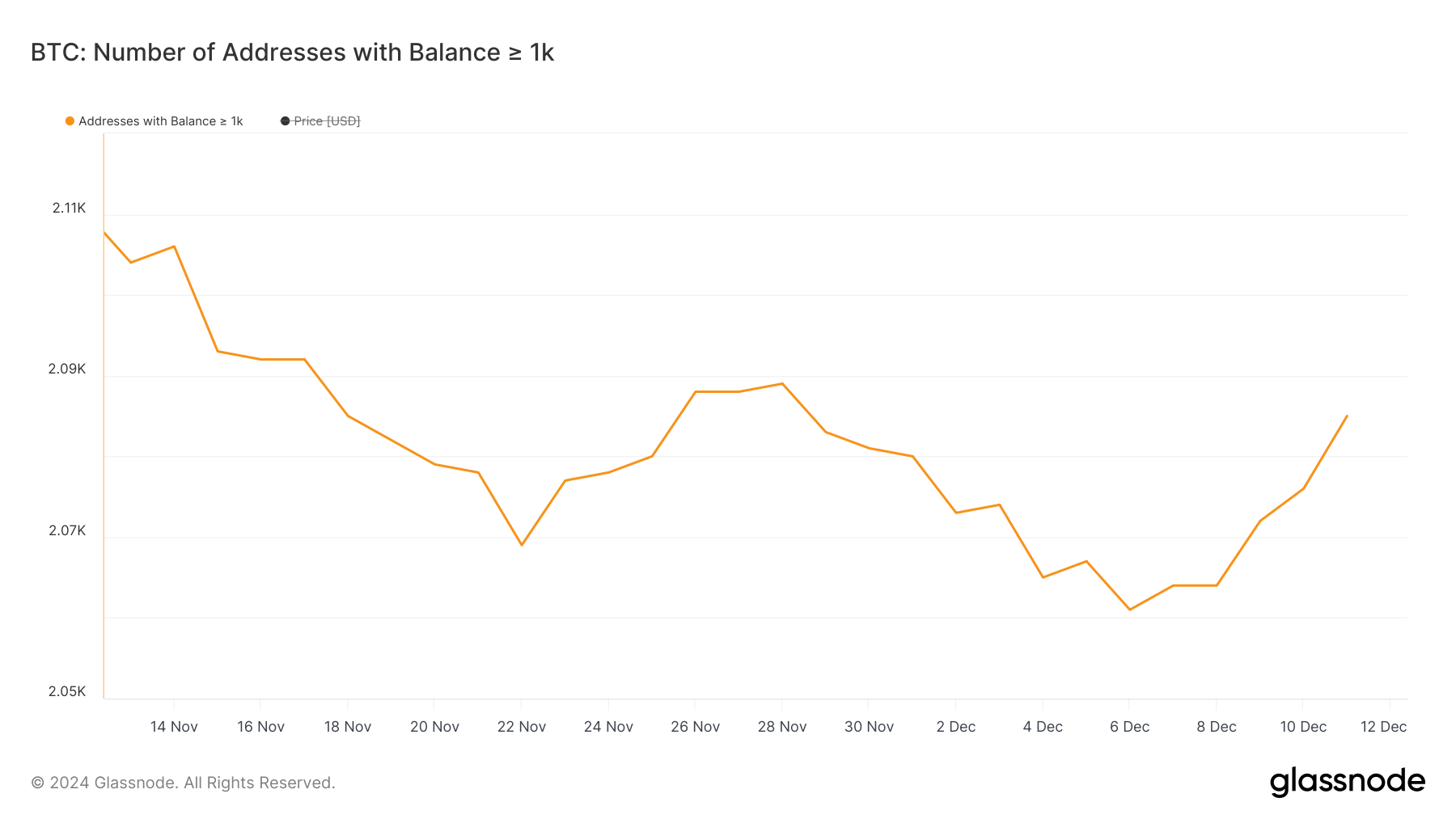

Meanwhile, the number of whale addresses holding at least 1,000 BTC, which fell to its lowest since August 2024 earlier this month, has started to increase again. While this new accumulation is a positive sign, whale numbers are still lower than levels seen in mid-November, opening the door for a further recovery.

BTC’s Current Uptrend Is Not Too Strong

Currently, BTC’s ADX index is 15.8. On December 9, it was around 11, indicating very low trend strength. By December 11, the index temporarily increased to 17 before stabilizing at its current level. This gradual increase shows some improvement in momentum but remains relatively weak overall.

ADX, also known as the Average Directional Index, measures trend strength. Values below 20 indicate a weak or unclear trend, while results above 25 indicate a strong trend. Bitcoin’s ADX index of 15.8 shows that the current uptrend lacks conviction.

Although the price of BTC has increased over the past 24 hours, the low ADX index suggests that the uptrend may have difficulty sustaining in the short term, putting the price at risk of moving sideways or down.

Bitcoin Whales Start Accumulating Again

The number of addresses holding at least 1,000 BTC has decreased steadily from 2,089 on November 28 to 2,061 on December 6, marking the lowest level since August 2024. This decline points to a period of distributed among Bitcoin whales, where large investors appear to be reducing their positions.

Such declines often reflect a cautious sentiment in the market, as these large players can significantly influence the trend. Their actions are closely watched because they often precede changes in market momentum, whether bullish or bearish.

As of December 6, this trend has been reversed with the number of whale addresses increasing to 2,085. This recovery suggests that fresh accumulation has taken place and signals confidence is growing among major BTC holders. While this is a positive sign, it is important to note that the current numbers have not yet reached the levels observed in mid-November.

This suggests that while whales are returning to the market, their overall activity has not yet fully returned to previously seen strength, opening up the potential for a further recovery.

BTC Price Forecast: Is $110,000 Possible in December?

Bitcoin price is currently moving between resistance near $103,000 and support near $99,000. The shortest EMA has crossed above another, signaling a potential uptrend.

However, the narrow gap between the lines and the weak ADX index indicate that the uptrend lacks strength. This means that the current price movement is not supported by significant momentum, leaving the trend vulnerable to changes.

If the uptrend strengthens, BTC price could retest $103,000, with a potential move to $105,000 and even $110,000. Conversely, if the trend reverses and BTC fails to hold above $99,000, the next support could be around $93,500. A deeper decline could take the price to $88,700, which would mark the lowest since mid-November.