[ad_1]

What is KeeperDAO (ROOK)?

KeeperDAO is an financial incentive protocol aimed at soliciting participation in “Keeper” methods for liquidity management and rebalancing amongst applications, which include trading, loan and exchange margin. This will allow participants to earn passive earnings in an optimum way of game concept, even though guaranteeing that decentralized fiscal applications continue to be liquid and orderly.

What difficulty does KeeperDAO remedy?

Opportunity value of capital

Market participants want to set aside money to seize options as they come up and massive liquidation options are capital-intensive in nature. Without a steady and predictable pool of liquidity to entice, the DeFi area is topic to arbitrage chance.

High barrier to entry

Maintaining the infrastructure to constantly scan and execute settlement and arbitrage transactions is operationally and financially pricey, building it hard for the common investor to engage.

Transaction charges

Making rewarding transactions mostly depends on raising transaction charges to get the priority queue for the following Ethereum block (Preferred Gas Auction, ‘PGA’). A massive sum of funds is invested on PGAs to win trades, enhance charges and decrease earnings for every person.

How does KeeperDAO remedy the over difficulties?

KeeperDAO presents a new way to remedy these difficulties. At the heart of KeeperDAO is a prevalent liquidity pool. Anyone can borrow from the pool to consider benefit of on-chain options (for illustration by liquidating a place in Compound, taking above Maker’s CDP and taking benefit of the cost big difference amongst Kyber and Uniswap). The earnings from the on-chain chance are assured to be returned to the pool (by a mechanism very similar to instantaneous loans). In this way, KeeperDAO’s liquidity pool acts as an insurance coverage fund for DeFi.

There are important financial advantages to joining Keeper’s liquidity pool:

Share capital and earnings

By making use of a income pool, holders can obtain higher options than they could individually obtain.

Reduce competitors

The 2nd perform of a liquidity pool is to decrease competitors in PGAs. Consider two uncooperative managers making an attempt to capture the similar chance on the chain. Profits are not shared, so the Keepers will engage in PGA to decrease their earnings. By pooling capital, earnings are distributed proportionately and Keeper no longer has to engage in competing transaction charge wars.

eat their earnings.

In purchase to alter the incentives for the two stakeholders in the KeeperDAO procedure (proprietor and LP), the undertaking would like to introduce the native governance token. The token will enable holders to propose and vote on all protocol updates, as nicely as control revenue sharing amongst LP and Keeper, along with new procedure proposals.

Basic details about the ROOK token

- Token identify: KeeperDAO

- Ticker: ROOK

- Blockchain: Ethereum

- Token conventional: ERC-twenty

- To contract: 0xfa5047c9c78b8877af97bdcb85db743fd7313d4a

- Token kind: Utility

- Total give: one,189,000 TOWER

- Circulating provide: 579.961 TOWER

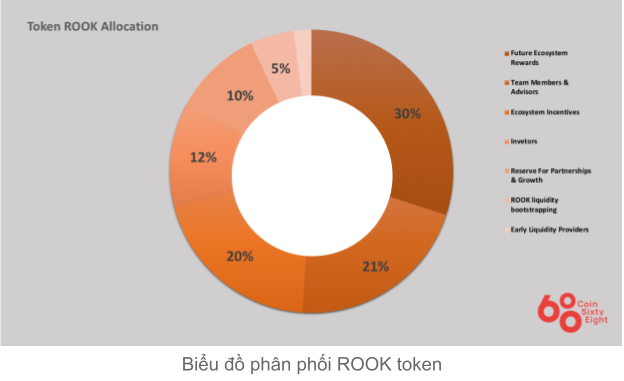

Token allocation

- Rewards for the long term growth of the ecosystem: thirty%

- Team member and advisor: 21%

- Awards to inspire ecosystem growth: twenty%

- Investors: twelfth%

- Reserve for partners and undertaking growth: 10%

- Launch of ROOK liquidity: five%

- Early stage liquidity supplier: two%

What is the ROOK token for?

- Administration.

- Adjust the sum of cryptocurrencies Keepers are holding and switch to other protocols for revenue.

ROOK token storage wallet

ROOK is an ERC20 token, so you will have lots of wallet alternatives to retailer this token. You can pick from the following wallets:

- Floor wallet

- Popular ETH wallets: Metamask, Myetherwallet, Mycrypto, Coin98 wallet

- Cool wallets: Ledger, Trezor

How to earn and personal the ROOK token

Buy immediately on the stock exchange

Where to invest in and promote ROOK tokens?

Currently, ROOK is traded on lots of distinct exchanges with a complete day by day trading volume of somewhere around $ one.four million. Exchanges listing this token incorporate: Balancer Network, Uniswap, Gate.io, FTX, …

What is the long term of the KeeperDAO undertaking, need to I invest in ROOK tokens or not?

KeeperDAO is an on-chain liquidity promise protocol for DeFi. The undertaking attracts liquidity suppliers and Keepers by the ROOK token reward mechanism. Through this write-up, you ought to have by some means grasped the simple details about the undertaking to make your investment choices. Coinlive is not accountable for any of your investment choices. I want you achievement and earn a great deal from this possible industry.

.

[ad_2]