Bitcoin mining problems has constantly been a robust indicator of BTC demand and is often utilised as a single of the methods to ascertain recent industry problems. And probably the most recent Bitcoin crash earlier in the week has some thing to do with this information.

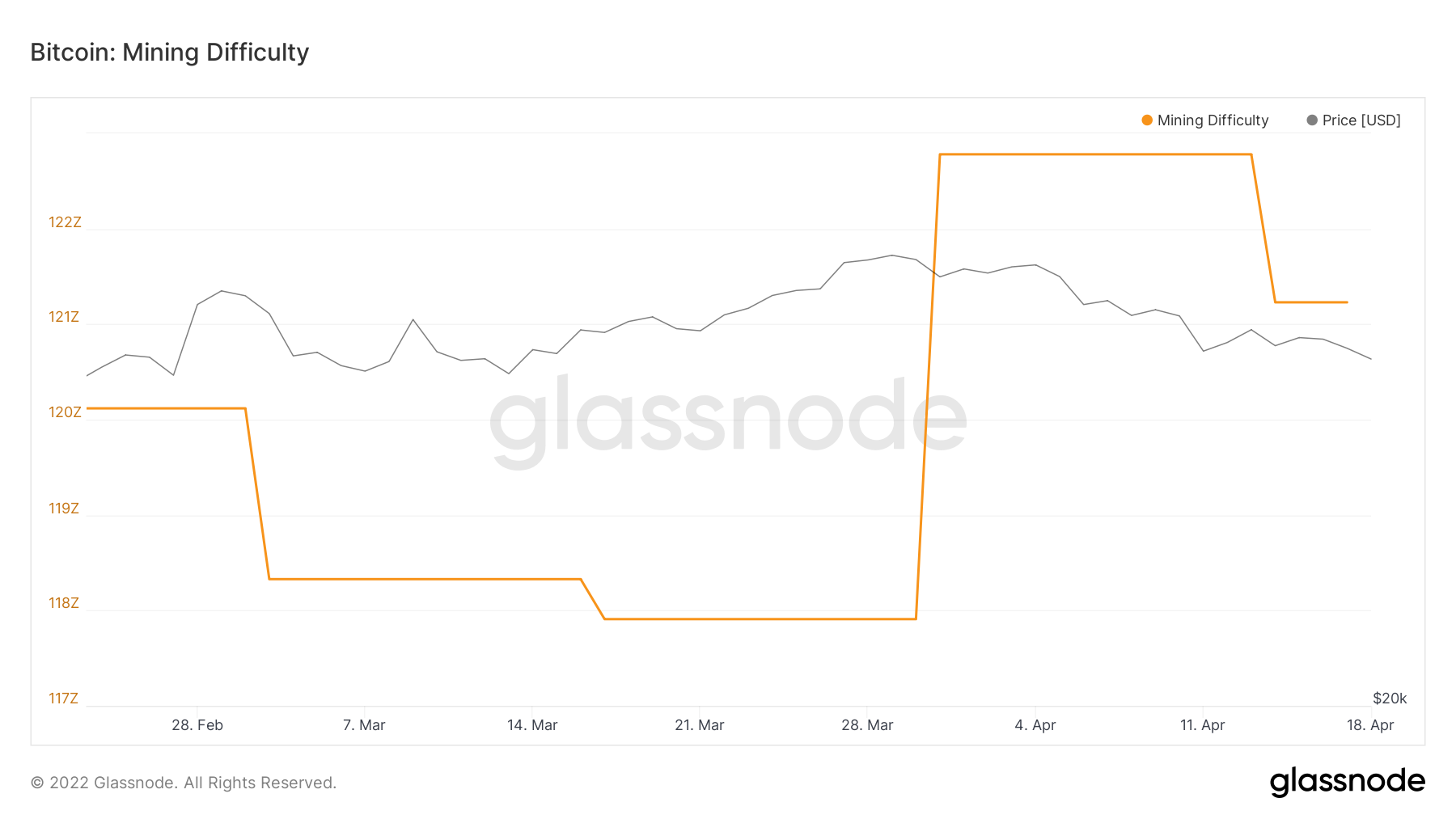

According to the most recent information from blockchain analytics platform Glassnode, Bitcoin’s mining problems has so far misplaced additional than one.26% right after rising by all-around four.13% at the finish of March this yr.

Bitcoin’s hashrate suffered very similar consequences, dropping to 202 EH / s from its all-time higher set on February 14 at 248.eleven EH / s.

So what effect do these two indicators have on Bitcoin? Basically, hashrate is a metric that correlates with the computing electrical power expected by a miner’s mining products to verify a transaction. Meanwhile, Bitcoin’s mining problems is instantly adjusted primarily based on the hashrate, to retain the time it requires to mine a just about frequent block at ten minutes. The larger the hashrate, the better the problems and vice versa. This is also generally noticed as a single of the critical drivers of Bitcoin’s extended-phrase trend consolidation.

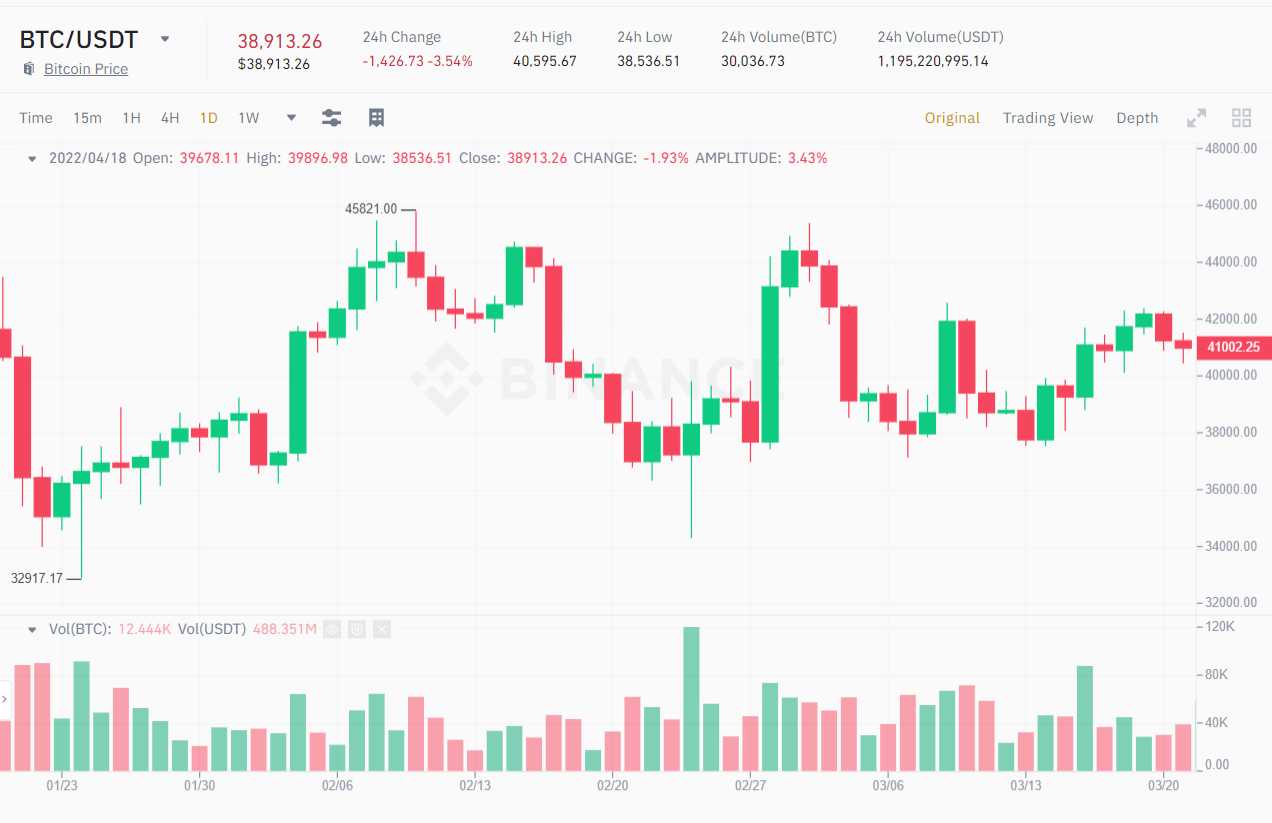

Going back to the final couple of months, we can effortlessly see coincidences in Bitcoin’s value corrections which have a pretty shut partnership with the over information. The very first time was on March three, 2022, BTC’s mining problems dropped by one.five%, followed by a drop shortly thereafter from $ 45,000 to all-around $ 38,000 well worth of Bitcoin.

Then on March 18, 2022 the problems continued to lessen for the 2nd time with .35%, the consequence of which was that Bitcoin downloaded $ two,000 in a single day.

Therefore, the crash that occurred earlier this week when BTC broke to the one-month lower at $ 39,200 is also comparatively understandable, in particular looking at the robust promote-off from miners proper now. , has overwhelmed any institutional momentum, pushing their weekly inflows to their worst retracement degree considering the fact that early 2022.

At press time, BTC is trading all-around $ 38,912.

Additionally, in a connected growth, Kazakhstan is taking ways to increase taxes on cryptocurrency mining organizations in the nation. According to a statement by the Minister of National Economy Alibek Kuantyrov, the scheme strategies to charge charges primarily based on the industry worth of the mined cryptocurrencies.

The government official mentioned that implementing this kind of a approach would raise price range revenues. In addition, miners working in Kazakhstan are also paying out additional for the sum of electrical energy consumed. The tariffs have been raised at a fee of one Kazakh tenge (around $ .0022) per kilowatt-hour of electrical energy utilised.

These are the most recent obstacles from Kazakhstan considering the fact that the starting of the yr. Riots and protests have induced the frequent disruption of a lot of miners in this nation due to world wide web connections and lack of electrical energy to present BTC mining. The vitality shortage has forced some firms to depart the nation and move to other places this kind of as the United States. Last month, additional than one hundred mining fields have been closed across Kazakhstan.

However, this occasion could critically threaten the mining marketplace as it is probable to encounter an additional wave of migration following the collapse in China final yr. In certain, Kazakhstan is the nation with the third greatest share of hashrate in the globe (18%), just behind Russia (eleven.two%) and the United States (35.four%).

Overall, in contrast to the yr-more than-yr graphs of hashrate and mining problems, there is certainly even now a regular raise in the two indicators, exhibiting that the demand for Bitcoin stays higher regardless of problems. in accordance to historical cycles. However, looking at the recent image, when Bitcoin constantly depreciates with hashrate and reversal issues, it will build rising marketing stress, which could push Bitcoin deeper in the quick phrase.

Synthetic currency 68

Maybe you are interested: