XLD Finance venture overview

What is XLD Finance?

Established in June 2021, XLD Finance is a decentralized ecosystem that supplies answers for fiscal platforms. The venture builds an infrastructure for Webthree and cryptocurrency tasks to website link them to common finance. Specifically, XLD Finance will create an infrastructure to encourage fiscal growth in markets this kind of as Web three., cryptocurrencies and gaming to make income.

XLD Finance just lately raised a big quantity of funds ($ 13 million) in a Series A funding round led by primary VCs Dragonfly Capital and Infinity Ventures Crypto. With this income, XLD Finance intends to broaden its growth and solution personnel to accelerate solution growth and application programming interfaces (APIs) even though expanding the networks, licensed spouse fiscal institution network and network at the similar time. of consumers.

Special capabilities of XLD Finance

XLD Finance whose aim is to modernize the provision and growth of fiscal providers infrastructure to make it easy and reputable for all consumers to use fiscal instruments constructed on decentralized technologies.

XLD Finance’s core goods involve payments, crypto-based mostly disbursements, and crypto-to-fiat offframp APIs that allow web3 and crypto tasks to deliver resources for their consumers of metrics regarded only to common fiscal institutions.

With a expanding network of merchants, XLD Finance now serves clientele in the Philippines, Indonesia, Malaysia, Vietnam, India and Bangladesh. XLD Finance launched the initially function in its ecosystem, xSpend, in January 2022, enabling consumers to use GameFi their tokens and stablecoins to shell out expenses, acquire products and providers working with only Metamask, Phantom or Ronin wallets.

In the close to potential, XLD Finance will launch OmniX, a digital currency delivery platform that simplifies the delivery of digital income, enabling organizations and tasks to shell out 1000’s of individuals with the digital currency quantity in three clicks. The XLD Finance roadmap contains a merchant payment API, an algorithmic stablecoin and a Webthree Software Development Kit (SDK) wallet.

Features of XLD Finance

Financial hub – Financial hub

XLD Finance connects and empowers folks and organizations with blockchain-based mostly, “bank-like” goods and APIs devoid of the complexities of common fiscal designs.

Global – Global growth

Through API integration, XLD Finance has reached some elements of the Southeast Asian industry and many others.

Developer-initially: priority for developers

The XLD Finance API simplifies complicated processes in just a handful of lines of code, enabling providers to be up and working in hrs.

Multi-chain – Multichain

XLD Finance is compatible with each EVM and non-EVM blockchains, i.e. ERC, BSC, Polygon and Solana, with far more chains on the way.

Basic facts about the XLD token

XLD Token Specifications

- Ticker: XLD.

- Blockchain: Ethereum.

- To contract: Updating

- Standard Token: ERC-twenty.

- Token form: Utility, government.

- Circulating provide: Updating

- Total provide: one,000,000,000 XLD.

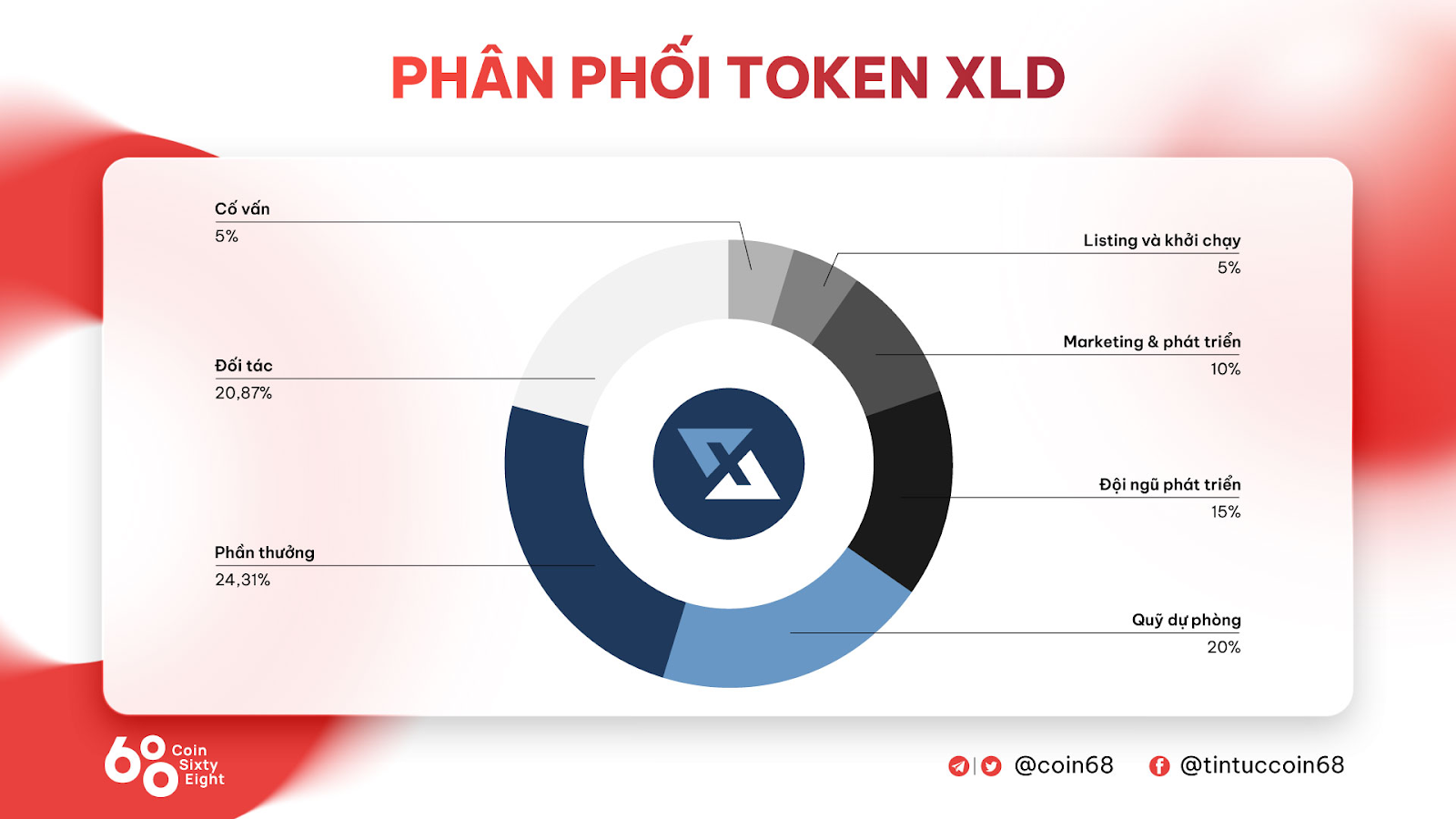

Allocation of the XLD token

- Counselor: five%.

- Quotation and launch: five%.

- Marketing and growth: ten%.

- Development group: 15%.

- Reserve fund: twenty%.

- Reward: 24.31%.

- Partners: twenty.87%.

Uses of the XLD token

Updating ….

XLD Token Unlock Program

Updating …

Where to invest in, promote and shop XLD tokens tokens

Currently, the XLD tokens have not however been offered, Coinlive will update the facts as quickly as achievable following the official facts gets to be out there.

Project growth roadmap

Updating …

XLD Finance growth group

Updating …

Investors and growth partners of the XLD Finance venture

This funding round noticed the participation of Advance AI, Circle, Digital Currency Group (DCG), IDG Capital, Insignia Venture Partners, Integra Partners, Morningstar Ventures, Openspace Ventures, Sfermion, Shima Capital, Transcend Fund, Believe inToken (TUSD), UOB Venture Management, FBG Capital, Kronos, Yield Guild Games (YGG), YOLO Ventures, Emfarsis and twenty other traders.

Predicting the potential growth of XLD Finance, should really it invest in XLD tokens or not?

The XLD Finance venture has just effectively finished a Series A funding round and now only 1 solution, Xspend, has been finished. XLD Finance has not however issued and offered XLD tokens on any stock exchanges, so investing in tokens should really be meticulously regarded as.

Through this short article, you have by some means grasped the primary facts about the venture to make your investment selections. Coinlive is not accountable for any of your investment selections. I want you achievement and earn a good deal from this probable industry.