Currently, Bitcoin is on a rough patch as the world’s very first cryptocurrency has been fluctuating in the $19,000 to $twenty,000 selling price variety. Even final week’s selling price action was not as obvious as most days when the coin is over a red candle.

At press time, Bitcoin is promoting for $19,711 just after a two.61% drop in the previous 24 hrs. For now, the major coin’s challenging days may perhaps not be above anytime quickly.

Although the industry has reversed its stance, crypto industry experts and strategists have created their predictions primarily based on their examination.

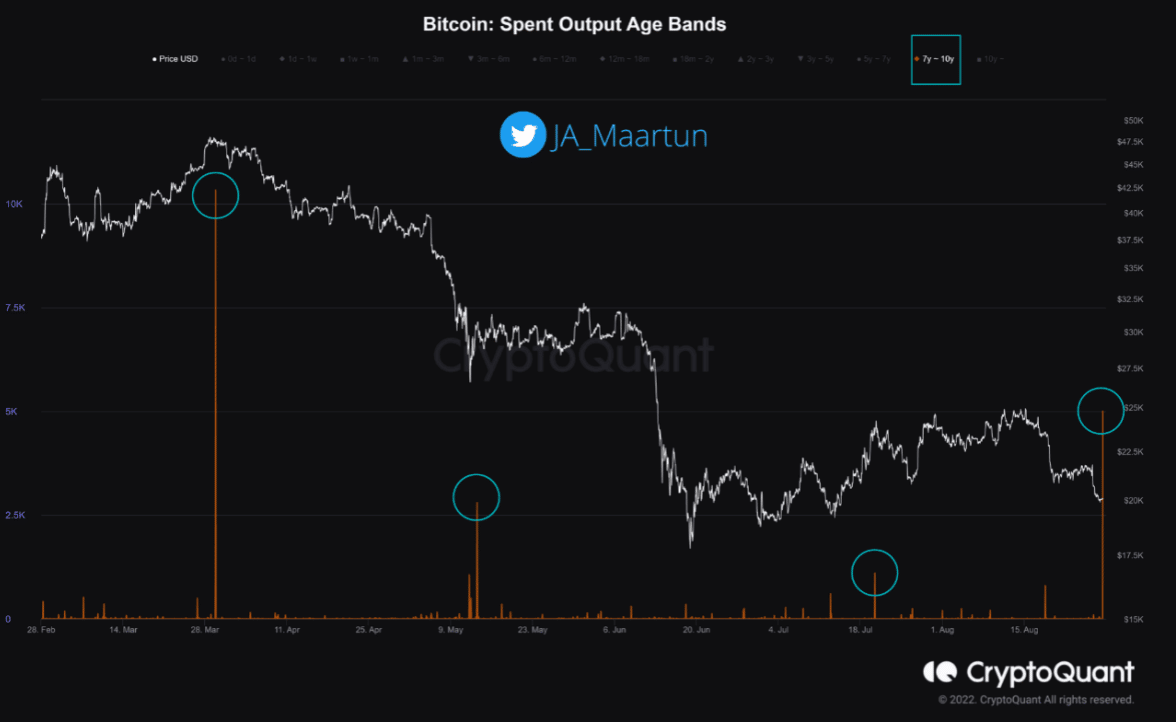

Among this kind of analysts, CryptoQuant writer Maartunn argues that current huge transactions may perhaps have impacted the industry. This form of situation frequently prospects to a selling price drop.

According to Maartunn, the move from right here is unpredictable, but by no usually means a bull run, and he also mentioned that he is not absolutely sure if there will be a assured drop or just a consolidation like in May.

Bitcoin selling price enhance?

On the contrary, Gert van Lagen, a technical professional, factors to a constructive head and shoulders pattern on the Bitcoin chart indicating an upward trend for the coin.

However, some events in the industry did not help this prediction. Meanwhile, some on-chain statistics help Lagen’s claims.

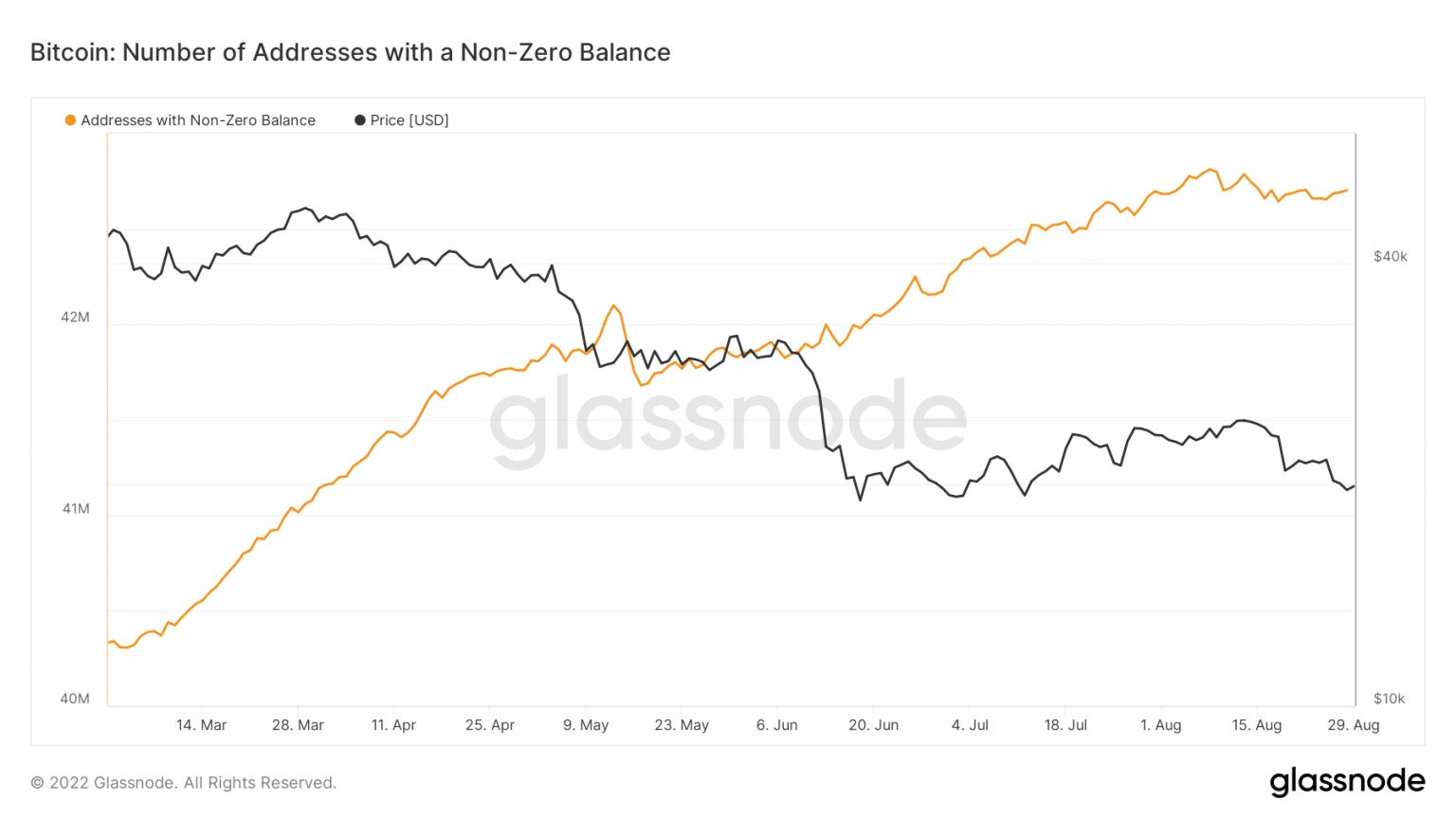

Regardless of the detrimental selling price motion, BTC addresses with non-zero balances have proven a steady enhance in current months. This exhibits that traders are extra assured in bitcoin in the system.

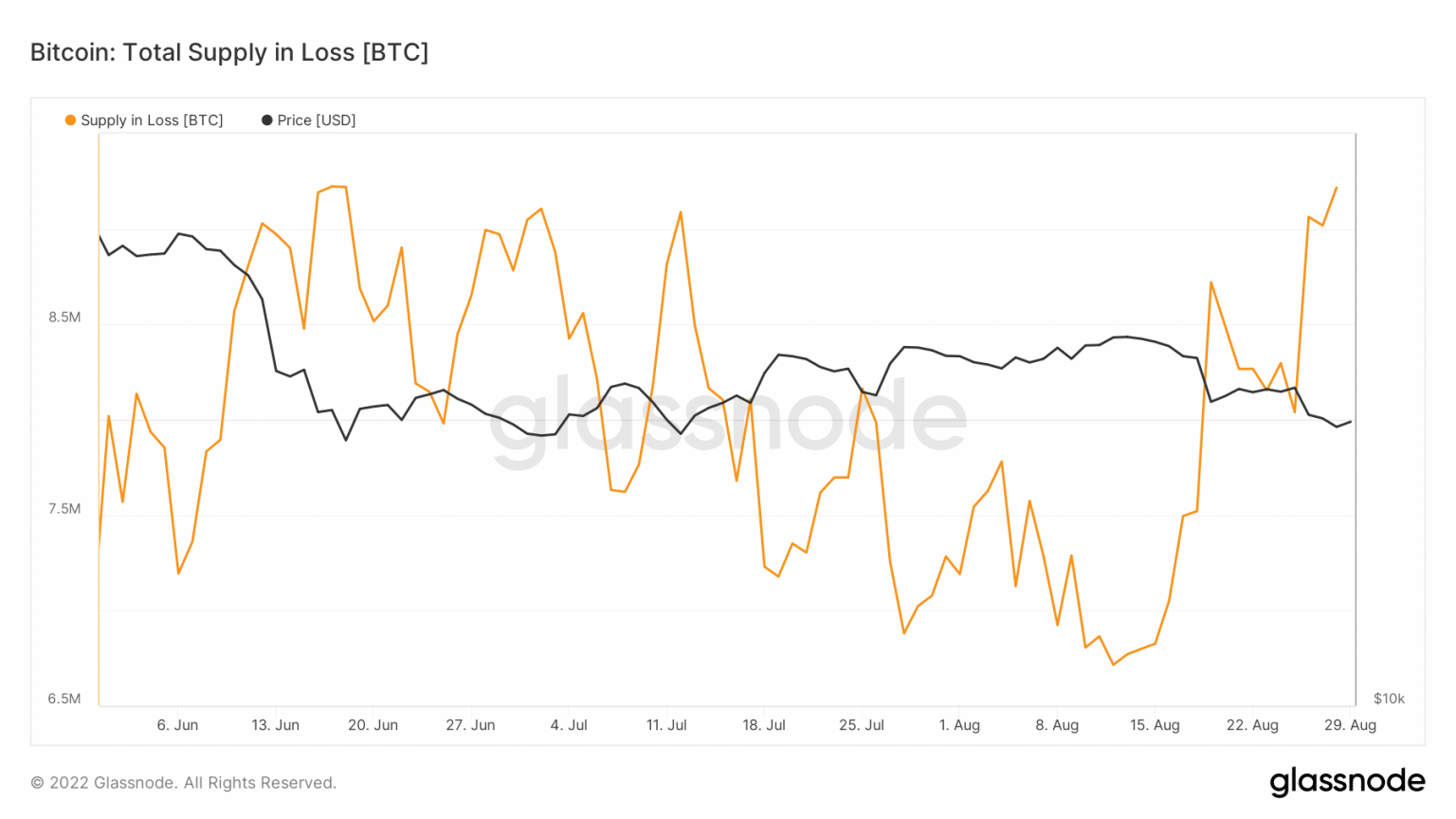

While some stats help an early bull industry outlook, other folks propose cooler occasions for the world’s biggest cryptocurrency. At press time, the provide of Bitcoin in a dropping place is on track to hit a 3-month large.

Although the variety dropped earlier this month, with the bear industry, the variety has reversed.

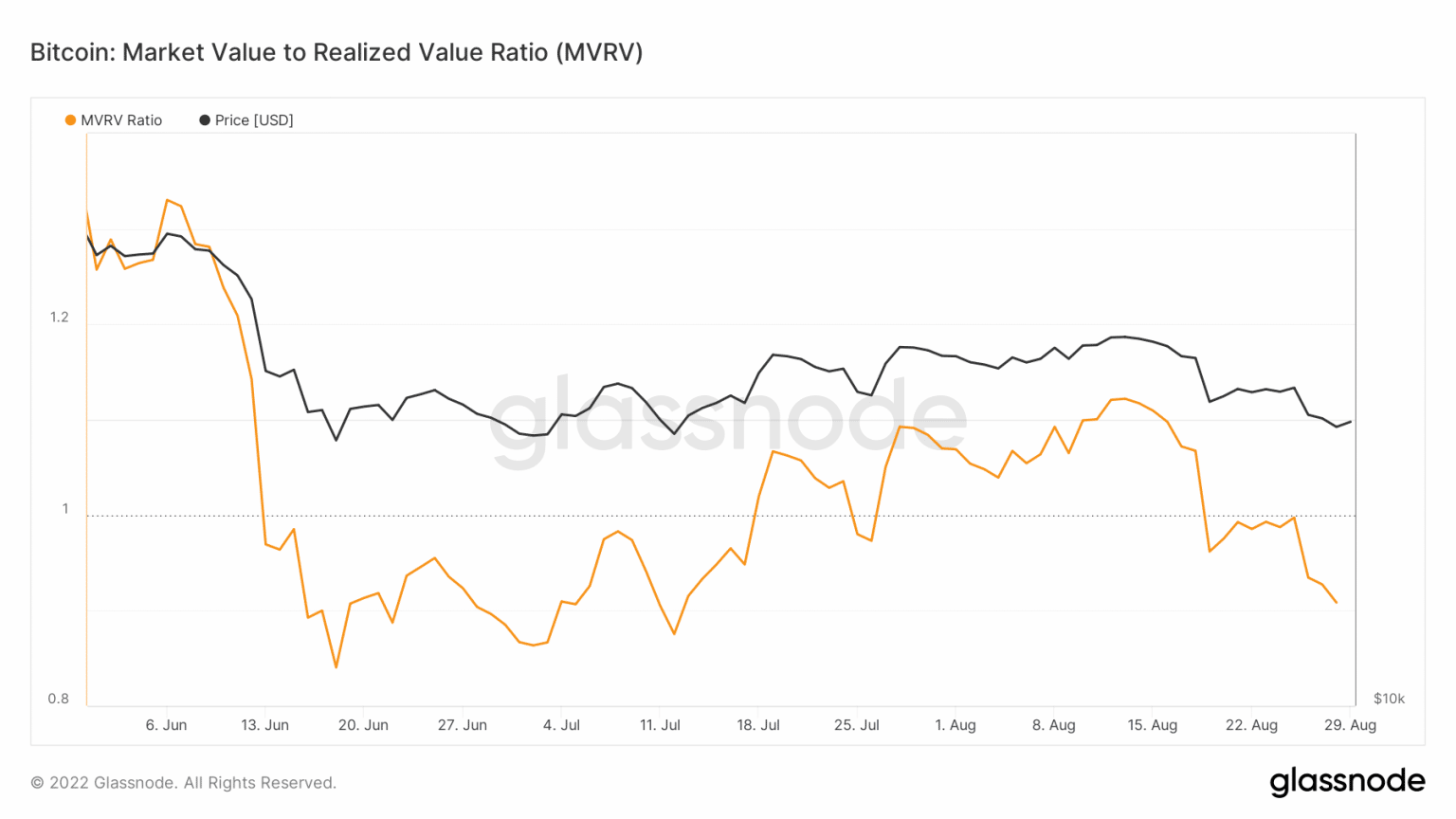

The MVRV industry share for Bitcoin is also appreciably beneath one, which ordinarily signifies a bear industry. However, the MVRV charge recorded a decrease than latest condition in the very first number of months, so hunting at historical information, yet another drop in worth is feasible.

Making trusted predictions about Bitcoin’s long term days and how it will hold up is a challenge due to the broad variety of opinions in the crypto planet, inconsistent metrics, and unattainable nature. prediction of the cryptocurrency industry.