Many of you who are interested in the Ethereum network have to have encountered the notion of MEV (Miners-Extractable Value) numerous occasions. However, this notion is even now very perplexing and odd mainly because it is even now a great deal in the way of infrastructure. Therefore, uncover MEV these days to much better have an understanding of this challenge !!!

What is MEV?

With Ethereum’s recent working construction, the miners will have complete rights decide on the transactions to involve in the block and then proceed with authentication. So, we have the notion of “extractable values” – the worth that miners can reap, thanks to firing and reorganizing transactions.

Why should really ETH end users care about MEV?

As the Ethereum network is frequently criticized by the concern of fuel charges, end users who interact routinely on this blockchain will need to be conscious of the volatility of transaction charges. This volatility is brought on by “Gas War” which I will make clear additional in the upcoming part “The damage of MEV” beneath.

Common types of MEV

First, the most well-known is at the forefront (practically, the miner will enter your transaction to start with consumer to consider revenue from that trade). The way to do this is to basically set the highest fuel degree of the user’s transaction, as a result setting up pre-authentication.

In front of, we have form working backwards, That is, miners will depend on the market place response or effect brought on by the user’s transaction, then area orders following the user’s transaction to gather the sum of the worth.

From there the notion will be born sandwich attachment, ie hamburger design. This is a mixture of a front execution transaction insert and a rear execution transaction insert.

However, not one hundred% of the challenge originates with the miners. MEVs are thoroughly deployable by a third get together (transaction monitoring bot). These bots can check and set their personal fuel costs to gather their MEV worth.

Damage and results of MEV

Before we speak about the principal injury, let us seem at the notion “arbitrage” to get the picture. Arbitrage practically translates to “arbitrage trading”. When the rate of ETH in DEX U is increased than the rate of ETH in DEX S, arbitrage bots will obtain ETH in U and promote in S to advantage from the variation in the exchange charge.

This will generally aid rebalance the market place rate, coordinate liquidity in a sensible way amongst trades. However, the challenge arises when as well lots of bots attempt to increase the transaction charge for an arbitrage possibility.

The consequence is when the market place fluctuates in rate, NS the better the arbitrage options, The war on fuel fees will consider area quite fiercely. At the identical time this aggravate the fuel challenge when there are solid market place fluctuations.

Also, because the transaction is postponed, the consumer can they have to accept unprofitable exchange costs, producing the DEX trading expertise a lousy 1.

Does EIP-1559 deal with MEV?

If you have not heard of the EIP-1559, you can uncover out the vital facts of this proposition in the podcast beneath:

> See also: Discussion DeFi ep four: Ethereum Discussion EIP-1559

EIP-1559, in concept, would be aid the transaction charge to slowly enhance (when there is market place volatility), alternatively of flinching and unpredictable as just before. So, will the war on fuel fees be contained? The response is the two yes and no.

As the base charge following eip-1559 was burned, the miners’ power is relatively decreased, as they are unable to recover the transaction charge following the fuel commissions war.

However, this update is unlikely to fully remedy the challenge, when the “tip fee” (the sum of more charges paid to inspire miners) even now moves up and down at the discretion of the individual producing the transaction, and this does not it does. reduce third events from hunting arbitrage. They are even inclined to spend more to mint NFTs following updating in London.

Can Chainlink’s FSS remedy MEV?

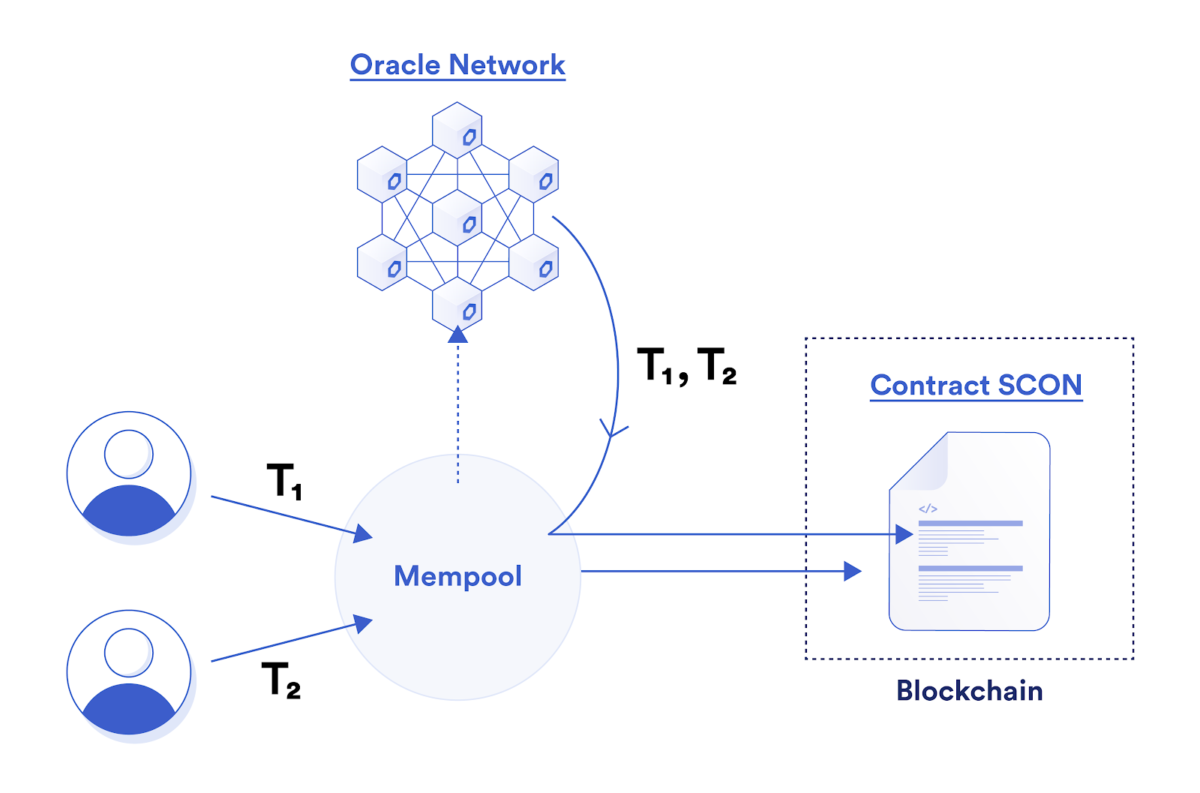

In September 2020, Chainlink launched a remedy for MEV known as FSS (Fair Sequencing Services). As a end result, they will develop an oracle network in the middle, rearranging the transactions in chronological purchase sent to Mempool, as a result sending this purchase back to the intelligent contract the consumer needs to interact with on the blockchain.

Note: Mempool is the area to obtain transaction validation requests, from right here miners will decide on transactions, then place them in the block to validate and place them in the blockchain.

However, possessing a unit in amongst will even now increase queries about decentralization (despite the fact that Chainlink has stressed the “fairness” of this remedy).

The precise roadmap for this remedy has not nonetheless been published in detail, so the effectiveness of the FSS will even now consider time to reply.

Flashbot: the prolonged-awaited remedy?

Flashbot is an organization funded by Paradigm. They had been born with the principle of producing the routines connected to the MEV transparent.

Flashbot auction is a decentralized auction network of front-working options, in which information relating to MEV is recorded in detail. This auction approach consists of “Miners” – that is, miners And “searcher” – men and women wanting for front-working options.

finish

So we looked at some of the ideas and complications surrounding MEV. If you are interested in in-depth subjects of the DeFi market place, you can join the discussion in the neighborhood Coinlive Chats Please!!!

Synthetic Currency 68

Maybe you are interested:

- DeFi Discussions ep.three: NFT, gaming, cross-chain… What to do when the market place “crashes”?

- Thinking back to the occasion in which SushiSwap “attacked the vampire” Uniswap, a milestone that transformed the landscape of the DeFi market place

What is submit MEV (Miner Extractable Value)? to start with appeared on Coinlive.