[ad_1]

This morning generally is a nightmare for these farmers Polygon and of all Billionaire Mark Cuban when TITAN token after greater than 2 weeks of steady progress from $ 2 to a peak of $ 70, lastly misplaced virtually $ 100 in worth in simply 2 hours. A panic sell-off occurred as everybody tried to withdraw or promote IRON for USDC, pushing fuel wei to a document excessive of 2000 GWEI – unprecedented on Polygon – a layer 2 blockchain network constructed supposedly near zero transaction charges of ETH.

So what occurred to Titan and IRON finance? Is this a hack, rugpull like different current hacks? To perceive this concern, let’s study via the mechanism of IRON Finance

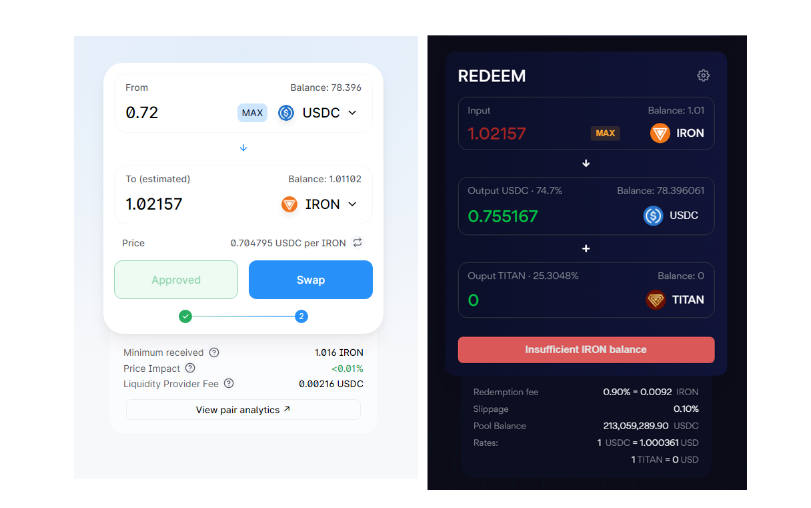

Mechanism of iron.finance

Iron finance is an under-collateralized stablecoin challenge. The primary thought is that customers will collateralize 75% USDC and 25% TITAN when minting IRON with a worth of 1 USD. Meanwhile TITAN is a bonus token that incentivizes customers as they supply liquidity for the IRON/USDC pair on Quickswap.

Iron Finance beforehand appeared on Binance Smart Chain however went unnoticed. The transfer of the protocol onto the Polygon network on the time Bitcoin crashed from $46,000 made the Project the main target of Polygon At that point, most traders would wish to maintain belongings within the type of Stablecoins, and a big APR. greater than 500% for offering liquidity for a stablecoin pair is just too tempting.

This attracted an enormous quantity of capital into the protocol, pushing the TVL stage of the challenge to a peak of $2 billion.

When folks suppose that IRON is a $1 stablecoin, of which 75% is collateralized with USDC, they may merely suppose that at most they may lose 25% of their worth by withdrawing their USDC from IRON. However, issues didn’t end up like that.

The Fall of TITAN

Because the return Iron finane generates simply by offering liquidity to stablecoins is extraordinarily engaging, it makes many individuals wish to take part on this protocol to extend their wealth whereas your entire crypto market turns bearish.

As an increasing number of folks wish to take part in incomes revenue on Iron Finance, the very first thing they need to do is mint extra IRON. For every IRON minted, $0.75 USDC and $0.25 price of TITAN will probably be required. The extra IRON is minted, the extra TITANs are purchased and burned. When TITAN will increase in value, it causes the APR of the IRON/USDC swimming pools to go larger and entice extra new traders. This created a requirement for TITAN and triggered the value of TITAN to extend steadily for greater than a month.

When the massive gamers have been farming TITAN for a very long time, out of the blue it seems like it’s time to money out. Especially when the overall market has proven optimistic indicators once more. They will promote TITAN to take revenue on USD. A big promote order of $200,000 price of TITAN triggered the value of TITAN to plummet. Remember, IRON is 25% collateralized by TITAN, when TITAN depreciates, the overall collateral from USDC and TITAN will lower, leading to the actual worth of IRON falling beneath 1$. This has created worry amongst some traders, as a substitute of burning IRON to earn USDC and TITAN. They offered IRON on to USDC on the liquidity swimming pools on Quickswap (yeah as a result of after receiving TITAN, they offered USDC anyway.)

When IRON drops beneath $1 on Quickswap, an arbitrage alternative arises. Now you should purchase 1 IRON on Quick for $0.9, then break up 1 IRON price $0.9 into 2 elements: $0.75 USDC and $0.25 price of TITAN. At this time, iron.finance will mint the quantity of TITAN tokens akin to $ 0.25. Immediately promote this token and you’ll have a revenue of $ 0.1 per IRON at $ 0.9 with none threat.

When TITAN is repeatedly minted and offered. That triggered the value of TITAN to proceed to fall, additional dragging the value of IRON beneath the closing stage. This course of creates a loop that makes it unattainable for IRON to return to the peg, whereas the overall provide of TITAN will increase to 27,805,897,236,589. The value of TITAN loses 100% of its worth because it approaches 0.

At the second, as a result of the value of TITAN has approached zero, smartcontract has stopped permitting customers to withdraw IRON to USDC. Iron staff will want 12 hours to vary the sensible contract permitting customers to withdraw USDC however withdrawing 75% of USDC will probably be a luxurious dream for individuals who are nonetheless holding IRON.

Epilogue

Really, no hacks or “rugpulls” occurred. This is merely a flawed design as massive outflows of cash move out of the protocol. Basically the mannequin of iron finance is actually extra like a ponzi scheme. Now, traders who do not get out in time, as a substitute of getting a return of 2-3% per day, they may get again $0.67 for each greenback invested in stablecoin IRON. Even uninformed individuals who purchase TITAN when the value drops, will virtually lose every thing, even when they purchase at 95% low cost.

This is only a sentence that I simply got here up with: “If you join a defi protocol and can’t answer yourself the question of where the revenue this protocol brings from. Perhaps you are the profit.”

[ad_2]