The DeFi arena caught fire in 2020, ahead of yield farming exploded on the scene. It seems like DeFi has taken off past experts’ predictions, in particular immediately after Compound started off distributing COMP governance tokens in June.

Before COMP was distributed, Compound was the 2nd greatest DeFi platform, by assets locked in the protocol. Just a handful of days later on, Compound swiftly grew to become the greatest DeFi platform and the COMP token grew to become the greatest DeFI token by industry capitalization.

Why does Compound “pump” so rapid?

The key impetus came from the truth that traders started off joining the Compound platform to “farm” COMP, that is, deposit tokens to lock in the protocol and get curiosity.

After Compound, the crypto neighborhood is also attracted by yield farming from other Defi tasks this kind of as Balancer, Curve, and Synthetix.

So what is Yield Farming, and why is the phrase becoming applied so a lot in the crypto planet? Let’s locate out with tiendientu.org by means of this post!

What is Yield Farming?

For actual farmers, “yield” is applied to measure the complete quantity of output they harvest. Similarly, in the DeFi planet, the “farmers” are those userand “yield” – the yield here is growing interest on the original assets like Dai, USDC, and USDT as they are included in DeFi platforms like Compound, Aave.

Now, the word “yield farming” is being used widely as a term, a new trend in response to the “crazy” of the DeFi world. Users are “planting” native assets to “harvest” DeFi tokens of increasing value.

COMP Farming

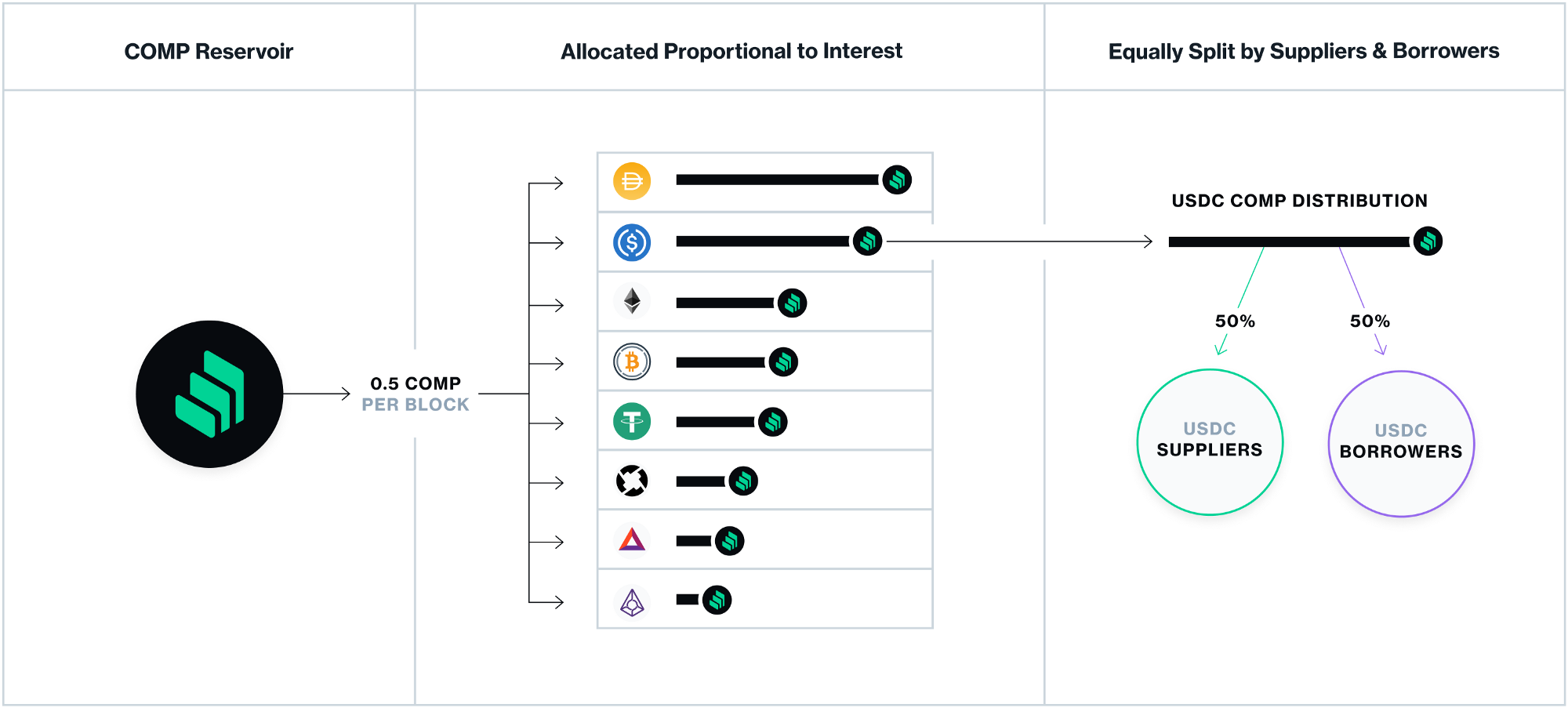

Compound is providing a reward system for liquidity creators on the platform. That is, these who borrow or lend assets on Compound will be distributed rewards of COMP in accordance to selected proportions. Currently, there are two,880 COMPs distributed per day.

The beginning of this reward system has attracted the attention of many traders. In the days that followed, many people moved their assets into Compound to start yield farming tokens COMP.

In addition, third-party projects are helping to facilitate farming COMP. Smart wallet project InstaDApp, for example, has come up with the “Max $COMP Mining” widget to make it easy for users to harvest COMP with just a few clicks.

BAL Farming

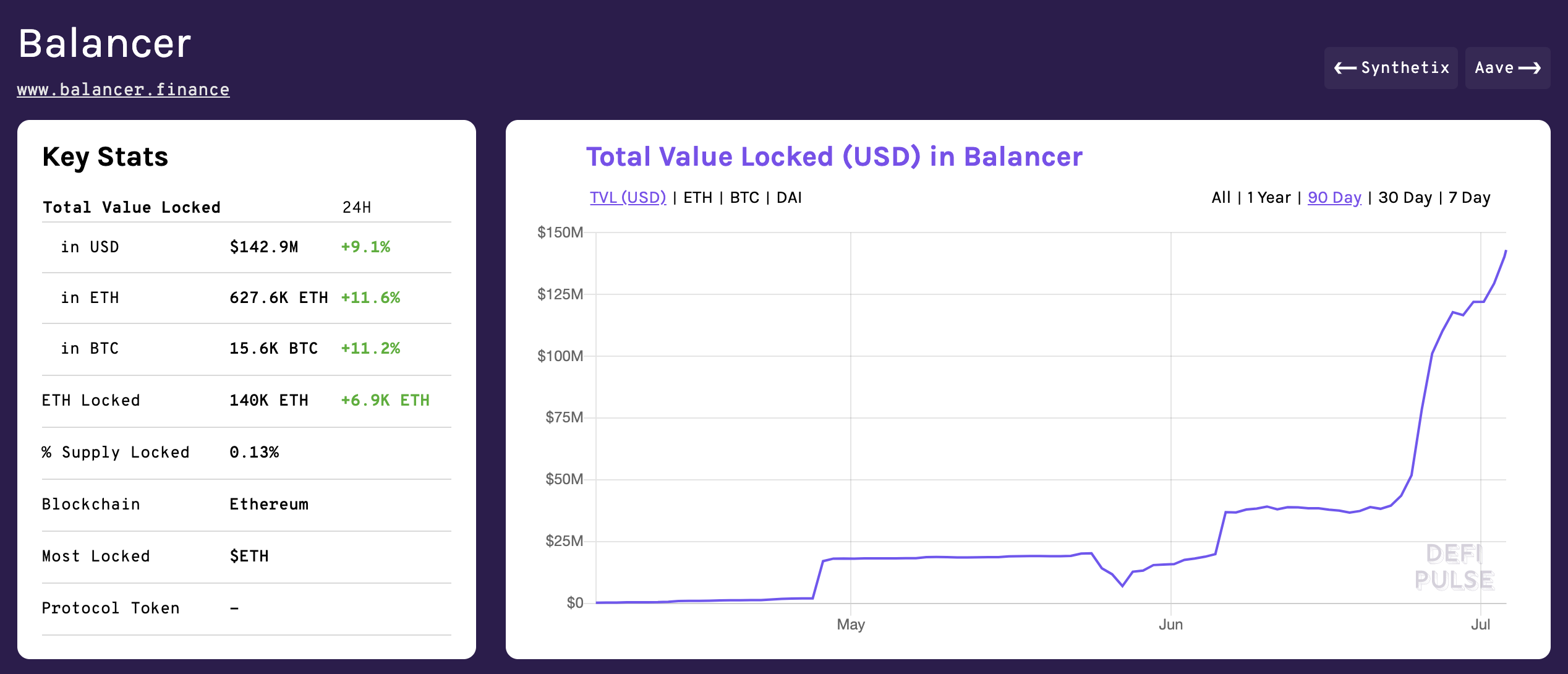

Balancer is an automated market maker that allows users to create a combined liquidity pool from various ERC20 tokens in a 1:1 ratio with the liquidity pool used on Uniswap. Balancer is a flexible yet innovative protocol.

Recently, the Balancer creators wanted the governance of the protocol to be decentralized so they created their own mining liquidity. BAL is the governance token of the Balancer. The total supply of BAL is 100 million tokens, 65 million tokens are used as rewards for liquidity creators on the protocol. Each week, the amount of BAL distributed is 145,000 tokens. This is an attractive enough number to attract traders to transfer their assets to the Balancer pool, serving to farm BAL.

Current BAL price:

Conclusion

Locking assets for curiosity is not new in the crypto industry. However, Yield Farming is exploding with the DeFi craze.

However, yield farming even now has dangers this kind of as asset liquidation, hacking mainly because of weak sensible contracts… Therefore, you really should be mindful although sending income to defi protocols to farm.