Ethereum Classic (And so forth) is unlikely to retain extended-phrase stability, in spite of the focus of the miners who are pouring this coin.

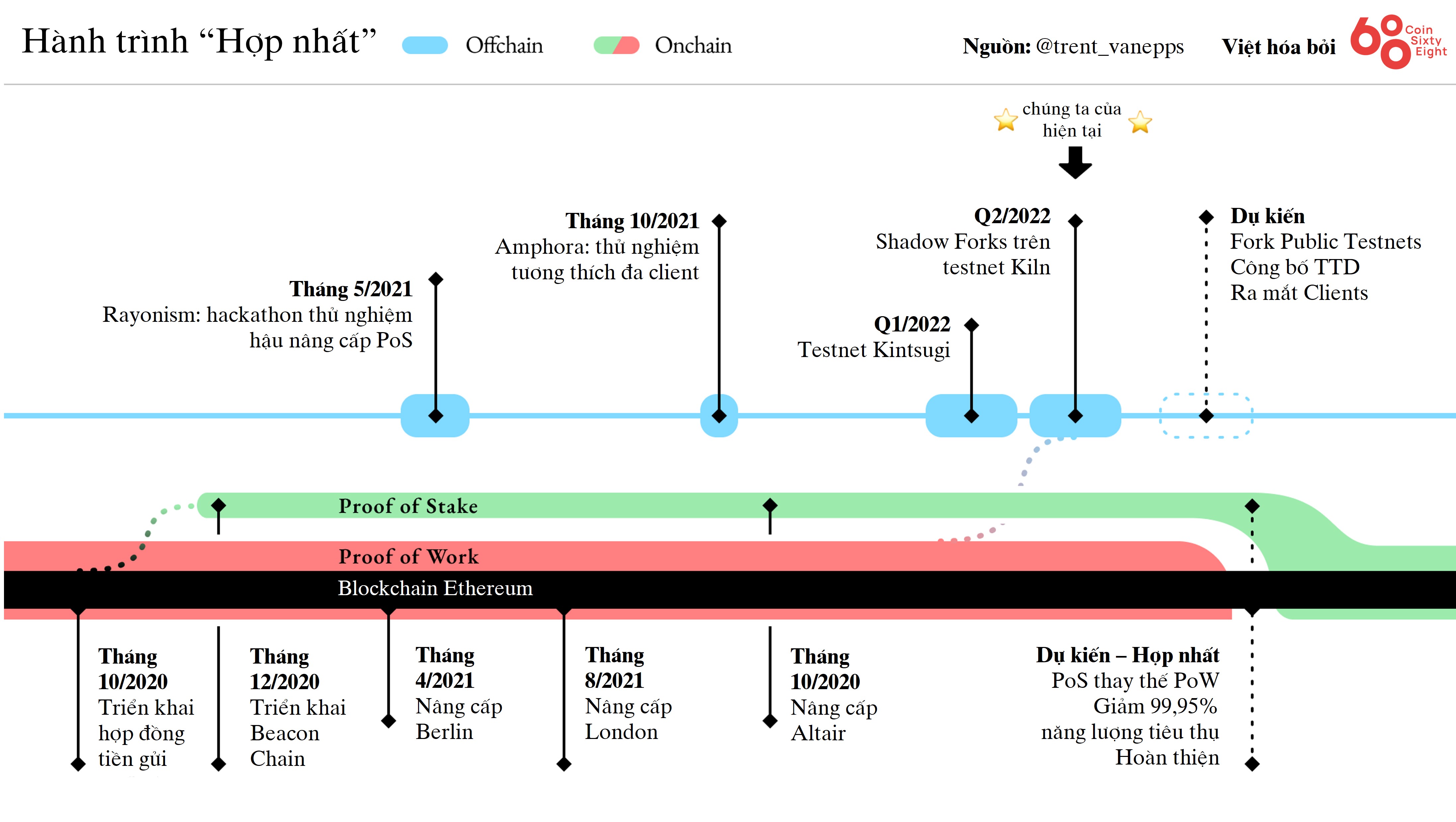

Cryptocurrency miners are exhibiting additional and additional curiosity in Ethereum Classic (And so forth) as Ethereum (ETH) is in the transition from vitality-intensive Proof-of-Work (PoW) consensus to higher-intensity Proof-of-Work (PoW) consensus vitality. Consensus-of-Stake (PoS) mechanism, this method is also regarded as “The Merge”.

-See additional: Vitalik Buterin announces improvement roadmap for Ethereum following the merger

This signifies that miners will no longer be ready to mine ETH by specialized products. Therefore, And so forth is unwittingly an different if they will not want to flip that variety of miners into scrap. However, transforming mining operations in And so forth immediately is complex mainly because ETH’s mining network is currently extremely massive and has held the consensus for a extended time so far.

Therefore, there are conflicting views in the Ethereum local community on the following path following Ether completes The Merge, not only on the mining arena but also on issues relating to the individual ambitions of miners, persons and organizations who are “familiar” with the edition. PoW of Ethereum. To uncover out additional about this story, study the post beneath:

Returning to the primary subject, in spite of the “attractiveness” surrounding Ethereum Classic, a new report by senior analysis analyst Tom Dunleavy of blockchain analytics company Messari is exhibiting that And so forth has extremely small extended-phrase viability.

Tom Dunleavy explained And so forth could rise by additional than thirty% final week following AntPool’s mining pool invested $ ten million to create and examine Ethereum Classic’s mainnet applications and in the days major up to consolidation, scheduled for week 3. September), but the currency is unlikely to develop sustainably.

Because Ethereum mining presently accounts for 97% of graphics processing unit (GPU) mining income and has a every day turnover of $ 24 million. Once merged, end users will be ready to validate transactions by betting on ETH as an alternative of executing vitality-intensive calculations, producing Ethereum-based mostly miners practically obsolete.

97% of the GPU mining round comes from Eth. two% comes from And so forth. The every day RWD for And so forth is ~ 700k versus 24m for Eth. If miners finish up migrating to And so forth, the hashrate will maximize by blowing up the mining variation, pushing quite a few miners out of the $. The only way to keep rewarding is if the And so forth value rises pic.twitter.com/xIueAyVrdZ

– Dunleavy (@ dunleavy89) 1 August 2022

Miners will be forced to promote their products or switch to And so forth mining, which presently accounts for two% of GPU mining income and raises about $ 700,000 in every day income. This important revenue gap signifies that even if miners switch to And so forth, the mining issues will maximize radically and depart quite a few unprofitable miners.

On the other hand, Mr. Tom Dunleavy extra that And so forth has a historical past of sudden value increases when the task is abruptly pointed out a whole lot by the local community in a quick time period of time, so the latest maximize in And so forth does not signify the nature of the extended-phrase network development task. Furthermore, Ethereum Classic has a extremely little variety of lively addresses. The latest degree of development of the network is much less than one/ten of Ethereum and there have been no important adjustments in the volume of transactions given that 2018.

Synthetic currency 68

Maybe you are interested: