Option Greeks is a set of measurement indicators employed to assess and handle the possibility of alternatives contracts. Traders who want to participate in alternatives trading will have to master the Option Greeks indicators to be capable to make acceptable and powerful investment selections. Let’s study about Greek Options with Coinlive by the post under!

What are Greek Options? Learn about metrics in alternatives trading

What are Greek Options? Learn about metrics in alternatives trading

What are Greek Options?

Option Greeks is a set of measurement indicators employed to assess and handle the possibility of alternatives contracts. These indices supply crucial data about how the worth of an selection alterations in response to alterations in many aspects this kind of as the underlying asset, curiosity prices, time remaining to expiration, and market place volatility.

What are Greek Options?

What are Greek Options?

The Greche selection incorporates five indicators identified as Delta, Gamma, Theta, Vega and Rho. Greek alternatives assistance traders and traders greater have an understanding of the possibility and revenue possible of alternatives. By observing and analyzing these indicators, traders can make intelligent selections when trading and managing alternatives positions.

What is an selection?

Before understanding a lot more about Option Greeks, let us study about the notion of an selection, which is a variety of derivative contract that offers the holder the ideal to invest in or promote a selected volume of the underlying asset at a selected predetermined degree, price tag and time. The underlying assets can be stocks, commodities, indices or cryptocurrencies. Options have a strike price tag, also regarded as a deal price tag, which aids the purchaser achieve lengthy- or brief-phrase accessibility to the underlying asset.

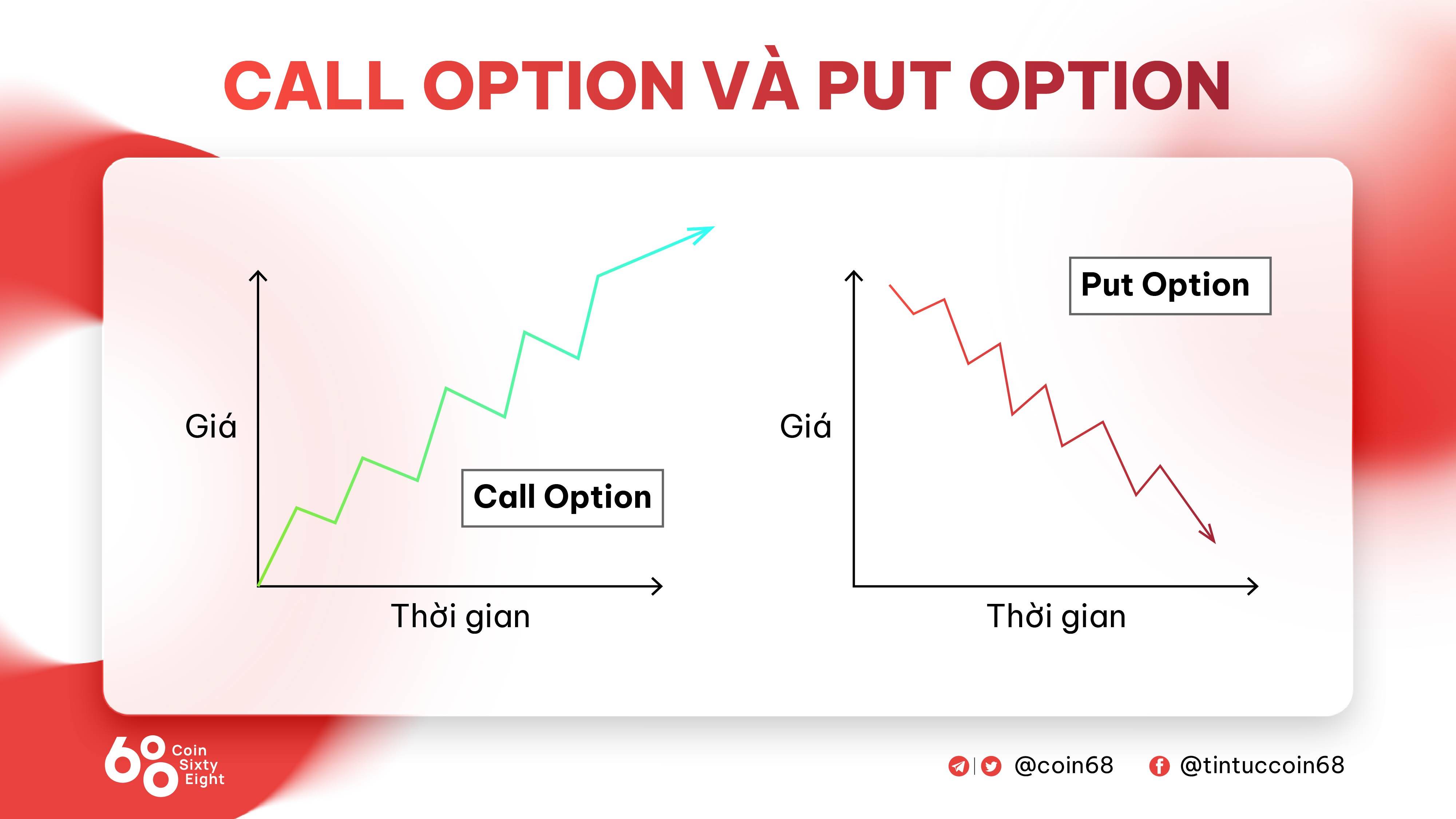

There are two forms of selection contracts as follows:

-

Calling alternatives (Purchase Option Agreement) It supplies selection consumers who can lengthy the agreed price tag and selection sellers who can brief the agreed price tag.

-

Put the alternatives (Put selection contract) it offers consumers of the selection the capacity to brief under the agreed on price tag and sellers the capacity to brief under the agreed on price tag.

Call selection and place selection

The purchaser of the selection will have to generally shell out the vendor a commission identified as the selection premium. The worth of a premium selection is established by the strike price tag and the quantity of days to expiration – DTE (expiration date). For the purchaser, the selection premium represents the greatest possible reduction. In contrast, an option’s premium represents the greatest possible revenue for the vendor.

Concepts employed to describe the agreed on price tag in alternatives contain:

-

To funds (ATM): In this situation, the agreed price tag is equal to the present price tag of the underlying asset.

-

Out of the Money (OTM): Here the recognized price tag is in an unfavorable place. For get in touch with alternatives, the strike price tag is greater than the price tag of the underlying asset. For place alternatives, the work out price tag is reduce than the price tag of the underlying asset.

-

In money (ITM): Here the strike price tag is in a favorable place. A get in touch with selection is ITM when it is reduce than the price tag of the underlying asset. The place selection is ITM when it is greater than the price tag of the underlying asset.

Importance of the Greeks selection

One of the largest blunders a new trader helps make is to instantly get started trading alternatives without having owning a primary comprehending of Greek alternatives. If traders do not know how alternatives will react to market place fluctuations, it will be hard to make smart investment selections. Once traders have mastered the ideas of Option Greeks indicators, they can make clever trading selections and earn revenue.

Greek Indicators Option

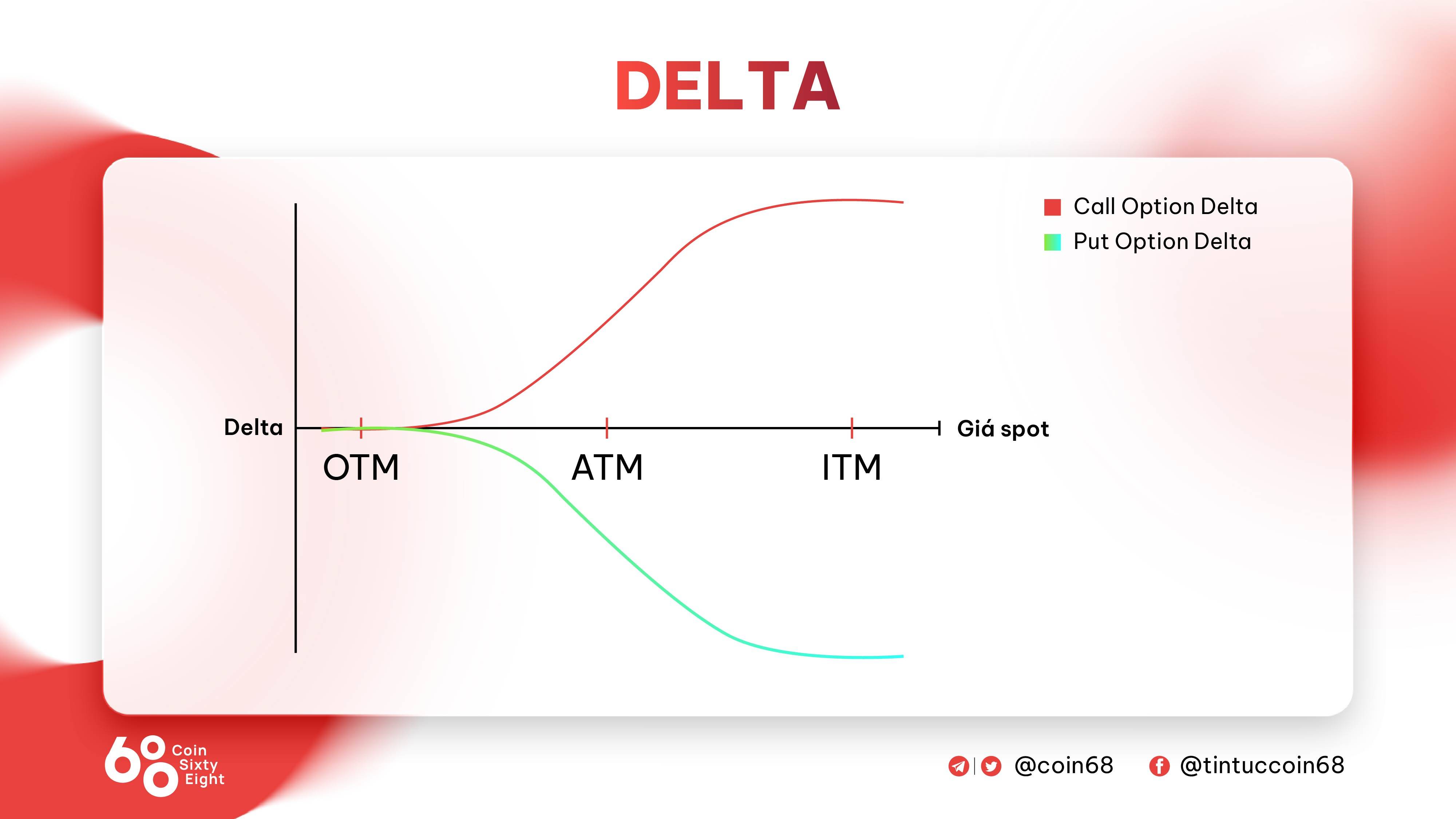

Delta

Delta is the calculated price at which the price tag of an selection alterations when the price tag of the underlying asset alterations. Call alternatives generally have a favourable delta in between .00 and one.00, that means they will have worth when the price tag of the underlying asset rises and vice versa. Put alternatives will generally have a unfavorable delta in between .00 and −1.00, that means they will have worth when the price tag of the underlying asset declines and vice versa.

Delta can also be viewed as the volume of publicity a trader has to the underlying asset at any offered time in relation to the dimension of the selection place.

For instance: The trader buys the OTM get in touch with selection at a time when BTC expenditures 25,000 USD with a contract dimension of one. BTC with a delta of .three. At that level, the trader will make or shed the exact same volume of funds from the get in touch with selection as they hold thirty% of the underlying asset ratio (one. BTC × .thirty delta = .three BTC).

If the worth of BTC increases to specifically $25,000 and the delta increases to .50, the possibility will then be 50% of the base volume (one. BTC × .50 = .five BTC).

A number of issues to note about the delta:

-

The delta worth can under no circumstances exceed −1. or one..

-

Delta alterations at the quickest price for ATM alternatives, specially people that are about to expire.

-

Changes in any implied volatility influence delta.

-

Traders can measure the price of adjust of delta utilizing gamma.

The model describes the Delta

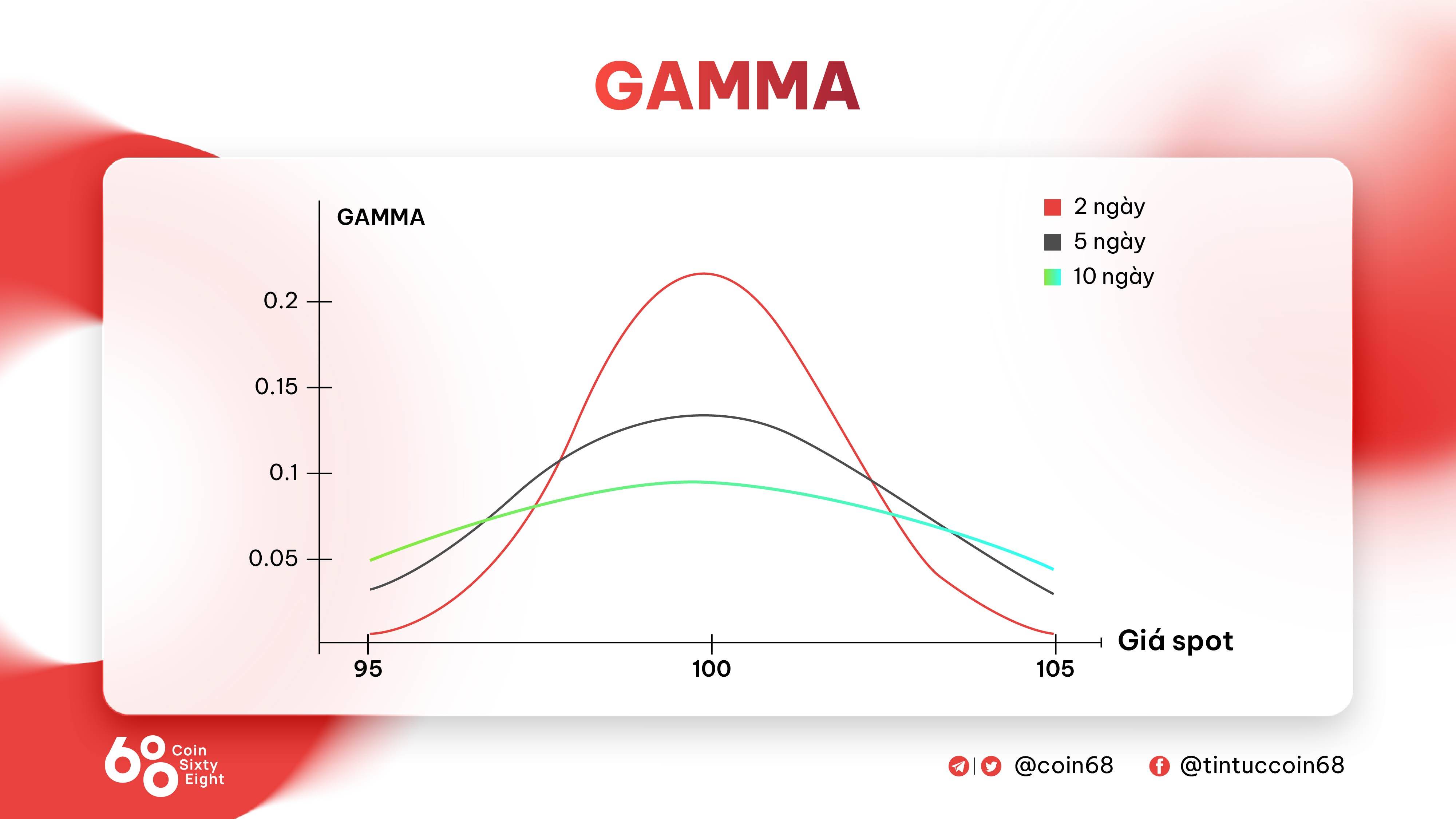

Range

Gamma measures the price of adjust of Delta primarily based on the adjust in the price tag of the underlying asset. A substantial gamma exhibits that Delta can adjust quickly when the price tag of the underlying asset alterations.

For instance: The get in touch with selection has a delta of .thirty and the trader is aware of that it will improve in worth by USD .thirty when the underlying asset increases by USD one (USD one × .three = USD .thirty). Traders by now know that an option’s delta increases as the worth of the underlying asset increases, and the gamma will inform them how a great deal it increases.

Furthermore, Gamma is highest when the selection is at a acceptable degree and a modest adjust in the price tag of the underlying asset can figure out regardless of whether the selection will expire ITM or OTM. The Gamma worth decreases when the strike price tag moves away from the present price tag of the underlying asset. Furthermore, the Gamma worth is greater when the selection is shut to expiration. From right here, a modest price tag motion is a lot more probably to influence the final result of the trader’s place.

Range description template

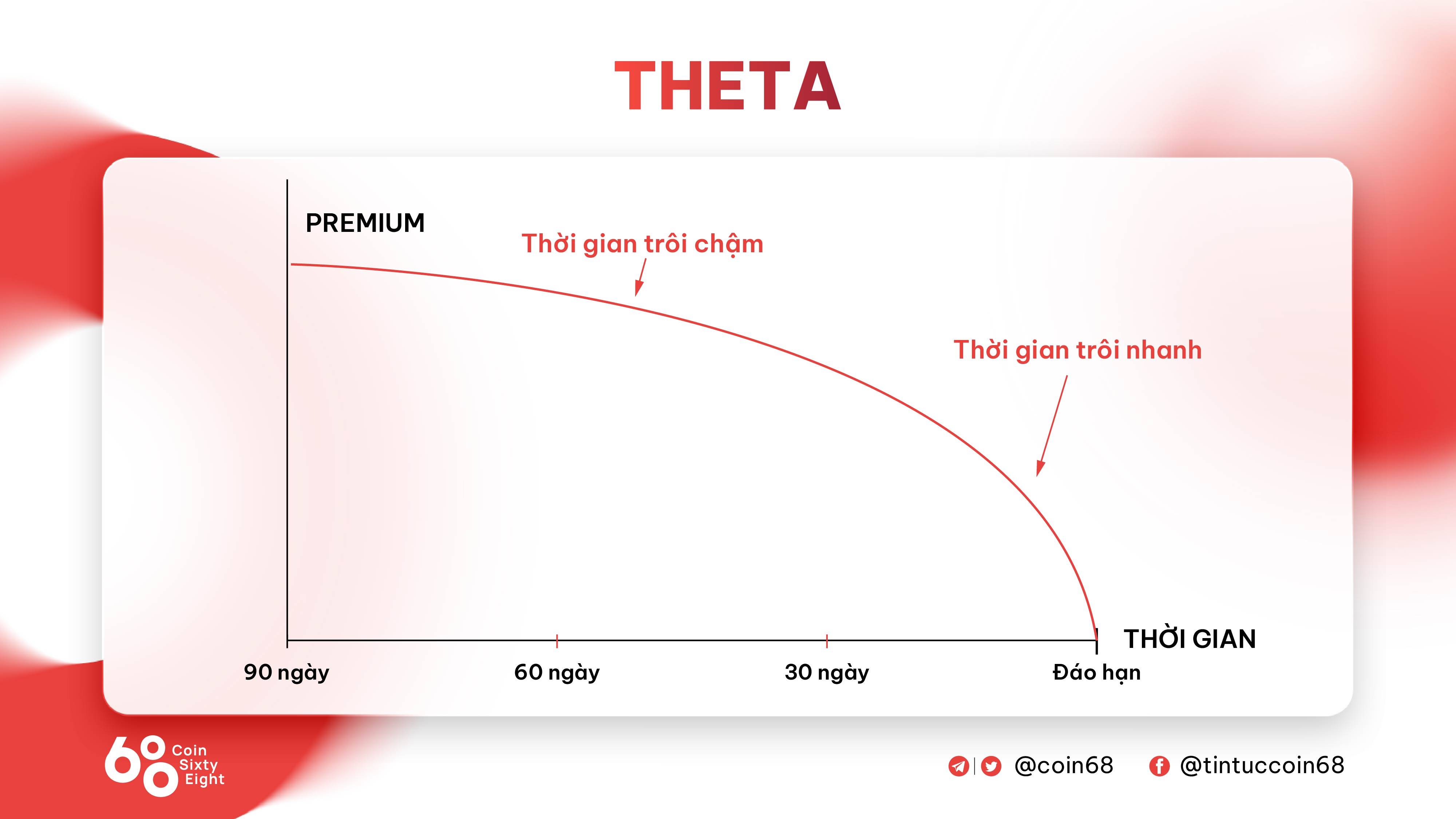

Theta

Theta measures the each day reduction in worth of an selection and measures the price of adjust of the option’s premium. When it comes to selection worth reducing more than time, right here are some issues to continue to keep in thoughts:

-

Theta is generally expressed as a unfavorable quantity mainly because all alternatives shed worth as 24 hrs pass.

-

A lengthy selection place will have unfavorable theta and the a lot more time passes, the a lot more disadvantaged the trader will be.

-

A brief place on an selection will have a favourable theta and the a lot more time passes, the a lot more worthwhile the trader will be.

-

Time decay is slower for alternatives with longer expiries, accelerating as the expiration date approaches.

-

While all alternatives decline more than time, ATM alternatives shed worth a lot quicker than ITM and OTM alternatives.

Theta description model

Vega

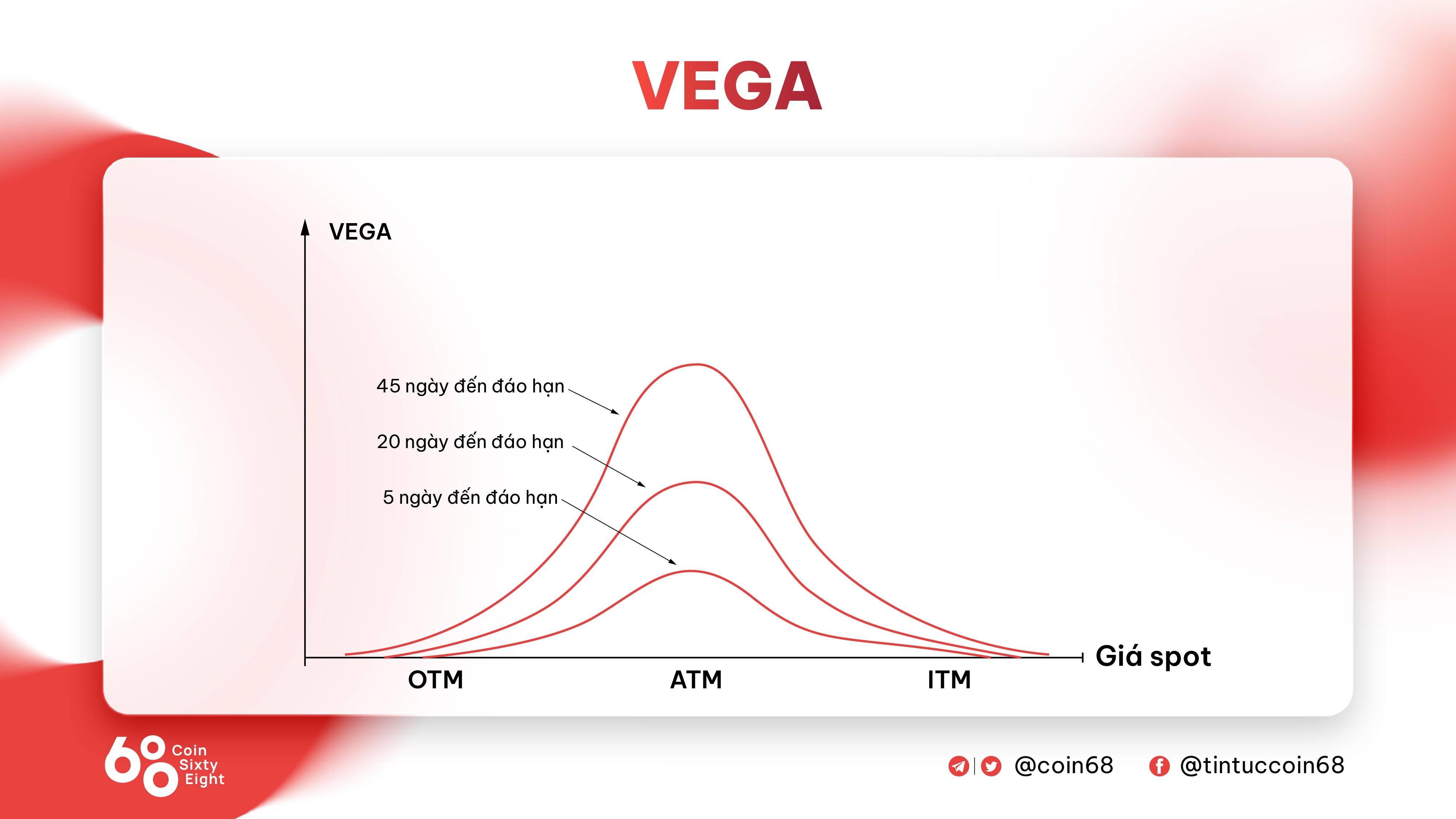

Vega measures the influence of market place volatility on the worth of an selection primarily based on the Implied Volatility – IV of the underlying asset. IV is how traders predict how an asset’s potential volatility will have an effect on alternatives. When the market place has greater volatility, IV will improve and the expense of selection commissions will improve. Some Vega guidelines:

-

Long-phrase alternatives will be a lot more delicate to vega than brief-phrase alternatives.

-

Vega is the highest for ATM alternatives and this index will reduce when moving to ITM or OTM.

-

The lengthy selection will have a favourable vega when the brief selection will have a unfavorable vega.

The model describes Vega

The model describes Vega

Rho

Rho is an index that measures the sensitivity of selection charges to curiosity prices. A favourable Rho signifies that the price tag of the selection will improve as curiosity prices rise and vice versa. Some attributes of rho contain:

-

Call selection premiums ordinarily improve when curiosity prices rise.

-

Put selection premiums normally decline when curiosity prices rise.

-

The gap in worth in between get in touch with and place alternatives is widening as curiosity prices rise.

Apply Option Greeks to alternatives trading

With the stock market place

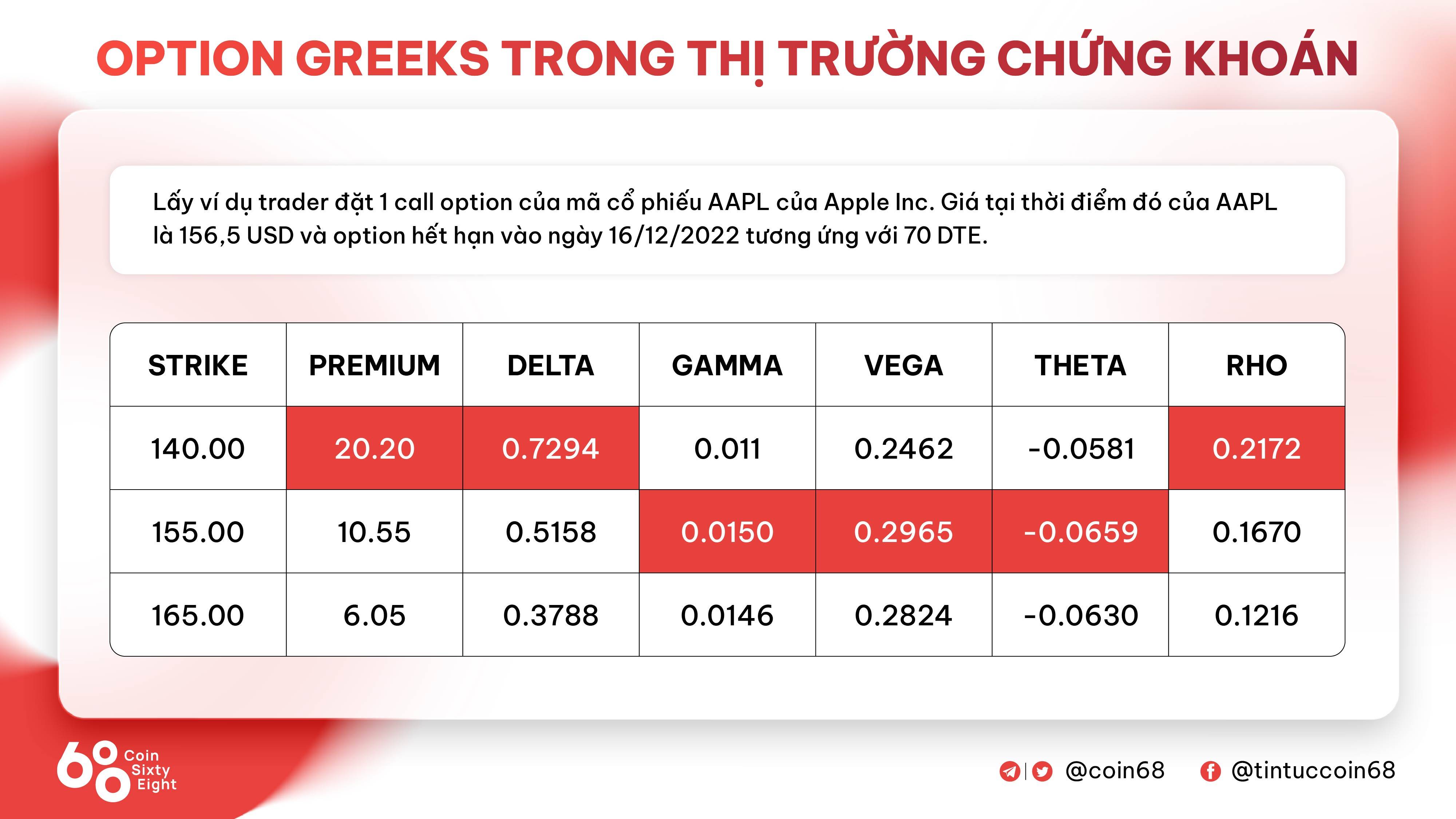

For instance, a trader areas a get in touch with selection on the stock code AAPL of Apple Inc. The price tag at that time of AAPL was 156.five USD and the selection expired on December sixteen, 2022, equivalent to 70 DTE.

The indicators of the Greek Option will be represented as follows:

-

At the time of purchase opening, the AAPL stock symbol get in touch with selection ITM was really worth $140. Here, ITM has the highest premium and delta and traders will also recognize that the selection has 70 DTE, so it gets to be rho delicate. In this situation, the ITM of the get in touch with selection is the most delicate.

-

With the ITM of the get in touch with selection currently being really worth $155, this is the closest price tag to the present price tag, so it has the highest gamma, vega, and theta values.

-

With the OTM of the get in touch with selection valued at USD 165, this is really far from the present price tag, so sensitivity to gamma, theta and vega will reduce. Note that irrespective of the strike price tag, the 70 DTE get in touch with selection is much less delicate to theta than the ten DTE strike price tag in the instance under.

Example of Greek alternatives in the stock market place

With the cryptocurrency market place

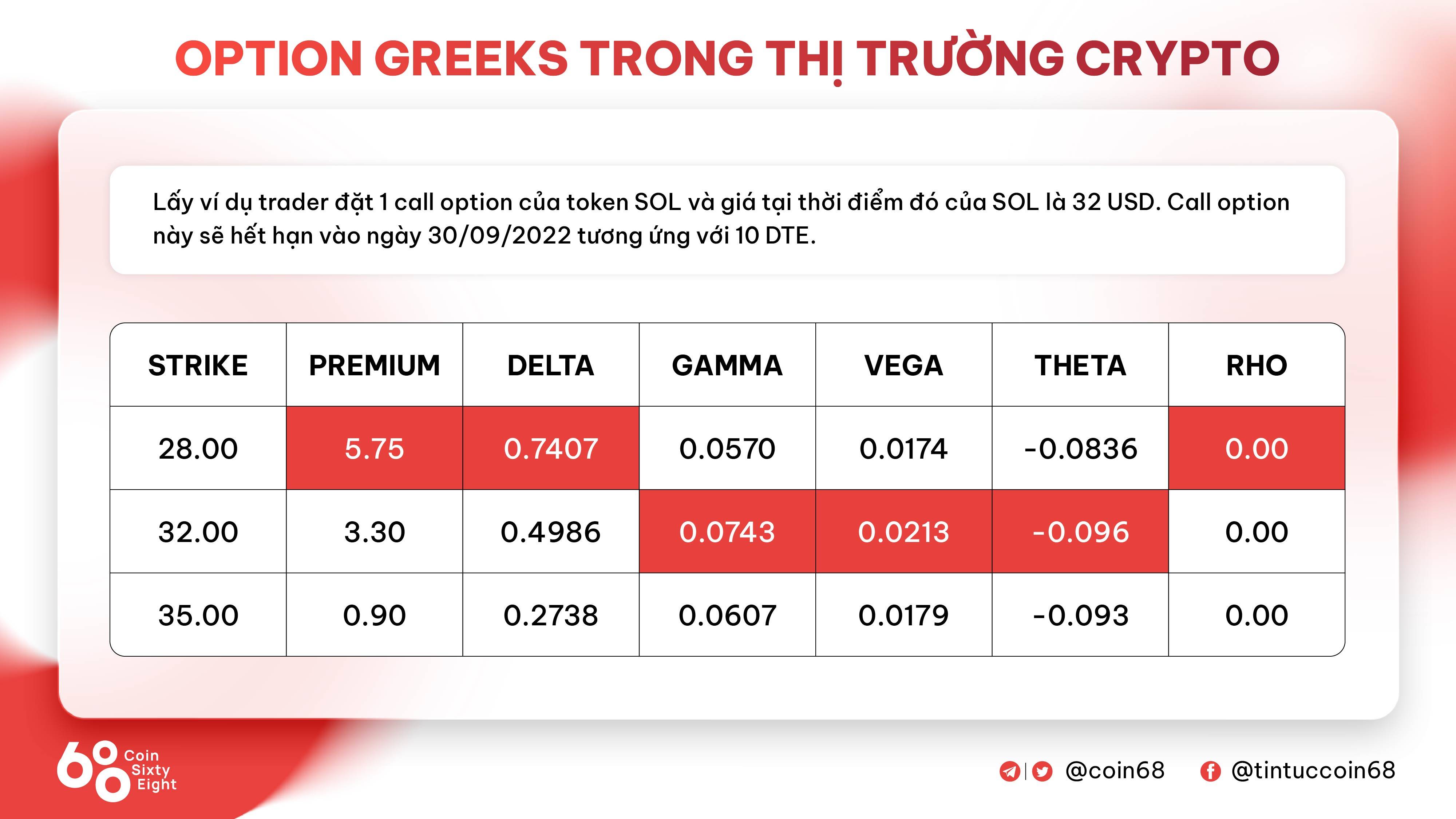

For instance, a trader areas a get in touch with selection on the SOL token and the price tag of SOL at that time is 32 USD. This get in touch with selection will expire on September thirty, 2022 corresponding to ten DTE.

The indicators of the Greek Option will be represented as follows:

-

At the time of purchase opening, the ITM get in touch with selection was really worth $28 versus the SOL token with the highest premium and delta. However, it is also the least delicate to gamma, vega and theta.

-

With an ATM get in touch with selection really worth $32, the delta will be shut to .five. Furthermore, it also has the highest gamma, vega and theta values.

-

With an OTM get in touch with selection really worth $35, there will be the lowest premium and delta.

In this situation, the trader will also recognize that mainly because it is closer to the present price tag than the $28 get in touch with selection (down three as a substitute of $four), it is a lot more delicate to the results of vega, theta, and gamma. Since all 3 of these charges are shut to expiration, rho has no result.

Example of Greek alternatives in the cryptocurrency market place

summary

Option Greeks is a set of measurement indicators employed to assess and handle the possibility of alternatives contracts. If traders can master the awareness of Option Greeks indicators, they can make clever trading selections and earn revenue from alternatives.

Through this post, you will likely have some primary data about Option Greeks to make your investment selections.

Note: Coinlive…