Analysts say the upcoming interest rate cut could be a good opportunity for Bitcoin price, but the market is still in a “wait and see” mode.

Cryptocurrency analysts are predicting three major events in the coming weeks that could push Bitcoin prices higher, depending on how the market reacts to them.

For the past seven months, Bitcoin has been trading in a bearish range between $74,000 and $52,000, and investors are becoming increasingly impatient about whether BTC will break out above or whether its price will continue to decline.

The market is in a ‘waiting’ state

Mena Theodorou, co-founder of Coinstash, said that Bitcoin’s next move will depend on how the market reacts to upcoming political and regulatory changes in the United States during the election season, as well as upcoming macroeconomic data releases.

“Whether BTC breaks out or falls will depend on the next big news or market shift […] At the moment, the market seems to be in a ‘wait and see’ mode.”

Interest rates and employment data

eToro market analyst Josh Gilbert says he is expecting the upcoming FOMC meeting on September 18 to be the next “big catalyst” for Bitcoin price.

Consensus Among market participants, Fed Chairman Jerome Powell is expected to cut interest rates by up to 0.525%, which Gilbert believes is positive for risk assets like Bitcoin.

“A rate cut is coming, but the question now is how big it will be. This week’s US jobs data will be the deciding factor and could impact crypto assets,” Gilbert said.

Coinstash CEO Tina Wang told Cointelegraph that investors should pay attention to the upcoming US jobs data due out on September 6.

“July’s unemployment rate was higher than expected, raising concerns about a possible recession. The unemployment rate is notorious for being a double-edged sword. On the one hand, a higher-than-expected rate could signal a greater risk of recession, which is not good news,” she said.

“On the other hand, it could be really positive for the market because it could give the Fed more reason to cut rates,” Wang added.

Overcoming ‘resistance cluster’

In a September 3 investment note reviewed by Cointelegraph, IG Markets analyst Tony Sycamore said Bitcoin would need to have a “sustained breakout” above recent highs of $65,000 to establish a true reversal.

If Bitcoin can break above this level, Sycamore suggests that the asset will face a “cluster of resistance” between $70,000 and $74,000 before the market can turn positive.

Bitcoin is currently trading at $59,140 and has gained 40% since the beginning of the year. At press time, BTC is still down 20% from its all-time high of $73,800 it reached on March 14, according to Data from TradingView.

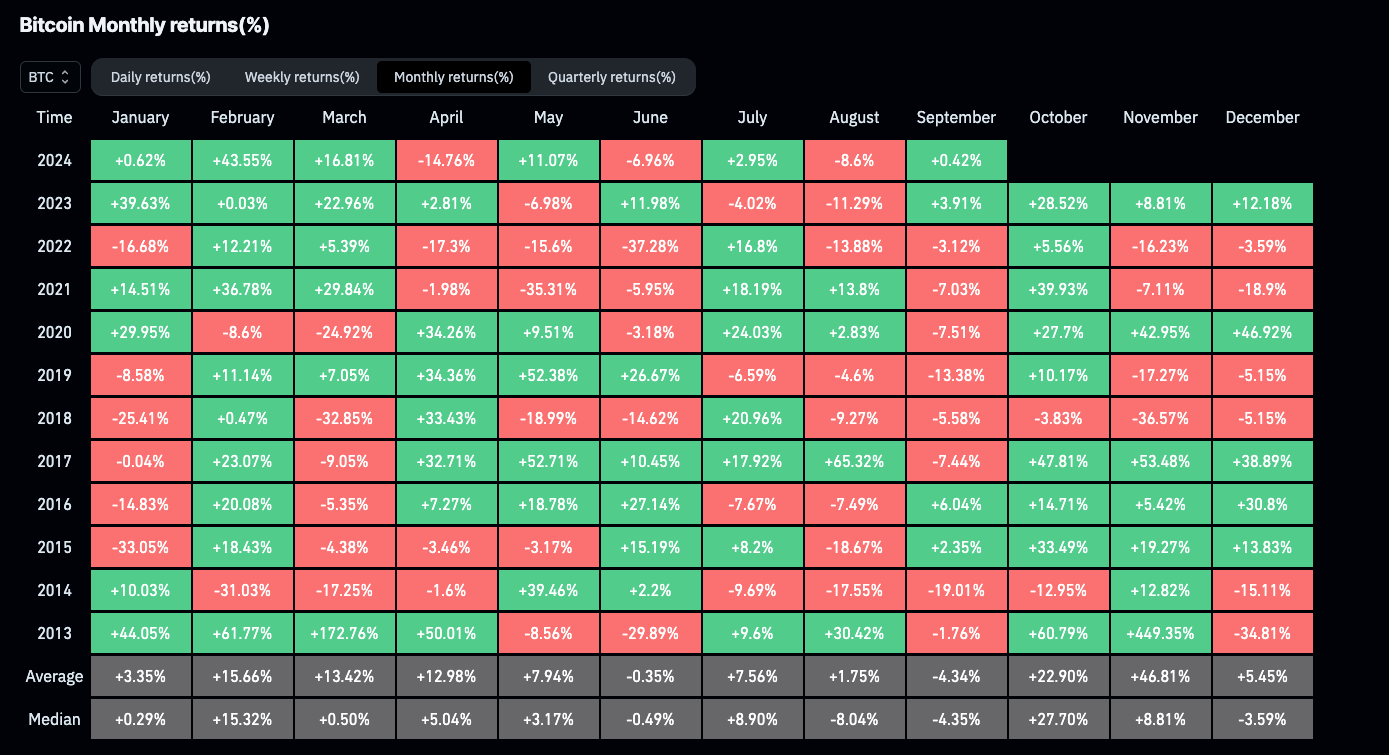

In the medium term, Gilbert said investors should prepare for further volatility in September. History shows that September is the worst month for Bitcoin prices, with an average monthly return of -4.3% over the eleven years since 2013.

“While global growth remains strong, US GDP was revised up last week, US corporate earnings growth hit double digits in the second quarter, and interest rate cuts all suggest that the market has plenty of room to run. There are certainly major risk events ahead, but there are reasons to be optimistic,” Gilbert added.

Bitcoin News Summary