Aave, a leading DeFi (DeFi) platform, is preparing to launch a fee switching mechanism to enhance its economic model.

This move is in line with a larger effort to ensure long-term sustainability and bring value to the Aave ecosystem.

Aave’s Fee Transformation Initiative

On January 4, Stani Kulechov, founder of Aave, hinted at plans to activate a fee migration initiative. This proposal aims to improve the platform’s revenue management by allowing Aave DAO to regulate how fees are collected and distributed.

Similar mechanisms are commonly seen on DeFi platforms and often reward Token Holders and stakers through redistribution of transaction fees.

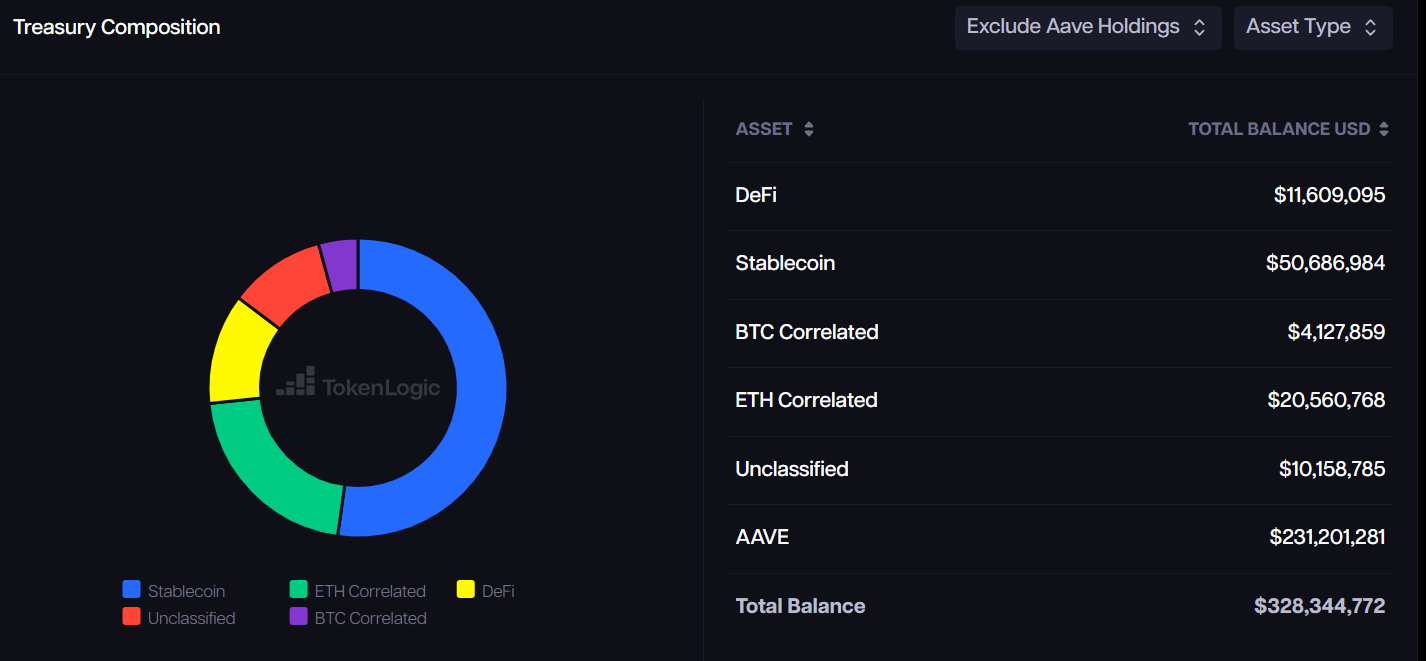

Aave’s strong financial position supports this initiative. Its treasury has nearly $100 million in non-domestic assets, including stablecoins, Ethereum and other cryptocurrencies. When including AAVE tokens, this figure exceeds $328 million, according to TokenLogic.

Marc Zeller, founder of Aave Chan, first introduced the idea of fee switching last year and emphasized its inevitability earlier this year. According to Zeller, Aave’s net revenue far exceeds its operating expenses, making the move not only feasible but also strategic.

When your protocol’s treasury looks like this, and the DAO’s net revenue is twice its operating costs (including incentives), Fee Switching is not an “if” but a “when” ,” Zeller stated.

Aave is the largest DeFi lending platform, providing users with decentralized borrowing and lending options. According to DeFillama data, there are more than $37 billion in assets locked on the platform.

Aave’s USDe-USDT Proposal Sparks Criticism

Meanwhile, the Aave community is also considering one propose more controversially to link Ethena’s USDe, a synthetic stablecoin, to Tether’s USDT.

This change will align the price of USDe to USDT using Aave’s pricing sources, replacing the existing Chainlink oracle. The goal is to minimize risks associated with price fluctuations and unprofitable liquidations.

USDe stands out from traditional stablecoins like USDT by relying on derivatives and digital assets like Ethereum and Bitcoin instead of fiat currency reserves. According to DeFillama data, USDe is the 3rd largest stablecoin, after USDT and USDC.

While there is significant support for the proposal, some community members have argued that it could create a conflict of interest, as the consultant involved in drafting the proposal has ties to Aave and Ethena. Critics, such as ImperiumPaper, have suggested that these advisors should exclude themselves from monitoring USDe parameters to ensure fairness.

“LlamaRisk is on Ethena’s Risk Committee, receiving monthly compensation. Ethena hired Chaos early on to help design and develop the risk frameworks used by Ethena. Both should recuse themselves from any oversight of USDe parameters,” Imperium Paper stated.