Ripple (XRP) has recently seen an increase in value over the past week, similar to other altcoins. However, over the past 24 hours, it has experienced a slight decline, but according to the XRP liquidation heat map, this appears to be temporary.

Currently priced at 0.58 USD. XRP’s recent decline is likely just a short-term pause. Here’s why this stagnation could soon reverse.

Bullish Indicator for Ripple’s Native Token

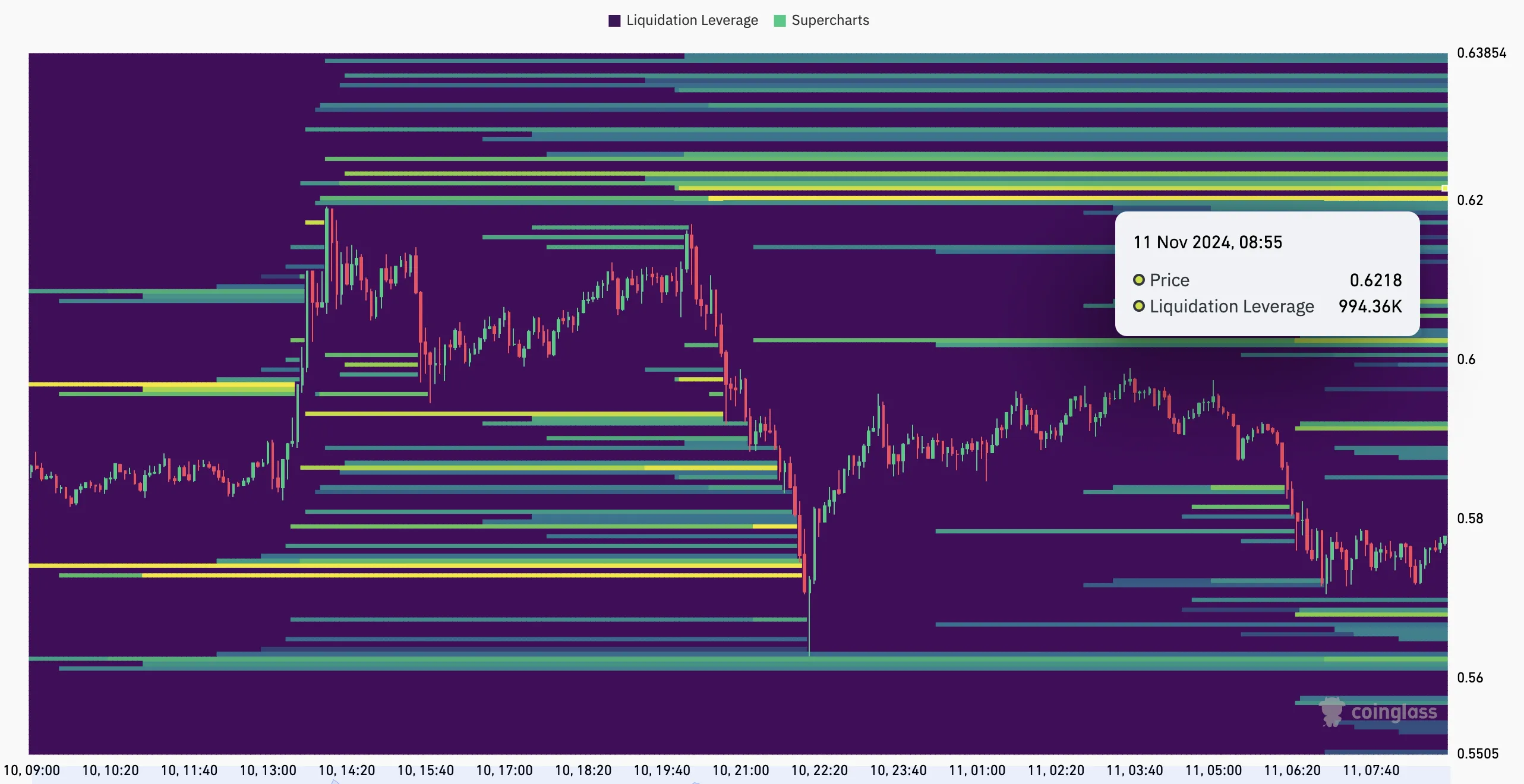

According to Coinglass, XRP has a wide range of prices and amounts of liquidity, but the most notable is around $0.62. As seen below, the color of the XRP liquidation heat map at this level has changed from purple to light yellow.

For those unfamiliar, liquidation heat maps predict price levels where large-scale liquidations are likely to occur. It also helps traders identify areas with high liquidity. In most cases, the higher the liquidity, the greater the chance of price moving to that zone.

In the case of XRP, a high concentration of liquidity emerged around $0.57 on November 10. But since the altcoin has already surpassed that level, it means the next level to reach is the next major one, at 0.62 USD.

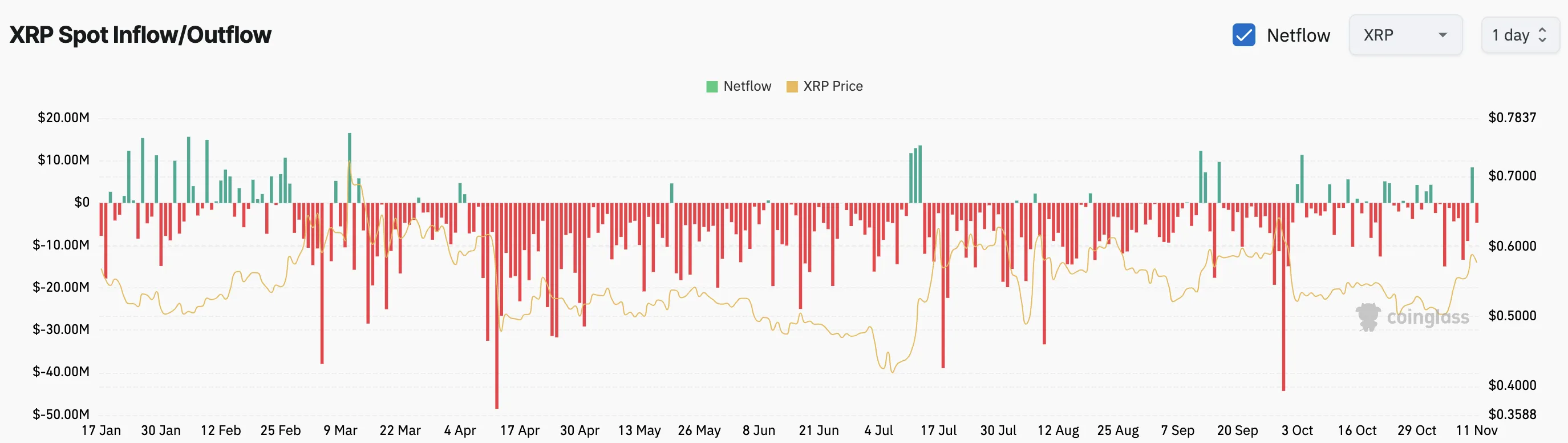

Additionally, the Spot In/Out index, which tracks token movements in and out of exchanges, is another indicator that suggests a bullish bias.

When a large number of tokens enter exchanges, it can signal an intention to sell, increasing downward pressure on prices. However, in this case, about $5 million worth of XRP left the exchange in the last 24 hours.

This pullout shows that most XRP holders are choosing to hold rather than sell, reflecting a bullish sentiment as investors show confidence in the Token’s potential for further growth.

XRP Price Forecast: Upward Momentum Temporarily Paused, But Not Yet Eliminated

Technically, XRP price moves above the 20 and 50 day Moving Averages (EMA) indicate the possibility of bullish momentum. These EMAs often act as support and resistance levels, and a price rise above them indicates an uptrend.

If the XRP price is below these levels, the trend is already bearish. Therefore, current data suggests that XRP could be gearing up for further growth. If that continues and buying pressure increases, the altcoin’s value could increase another 7% to $0.62.

Interestingly, this location is also where the important 23.6% Fibonacci level lies. However, if the liquidation heat map indicates a movement of liquidity to a lower area, then altcoin value could decline. In that case, the price of XRP could drop to the 61.8% Fibonacci level at $0.55.