The emphasis of the final handful of days has been the Ethereum The Merge occasion. There is surely no want to say also substantially about the relevance of this occasion for the advancement of Ethereum. You can read through connected posts right here.

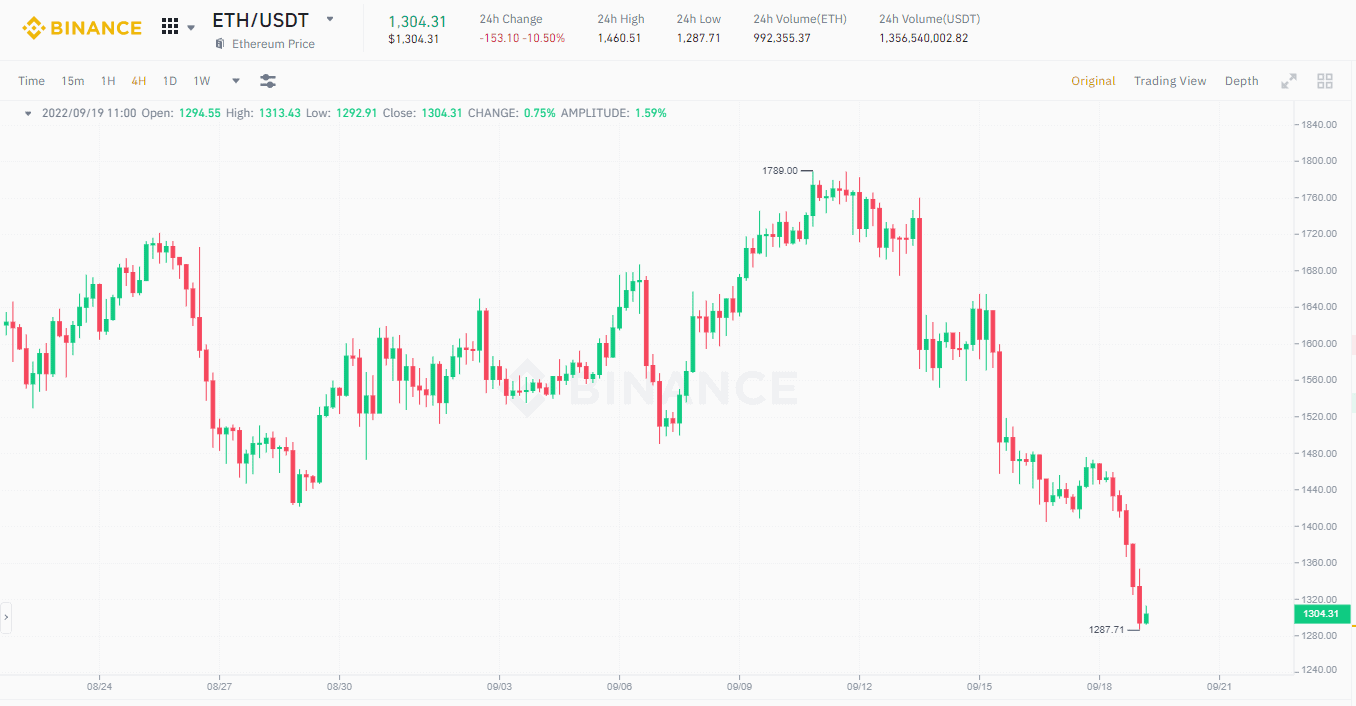

As crucial and anticipated as it is, the selling price of ETH soon after The Merge has started off to plummet. The red candles “enter the ground”, pushing the selling price of ETH from $ one,790 prior to The Merge to just $ one,300.

Why with a bullish occasion like The Merge, with a effectively-reviewed undertaking like Ethereum, why does the selling price of ETH go down all the time?

Let’s come across out with Coinlive some attainable good reasons for this incident!

The market place predicament is not optimistic

We all agree that the cryptocurrency market place has entered “winter” due to the fact the starting of 2022. The most important currency in the total market place is Bitcoin, which has fallen much more than 70% due to the fact its peak of 69,000 USD. Also this morning BTC plunged to $ 19,300, continuing to engulf the market place in a “sea of fire”.

Once in a extended-phrase downtrend, the spikes for no matter what explanation are quick-phrase.

ETH is no exception. The pleasure surrounding The Merge has pushed the selling price of ETH to almost $ one,800 – we can currently see this as a quick-phrase bull run. So soon after The Merge, when the “motivation” for development was not essential, the selling price of ETH started to fall in the common path of the market place.

Furthermore, the macroeconomic predicament among now and the finish of 2022 is not also optimistic. You can read through the Fed’s curiosity fee adjustment examination in past Coinlive posts. Macro variables impact the total cryptocurrency sector, not just Ethereum, so when the cryptocurrency reacts to these variables, the selling price of ETH also falls.

ETH promoting strain

On the digger side

In early September, Coinlive reported that miners have been raising their accumulation of ETH in anticipation of The Merge, with the expectation that the selling price of ETH would rise. So clearly soon after The Merge and also partly mainly because PoS miners have to switch to mining other coins, it is inevitable that they will promote ETH.

From the neighborhood waiting for the ETHW airdrop

The psychology of getting and holding ETH to “wait for something” aided drive up the selling price of ETH prior to The Merge. So when the incentive to get the airdrop is in excess of, it truly is time for these people today to promote ETH.

From ETH borrowers

In addition to the group of people today who acquire and hold ETH, there are also “stronger” people today, who rush to borrow ETH on the lending platforms. Whether that system is successful or not, soon after The Merge, they are also forced to repay the loan. All of these actions aided carry the selling price of ETH down.

Buy rumors, promote information

You unquestionably do not want to clarify substantially about the “Buy the rumors, sell the news” system in the cryptocurrency market place. Of program, no system is definitely correct, but The Merge occasion proved that this is a rather productive quick-phrase way of trading.

Also, if you comply with the information routinely, you currently know that institutional traders are “actively” extended ETH prior to The Merge. So soon after the finish of The Merge, the “long” momentum is gone, most will pick to promote ETH.

In truth, most analysts assume ETH selling price to drop soon after The Merge for the over good reasons. So it truly is no shock that that prediction came correct.

Risk of getting classified as a protection

“Being classified as a stock” is even now a risky sword on Ethereum’s head. ETH’s staking model soon after The Merge runs the chance of challenges from the SEC.

Of program, this is only Mr. Gary Gensler’s private view, not the SEC’s ultimate judgment. However, this concern is even now straightforward to panic traders and promote ETH.

Bring the selling price of ETH to the genuine degree

Storm promoting hype all over The Merge has progressively subsided. If the selling price of ETH has risen, it has also risen. Therefore, this is the time when the ETH selling price returns to its authentic degree, in relation to the existing market place predicament.

In June 2022, when BTC misplaced the $ twenty,000 mark for the to start with time in 18 months, trading all over $ 19,000, the selling price of ETH even hit the “top three digits”. The writer does not imply that $ 999 is the real selling price of ETH, but seeking back this time ETH is trading larger than the then correlation, even though BTC is even now all over $ 18-19,000.

Conclusion: decline does not imply lousy

With all of the over good reasons, the ETH dump soon after The Merge is inevitable. Especially when the BTC leader is even now all over $ 19,000 and has not proven any indications of development.

Furthermore, the red and green candles on the exchange are only element of the cryptocurrency market place. Ethereum is even now the most important undertaking, the Unification occasion brings optimistic adjustments to the total undertaking.

Work bullish Long-phrase Ethereum does not imply that we have to constantly “long” ETH on the selling price chart.

Finally, you need to obviously determine whether or not you are an investor or a trader, based mostly on what time frame to have a affordable investment and trading system. I do not want to be a quick phrase trader but then you have to switch to a extended phrase holder mainly because you acquired misplaced …

Giovanna

Maybe you are interested: