Stellar (XLM) price has dropped more than 10% in the past 24 hours, but still maintains a 94.07% increase over the past week, standing out among the top 100 Cryptocurrencies. Indicators such as RSI and Ichimoku Cloud show that bullish momentum is weakening as XLM faces increased selling pressure.

If the downtrend continues, XLM could test the critical support at $0.099. However, if it recovers, it could target $0.638 and potentially reach $0.70.

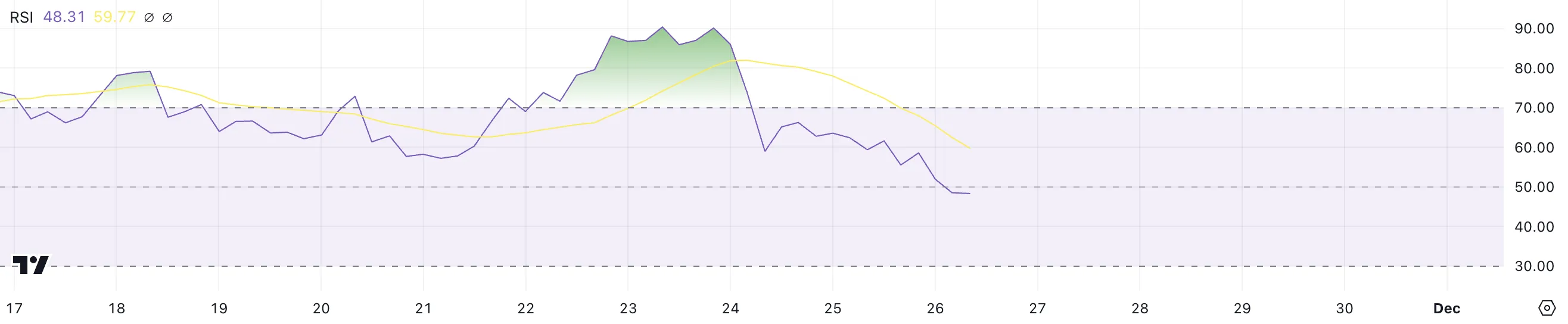

XLM’s RSI Slides Towards Neutral Zone

Stellar’s RSI is currently at 48.31, down from over 70 when XLM reached $0.60, its highest price in the past three years. RSI, or Relative Strength Index, measures momentum using a scale from 0 to 100, with values above 70 indicating overbought conditions and below 30 indicating oversold conditions.

The drop in RSI reflects a decline in bullish momentum as XLM faces a correction.

With an RSI level of 48.31, XLM is in the neutral zone, neither overbought nor oversold. This suggests that Stellar price may continue to decline before a new rally begins.

However, if RSI stabilizes or increases, XLM could recover momentum and reestablish a bullish trend.

Stellar’s Ichimoku Cloud Shows a Bearish Trend Emerging

Stellar’s Ichimoku Cloud chart is showing that bearish momentum prevails as the price has dropped below Kijun-Sen (orange line) and Tenkan-Sen (blue line).

This shows that bullish sentiment is weakening, with the price close to the edge of the cloud (Senkou Span A and B), which is currently providing short-term support. If the price continues to fall into or below the cloud, it could confirm a bearish trend reversal.

The cloud itself currently maintains a bullish structure as the Senkou Span A is rising, but its thinness signals a weakening of the support ahead.

If XLM fails to reclaim levels above Tenkan-Sen and Kijun-Sen, selling pressure could strengthen further. However, if the price recovers and breaks above the cloud, this could signal a continuation of the recent bullish trend.

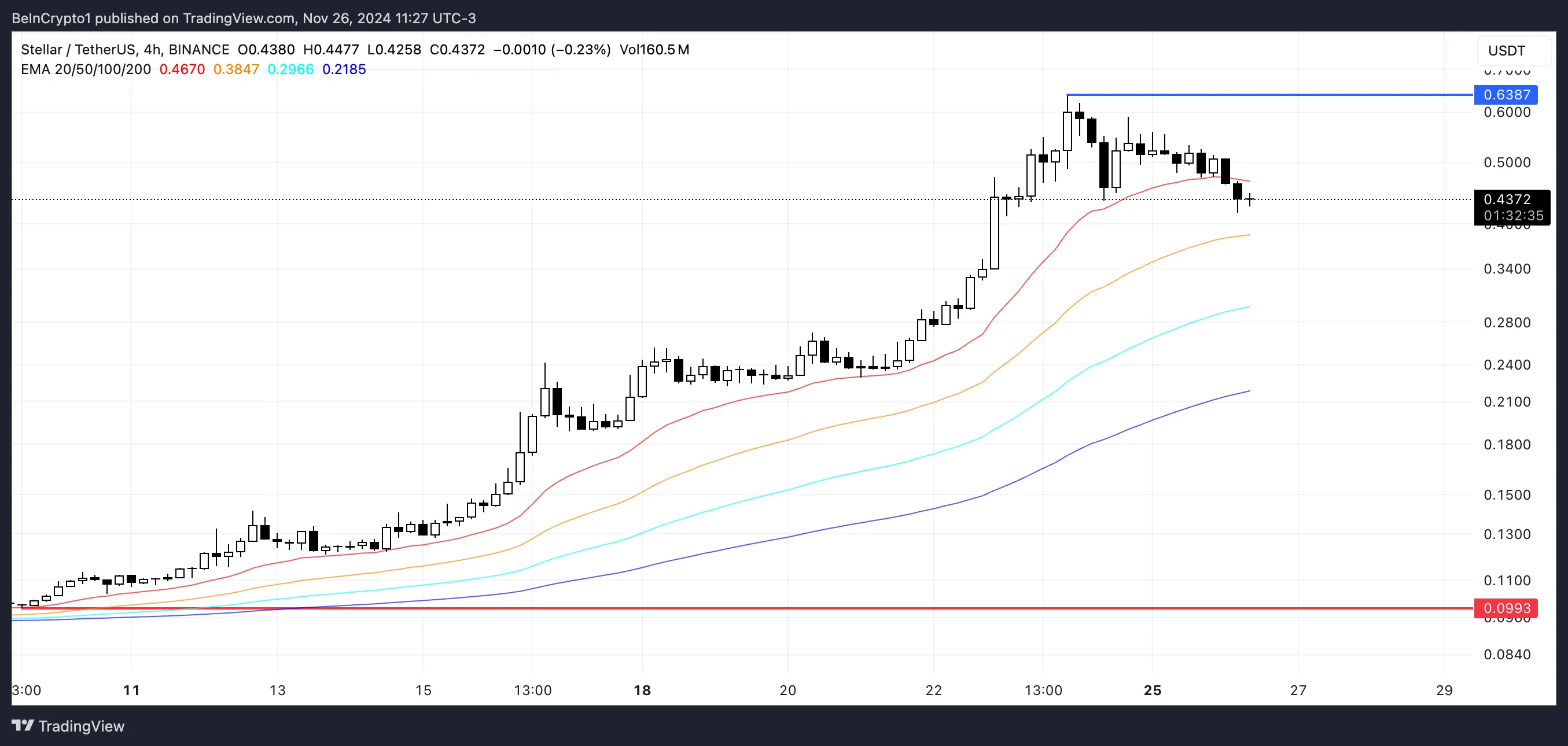

XLM Price Forecast: Sharp Correction If Buying Pressure Does Not Return

Stellar’s EMAs remain bullish, with the short-term lines above the long-term ones, indicating an overall bullish trend. However, the narrowing gap between these lines suggests the upward momentum is weakening and there may be a change in sentiment.

This suggests that the current downtrend could increase if XLM buying pressure does not return soon.

If the downtrend strengthens, XLM price could fall as deep as the strong support at $0.099, representing a correction as large as 76%.

Conversely, if Stellar price regains its recent upward momentum, it could retest resistance near $0.638. A break above this level could push XLM up to $0.70, giving it a potential 62% advantage from current levels.