The past week has seen a decline in crypto market activity, marked by a 4% drop in global market capitalization in just the past 24 hours.

However, some assets have caught the attention of Crypto Whales as these large investors attempt to trade against the general market trend in anticipation of a price increase in the coming weeks.

Toncoin (TON) Increases Number of Crypto Whales

The price of Toncoin (TON), the cryptocurrency associated with the popular messaging app Telegram, has dropped 17% over the past month. However, on-chain data shows that this is a buying opportunity that whales have spotted.

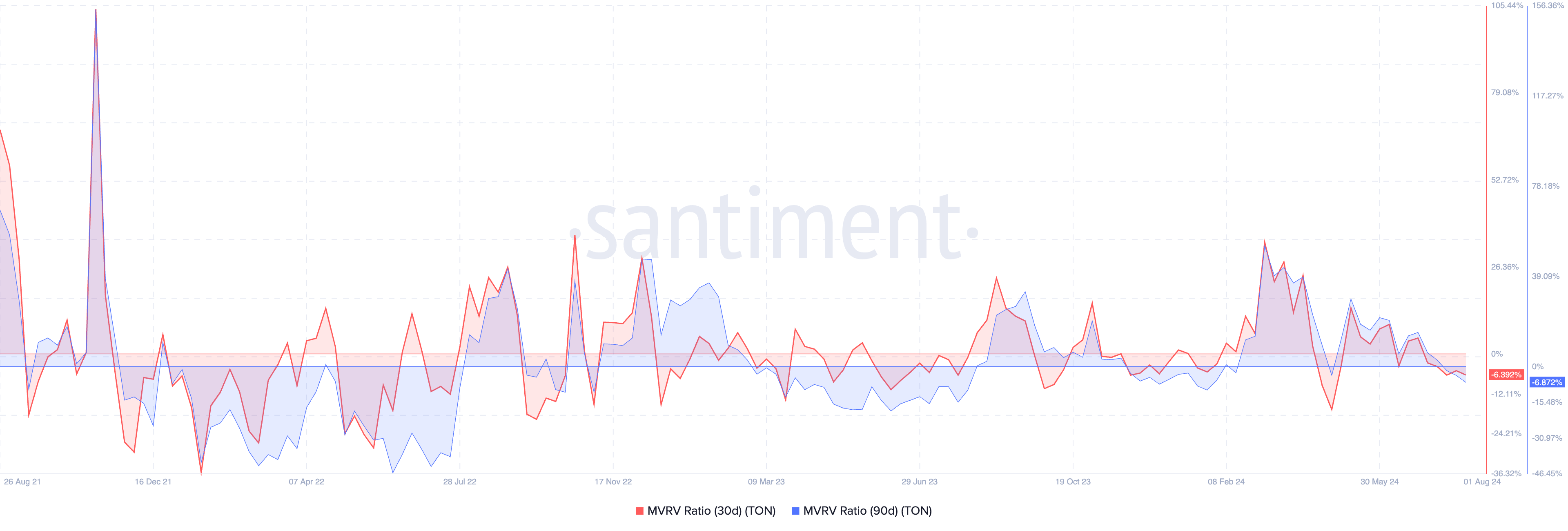

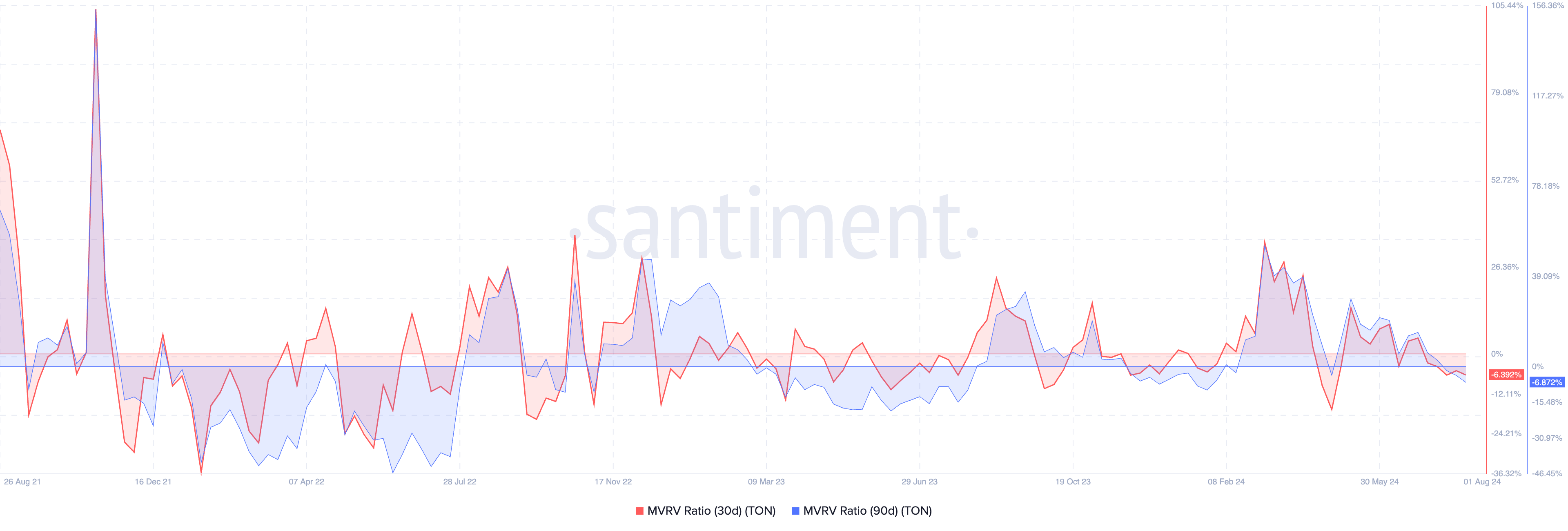

Indicators from TON’s Market Value to Realized Value (MVRV) ratio show that the altcoin is currently undervalued, signaling a buying opportunity.

At the time of writing, the token’s MVRV ratios measured on various moving averages are all negative. Its 30-day and 90-day MVRV ratios are -6.39% and -6.87%, respectively.

This index measures the ratio between the current price of an asset and the average price at which all of its coins or tokens were bought. When the index is below 0, the current market value of the asset is lower than the price at which most investors bought it.

Historically, negative MVRV ratios have often provided buying opportunities for traders who want to “buy low” and hope to sell high at a later date.

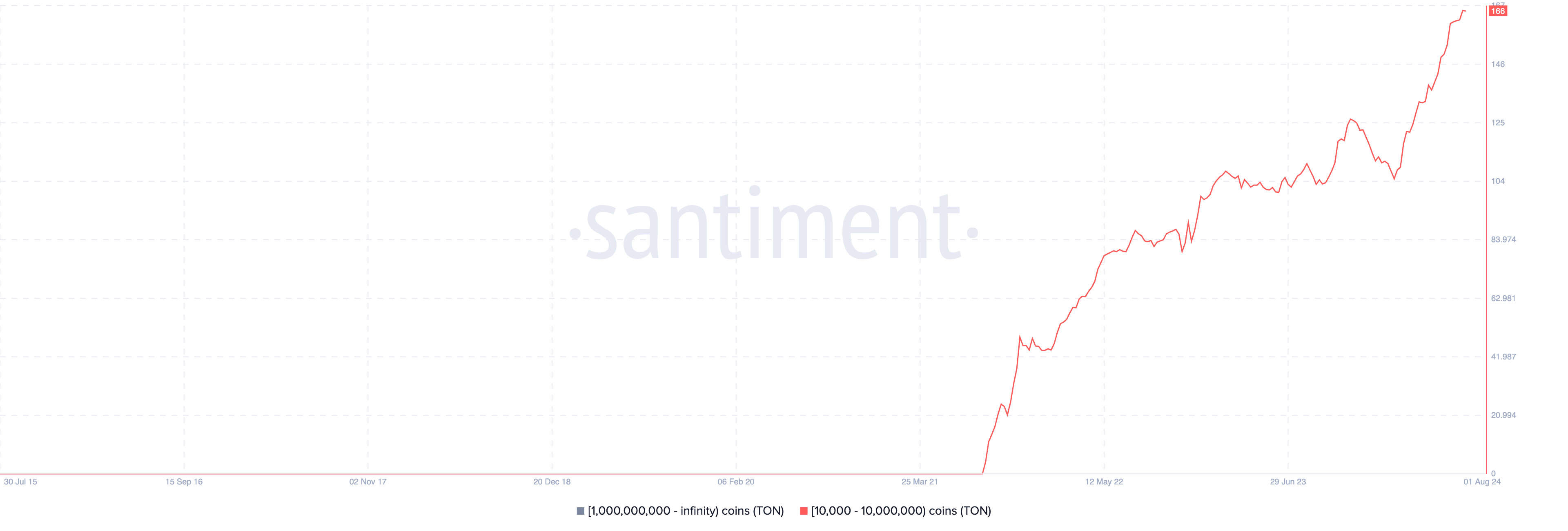

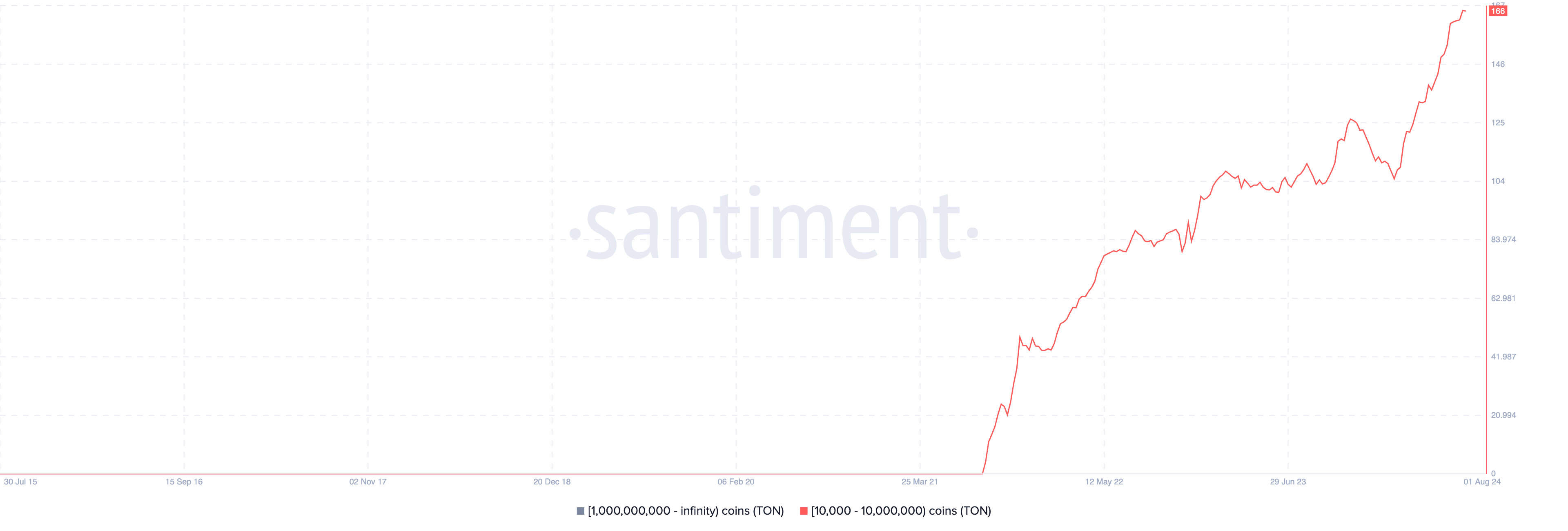

As TON’s price has fallen, whales have been accumulating more. According to Santiment, the number of TON whales holding between 100,000 and 10,000,000 tokens has increased by 2% over the past month. The number of addresses in this group holding TON is now at an all-time high.

The increase in whale demand for TON could also spark interest from retail investors.

If this happens and the token starts an uptrend, its price could climb to $6.81.

Major Investors Increase Their Tron (TRX) Holdings

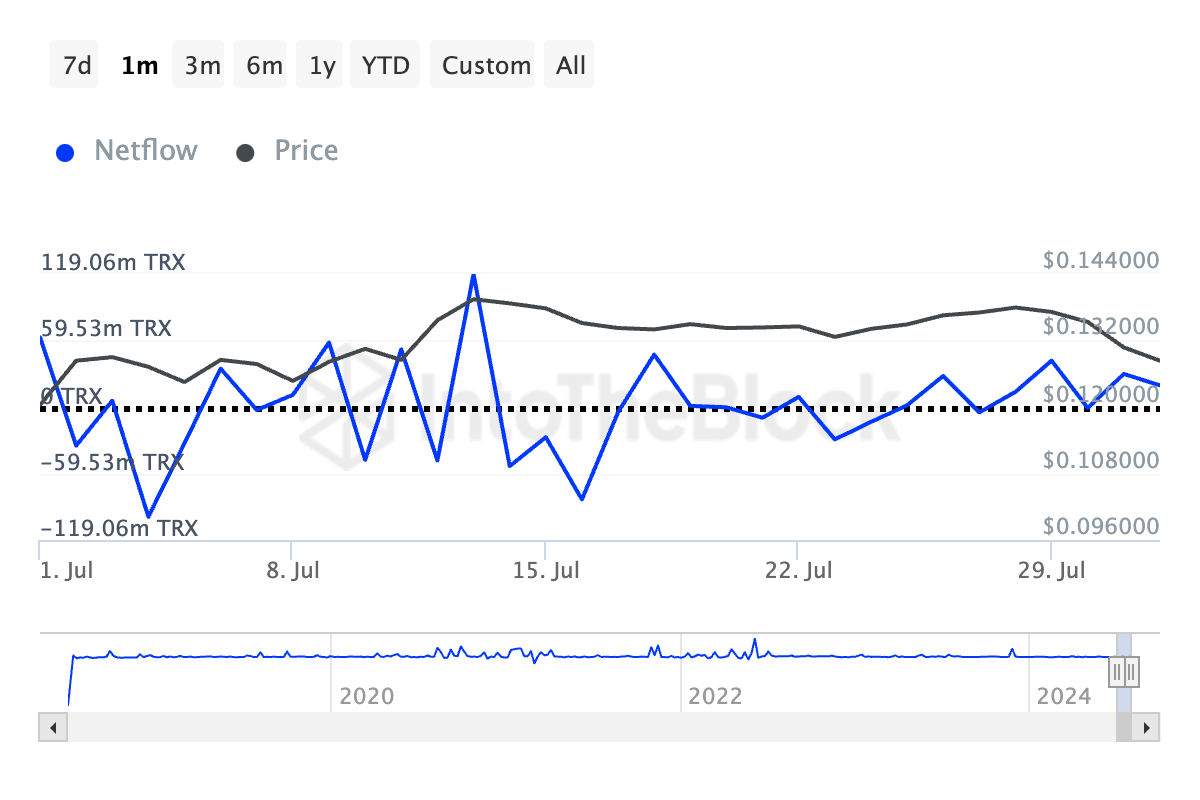

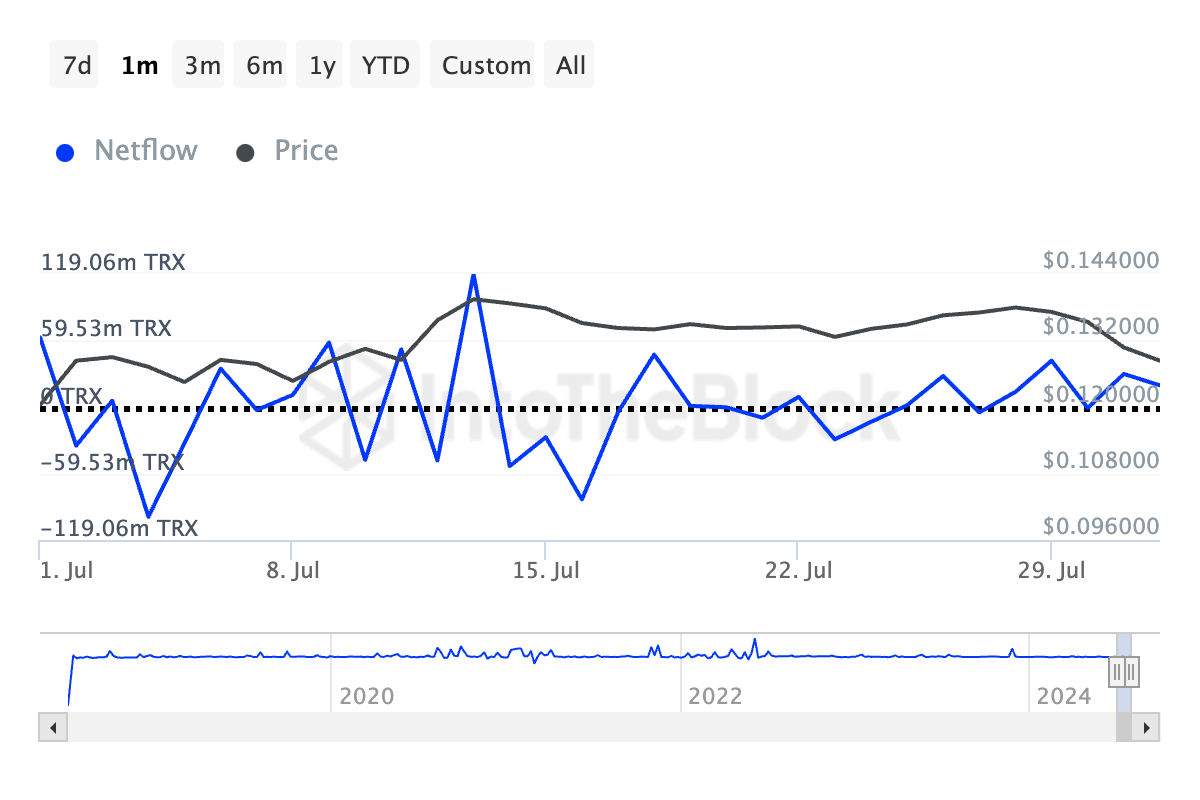

On-chain data from IntoTheBlock has revealed a significant 243% increase in the net inflow of TRX major investors over the past 30 days.

Large investors refer to addresses that hold more than 0.1% of an asset’s total circulating supply. Their net flow measures the difference between the amount of coins these investors bought and the amount they sold over a given period of time.

When net inflows increase, it means that crypto whales are buying more coins. This is considered a bullish sign, suggesting a potential price rally.

It is important to note that TRX whales have been increasing their accumulation despite the coin moving sideways over the past month. Data from the daily chart shows that the altcoin fluctuated within a horizontal channel throughout July and broke below the lower boundary of the channel on the last trading day of the month.

If whale accumulation continues, it could trigger a broader demand for the coin. This could lead to a price surge, which could see TRX trade at $0.13.

Binance Coin (BNB) and the Emerging Bullish Divergence Signal

The relative balance between BNB buying and selling pressure has prevented its price from swinging wildly in either direction over the past few weeks.

However, the coin’s Chaikin Money Flow (CMF) index has maintained an upward trend over that period. This index measures the flow of money into and out of an asset’s market. At the time of writing, BNB’s CMF is 0.24.

The sideways price while the CMF is rising indicates a potential bullish divergence. This indicates an increasing inflow of money into the asset, which is usually a sign of accumulation by large investors.

Although BNB price is fluctuating sideways, the rising CMF suggests that the coin’s fundamental strength may be increasing.

If BNB successfully breaks the resistance and rises, its price could hit $617.