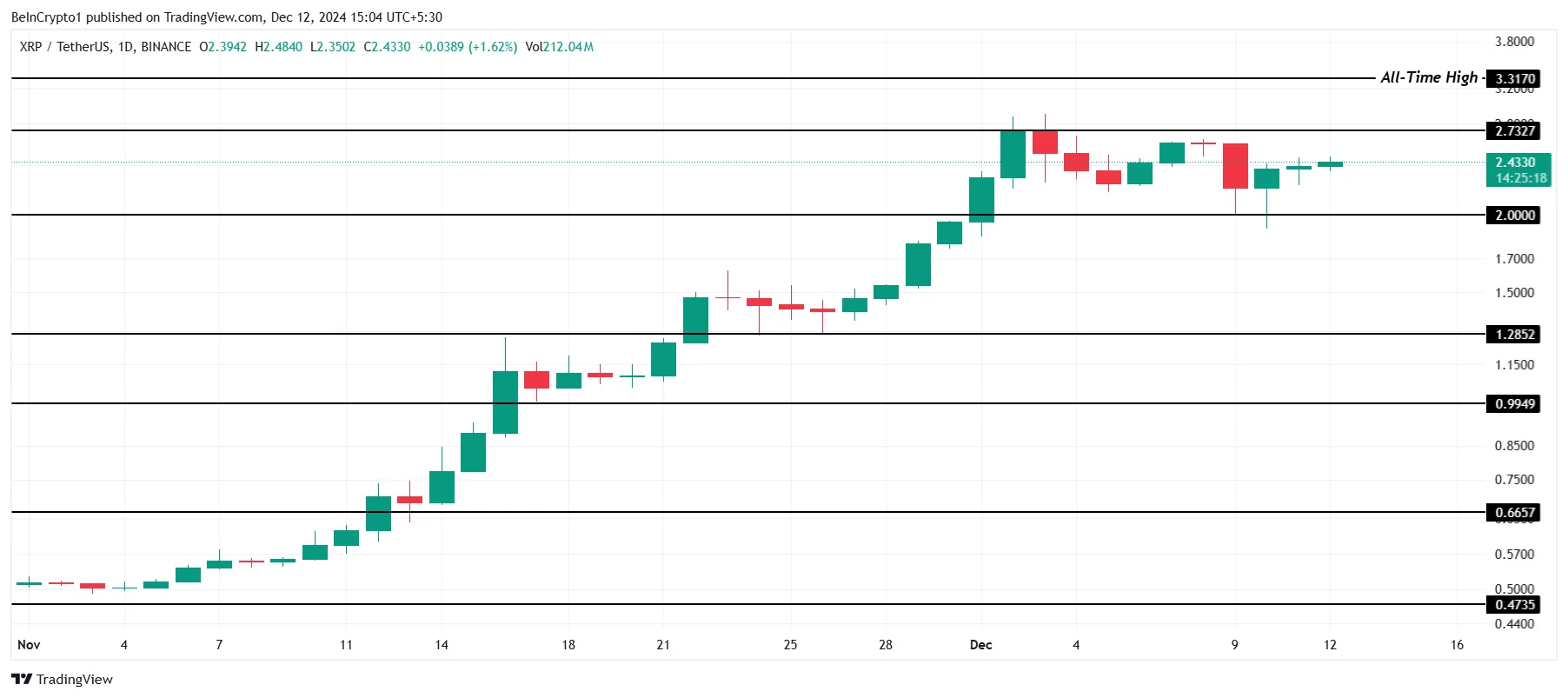

XRP’s price has been under pressure over the past few weeks as it struggled to overcome key resistance at $2.73. Investors had hoped that a breakout through this level would push the altcoin to a new all-time high (ATH), but the delay has led to increased profit-taking.

This hesitation and the subsequent sell-off have eroded investor confidence, as many choose to secure profits at current prices rather than wait for further price increases.

XRP Investors Are Pessimistic

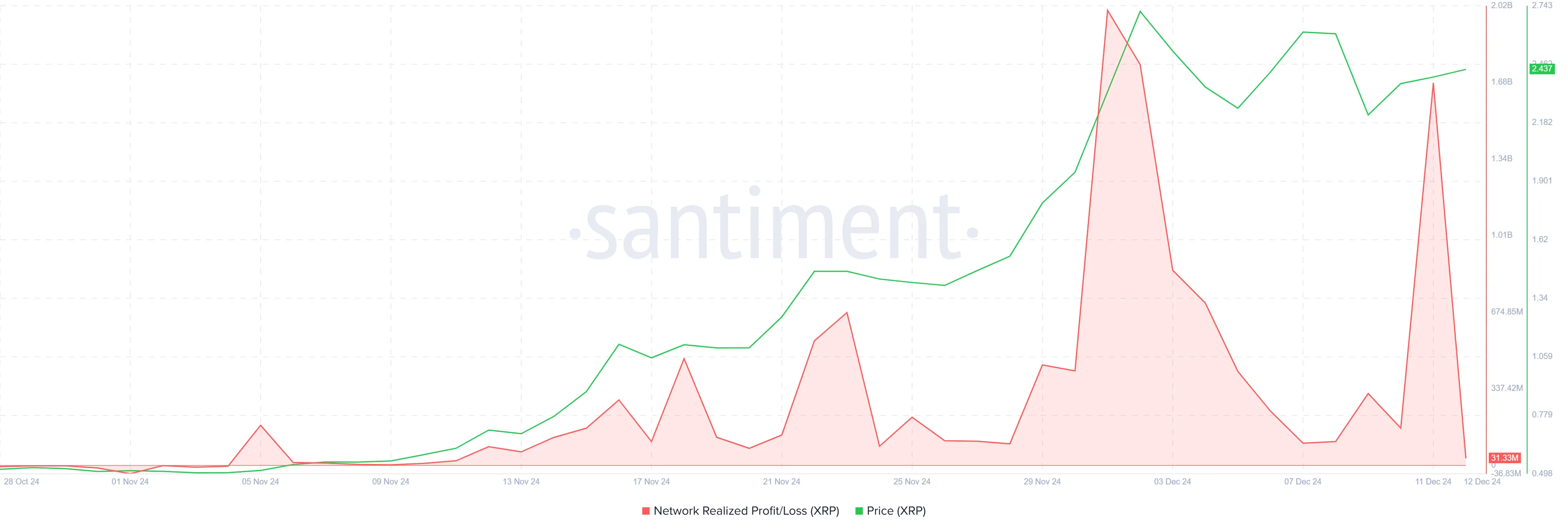

Profit-taking has increased as XRP price has been unable to overcome the $2.73 resistance level, leading many investors to choose to cash out profits from recent gains. This behavior is evident in the increase in realized profits, a key indicator of selling pressure.

Realized profits measure the gains when coins are transferred to new addresses, and their increase suggests that XRP holders are choosing to lock in profits rather than wait for higher price gains. This trend is a worrying signal for XRP’s short-term price outlook.

As many investors take profits, this creates a negative feedback loop that erodes altcoin momentum. While profit-taking is a normal market reaction, the high level of selling suggests that investor confidence is starting to wane.

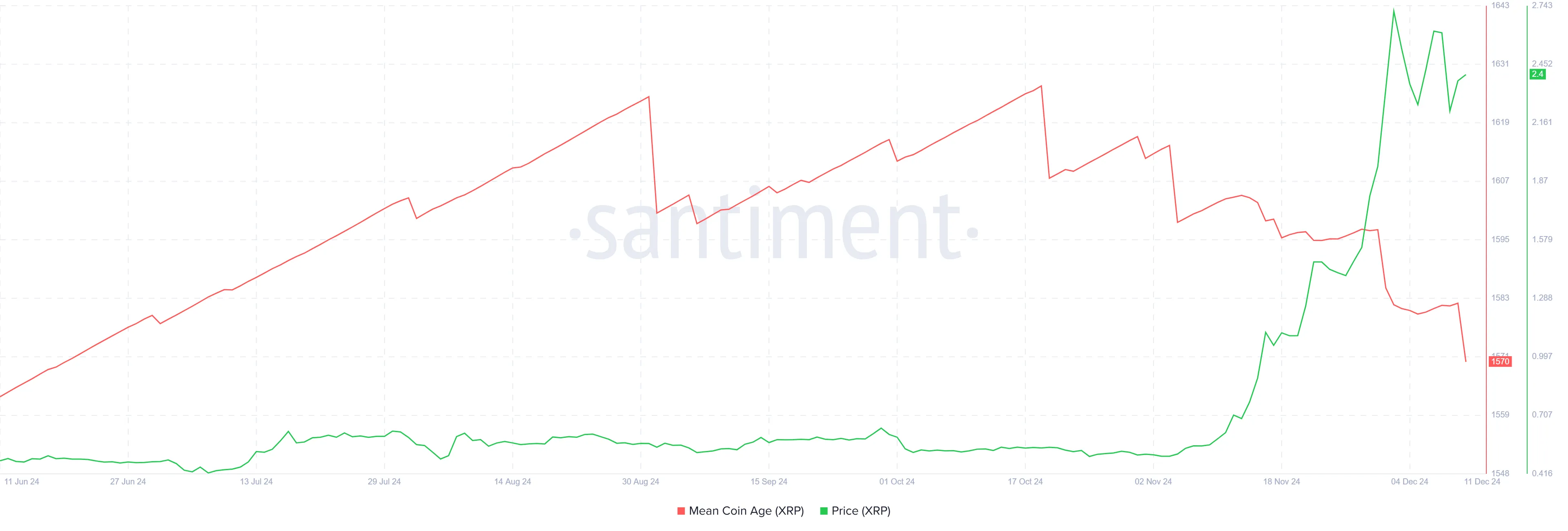

The broader macro momentum for XRP has not been positive. One of the key indicators of investor confidence, Average Coin Age (MCA), has been in steady decline over the past few weeks. The index tracks the average age of coins in circulation, and the decline suggests that long-term holders are losing interest in holding XRP.

Although the broader Cryptocurrency market is gaining momentum, XRP has yet to post significant gains, affecting overall market sentiment. Even as the market is experiencing strong price increases, XRP’s inability to similarly appreciate is causing many to reconsider their positions. This weak macro momentum continues to impact price stability and investor confidence in the asset.

XRP Price Forecast: Looking for a Breakout

XRP’s current price of $2.43 is facing resistance at $2.73, a key mark that prevents the altcoin from reaching a new all-time high above $3.31. This proximity to the barrier creates both opportunity and risk for investors as the Token approaches a pivotal point in its price action.

Despite the upside potential, negative factors suggest that XRP could continue to stay in the $2.73 to $2.00 range. Macroeconomic conditions have dampened market sentiment around XRP, leading to a cautious move. Investors need to monitor this range to find the next price direction.

To neutralize the negative scenario, XRP must break the $2.73 threshold and turn this resistance into support. This move will pave the way for a retest of the ATH at $3.31, signaling a return to upward momentum. Until then, XRP’s price action remains in a wait-and-see mode with limited upside momentum.