The persistently demanding landscape of the existing cryptocurrency market place continues to clash with crypto payments companies Wyre and EmpireDAO.

Wyre lays off workers, downsizing

After virtually a decade of founding, crypto payments enterprise Wyre is on the verge of shutting down, a former worker shared Axios.

Wyre, a cryptocurrency payments enterprise founded in 2013, has advised workers it is shutting down due to layoffs, Axios has discovered. https://t.co/oMl37yTP2u

— Axios (@assios) January 3, 2023

The basic economic downturn coupled with the collapse of various crypto institutions has produced several corporations unviable. According to Axios, Wyre is laying off workers with no incurring any severance spend.

CEO Ioannis Giannaros announced by way of e mail that the enterprise will liquidate and finish companies in January 2023. However, the CEO confirmed to the media that they are nevertheless working, only getting ready to downsize.

Before, Bolt announced the acquisition of Wyre for $one.five billionbut the deal was canceled in September. Wyre has raised $29 million from 9 funding rounds and has attracted the consideration of several significant names this kind of as Samsung Next Ventures, Pantera Capital and Stellar Development Foundation, Crunchy base information.

EmpireDAO cancels workplace rental

The public also located info about the lease termination of Empire DAO’s workplace at 190 Bowery, New York, right after much less than a 12 months of housewarming, raising worries about the failure of this ecosystem.

Founder Mike Fraietta started leasing the constructing in March 2021 and developed an open “WeWork of Web3” workspace. Since then, EmpireDAO has attracted one,500 members and 300 workplace guests each day, in accordance to CoinDesk.

Last month, Fraietta attempted to increase far more dollars from the mob to conserve the day, aiming to increase 205 ETH (virtually USD 250,000). But efforts in the long run failed, the venture only acquiring curiosity from 27 donations, totaling six.71 ETH ($eight,150 USD). This capital will be returned to the investor straight away.

Currently, the founder of the venture is making an attempt to move EmpireDAO to yet another spot for the revival system and come back with DAO portion two. All will be uncovered at approaching cryptocurrency conferences.

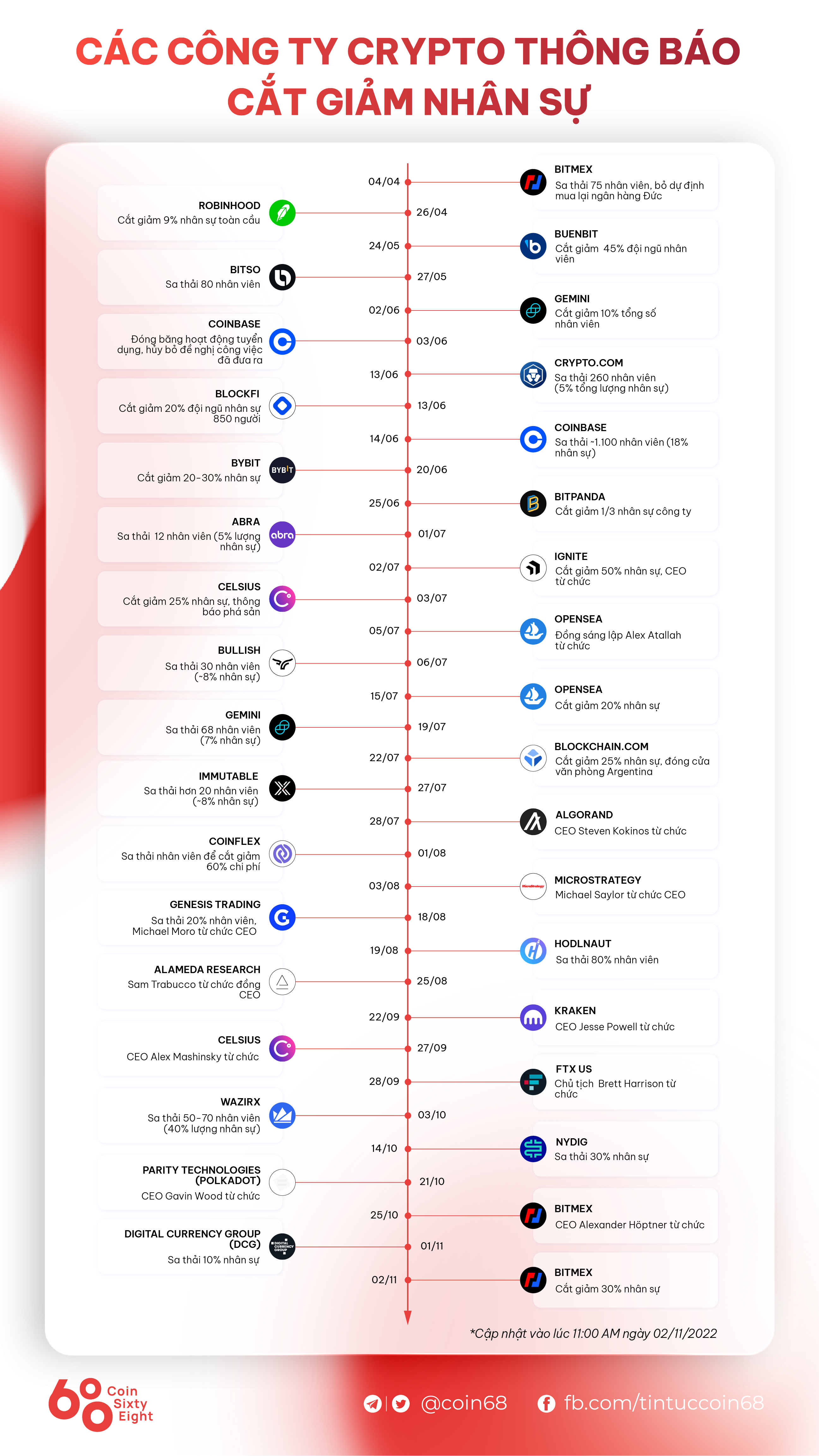

Alongside Wyre and EmpireDAO on the checklist of value cutting and corporate restructuring are Kraken, ByBit, GameStop, Amber Group, Paradigm…

Synthetic currency68

Maybe you are interested: