Worldcoin (WLD) last week recorded a significant increase, up 50% and attracted great attention from investors.

However, after hitting an important resistance level, WLD stalled and fell 11% in just the past 24 hours.

This resistance has been a major challenge over the past three months, marking a possible market top for this altcoin.

Worldcoin Is Facing Challenges

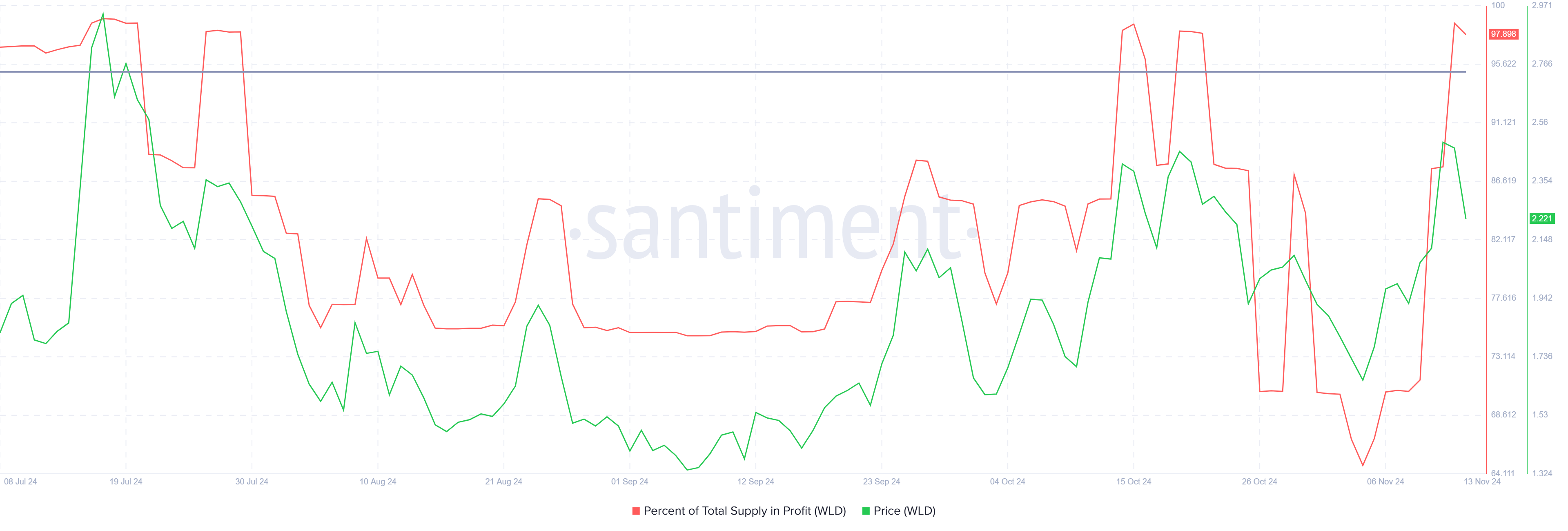

Currently, 97% of Worldcoin supply is profitable, which is often a sign of a market top. When more than 95% of a cryptocurrency’s supply becomes profitable, historical trends show that growth typically stops, increasing the likelihood of a price reversal.

For Worldcoin, this high level of returns hints at a pullback as investors look to take profits.

History shows that when such a high profit point is reached, it is often followed by a correction period, when investors tend to sell.

With WLD, the current yield supply is consistent with the market top pattern seen in previous altcoin cycles. Selling pressure is high on Worldcoin, the possibility of a short-term decline is increasing.

Analyzing the macro dynamics of Worldcoin, the distribution of active addresses according to profitability strengthens the thesis of a market top.

Notably, more than 25% of active addresses holding WLD are in profit, which is a concern. When the percentage of profitable addresses exceeds 25%, investors tend to sell, which has historically put downward pressure on asset prices.

This high yield density adds to the pessimism for WLD, as the altcoin has faced heightened selling activity.

The combination of widespread profitability and a large percentage of profitable participating addresses could continue to challenge Worldcoin’s recent uptrend, making price increases more difficult without a period of accumulation.

WLD Price Forecast: Overcoming the Barriers

Over the past 24 hours, Worldcoin price is down 11% as the altcoin failed to overcome resistance at $2.48 for the third time in three months.

Currently trading at $2.21, WLD appears to be having difficulty sustaining its recent gains due to selling pressure and resistance from higher levels.

If this decline continues, Worldcoin could find support at $2.11, providing a chance for a reversal.

However, if the downtrend persists, the next support levels at $2.00 and $1.74 could emerge, marking the possibility of a deeper decline for the altcoin.

Conversely, a rally from $2.11 would neutralize the negative outlook, allowing Worldcoin to attempt to overcome the $2.48 resistance.

Successfully surpassing this level will signal a new growth trend, which could lead WLD to further increases.