Regardless of regardless of whether you are an previous trader or just a novice trader, you need to have to spend interest to the Fed’s selections. Find out with Coinlive what the Fed is, how does the Fed’s selections have an impact on the globe economic system?

What is the Fed?

Fed (Federal Reserve System) The Federal Reserve, also recognized as the Federal Reserve, is the Central Bank of the United States, founded on December 23, 1913. The Fed was signed by President Woodrow Wilson below the “Federal Reserve Act” to sustain a versatile, steady and financial policy. harmless for the United States.

The Fed is totally independent and does not rely on or influence the US government. This is the only organization in the globe authorized to print USD (US bucks). Therefore, the Fed plays an crucial purpose in organizing and adjusting financial policy. The Fed’s alterations in curiosity charges and the cash provide will right have an impact on the market place and traders.

The existing Fed chairman is Jerome Powell, who was appointed by President Donald Trump to head the US Federal Reserve in November 2017.

The historical past of the Fed

1791Alexander Hamilton – the to start with US Secretary of the Treasury – presented to Congress the creation of a central financial institution known as the First Bank of United States (BUS1) in purchase to resolve the financial troubles of the United States. The then President of the United States, Mr. Washington, signed this proposal and permitted it to operate for twenty many years (1791 – 1812).

1812, when BUS1 had just run out of time, it was also the time when the war in between the United States and Great Britain broke out. This war induced the United States a whole lot of fiscal hardship, banking institutions in the United States have been practically insolvent due to the prolonged state of indebtedness, investments for US military operations.

In this context, President Madison has written down a choice approving the establishment of a 2nd US financial institution (BUS2) to restore the economic system and financial policy in the United States. This validity also has a duration of twenty many years (1816 – 1836).

After BUS2, time period from 1862 to 1913 There has been a series of upheavals in the banking sector in the United States. Specially time period 1907 witnessed the crisis in the banking procedure. At this time, the United States Congress has made the decision to create a “National Monetary Committee” with the endeavor of drawing up a prepare for the reform of the banking procedure to meet the coordination wants of the market place.

Nelson Aldrich, head of the Republican congress and financier, was appointed chairman of the National Monetary Commission. He has performed a series of investigations and studied state-of-the-art designs of the central banking institutions of England and Germany. He then proposed the creation of a new Federal Reserve that would handle the root of the dilemma. However, his proposal was opposed to Congress in 1911 for the reason that most of the seats in parliament have been held by Democrats.

1913President Woodrow Wilson has finished all the things doable to influence and approve Aldrich’s act to create the Federal Reserve. Finally, the Federal Reserve Act was passed in late 1913 and the Fed officially went into operation in 1915.

Role and duties of the Fed

The United States went by a time period without the need of the Fed’s existence and suffered quite a few financial shocks affecting its development fee. Therefore, the establishment of the Fed is important. Initially, the US Congress recognized only three basic goals of the Fed: to enhance task options, stabilize costs and modify curiosity charges.

However, given that 2009, the purpose and duties of the Fed have expanded and are plainly proven by the following 4 primary suggestions:

- Implement financial policies aimed at stabilizing employment and stabilizing market place costs. At the similar time, the impact of the prolonged-phrase curiosity fee adjustment.

- Supervise credit score institutions and banking institutions in purchase to make sure the safety of the fiscal procedure and ensure the legit interests of folks and borrowers.

- It detects, prevents and proposes remedies to doable dangers affecting the US fiscal market place.

- Providing fiscal providers to US government fiscal institutions, overseas fiscal institutions. At the similar time, it plays a critical purpose in the working of the country’s payment procedure.

The nature of the Fed

This company is totally independent, independent and not influenced by the US government. When it has to consider on lots of crucial roles, independence will aid the Fed make policies in line with actuality, make sure the stability of the federal fiscal procedure, and aid the complete country’s economic system create in accordance to the existing predicament.

The Fed’s reserve is also wherever the biggest concentration of cash and gold in the globe is concentrated. The New York City Bank of the US Federal Reserve at the moment holds 25% of global gold reserves and most of them are global gold deposits.

Political independence

The Fed is absolutely free to make financial policy selections without the need of possessing to go by anybody in the executive and legislative branches of the government.

The Fed is absolutely free to use the equipment to regulate curiosity charges on loans and deposits. The USD exchange fee, and at the similar time, offers the reserve degree needed to fulfill the Fed’s optimum endeavor of stabilizing costs. Creating the circumstances for the sustainable advancement of the economic system

Financial independence

The Fed does not acquire funding awarded by Congress.

The Fed has its very own working spending budget by asset management.

Although not funded by the government, all Fed working revenue go back to the government. The Fed is thought of a cash press when it generates tens of billions of bucks in yearly revenue.

Independence in organization and personnel

Unlike the US president’s four-12 months phrase, council members have a phrase of up to 14 many years. This suggests that the Fed operates constantly and has lots of distinct presidential terms.

However, the president does not have the energy to interfere in Fed selections, but the president has the energy to clear away the Fed presidency, even though this likelihood is not large.

In historical context, US President Donald Trump has repeatedly criticized the Fed as a “stubborn child” for refusing to reduced the USD curiosity fee as he desired.

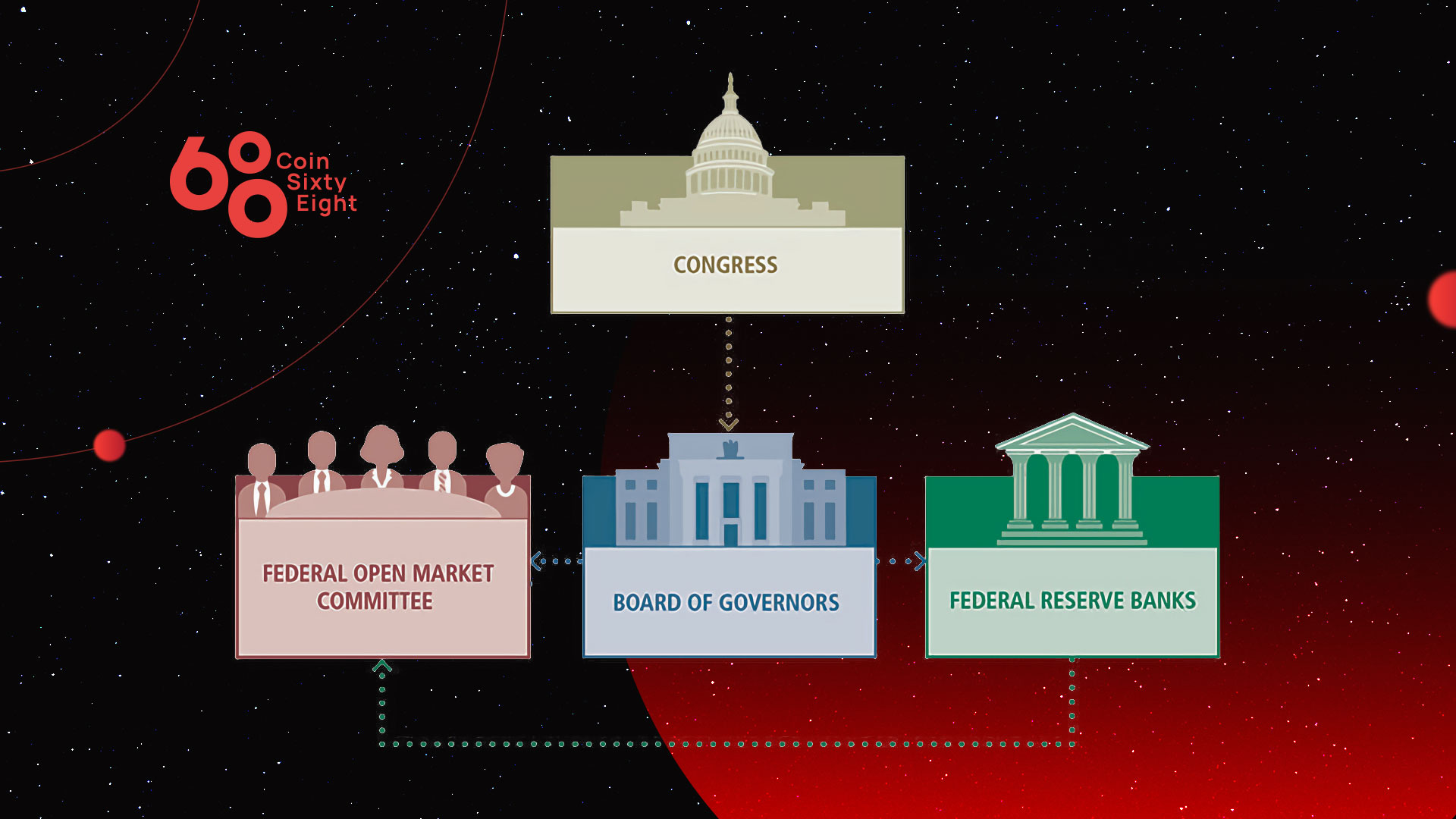

The organizational construction of the Fed

one. Board of Governors (Federal Reserve Board)

- Consisting of seven members, authorized by the President and Congress.

- Each phrase is 14 many years previous, goes by lots of presidents and functions to the finish of the phrase. Unless he is eliminated by the president.

- The Board of Directors can’t serve extra than two terms.

- It is an company that operates independently of the federal government, accountable for the formulation and implementation of financial policy.

- It regulates and oversees the operations of the twelve Federal Reserve banking institutions and the complete US fiscal procedure.

two. Federal Open Market Committee (FOMC)

- It is produced up of seven members of the Board of Governors and five presidents of the Federal Reserve Bank.

- This company is accountable for the implementation of US financial policy.

- The FOMC holds eight meetings a 12 months to set curiosity charges in the cash provide.

- Most FOMC selections have an impact on enterprise and customer credit score.

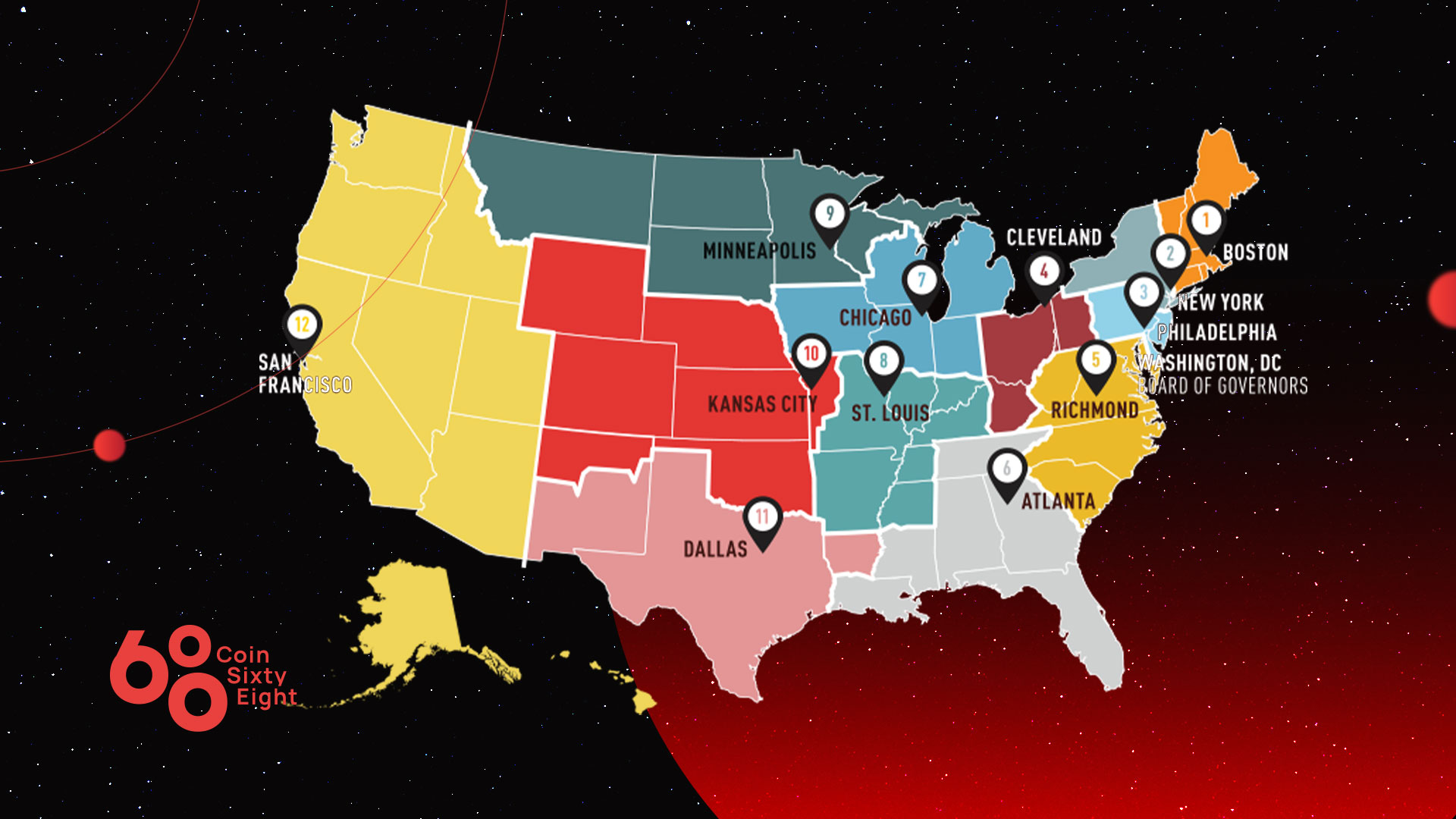

three. Federal Reserve Banks

- Including twelve Federal Reserve Banks during the United States this kind of as Boston, New York, Philadelphia, Cleveland, Richmond, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, Dallas and San Francisco.

- Federal Reserve banking institutions are not a federal government instrument. They are independent nearby personal banking institutions.

- Many banking institutions on the over listing also concern shares on the market place.

- The notes issued by the Fed are the supply of the cash and are place on the market place for circulation by Federal Reserve banking institutions in the area.

Reasons why the Fed raised curiosity charges

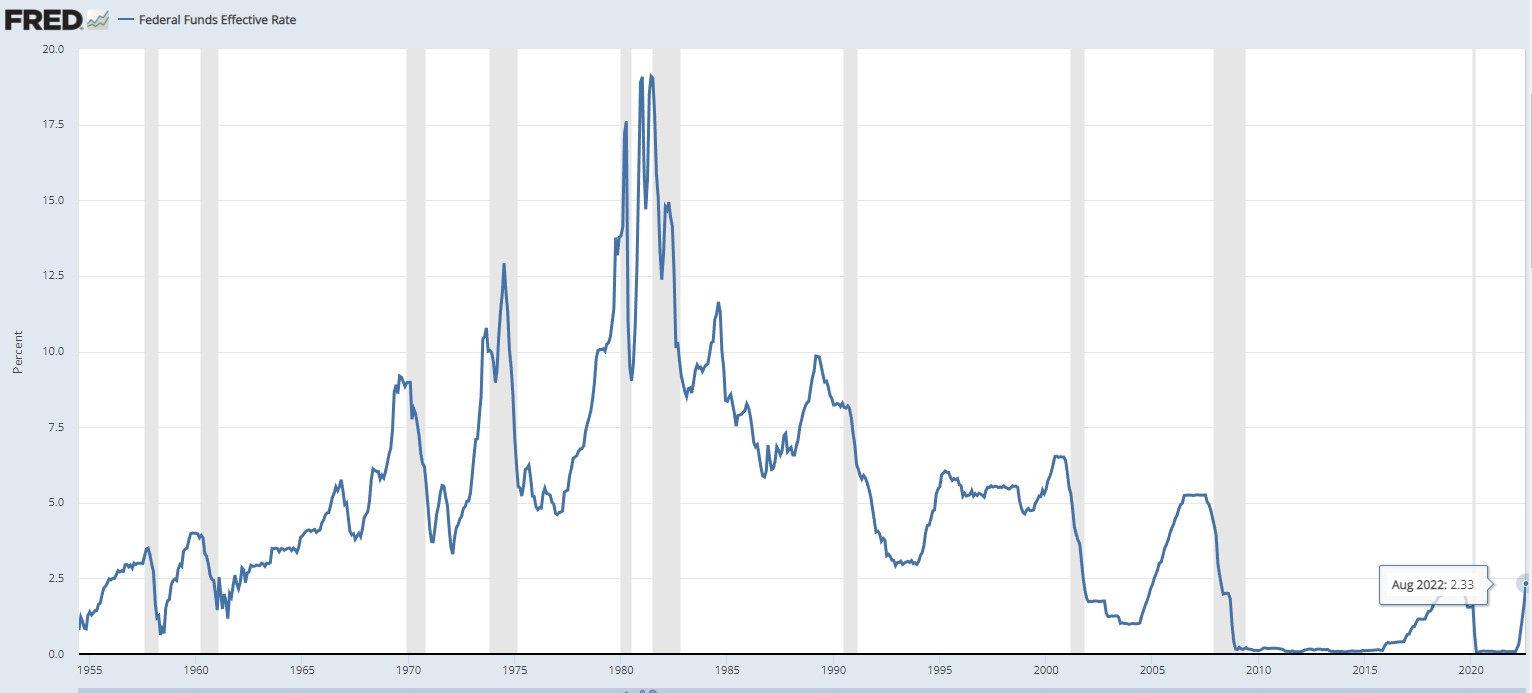

Currently, the US Federal Reserve is stepping up curiosity fee hikes to manage inflation. This warns of a increasing chance of an financial downturn. When the Fed raises curiosity charges, it can slow down the country’s financial pursuits. However, at existing, the US economic system nonetheless has a relatively steady base, so significantly so that if it transpires, it will be mild and in a brief time.

In basic, the Fed has raised curiosity charges quite a few occasions in the previous to manage inflation. This has a large influence on most assets this kind of as genuine estate, stocks, commodities, commodities and primarily cryptocurrencies.

For a deeper comprehending, the primary motives the Fed raises curiosity charges are typically:

- Once the Fed realizes that the economic system is increasing also quick, the Fed will make selections to increase curiosity charges. This is a preparatory stage for when the market place cools down and displays indications of declining, it decides to reduced curiosity charges to stimulate financial demand.

- The existing curiosity fee is nonetheless also minimal if you subtract the inflation fee. If in the United States the announced curiosity fee is two.five% / 12 months and the inflation fee is one.five% / 12 months, the genuine curiosity fee is only one% / 12 months. A rather modest variety helps make the Fed choose to increase curiosity charges.

- A rise in curiosity charges will cut down the quantity of cash customers borrow to invest on liabilities. This will restrict the creation of debt bubbles in the fiscal markets. Encourage customers to borrow cash to invest in other assets to create income movement.

Impact of the rise in curiosity charges

Because the purpose can’t be denied …