XRP has seen an increase in selling activity since hitting a three-year high of $1.63 on November 23. Currently trading at $1.41, the altcoin has pulled back in price. 13%.

On-chain data shows a spike in profit-taking activity over the past few days. This signifies a possible continuation of XRP’s downtrend. What should investors prepare for?

XRP investors take profits

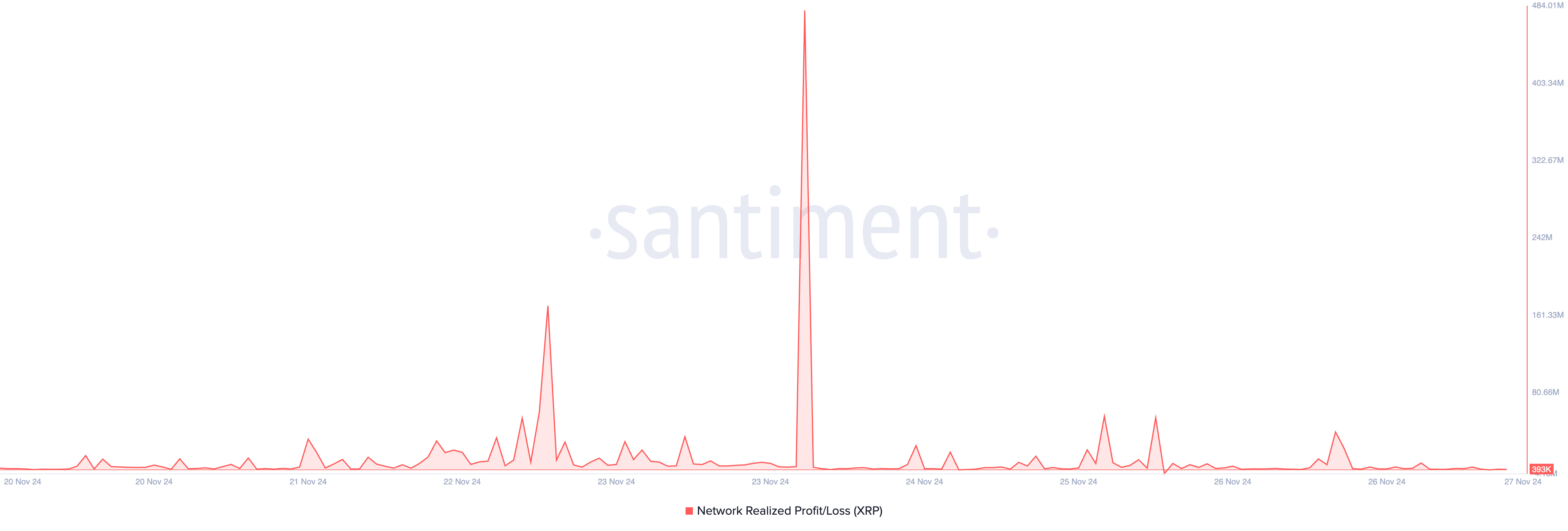

TinTucBitcoin’s review of XRP’s on-chain performance has shown a boom in profit-taking from investors, reflected in a surge in real profits. According to Santiment data, over the past seven days, XRP realized profits reached $1.84 billion, the highest level since April 2021.

The realized return on the network of an asset measures the overall return achieved by investors on the network, based on the price at which the token last traded. When this index spikes, it shows that many investors are selling assets at a significant profit compared to the original purchase price.

This typically occurs during periods of high market activity. It marks a trend of profit-taking and hints at potential changes in market sentiment. When selling pressure increases, the downward price trend persists.

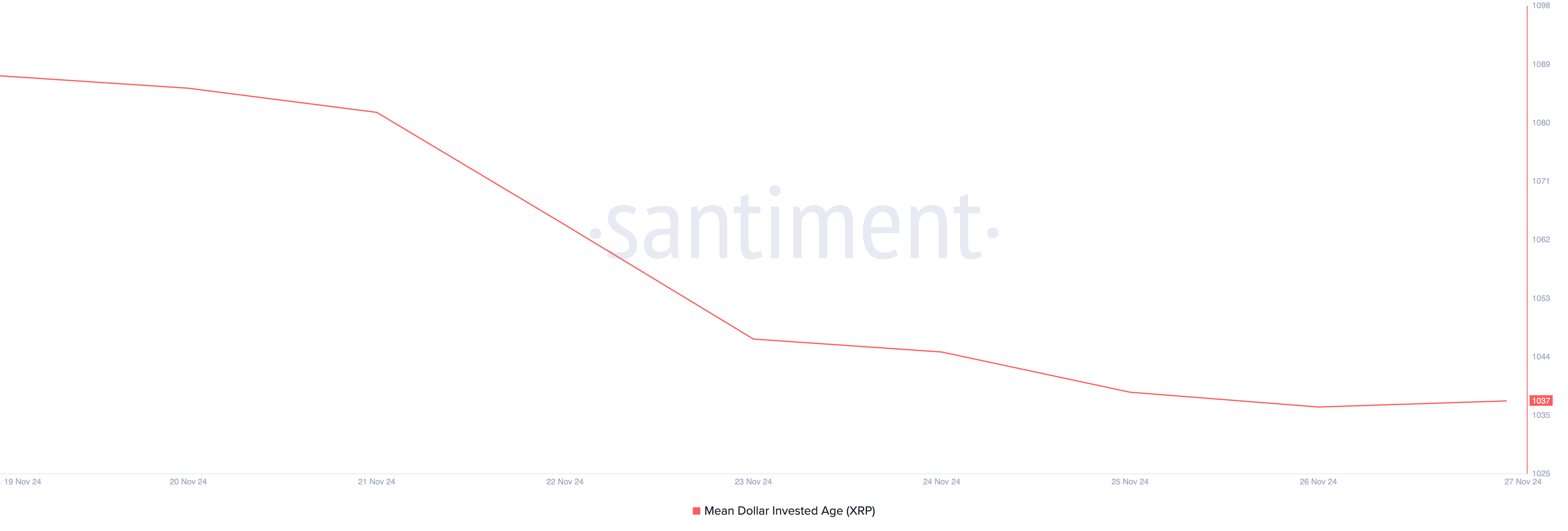

Notably, XRP long-term holders contribute to the downward pressure on its price. They have taken advantage of the token’s rally to multi-year highs to take profits, as shown by the decline in XRP’s USD median investment age (MDIA) over the past week.

This metric tracks the average age of all USD invested in an asset, reflecting how long tokens have been held in wallets. When this index drops, it indicates increased activity on the network as old coins are being moved or spent.

In the case of XRP, when MDIA drops during a bullish period, active long-term holders sell their assets, contributing to downward pressure on the altcoin’s price. The reason is not difficult to understand.

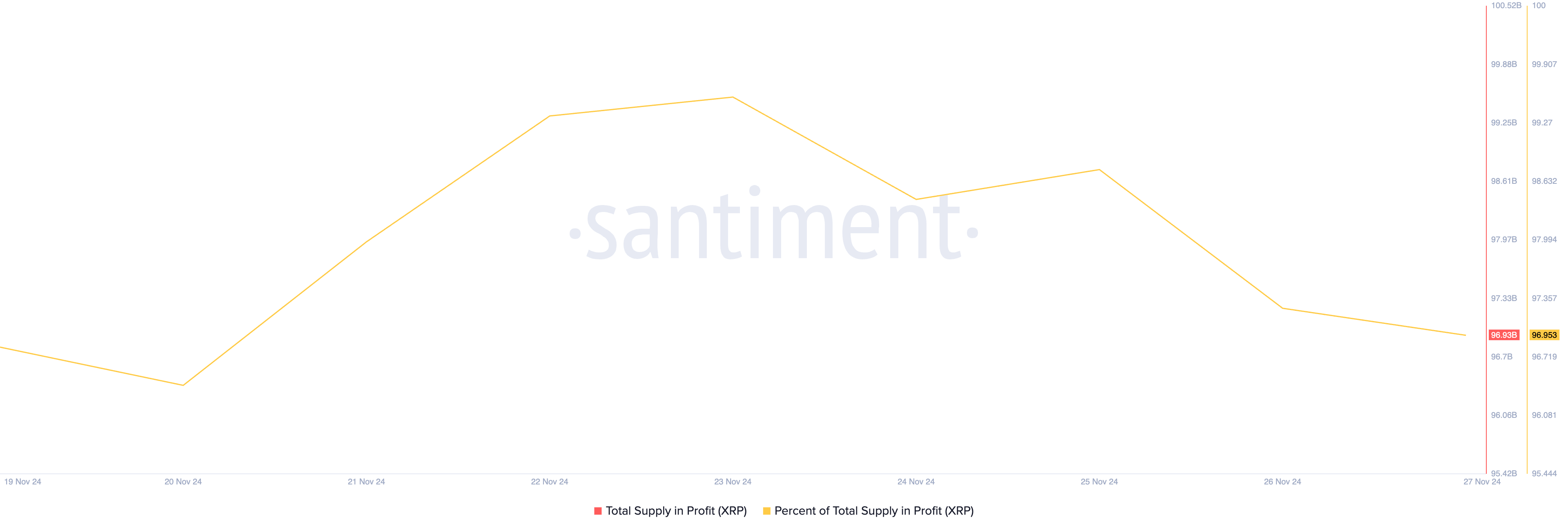

The share of XRP supply in profit recently surpassed 90%. This means that the majority of XRP holders are currently in profit. As of now, nearly 97% of the total circulating supply of 99 billion Tokens are profitable.

XRP Price Prediction: Risk of Token Falling Below 1.30 USD

XRP is currently trading at $1.41, above support formed at $1.33. Continuous profit-taking from investors will pull XRP price to test this support level. If not sustained, the downtrend strengthens, and XRP price could drop to $1.28.

On the other hand, this bearish forecast will be invalidated if buying activity continues. This could push XRP prices back to three-year highs of $1.63.