The price of Ripple (XRP) has seen a strong rally, up 51.33% in the past seven days and up 109.09% in the past month. This strong momentum has pushed XRP into a bullish phase, with key indicators such as the EMAs supporting its upward trend.

However, signs of weakening momentum, such as falling RSI and negative CMF, suggest caution may be necessary. Whether XRP continues to advance further or encounters a sharp correction will depend on how the market reacts to these fluctuations.

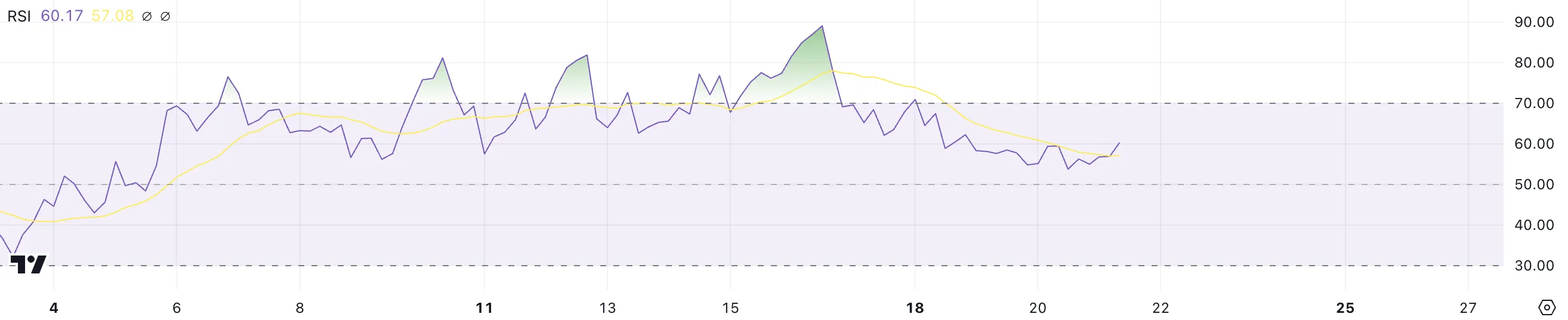

XRP’s RSI Is Below Overbought Level

XRP’s RSI fell to 60 after almost reaching 90 on November 16 and remained above 70 from November 15 to 17.

This drop shows that Ripple has exited the overbought zone, where strong buying pressure once pushed its price higher. This decline signals the market is softening, with traders likely to profit from the sharp price increase.

RSI measures the speed and magnitude of price changes, with values above 70 indicating overbought conditions and below 30 indicating oversold conditions. At 60, XRP’s RSI reflects momentum that remains positive but shows a more balanced sentiment compared to the previous rally.

While the uptrend remains in place, a lower RSI could indicate a slowing pace of growth, with consolidation likely as the market stabilizes. If buying pressure returns, XRP price could continue its upward momentum, but if RSI falls further, this could signal bullish momentum is waning.

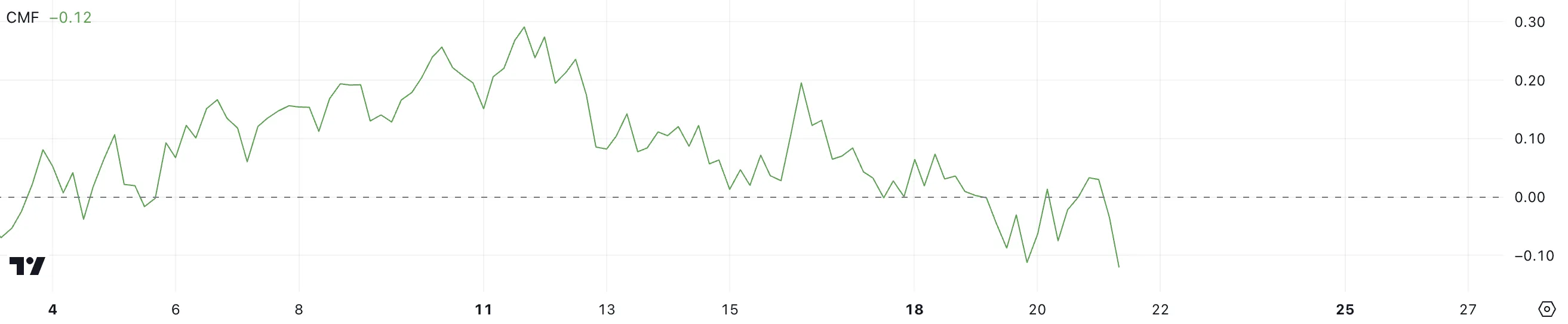

Ripple’s CMF Now Negative After 14 Days of Positive

XRP’s Chaikin Money Flow (CMF) is now -0.12, after showing positive levels from November 5 to 19. This is also its lowest since October 31. Conversion to negative territory reflects increased selling pressure and the possibility of withdrawing capital from this asset.

The transition from a positive CMF value earlier this month signals a weakening in bullish momentum as many market participants reduce their exposure to Ripple.

CMF measures the volume and flow of money into or out of an asset, with positive values indicating inflows (appreciation) and negative values indicating outflows (decreases).

XRP’s CMF at -0.12 shows that bearish sentiment is starting to increase, potentially pressuring its price despite the recent bullish momentum. If CMF remains negative or falls further, it could indicate continued selling pressure, challenging Ripple’s ability to continue the bull run.

Ripple Price Forecast: Highest Price Since 2021?

XRP’s EMAs currently exhibit a bullish structure, with the short-term lines above the long-term lines and the price trading above all of these EMAs.

However, the narrowing gap between price and some of these lines suggests that the upward momentum may be slowing. This could signal that the uptrend is weakening, leaving XRP price vulnerable to changes in market sentiment.

If a downtrend emerges, as indicated by a weakening RSI and negative CMF, Ripple price could come under significant pressure and could drop to the $0.49 support, representing a massive 56% correction.

On the other hand, if the uptrend regains strength, XRP could climb to test $1.27 and potentially surpass $1.30, marking its highest price since May 2021.