XRP price has increased 14% over the past seven days but is currently in a correction phase, trading steadily between $2.34 and $2.46 over the past six days. The period of fluctuation in this range reflects the market’s balance, with no one party in control between buyers and sellers.

The number of XRP whales holding between 10 million and 100 million XRP coins has also stabilized since late December, further reinforcing neutral market conditions. However, if the growth momentum strengthens, XRP could break out and aim for the next key resistance levels such as $2.72 and $2.90.

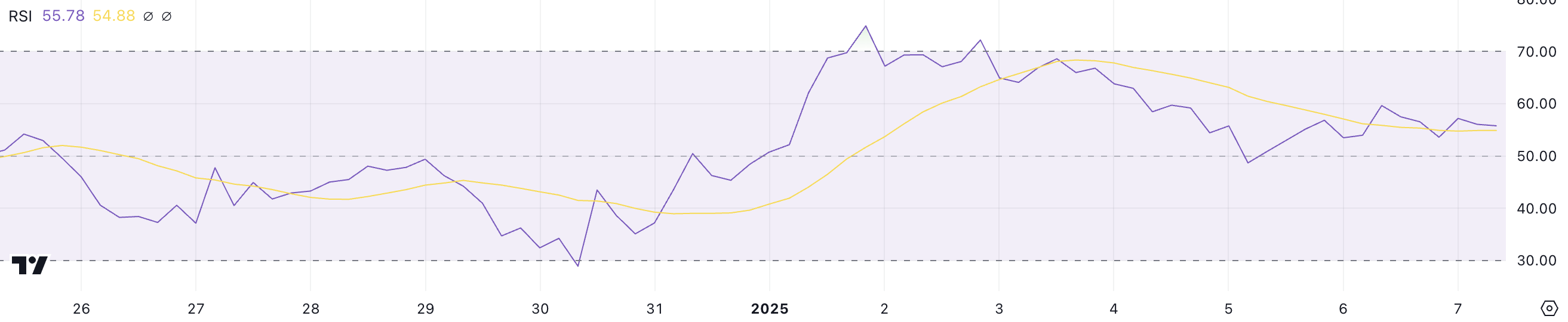

XRP’s RSI is currently Neutral

XRP’s Relative Strength Index (RSI) is currently at 55.7, indicating a period of moderate market momentum. RSI is a technical indicator that measures the speed and strength of price movements on a scale of 0 to 100, helping traders identify whether an asset is overbought or oversold.

Values above 70 typically indicate overbought conditions and a possible price correction, while values below 30 indicate oversold conditions and a possible price recovery. XRP’s RSI, which has been in the neutral zone since January 3, shows that the pressure between buyers and sellers is balanced.

At current levels, XRP’s RSI shows a weak correction, with no clear side dominating the market.

For growth momentum to return, RSI needs to move closer to the overbought zone, reflecting stronger buying activity. Conversely, if RSI begins to decline, this could be a signal of weakening sentiment and the possibility of a small correction.

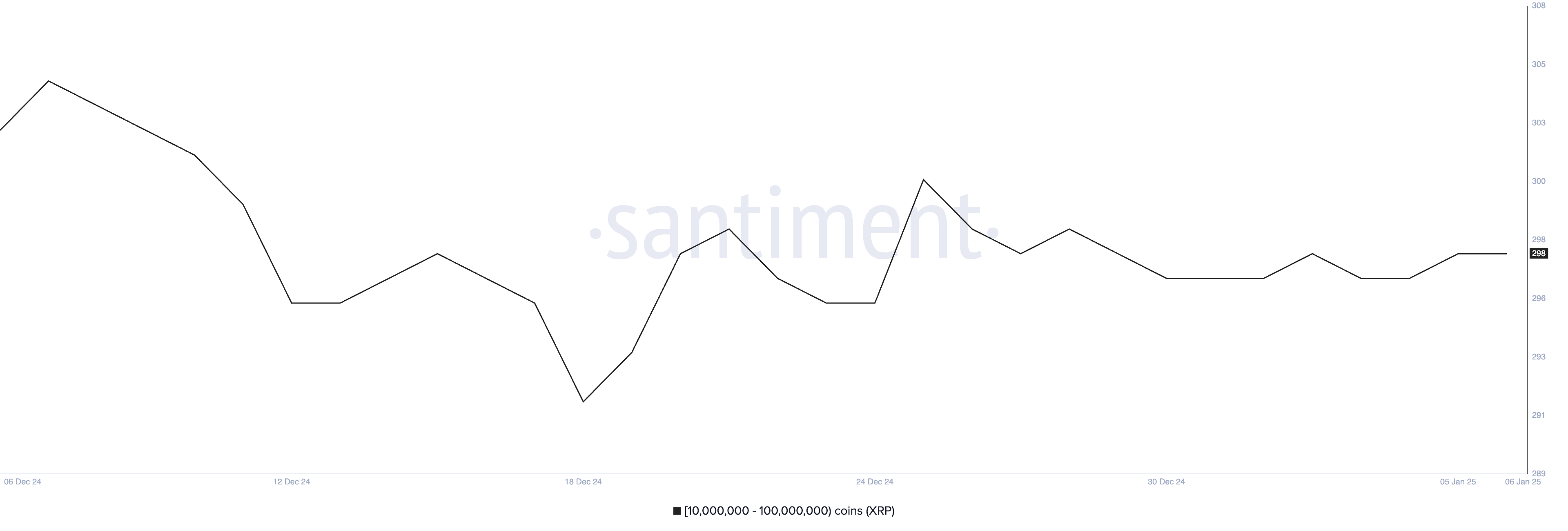

XRP Whales Stable Since Late December 2024

The number of XRP whales holding between 10 million and 100 million XRP coins has fluctuated significantly recently. After reaching a monthly high of 305 on December 7, the number plummeted to a monthly low of 292 on December 18.

Since then, the population has recovered slightly and has remained steady at around 298, stable since December 27. Monitoring whale activity is important as these large Holders can significantly impact the whales. market trends through their buying or selling decisions.

The stability in whale numbers over the past two weeks indicates a market correction phase. This may show that large investors are not completely active in accumulating or discharging goods, reflecting a neutral sentiment.

For XRP price, this stability may equate to limited volatility in the short term, as the absence of large-scale moves from whales helps maintain price stability. However, an increase or decrease in whale activity could signal the start of a new trend.

XRP Price Prediction: Will It Increase 20%?

XRP price has been correcting over the past six days, trading in a narrow range between resistance at $2.53 and support at $2.33. This price behavior reflects a lack of clear momentum, the market is waiting for a decisive move.

If support at $2.33 is tested and fails, XRP could face further decline, with $2.13 and $1.96 seen as the next key targets.

The EMA for XRP shows uncertainty, with no clear signal on the current direction. However, if momentum returns, XRP price could retest the resistance at $2.53.

A successful breakout above this level could trigger further growth, targeting $2.72 and possibly even $2.90, representing 20.3% growth potential. The final result will depend on whether the buyers or sellers control the market in the coming days.