With the advent of a quantity of new blockchains that are ground breaking in all respects, Ethereum is dealing with lots of main problems in keeping its place in the marketplace.

Specifically, cryptocurrency investment fund giant Andreessen Horowitz (a16z) has just launched a in depth report to assess the latest probable of cryptocurrencies in basic, with a unique target on Ethereum (ETH). . Additionally, a16z focuses on subjects like Web3 growth, cryptocurrency adoption, DeFi, and stablecoins.

Presentation of the a16z state of cryptocurrency 2022 report

A great deal has transformed because we started off investing in cryptocurrencies just about a decade in the past.

Here are five crucial factors from the a16z crypto web3 field survey and information evaluation @darenmatsuoka, @eddylazzarin, @cdixon & @rhhackett ️ pic.twitter.com/JFLXbNh03u

– a16z (@ a16z) May 17, 2022

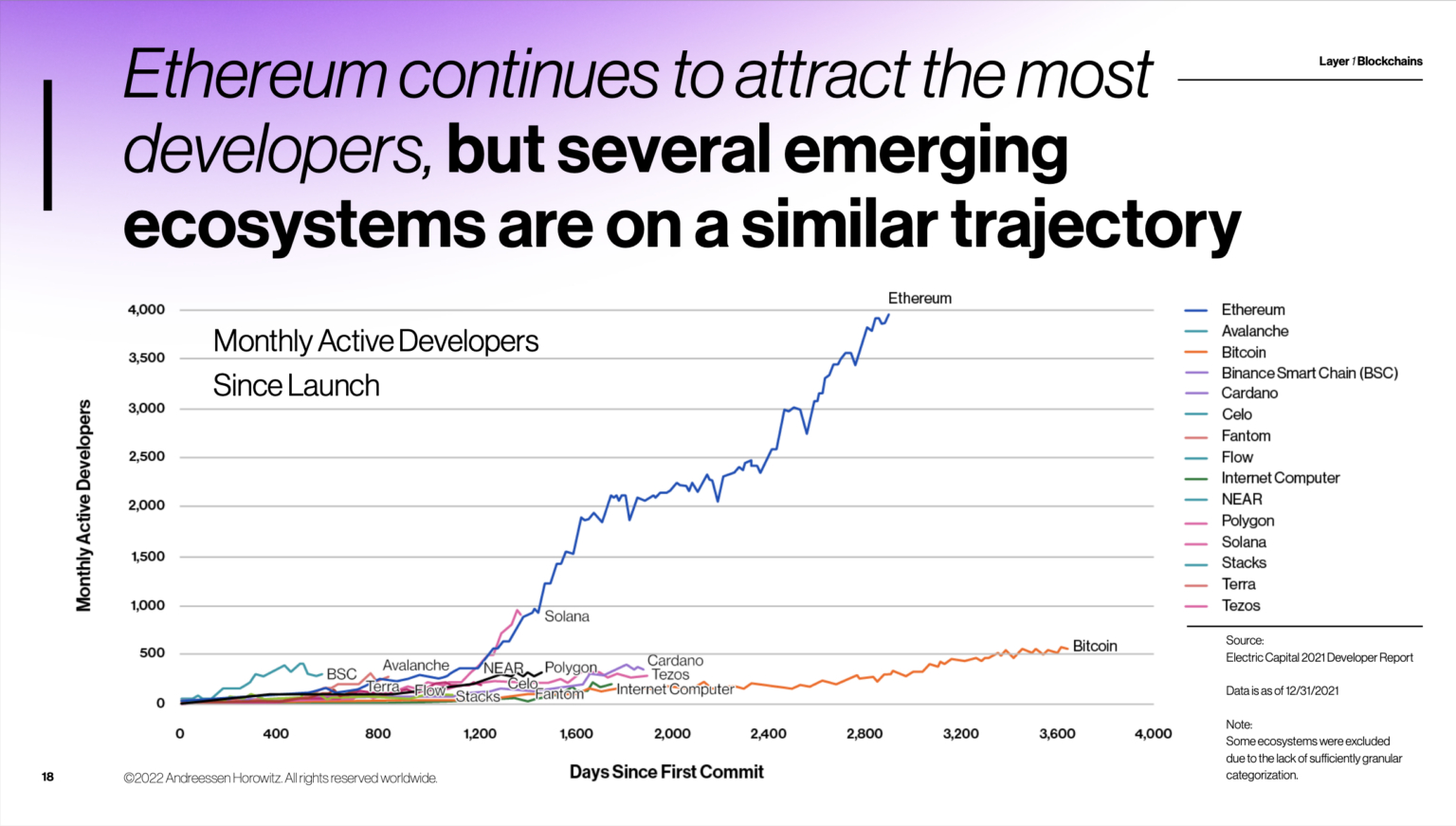

According to a16z, Ethereum totally outperforms the competitors in terms of engineering curiosity, as the network sees all-around four,000 regular monthly energetic developers in contrast to Solana which ranks 2nd with one,000. Bitcoin and Cardano are in the up coming positions at 500 and 400 respectively.

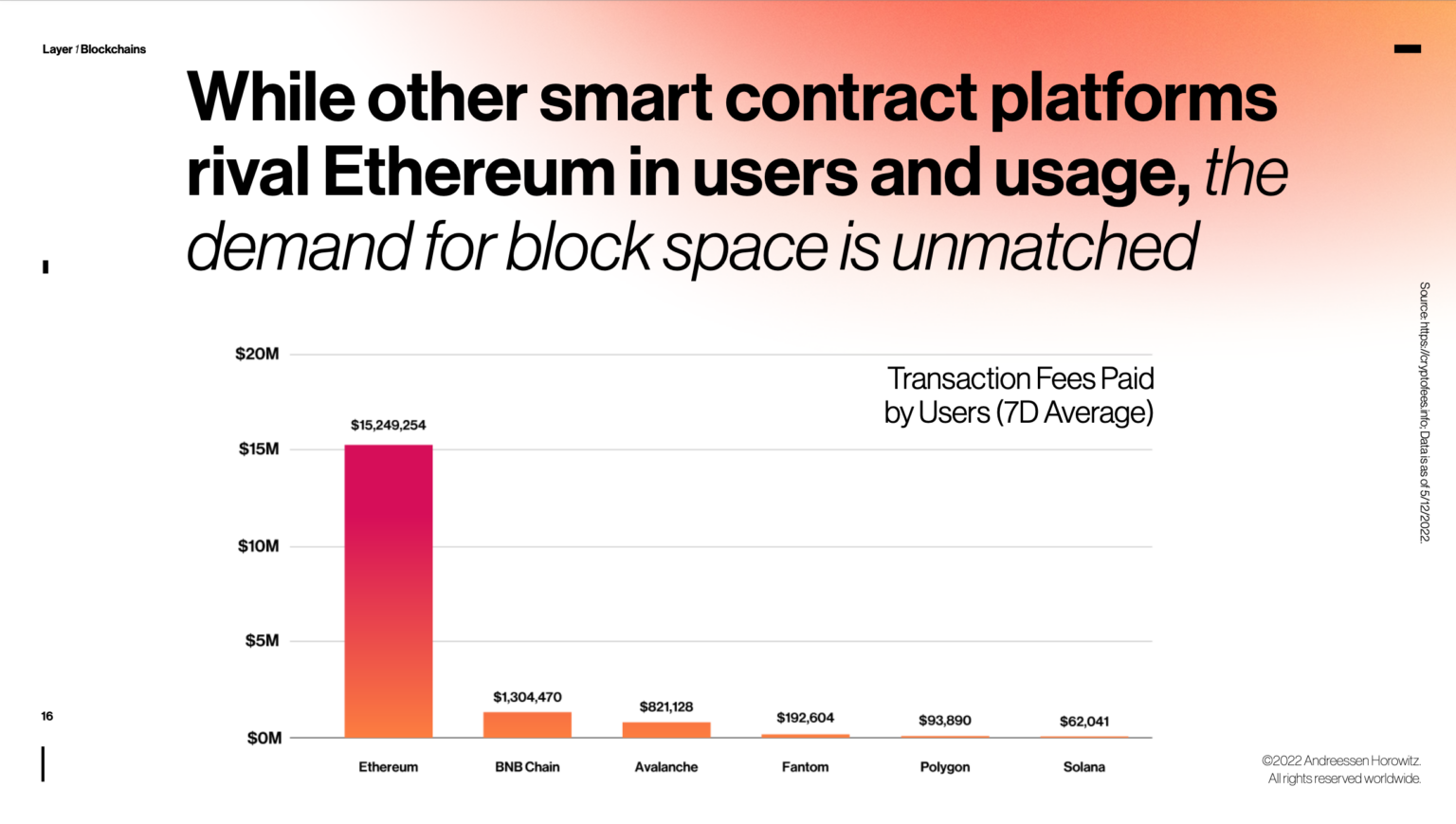

The demand for Ethereum can also be demonstrated as a result of the estimated transaction costs paid on the blockchain on the 7-day normal, beginning May twelve. Data displays that Ethereum accounted for $ 15.24 million producing enhanced demand, in contrast to BNB Chain, Avalanche, Fantom, Polygon and Solana with all-around $ two.five million in mixed costs.

Ethereum’s recognition is also a double-edged sword. Because Ethereum has historically been valued for decentralization versus downsizing. As a end result, other blockchains have been capable to “attack” this weakness of Ether and appeal to customers with guarantees of very good effectiveness and reduce fees.

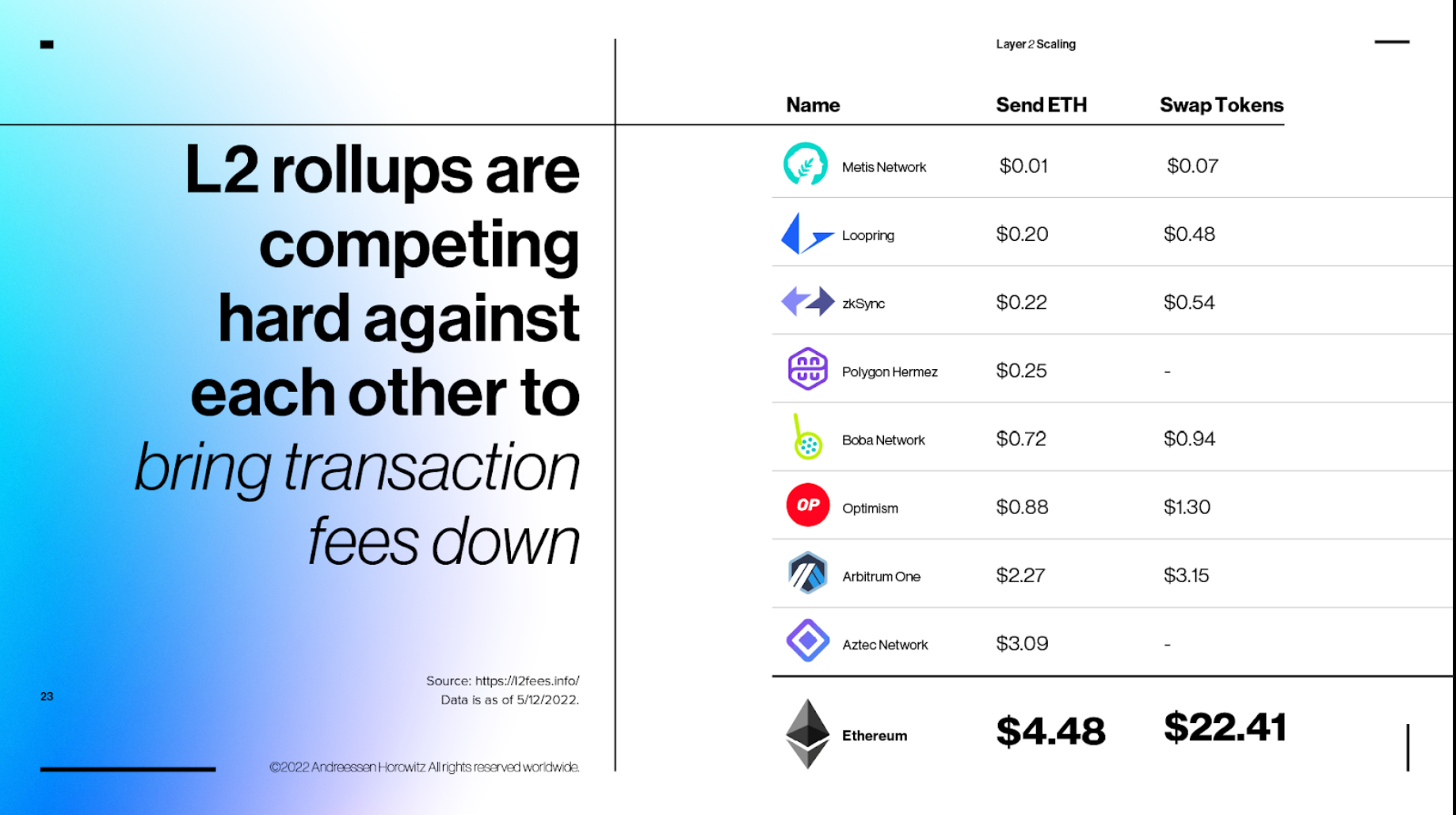

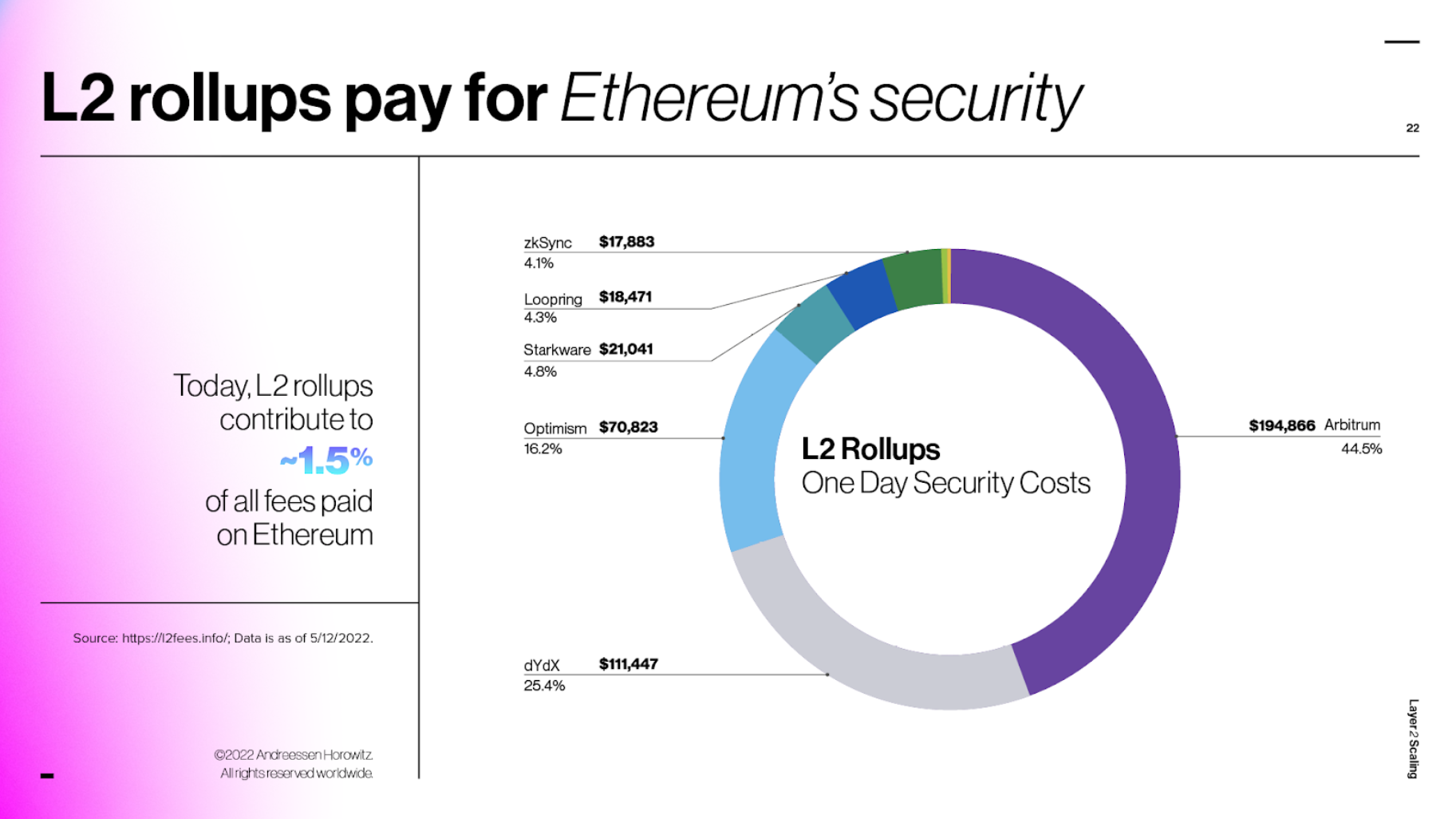

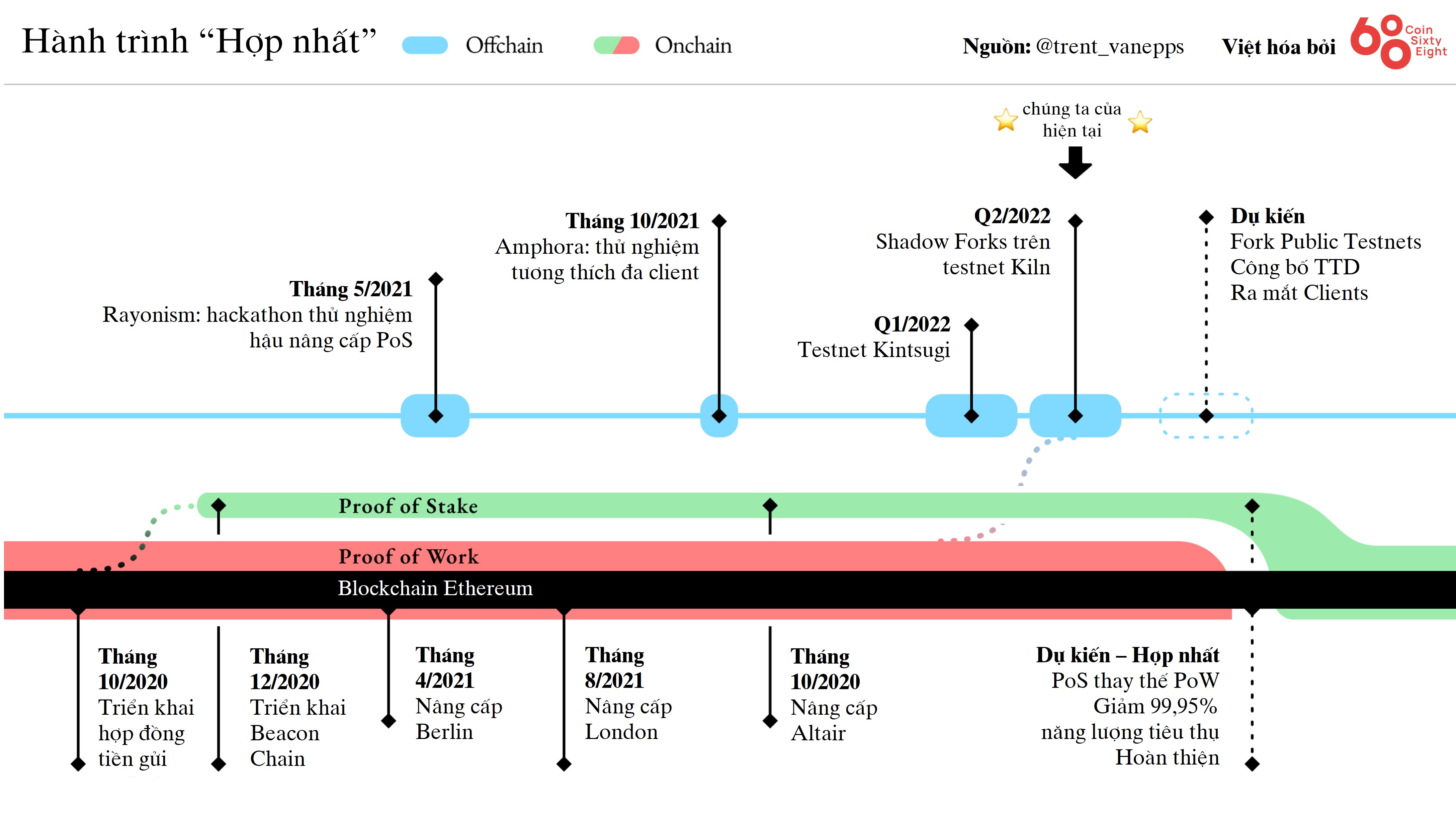

Therefore, Level two scalability answers have emerged with an extraordinary growth aimed at cutting down costs for Ethereum and rising the pace of transactions although waiting for the improve to switch to Proof. The prolonged-awaited -of-stake is coming to the platform to make the most effective network.

The help from Layer two is fairly significant taking into consideration that all through adoption so far, scaling answers have contributed approximately one.five% to the commission cost savings created on ETH.

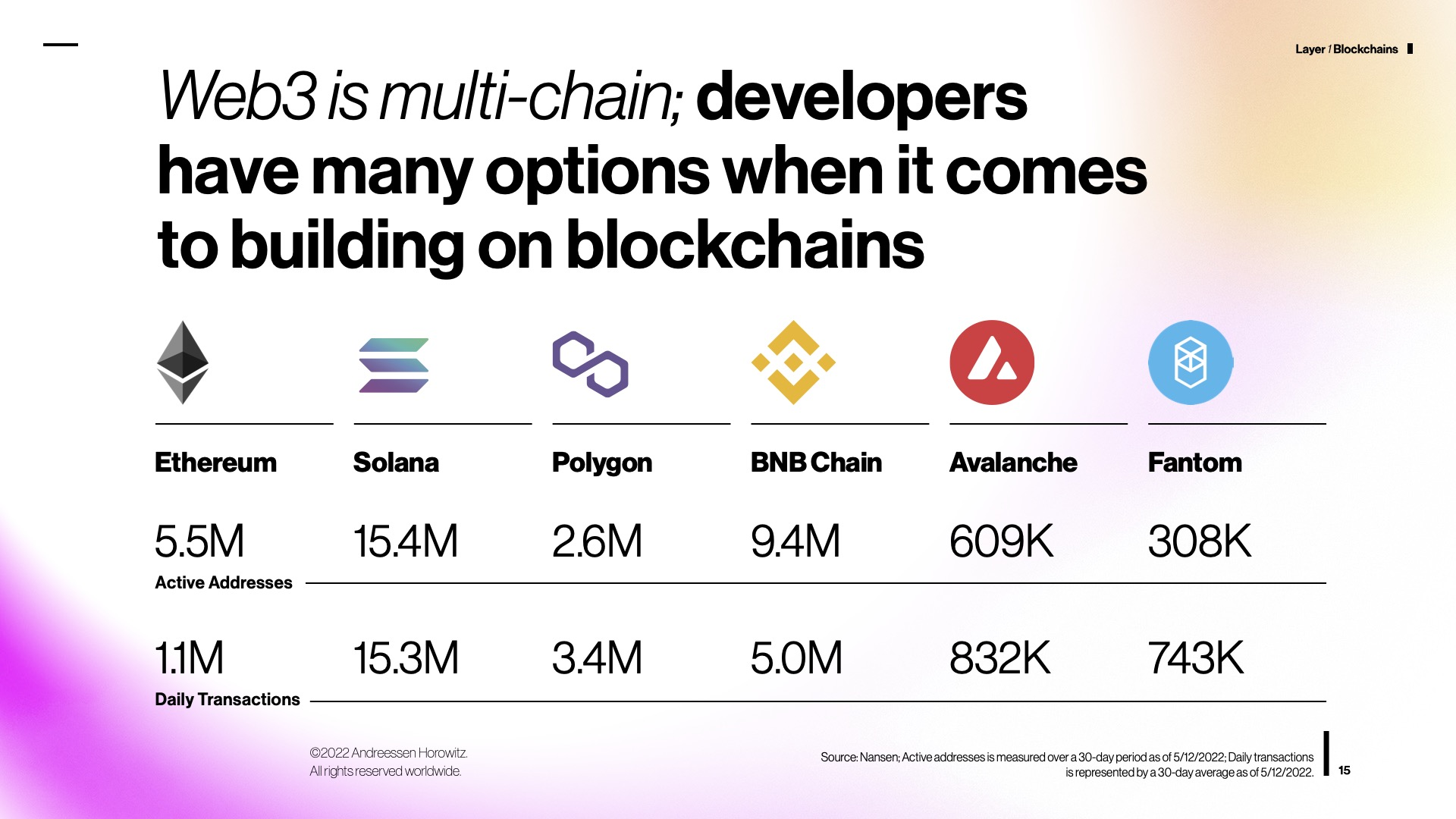

However, consolidation is unlikely to transpire anytime quickly, at least until finally the third quarter of this 12 months. This will generate an chance for competing blockchains, which include Solana, BNB Chain, and Polygon, to carry on to closely comply with Ether in terms of addresses and day-to-day transactions.

The information displays that Ethereum has five.five million energetic addresses representing one.one million day-to-day transactions, although Solana has a whopping 15.four million energetic addresses and 15.three million transactions. BNB Chain is in third area with 9.four million and five million, although Polygon has a complete of about two.six million and three.four million respectively.

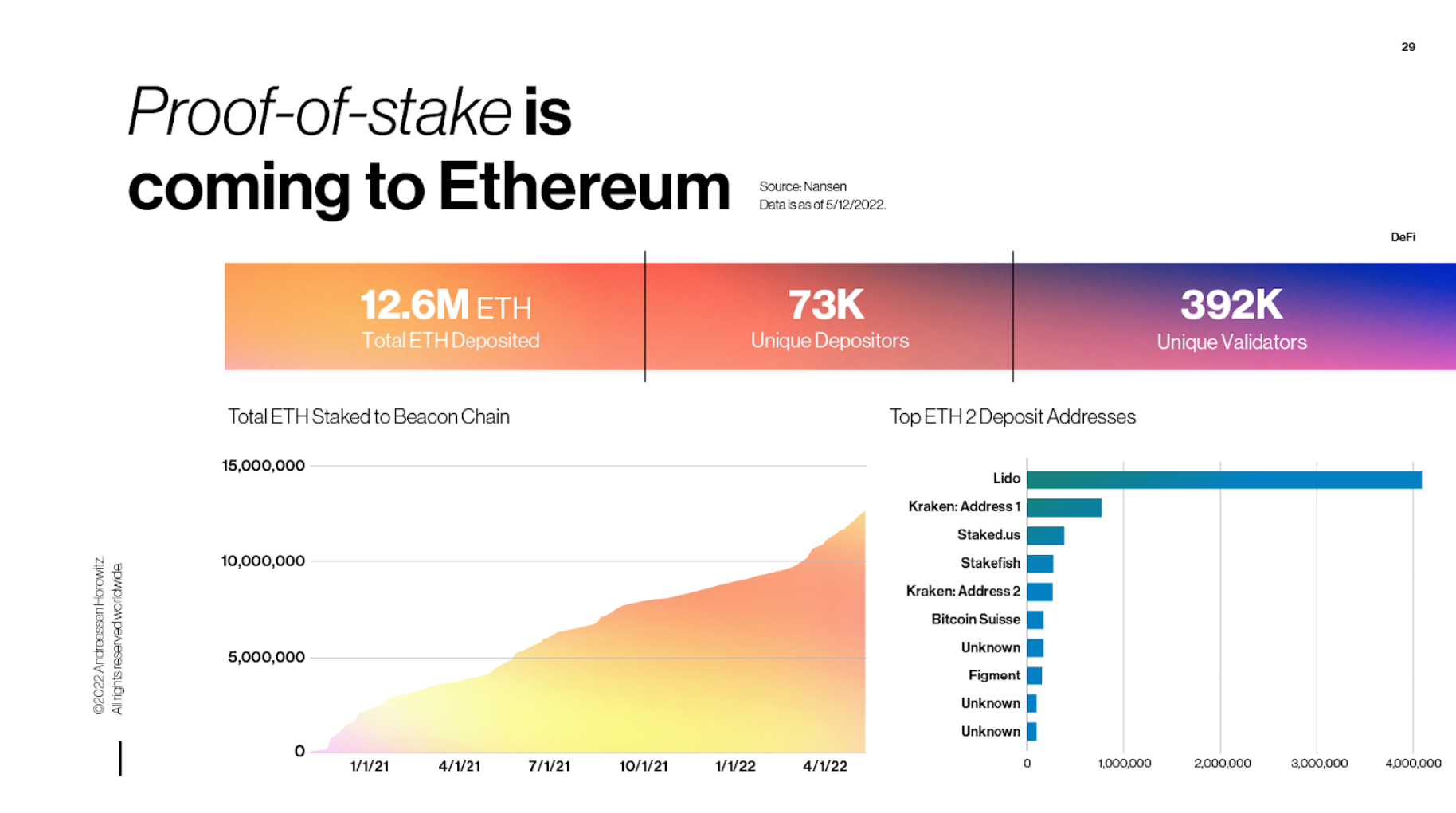

However, although dealing with some problems as talked about over, it is undeniable that Ethereum is even now obtaining solid self confidence in the long term of PoS from customers, not just traders, single cryptocurrency but also in terms of reception by numerous common institutions.

To greater fully grasp the overview of the penetration of huge common firms in Ethereum and how they “bet” on the long term of ETH, refer to the in depth posting beneath:

– See far more: Ethereum (ETH) – The place of “blockchain hegemony” is reflected in the degree of reception of huge firms

At the time of creating, more than ten% of the complete excellent provide of ETH is locked in the Ethereum two. contract, with the greatest percentage of ETH blocking coming from Lido Finance’s staking platform with more than thirty%. Thanks to this benefit, Lido has now overtaken Curve, getting to be the DeFi protocol with the greatest TVL.

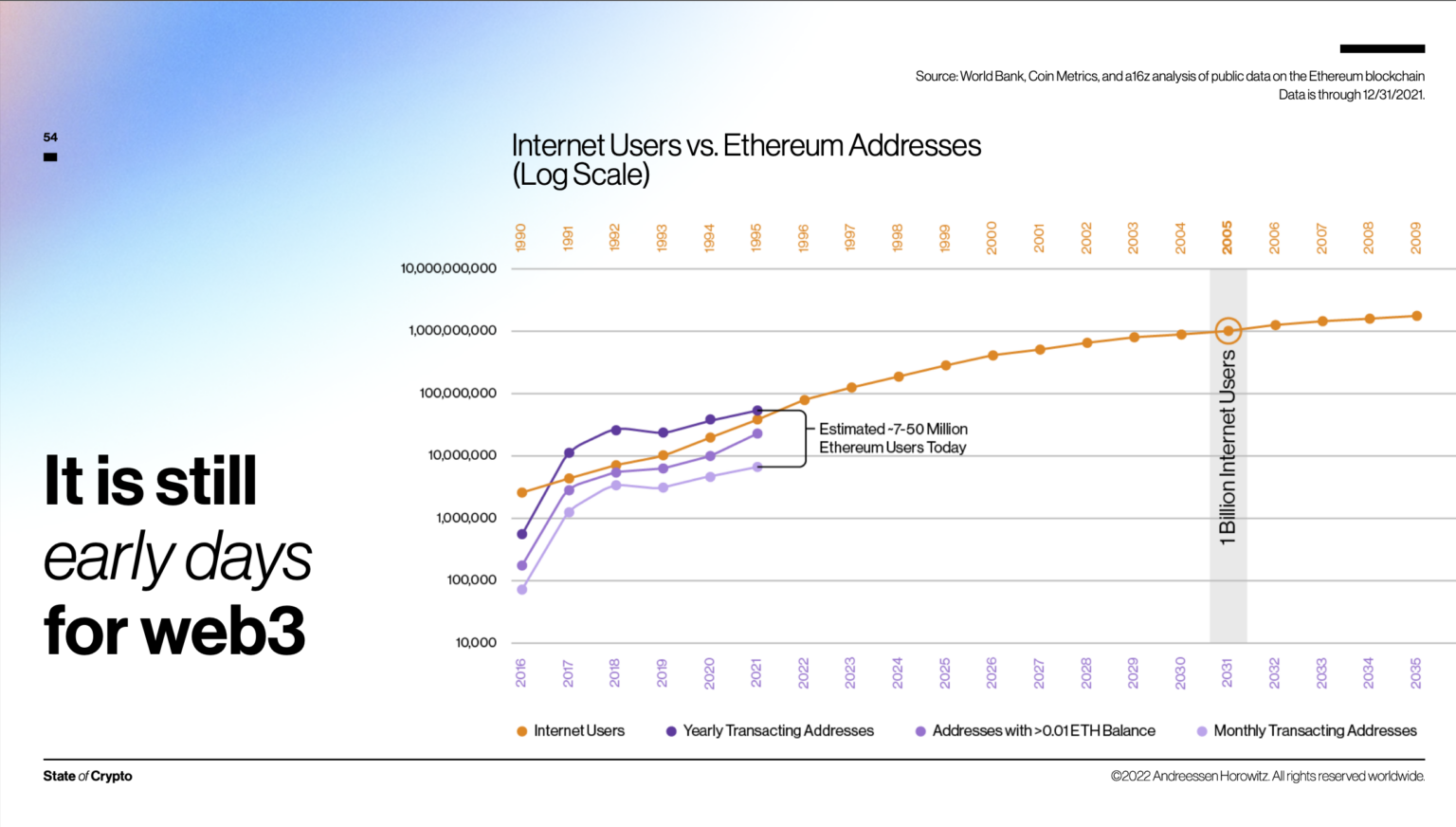

Furthermore, a16z estimates that there are amongst seven million and 50 million energetic customers of Ethereum now, primarily based on numerous on-chain metrics, the context is comparable to the evolution of the Internet all-around 1995. For comparison, the Internet has reached one billion customers in 2005. Incidentally, this is also the time when Web2 started forming its prosperity cycle.

Combined with crucial components from other locations which include DeFi’s complete locked-down worth (TVL) grew to $ 113 in just two many years or NFT created $ three.9 billion in income. So far, it is probable that Web3 could attain the exact same threshold of one billion net customers inside of the up coming ten many years. And unquestionably, to sustain the “unique” marketplace share in these two locations, Ethereum will have a great deal of operate to do on the up coming journey.

Synthetic currency 68

Maybe you are interested: