InifinityPools is a protocol primarily based on Uniswap V3 that permits customers to trade derivatives this kind of as alternatives, perpetual futures with higher leverage and with out worrying about liquidation. InfinityPools has an lively leverage mechanism that permits customers to repay loans with any assets represented by LP tokens. Let’s master about InfinityPools with Coinlive via the write-up beneath!

What is InfinityPools? Derivatives protocol with versatile leverage mechanism for traders

What is InfinityPools?

InifinityPools is a protocol primarily based on Uniswap V3 that permits customers to trade derivatives this kind of as alternatives, perpetual futures (perpetual contracts) with higher leverage and with out worrying about liquidation. InifinityPools does not use oracle facts to unlock different goods on Uniswap even though avoiding third events from manipulating costs to influence the protocol.

What is InfinityPools?

Through InfinityPools, customers can borrow fixed-phrase assets towards present LP positions comparable to Uniswap V3. They will pay out an preliminary charge that covers charges that may possibly come up more than the daily life of the loan. If the user’s place has a damaging stability, the assets will be returned to LP. However, if the loan is lucrative, they can lengthen the loan phrase and proceed paying out curiosity, or they can terminate the loan and get their income.

With traditional derivatives protocols, when customers borrow a leveraged asset like USDC, they should repay the loan in USDC. However, InfinityPools has a a lot more versatile mechanism when it comes to permitting customers to repay loans with any asset represented by the LP token.

For illustration: John borrowed LP tokens of the ETH/USDC pair to get a lengthy place on ETH. If the price tag of ETH drops, John can repay your loan with ETH alternatively of USDC

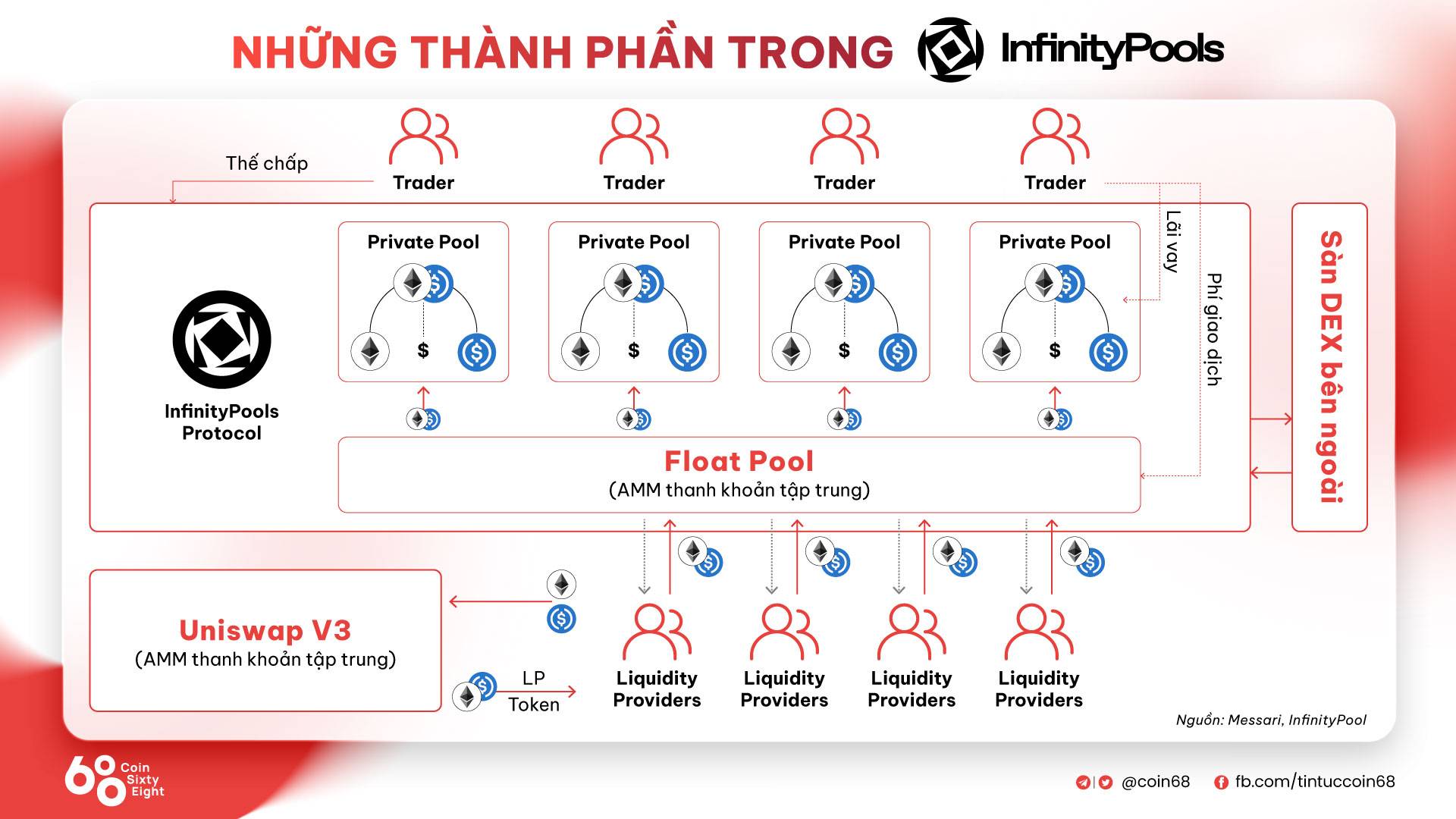

Components participating in InfinityPools

Liquidity Provider (LP): First, LPs offer liquidity to Uniswap V3 inside a price tag assortment of their deciding upon. Then, LP tokens are deposited into InfinityPools to be produced offered to traders. Additionally, LPs can also immediately offer liquidity to InfinityPools if they want.

InfinityPiscine: The protocol pools LP tokens into a new centralized liquidity AMM pool termed Float Pool comparable to Uniswap V3 but with some small variations. The assets in the pool are offered for each spot and leveraged derivatives trading. Traders employing leverage can borrow two styles of loans from Float Pool: fixed phrase loans with x40 leverage and variable loans with pretty much limitless leverage. The protocol pools loans as lengthy as these positions are open to develop a perpetual variety solution.

Merchants: First, traders home loan assets to safe their loan. When traders borrow, they lock LP tokens in a new personal pool termed Swapper with a fixed price tag. From right here, traders can make limitless, commission-no cost trades to efficiently improve or lower leverage at a particular price tag. The closer the picked strike price tag is to the latest price tag, the higher the trader’s leverage, but also the higher the reduction fee.

Additionally, traders pay out continuous curiosity primarily based on the quantity of offered LP capital they have borrowed at a particular price tag (comparable to loans on Aave). The curiosity fee on fixed-phrase loans is paid up front by the borrower, a lot more closely resembling an selection charge than the financing fee employed in conventional perpetual goods.

InfinityPools elements

InfinityPools working mechanism

Coinlive will get the following illustration: The price tag of ETH is one,000 USD and Henry presents liquidity of one,000 USDC in the ETH/USDC pool at the ETH price tag of 900 USD on AMM DEX. Henry will then get LP tokens representing the place he has presented liquidity to.

Bob, as a trader who desires to get a lengthy place on ETH, will home loan one hundred USDC and borrow LP tokens from Henry in exchange for one thousand USDC. Bob can then exchange one thousand USDC for one ETH employing any DEX. Because of the one hundred USDC home loan and one thousand USDC loan, Bob desires ETH with x10 leverage and we will have three situations:

-

Scenario one: If the price tag of ETH goes over one thousand USD, Bob tends to make a revenue and sells component of one ETH for one thousand USDC and returns the LP token to Henry.

-

Scenario two: If the price tag of ETH falls to a lot more than one thousand USDC but over 900 USDC, then one ETH that Bob holds is really worth a lot more than 900 USDC but much less than one thousand USDC and Henry expects to get LP tokens really worth one thousand USDC back. From right here, Bob will have to promote his one ETH and get some of his collateral to offset the loan to Henry.

-

Scenario three: If the price tag of ETH falls beneath 900+ USDC, Henry will assume to get one.eleven ETH back in LP tokens. Bob previously holds one ETH and the remaining .eleven ETH has a greatest worth of pretty much one hundred USDC. Therefore, as in situation two, Bob only wants to exchange his collateral for ETH to absolutely repay Henry.

What sets InfinityPools apart is the capability to borrow tokens in the pool as the protocol permits traders to exchange borrowed tokens for other tokens in the pool at a pre-established price tag. For illustration, if a consumer borrows ETH, he can exchange ETH for USDC at a predetermined price tag and vice versa. The capability to trade borrowed tokens at a pre-established price tag assures that traders and protocols are not exposed to liquidation dangers.

Additionally, InfinityPools necessitates traders to have a minimal collateral quantity with LP tokens inside a particular liquidity assortment. Consequently, the closer the assortment of the borrowed liquidity is to the latest market place price tag of the token, the higher the leverage enabled. For illustration: If the liquidity pool borrowed from ETH is deployed at 999 USDC, the preliminary collateral necessary will be one USDC corresponding to x1000 leverage.

Of program, traders should pay out an ongoing funding fee to LPs in exchange for lending their LP tokens. As lengthy as this funding fee is paid, the trader can keep his place irrespective of the price tag of the asset.

InfinityPools Highlights

Unlimited leverage: With settlement liquidity assured upfront, the leverage offered to traders can develop pretty much infinitely.

Unlimited resource styles: Any variety of resource can be securely exploited as the protocol utilizes present DEXs and tends to make InfinityPools wholly permissionless.

Don’t use Oracle: InfinityPools does not rely on an external oracle mainly because the asset worth is predetermined in the LP positions borrowed by traders. These LP positions use AMM to ascertain the worth of the asset. Not employing an external oracle assists the protocol stay away from vulnerabilities and restrict much less preferred asset lessons as very well as other leveraged goods.

Not liquidated: Traders do not have to be concerned about liquidating trading positions but should repay all assets borrowed from LP.

Extension Capacity: InfinityPools does not rely on bots or liquidity oracles, so the protocol can function independently (except for the dependency on DEXs like Uniswap) and permits scaling for any asset variety.

Basic facts about tokens

InfinityPools at this time has no particular facts on the token’s launch. Coinlive will update as quickly as there is the hottest facts on the undertaking.

Roadmap for growth

At the second, InfinityPools has not announced facts on its growth roadmap. Coinlive will update as quickly as there is the hottest facts on the undertaking.

Development crew

InfinityPools was created by the Lemma Labs crew with the following two important members:

Investors

Currently, InfinityPools has not announced investor facts in their capital raising rounds. Coinlive will update as quickly as there is the hottest facts on the undertaking.

Company

InfinityPools has not at this time announced facts about its partners. Coinlive will update as quickly as there is the hottest facts on the undertaking.

summary

InifinityPools is a protocol primarily based on Uniswap V3 that permits customers to trade derivatives this kind of as alternatives (alternatives), perpetuals (perpetual contracts) with higher leverage and with out worrying about liquidation. Despite obtaining a versatile leverage mechanism, InifinityPools should broaden its use to illiquid assets even though retaining the security of each traders and the protocol all through the liquidation method.

Through this write-up, you will likely have some standard facts about the InfinityPools undertaking to make your investment choice.

Note: Coinlive is not accountable for any of your investment selections. I want you good results and earn a great deal from this prospective market place!