XRP is currently struggling below a key resistance level for more than a month, causing discomfort for investors as the altcoin struggles to find growth momentum.

This prolonged stagnation has affected trader confidence, with many choosing to withdraw amid a situation where prices show no signs of significant growth.

XRP traders are uncertain

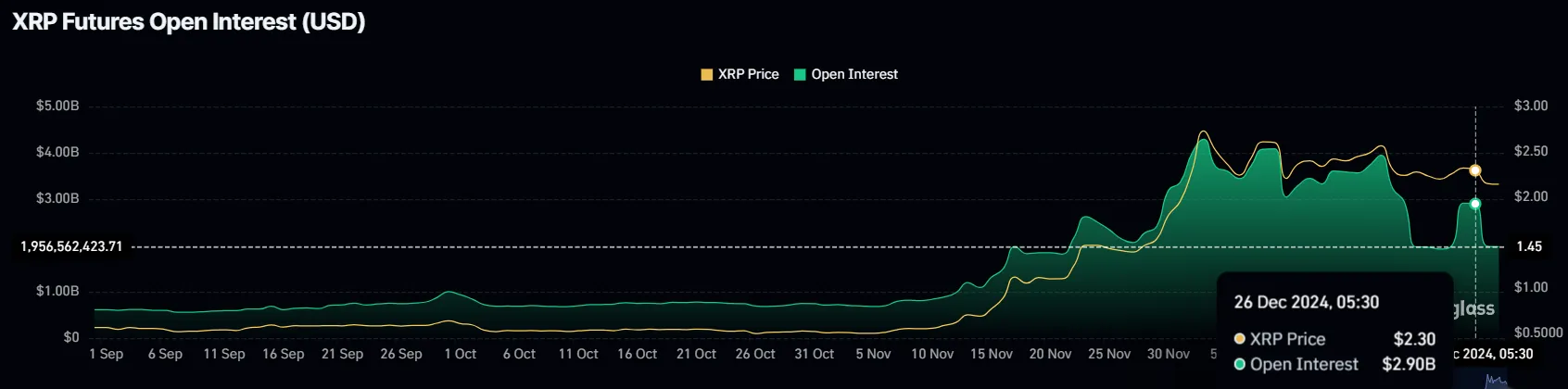

XRP Futures open interest (OI) has dropped by $1 billion in the past 24 hours, indicating a loss of trader confidence. Just a day ago, OI increased to $2.9 billion, thanks to expectations of a price increase. However, when these hopes failed to materialize, traders began to withdraw their funds.

This sudden withdrawal shows increased negativity in the XRP fan community. The decline in OI highlights growing skepticism surrounding XRP’s ability to overcome current resistance levels, which could dampen market activity further in the short term.

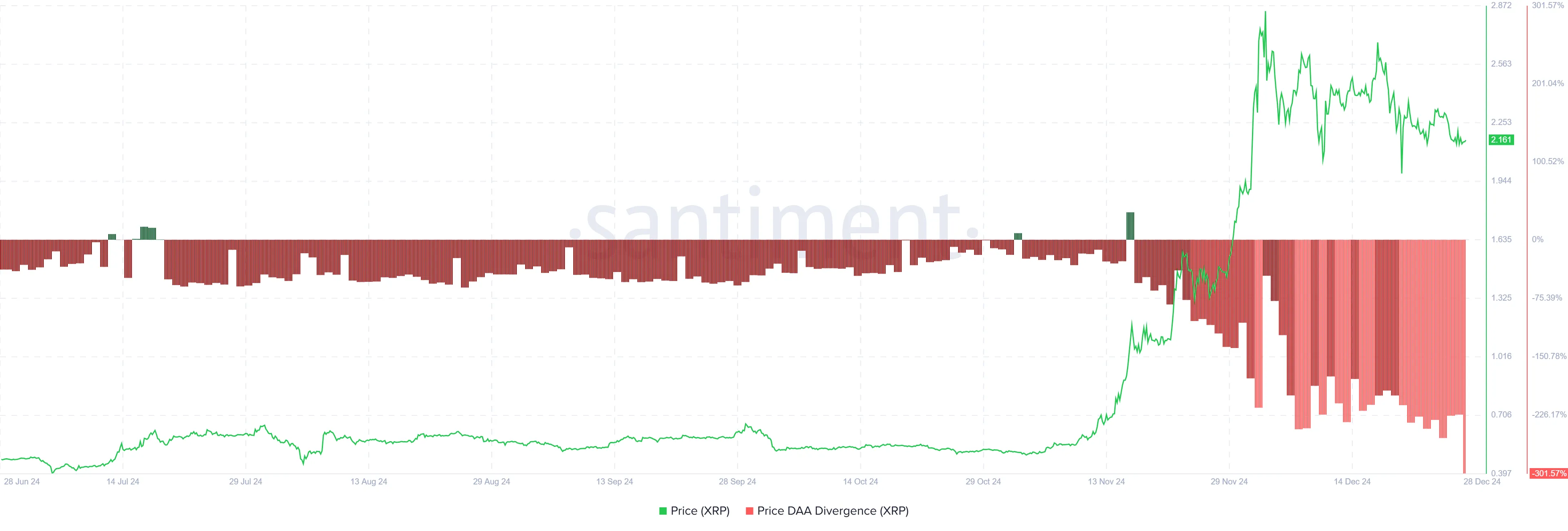

XRP’s macro trend is also showing signs of weakening. The DAA price divergence indicator is currently sending a sell signal, reflecting decreasing participation and flat price. This negative indicator suggests that traders may start taking profits, which could lead to further price declines.

If selling pressure increases, XRP could face additional challenges. The combination of falling participation and investor hesitation could delay the altcoin’s recovery, leaving it locked in a consolidation period until stronger market signals emerge.

XRP Price Prediction: Exiting Consolidation Phase

XRP price has dropped 20% over the past month but remains stable above the $2.00 support level. However, this altcoin is still struggling below an important resistance level at $2.73, unable to break and initiate a rally.

If negative factors continue to persist, XRP could continue to consolidate and also risk losing support at $2.00. This scenario will weaken investor confidence and increase downward pressure on prices, prolonging the current stagnation.

Conversely, if broader market conditions turn positive, XRP could break through the $2.73 resistance and move towards an all-time high of $3.31. Reaching this level will invalidate the negative sentiment and signal a new uptrend, attracting more investors back to the market.