In the money industry, liquidity is an crucial essential to guaranteeing the sustainability of assets. Therefore in the industry, in addition to the two events, purchaser and vendor, there is also a third celebration that assists keep the liquidity of the industry, namely the Market Maker. So, what is Market Maker? Let’s locate out with Coinlive in the post beneath.

What is MarketMaker? How the Market Maker will work in the money markets

What is MarketMaker? How the Market Maker will work in the money markets

What is MarketMaker?

Market Maker (abbreviated to MM) is an personal or organization with in depth capital and working experience, specializing in giving trading providers and generating liquidity for the money industry. They do this by getting and promoting assets, this kind of as tokens, stocks, bonds, foreign currency and commodities, at pre-established charges. This tends to make the industry much more liquid, that means assets can be purchased and offered much more simply.

What is MarketMaker?

What is MarketMaker?

Market Makers normally preserve bid and inquire charges at compact spreads and deliver liquidity to the industry, as this attracts much more purchasers and sellers and prospects to larger trading volumes. Higher trading volume increases the industry maker’s earnings.

MMs perform an crucial position in sustaining the versatility and liquidity of an asset class, guaranteeing that markets can operate smoothly and effectively. Market Makers normally get paid by charging commissions on trades they make. They can also earn funds by spreading the distinction amongst the getting and promoting charges.

How the Market Maker will work

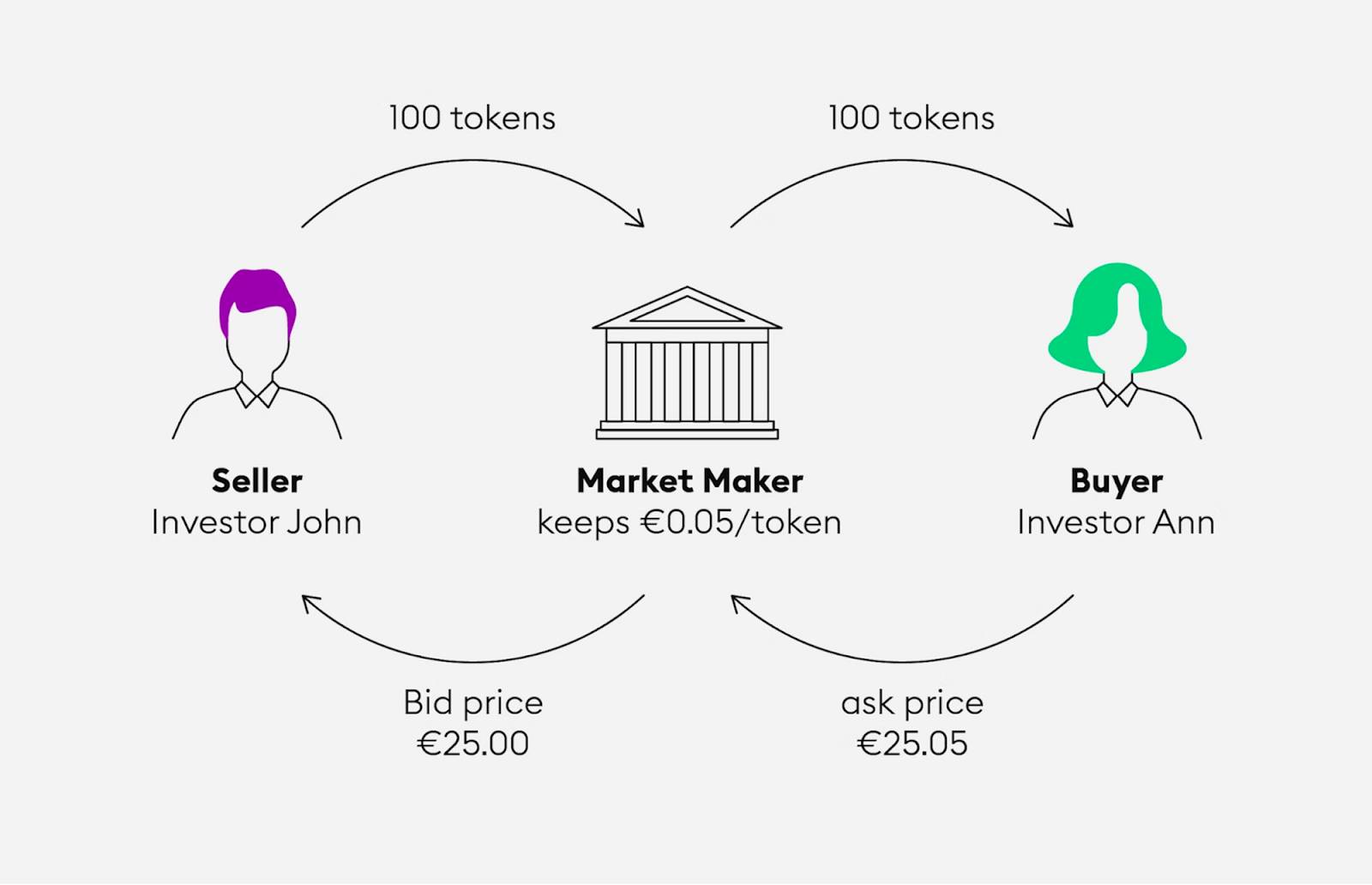

Market Maker will work by getting and promoting assets at pre-set charges. These charges are referred to as the bid price tag and the inquire price tag. The bid price tag is the price tag at which the Market Maker is inclined to get the asset, though the inquire price tag is the price tag at which the Market Maker is inclined to promote the asset.

When an investor needs to promote an asset, he areas a get purchase at the bid price tag. The Market Maker will match this get purchase with a further investor’s promote purchase, or the Market Maker itself will promote the asset to that investor at the providing price tag.

Similarly, when an investor needs to get an asset, he will spot a promote purchase at the asking price tag. The Market Maker will match this promote purchase with the get purchase of a further investor, or the Market Maker itself will order the asset from that investor at the supplied price tag.

The way to revenue from Market Maker

The Market Maker tends to make earnings in two principal approaches:

- Price distinction (spread): This is the most widespread way for MM to make a revenue, they will bid somewhat significantly less than the asking price tag. When an investor areas an purchase to get an asset at the bid price tag, MM will match this get purchase with a promote purchase positioned at the bid price tag. Through this technique, MM will revenue from the distinction amongst get and promote orders.

- Commission: MM also tends to make funds by charging commissions for every single transaction you make. This charge is commonly charged to significant traders who make significant volume transactions.

The way MM tends to make earnings is described as a result of the following picture:

The way to revenue from Market Maker

The way to revenue from Market Maker

The larger the trading volume, the much more revenue the Market Maker will get, so they generally want the industry to be as lively as attainable. To obtain this, MMs generally use price tag line advertising and marketing across firms pump – landfill token to build results FOMO appeal to traders, specifically these new to the industry.

Why is the Market Maker crucial?

The Market Maker plays an crucial position for assets, specifically for cryptocurrencies, since liquidity is crucial to make certain the continuity and stability of money markets. When an asset has substantial liquidity, traders can simply get and promote it at a realistic price tag and with significantly less threat.

In the early phases of listing a new asset class, liquidity is generally extremely very low. MM will be a third celebration that presents liquidity to the industry by getting and promoting that asset. In other phrases, MM is a man or woman who acts as an intermediary amongst purchasers and sellers, assisting to connect the two events and facilitating smooth transactions. Here are some strengths that MM brings to the industry:

- Create liquidity: MM will constantly get and promote assets at realistic charges, building it straightforward for traders to get and promote these assets.

- Attracting traders: When an asset has substantial liquidity, traders will have much more options to trade that asset. This assists appeal to traders to the industry and advertise industry growth.

- Risk reduction: When traders want to get or promote assets, MM will generally be offered to execute the transaction, guaranteeing that transactions are executed securely and effectively, which assists lessen dangers for personal traders.

- Create competitors: MMs will compete with every single other to deliver the ideal liquidity to the industry. This assists build competitors and realistic charges for traders.

- Increasing industry transparency: MM will deliver details on the price tag and trading volume of the asset. This assists enhance industry transparency and assists traders make much more informed investment selections.

summary

Above is the total post on Market Maker. Through the post, Coinlive hopes that readers can much better have an understanding of how Market Maker will work, the techniques of building earnings, and the value of Market Maker for the money industry. I want you worthwhile investment specials!