LUNA, the token of the Terra blockchain, established a new ATH on December one, as the large demand for the network’s UST stablecoin entices consumers to pursue a wide range of incentive schemes.

This is the 2nd time in November, LUNA hit a new all-time large at $ 60.08. As of press time, LUNA is trading at $ 57.63, up eleven% more than the previous 24 hrs.

Since the greatest Earth update in historical past, Columbus-five, was officially rolled out on September thirty, ushering in a new era for the ambitious blockchain venture, LUNA has steadily taken form. Strong momentum to proceed to sustain the uptrend. in spite of the unstable condition amongst the founder of Terra (LUNA) and the SEC.

On the other hand, the “docking” occasion with Cosmos IBC (ATOM) and the welcome of Chainlink on the testnet subsequently strengthened the platform. But the primary motive for LUNA’s breakthrough is largely due to the greatest token burn up proposal in historical past, which was authorized by the protocol governance group in early November.

LUNA is portion of the algorithmic balancing technique that aids stablecoins operating on the Terra blockchain sustain parity with fiat currencies. One of the key developments of the Columbus-five network update in October was a new layout to maintain stablecoins anchored to their fiat worth, when USTs are minted, a portion of the LUNA will be misplaced.

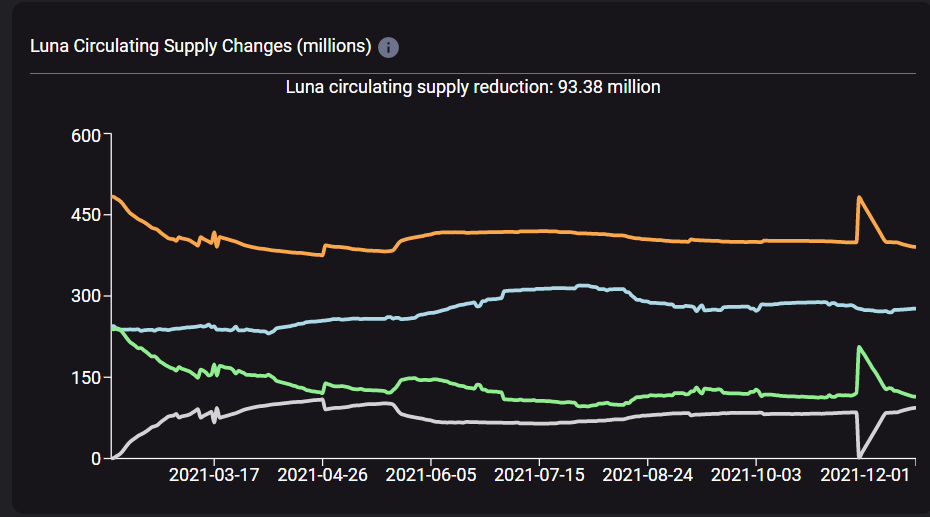

It is simply just understood that LUNA is a improvement model proportional to the requirements of UST. As demand for UST increases, so does the selling price of LUNA. According to information from Terra Analytics, much more than 93 million LUNAs have been burned because the Columbus-five update went into result.

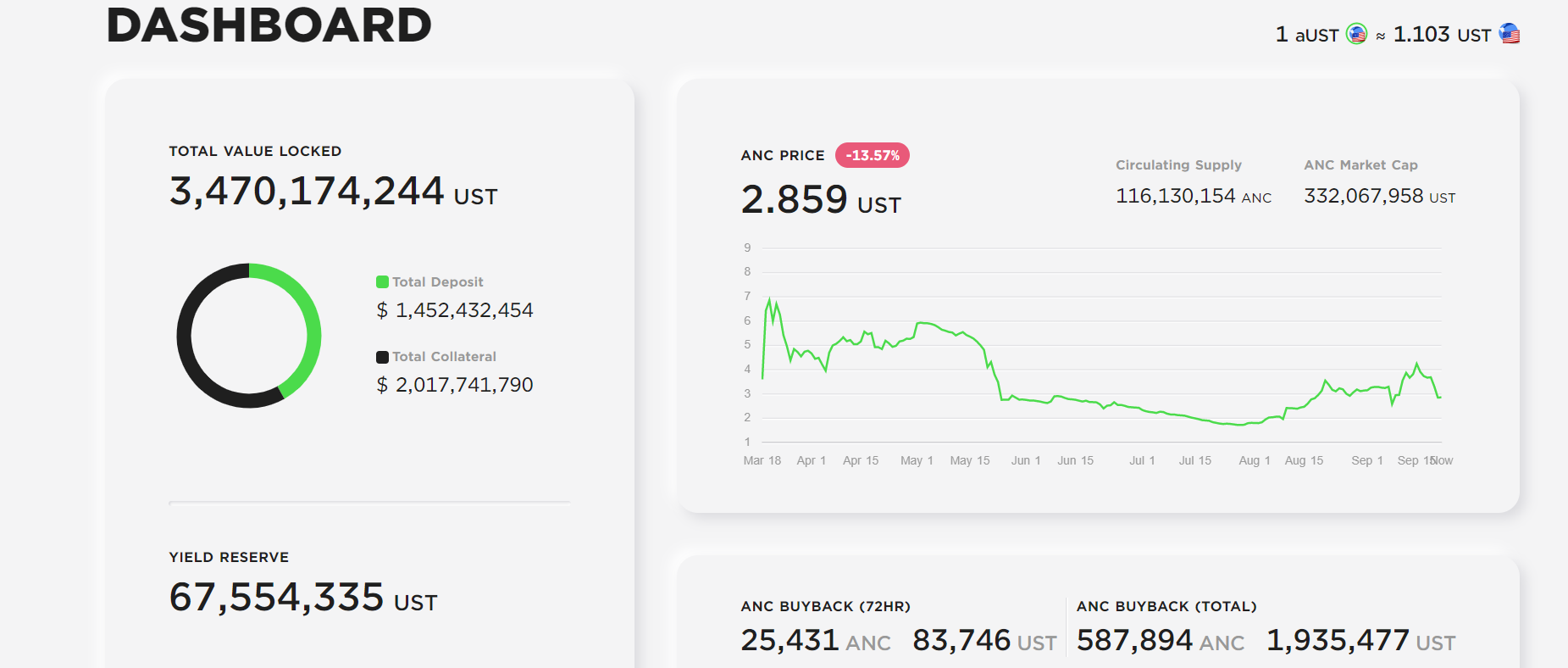

For comparison, let us get a seem at the picture of Anchor Protocol, the top rated DeFi protocol of the Terra blockchain, which reached $ three.five billion in complete locked-in worth (TVL) at the finish of September with a complete UST worth in the platform. . the climate.

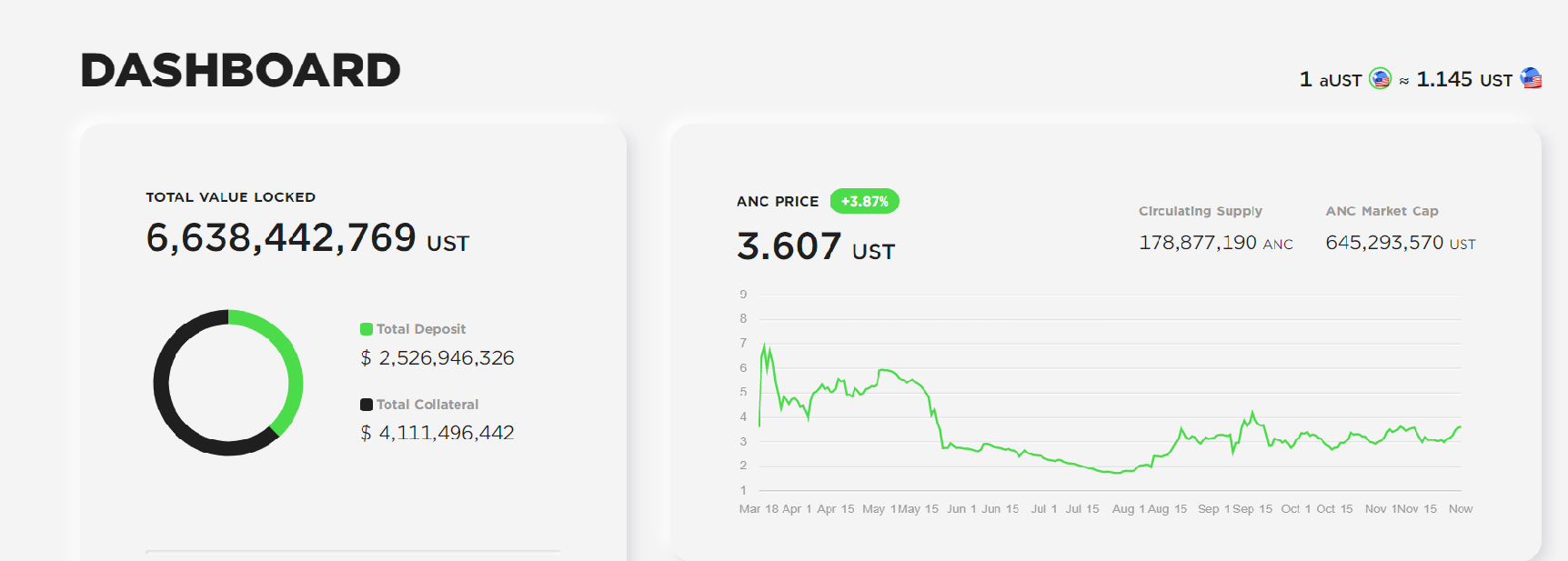

Anchor at this time has a TVL of $ five.21 billion, which is one.four instances the outdated figure, but the complete worth of UST caught in Anchor has elevated by much more than one hundred% and is hovering about $ six.63 billion. This explains why LUNA has this kind of an remarkable effectiveness.

Furthermore, a variety of liquidity incentive applications from Earth-based mostly decentralized finance (DeFi) platforms are also an equally essential element. For illustration, Abracadabra.Money, a multi-chain decentralized lending platform, has launched a zero-price token for-revenue merchandise identified as Degenbox. The initially merchandise that lets consumers to deposit UST as collateral to obtain curiosity.

one / 🧙🏼♂️!

Our new $ UST the market place is right here! 🔥

-Interest two.five%

– five% liquidation charge

-LTV 90%

– Loan charge one%Our #Degenbox the approach is also energetic in this market place, but we have a new selling price oracle exclusively for it! 🔮

Start here👇🏻

https://t.co/IdDItolKXt pic.twitter.com/3WEjf3yGNH

– ️ (@MIM_Spell) November 30, 2021

Another push came from the Astroport blocking occasion, a decentralized exchange protocol on Earth. Astroport will launch a blocking occasion on December 6th, enabling consumers to block their LUNA in exchange for the protocol’s unreleased ASTRO rewards.

✦ From now on, LBPs are a public superior of the Earth

Astroport builders are proud to announce new open supply code for liquidity bootstrapping pools (LBPs) on Terra: https://t.co/ju8SxZUu3N pic.twitter.com/Kq0BM0PAE5

– Astroport (@astroport_fi) November 30, 2021

Terra is the fifth greatest blockchain by complete blocked worth (TVL) at $ eleven.71 billion. An exciting level is that in February of this 12 months, Terra (LUNA) fluctuated in the $ two selling price array just by sporting a startup venture t-shirt.

Synthetic Currency 68

Maybe you are interested: